Ether Falls to 3331 as Support Snaps Amid 137B Whale Accumulation – CoinDesk

Published on: 2025-11-07

Intelligence Report: Ether Falls to 3331 as Support Snaps Amid 137B Whale Accumulation – CoinDesk

1. BLUF (Bottom Line Up Front)

The strategic judgment is that the recent decline in Ether’s price, despite significant whale accumulation, suggests a complex market dynamic where institutional confidence is countered by broader market bearish sentiment. The most supported hypothesis is that institutional investors are strategically accumulating Ether, anticipating a long-term price recovery. Confidence level: Moderate. Recommended action: Monitor institutional buying patterns and technical indicators for signs of market stabilization or further decline.

2. Competing Hypotheses

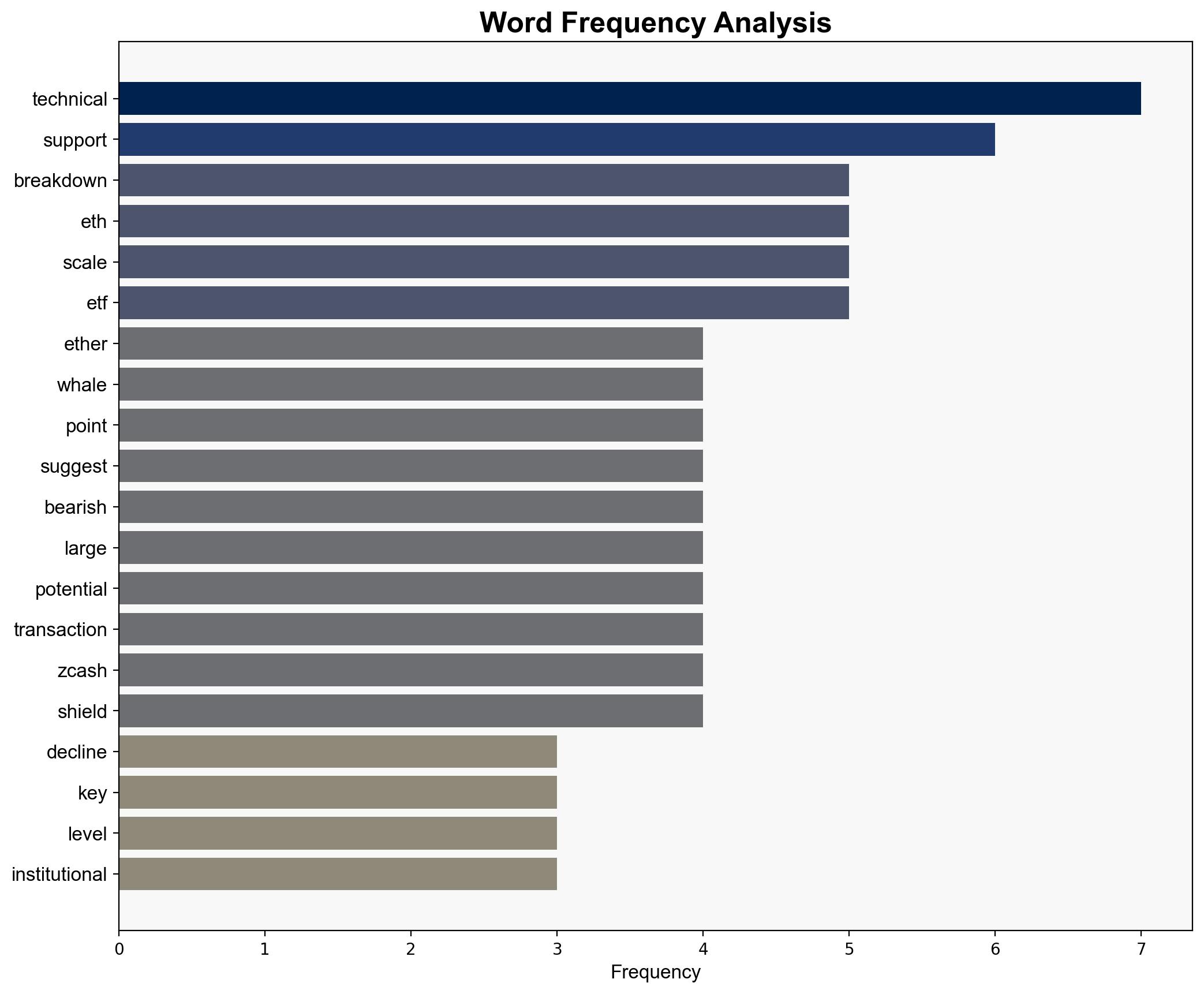

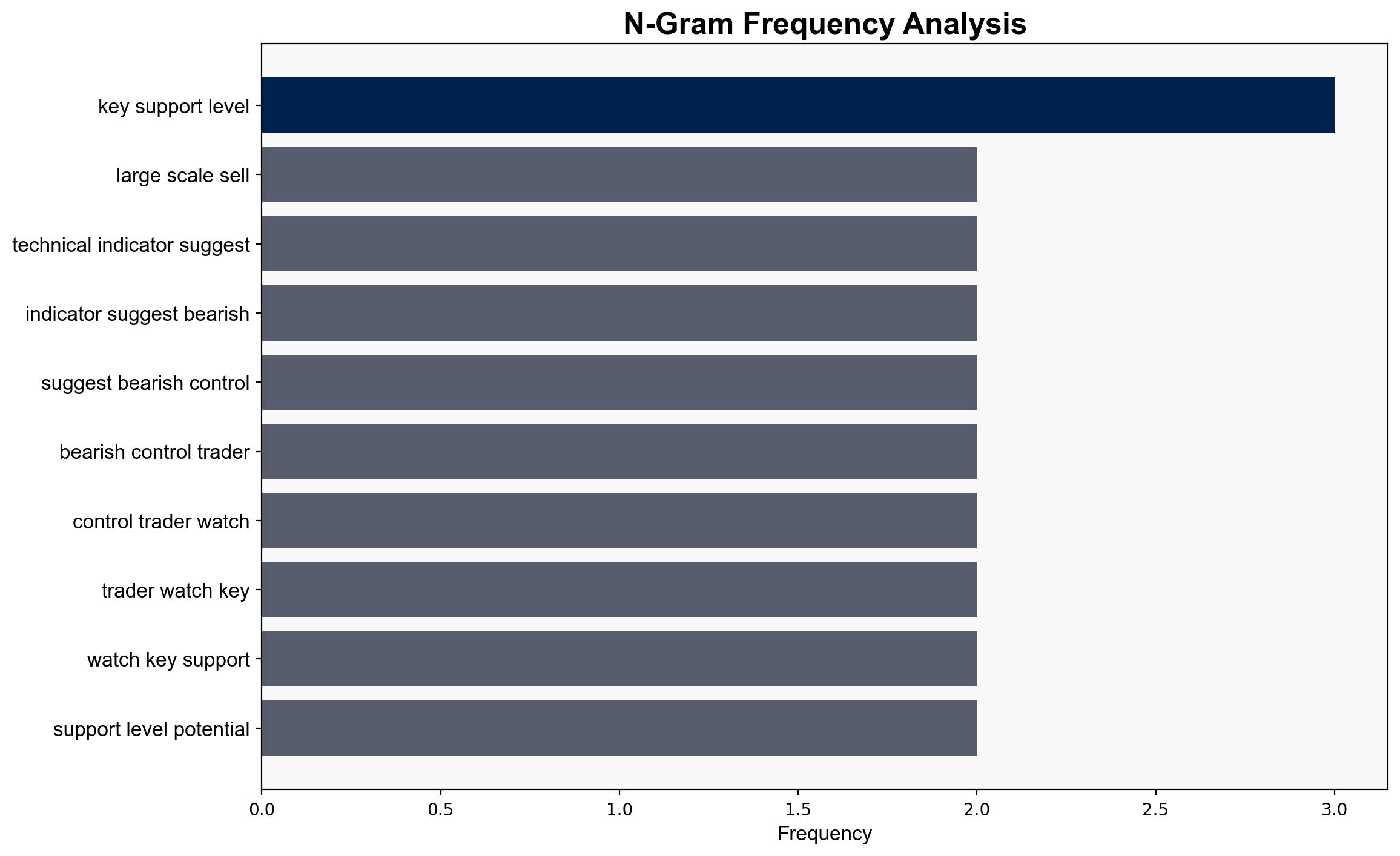

1. **Hypothesis A**: Institutional investors are accumulating Ether during the price dip, indicating confidence in a long-term price recovery. This is supported by the significant volume of Ether purchased by large holders during the decline, suggesting strategic entry points.

2. **Hypothesis B**: The decline in Ether’s price is primarily driven by bearish market sentiment and retail panic, with whale accumulation insufficient to counteract the downward trend. The sharp price drop and failure to reclaim resistance levels support this view.

Using ACH 2.0, Hypothesis A is better supported due to the presence of significant whale activity during the decline, which typically signals institutional confidence in future price recovery.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that whale accumulation is a reliable indicator of future price recovery. Hypothesis B assumes that retail panic and bearish sentiment are the dominant market forces.

– **Red Flags**: The divergence between whale accumulation and price decline could indicate manipulation or misinterpretation of whale activity. The absence of clear data on the motivations behind whale purchases is a potential blind spot.

4. Implications and Strategic Risks

– **Economic**: Continued price volatility could impact investor confidence and market stability.

– **Cyber**: Increased trading activity might attract cyber threats targeting exchanges and wallets.

– **Geopolitical**: Regulatory responses to market volatility could influence global cryptocurrency policies.

– **Psychological**: Retail investor panic could exacerbate market declines, leading to a self-fulfilling prophecy of bearish sentiment.

5. Recommendations and Outlook

- Monitor whale activity and technical indicators for early signs of market stabilization.

- Engage with regulatory bodies to anticipate potential policy changes affecting cryptocurrency markets.

- Scenario Projections:

- Best Case: Institutional confidence leads to market stabilization and recovery.

- Worst Case: Continued retail panic drives further declines, triggering broader market sell-offs.

- Most Likely: Short-term volatility persists with gradual stabilization as institutional buying offsets retail selling.

6. Key Individuals and Entities

– No specific individuals are mentioned in the source text.

– Entities: CoinDesk, institutional investors (whales), retail investors.

7. Thematic Tags

cryptocurrency market dynamics, institutional investment, retail investor behavior, market volatility