ETSA winner Capillary Tech China JVs must bring tech talent – The Times of India

Published on: 2025-10-09

Intelligence Report: ETSA winner Capillary Tech China JVs must bring tech talent – The Times of India

1. BLUF (Bottom Line Up Front)

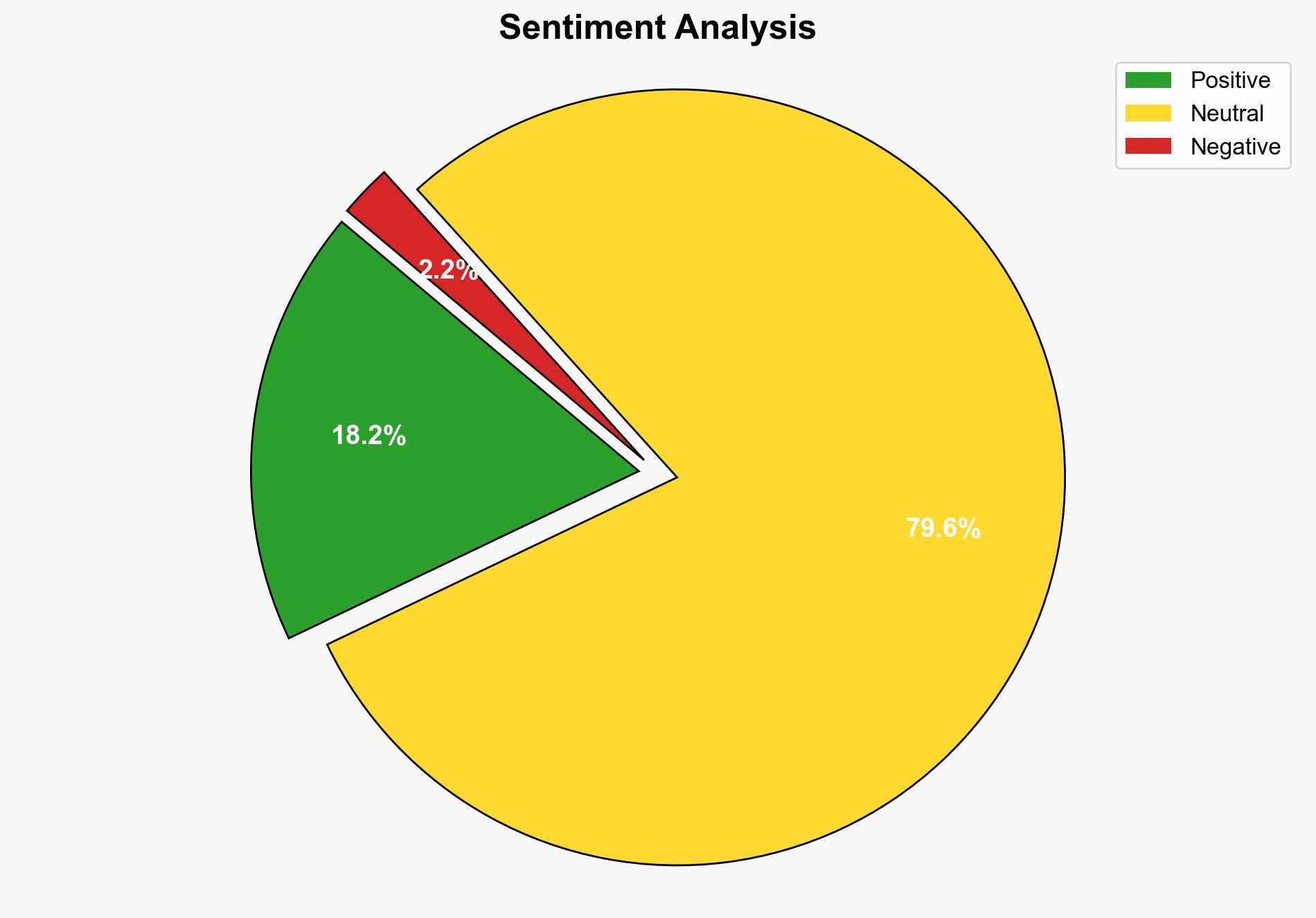

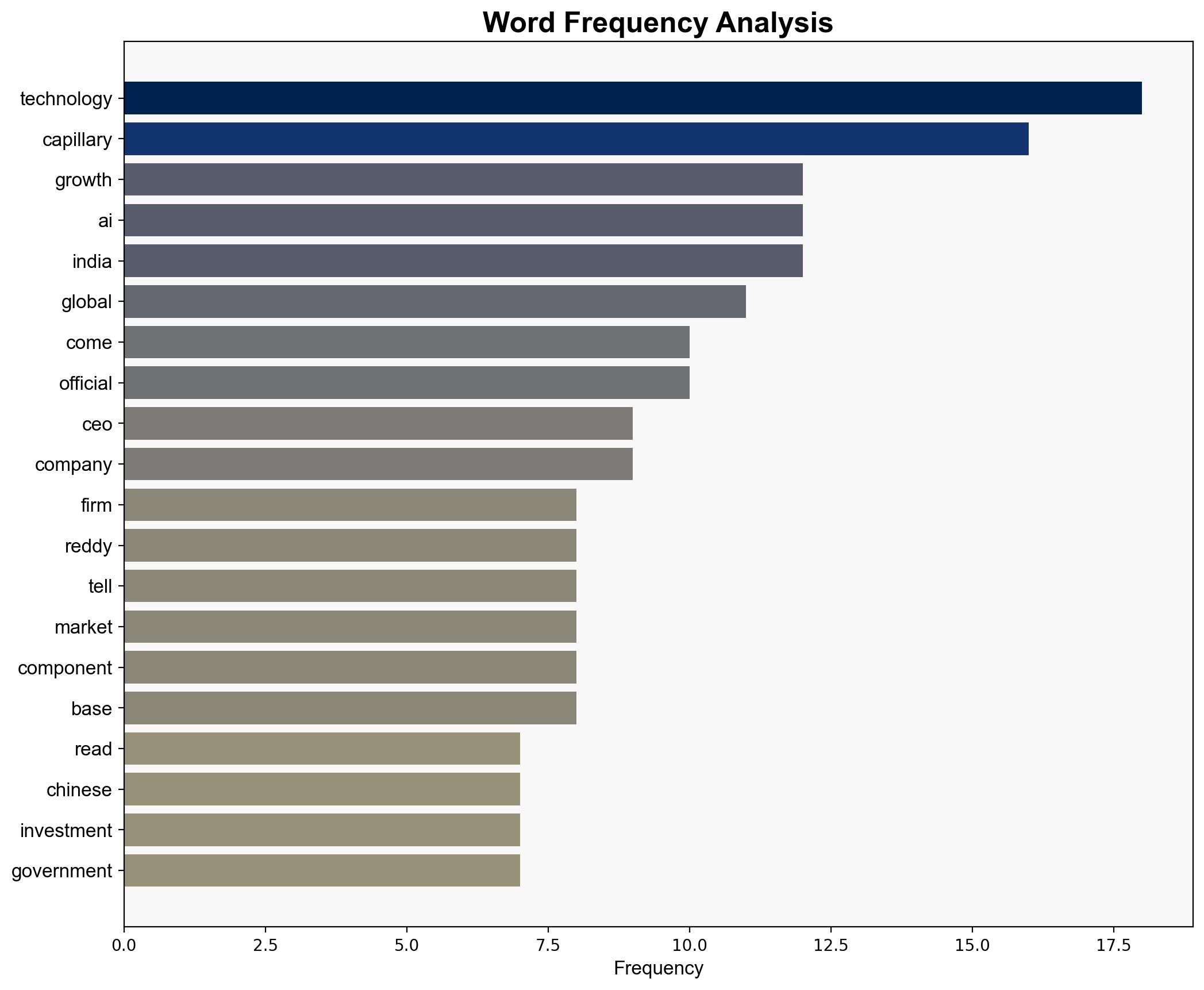

Capillary Technologies is strategically positioning itself to leverage joint ventures (JVs) in China, focusing on technology transfer and talent acquisition. The most supported hypothesis suggests that Capillary is aiming to strengthen its market position by integrating advanced technological capabilities and local expertise. Confidence level: Moderate. Recommended action: Monitor Capillary’s JV developments and assess the impact on regional tech ecosystems.

2. Competing Hypotheses

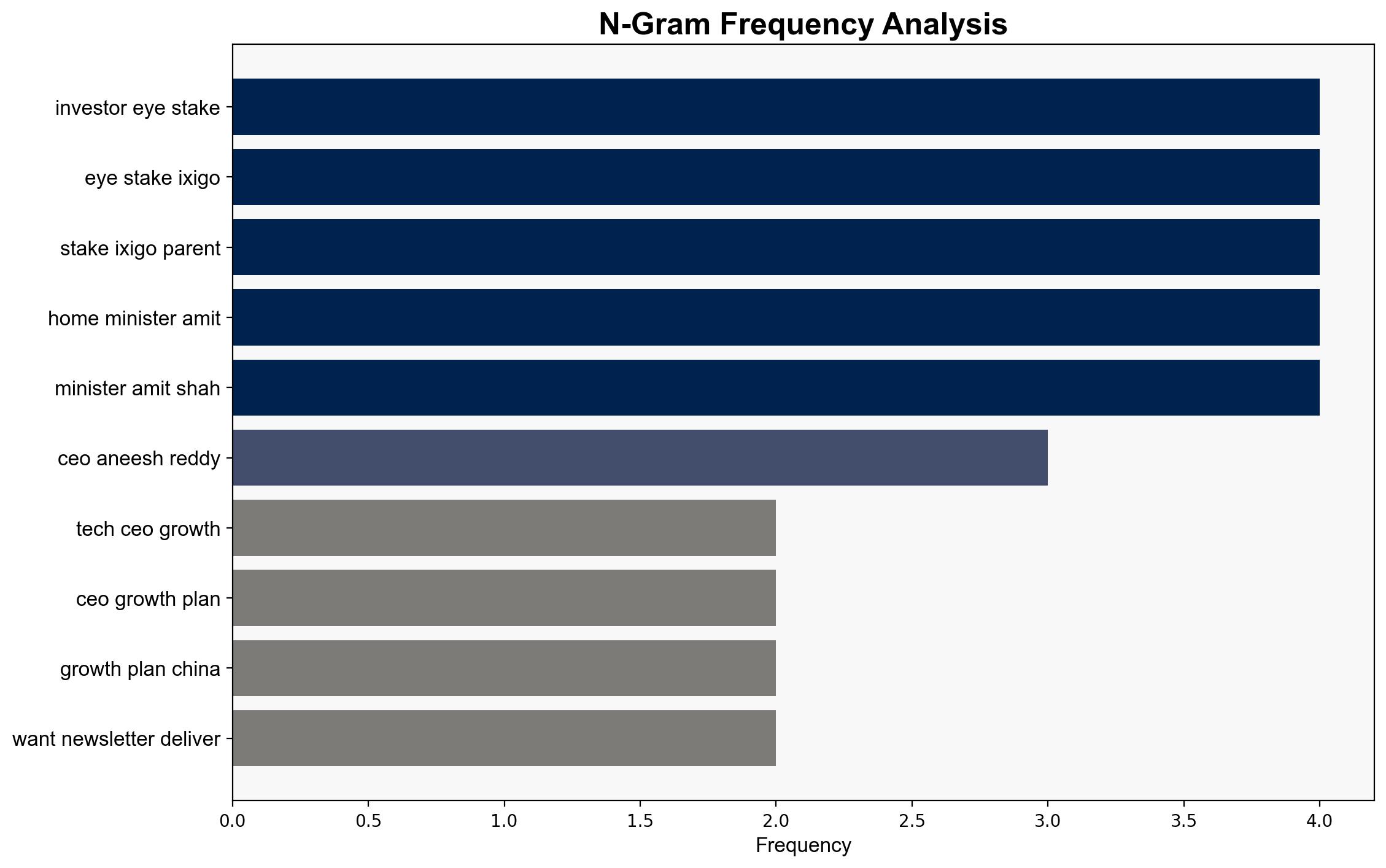

1. **Hypothesis A**: Capillary Technologies is pursuing JVs in China primarily to access advanced technological capabilities and integrate them into its operations, enhancing its competitive edge in the global market.

2. **Hypothesis B**: The primary goal of Capillary’s JVs in China is to expand its customer base and market presence in Asia, using local partnerships to navigate regulatory and market entry challenges.

Using ACH 2.0, Hypothesis A is better supported due to Capillary’s emphasis on technology transfer and talent acquisition, as well as its strategic focus on strengthening global enterprise loyalty.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Capillary’s JVs will lead to meaningful technology transfer and that the company can effectively integrate local talent.

– **Red Flags**: Potential over-reliance on Chinese partners for technology and market access could pose risks if geopolitical tensions escalate. The lack of detailed information on the specific terms of the JVs is a blind spot.

4. Implications and Strategic Risks

Capillary’s strategy could set a precedent for other tech firms seeking to leverage Chinese technological advancements. However, this approach carries risks, including potential intellectual property vulnerabilities and dependency on Chinese supply chains. Geopolitical tensions could disrupt operations or lead to regulatory challenges.

5. Recommendations and Outlook

- **Mitigation**: Establish robust IP protection measures and diversify supply chains to reduce dependency on Chinese components.

- **Opportunities**: Explore partnerships with other Asian markets to balance geopolitical risks.

- **Scenario Projections**:

– **Best Case**: Successful technology integration and market expansion lead to significant revenue growth.

– **Worst Case**: Geopolitical tensions or regulatory changes disrupt operations, leading to financial losses.

– **Most Likely**: Moderate success with some technology integration and market expansion, but ongoing challenges in managing geopolitical risks.

6. Key Individuals and Entities

Aneesh Reddy, Capillary Technologies

7. Thematic Tags

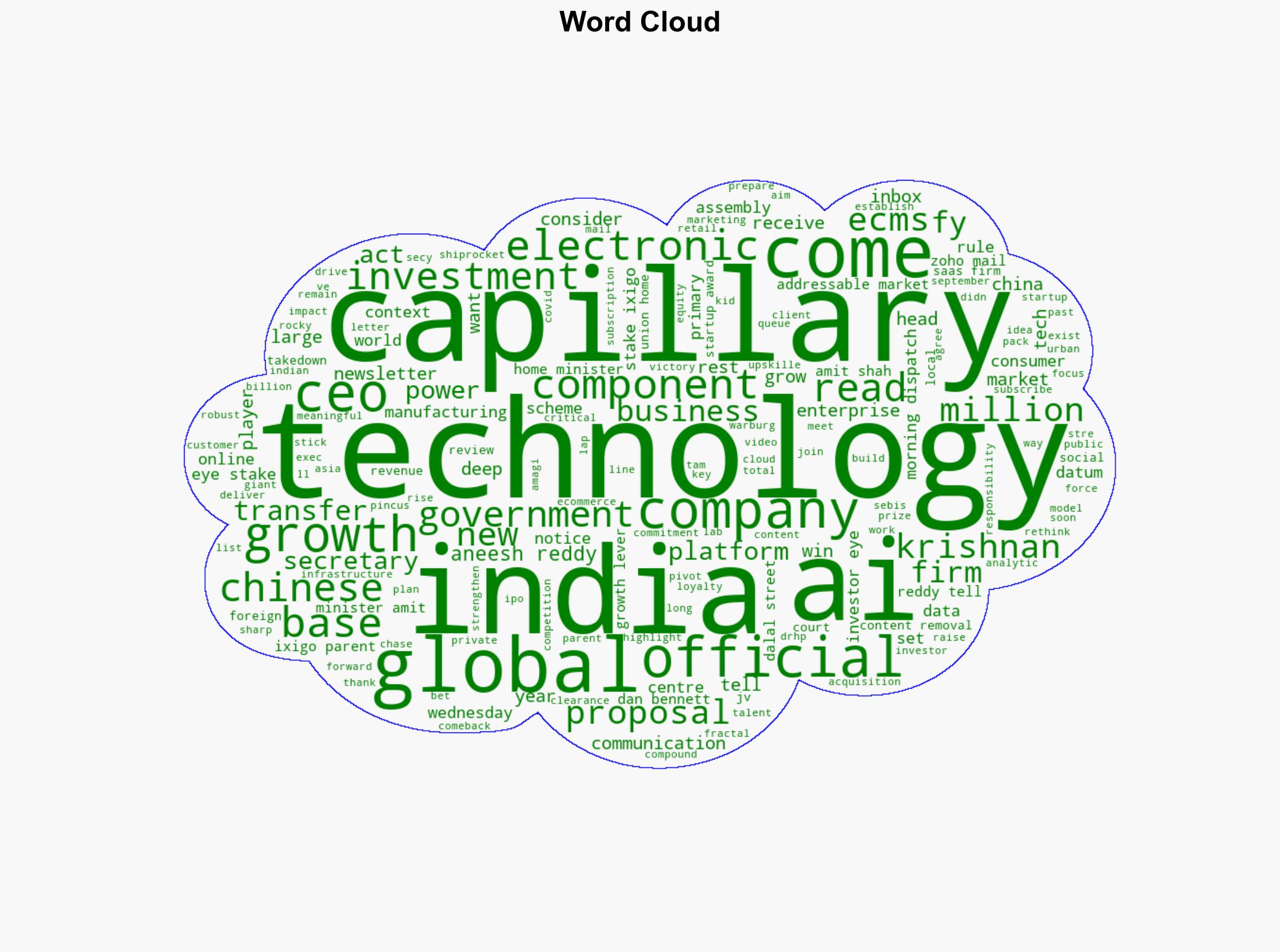

technology transfer, joint ventures, market expansion, geopolitical risk, intellectual property