EU Oil Sanctions Target Russian Crude, Impacting Indian and Turkish Refineries Amid Potential Loopholes

Published on: 2026-01-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: New Sanctions On Russian Oil Hit Indian Turkish Refineries Enter China

1. BLUF (Bottom Line Up Front)

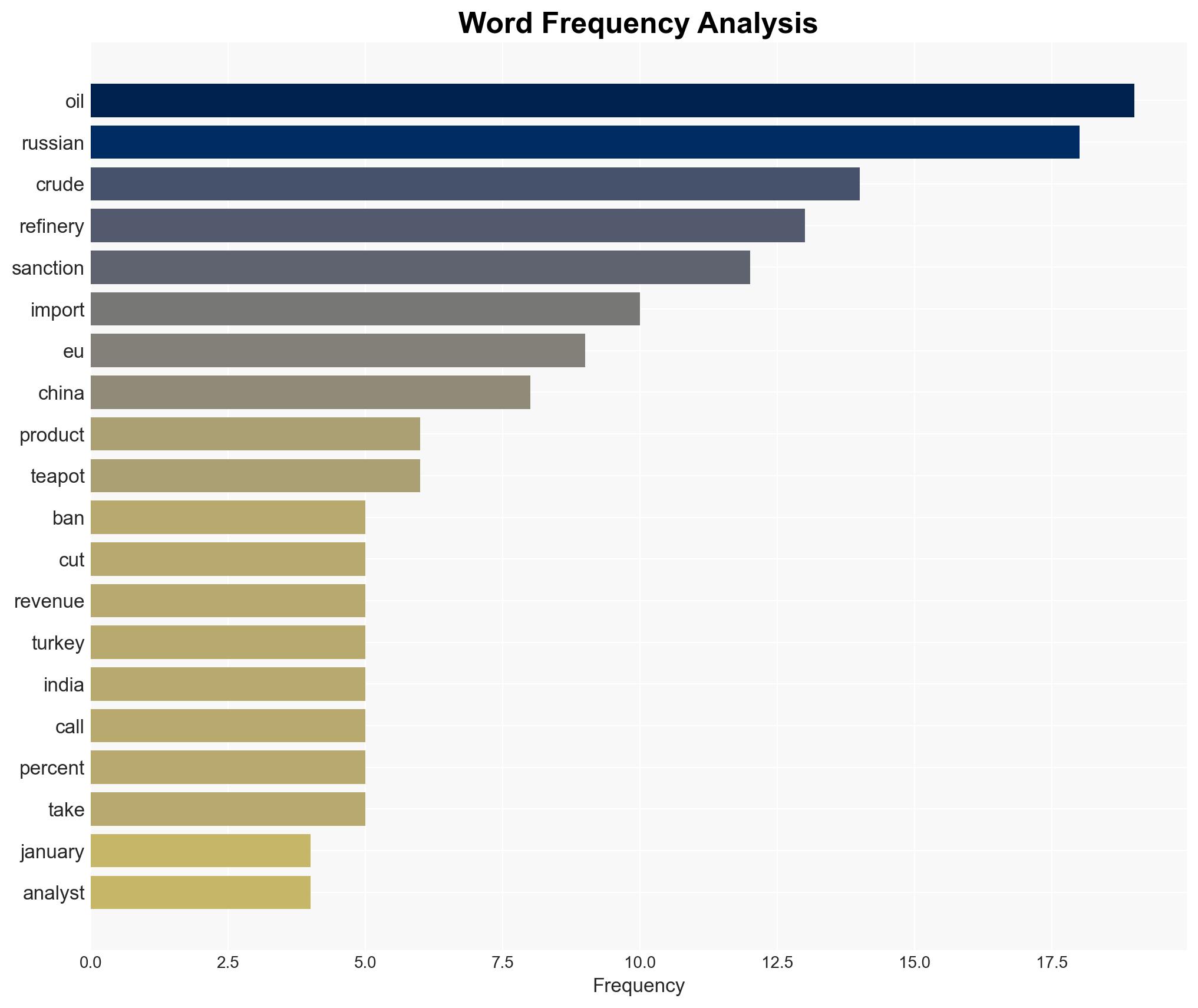

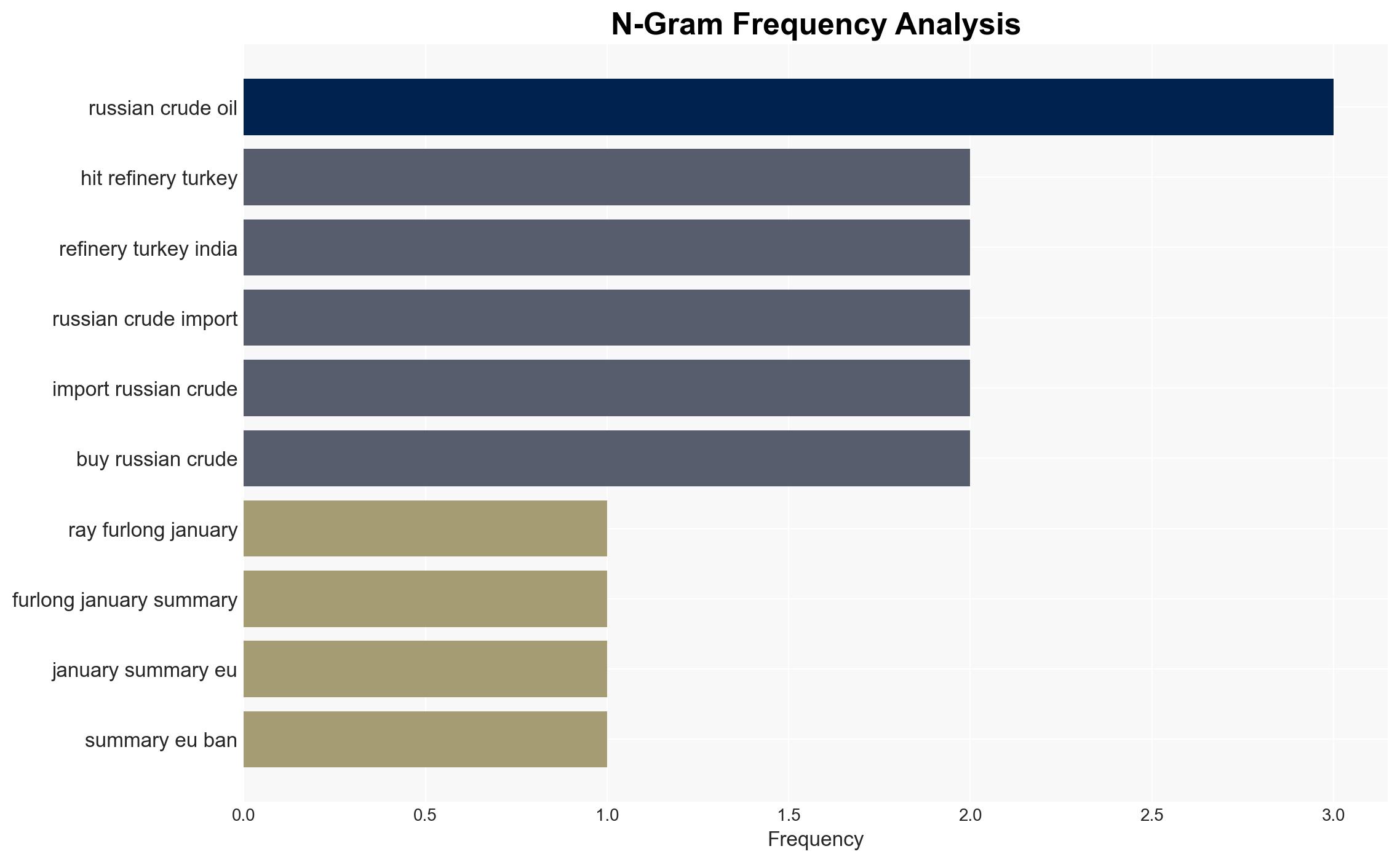

The EU’s ban on products derived from Russian crude oil is likely to significantly impact refineries in Turkey and India, while potentially increasing Chinese purchases of Russian oil. The sanctions aim to reduce Moscow’s war revenues, but loopholes may undermine their effectiveness. Overall, there is moderate confidence in these assessments due to existing information gaps and potential for deceptive practices.

2. Competing Hypotheses

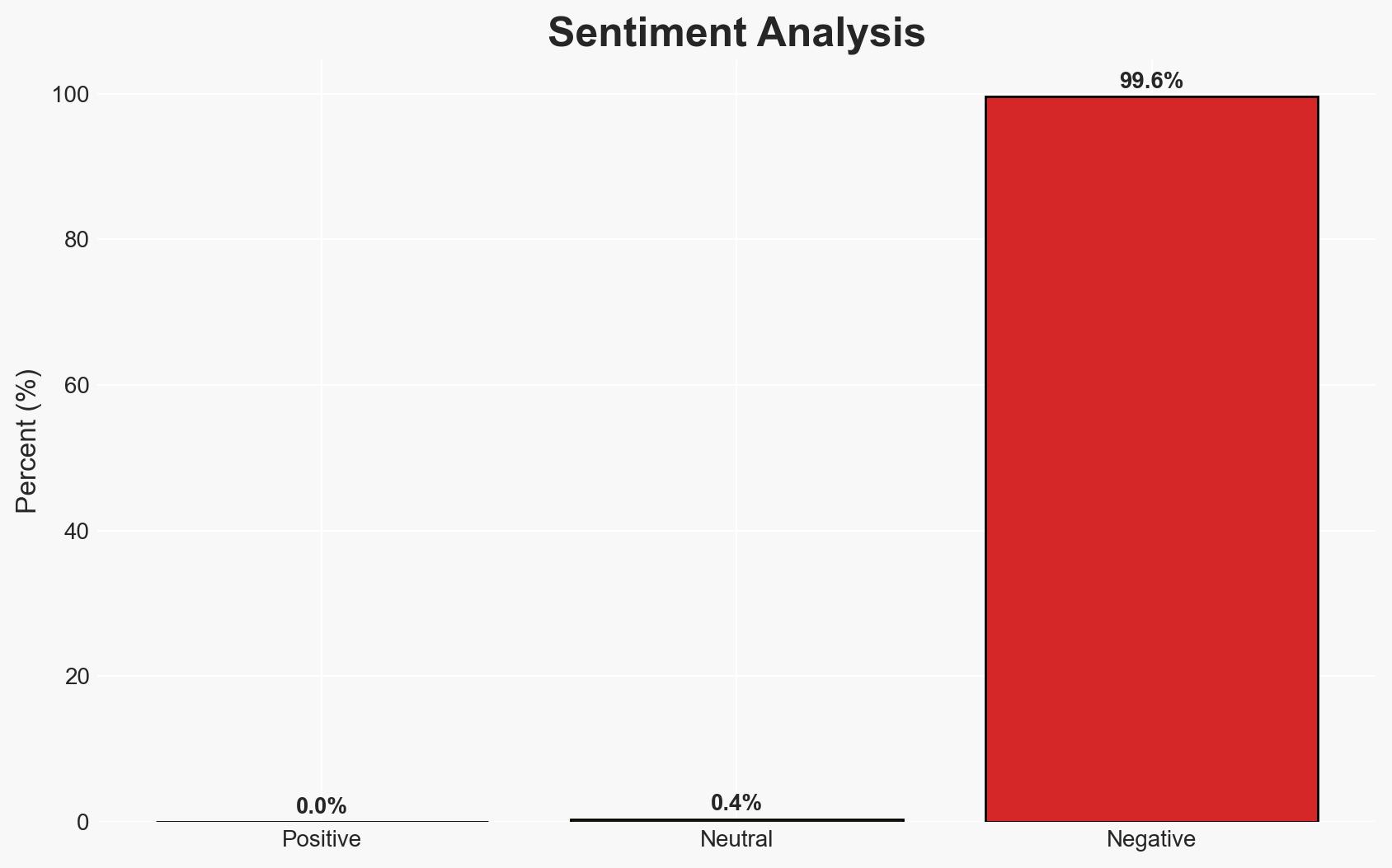

- Hypothesis A: The EU sanctions will effectively reduce Russian oil revenues by curtailing exports to key markets, thereby weakening Moscow’s financial capacity to sustain its military operations in Ukraine. Supporting evidence includes the significant reduction in Russian crude imports by Turkey and India. However, uncertainties remain regarding the enforcement of sanctions and potential circumvention tactics.

- Hypothesis B: The sanctions will have limited impact on Russian revenues due to the ability of refineries to obscure crude origins and re-export through exempt countries. This is supported by warnings from analysts about existing loopholes and the potential for increased Chinese purchases. Contradicting evidence includes the self-sanctioning actions by major Indian refineries.

- Assessment: Hypothesis B is currently better supported due to the historical precedent of sanctions evasion and the complexity of global oil markets. Key indicators that could shift this judgment include stricter enforcement measures by the EU and increased transparency in oil trading practices.

3. Key Assumptions and Red Flags

- Assumptions: The EU will maintain its current level of enforcement; China will continue to purchase Russian oil; refineries will seek to maximize profits despite sanctions.

- Information Gaps: Detailed data on the enforcement mechanisms of the EU sanctions and the extent of Chinese purchases of Russian oil.

- Bias & Deception Risks: Potential bias in data from energy market analysts; risk of manipulation by refineries concealing crude origins.

4. Implications and Strategic Risks

The development could lead to shifts in global oil supply chains and affect geopolitical alignments. Over time, this may influence the stability of oil markets and the economic resilience of countries dependent on Russian oil.

- Political / Geopolitical: Potential for increased tensions between the EU and countries circumventing sanctions; shifts in alliances as countries adjust to new oil supply dynamics.

- Security / Counter-Terrorism: Minimal direct impact, but economic strain on Russia could indirectly affect its military capabilities.

- Cyber / Information Space: Potential for increased cyber operations targeting oil supply chain data and enforcement mechanisms.

- Economic / Social: Possible increase in oil prices due to supply disruptions, impacting global economic stability and social cohesion in oil-dependent regions.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of oil trade routes and refinery activities; engage with international partners to ensure compliance with sanctions.

- Medium-Term Posture (1–12 months): Develop resilience measures for potential oil supply disruptions; strengthen partnerships with compliant countries to stabilize markets.

- Scenario Outlook: Best: Effective sanctions enforcement reduces Russian revenues significantly. Worst: Loopholes and non-compliance render sanctions ineffective. Most-Likely: Partial effectiveness with ongoing challenges in enforcement and compliance.

6. Key Individuals and Entities

- Tupras (Turkish refinery owner)

- CREA (Center for Research on Energy and Clean Air)

- David Edward (General Index)

- Sumit Ritolia (Kpler analyst)

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

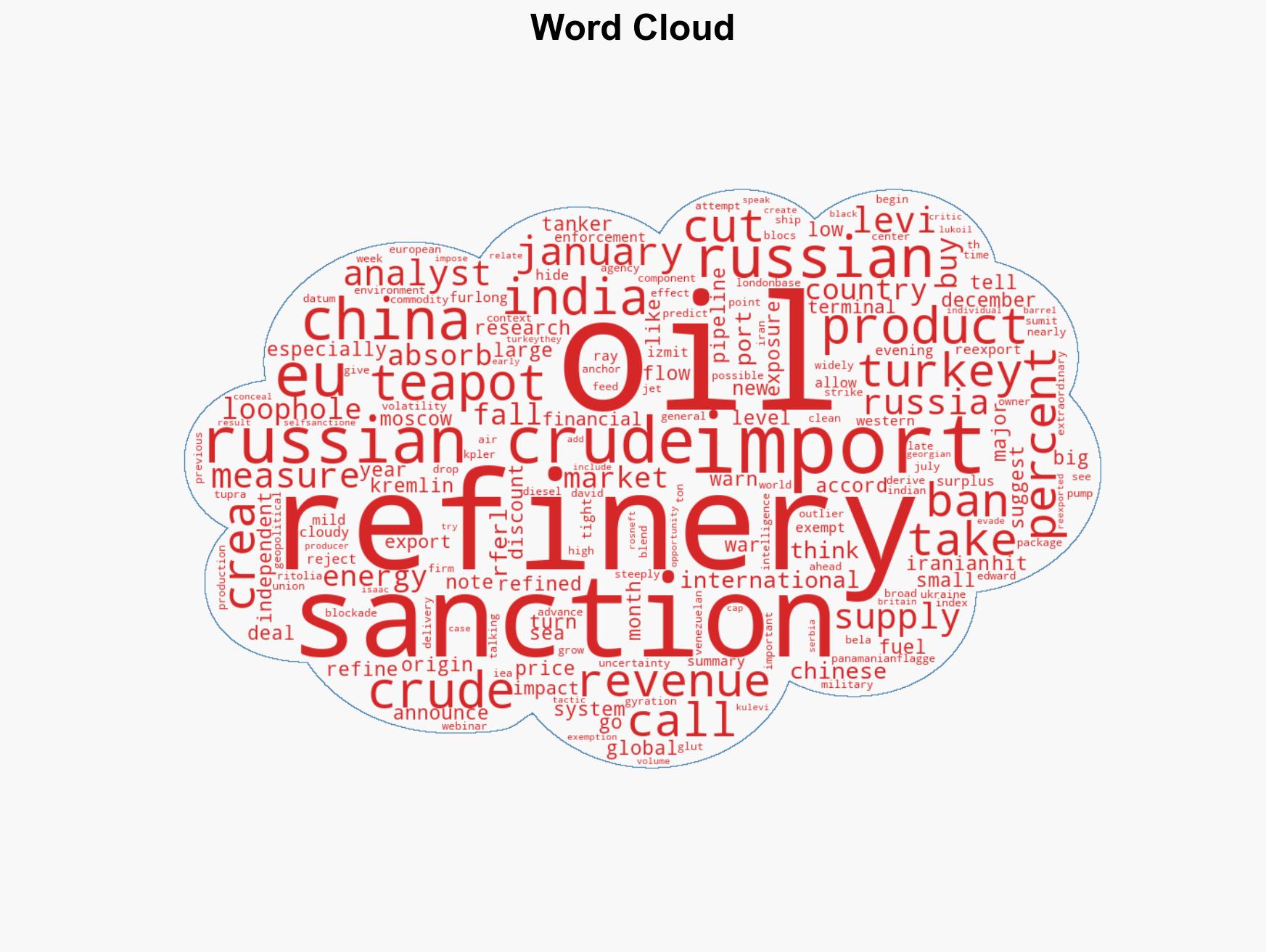

regional conflicts, sanctions, oil trade, geopolitical dynamics, energy security, economic impact, enforcement challenges, Russian revenues

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us