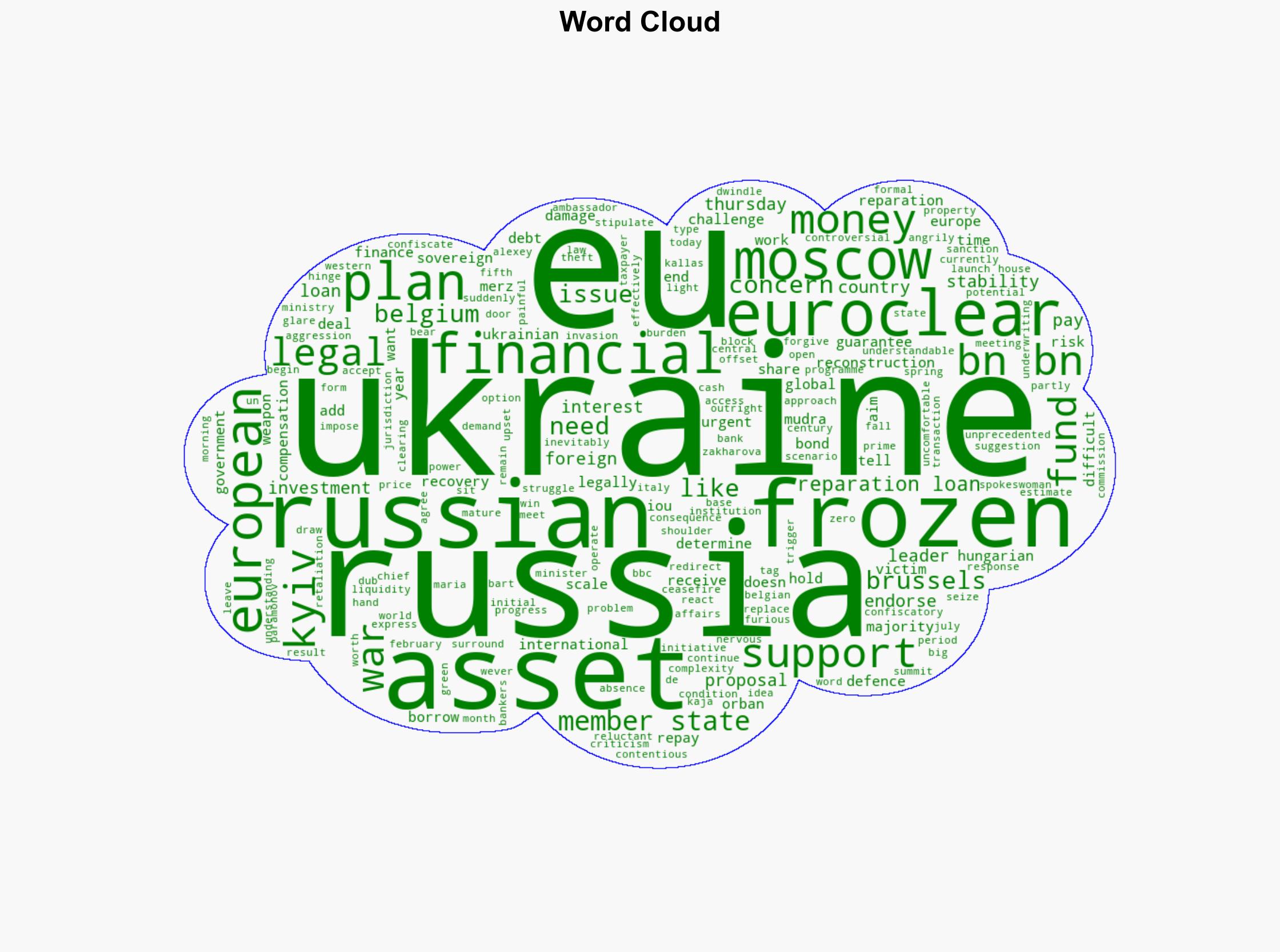

EU set to endorse deal to turn frozen Russian assets into support for Ukraine – BBC News

Published on: 2025-10-23

Intelligence Report: EU set to endorse deal to turn frozen Russian assets into support for Ukraine – BBC News

1. BLUF (Bottom Line Up Front)

The European Union is considering a plan to utilize frozen Russian assets to support Ukraine, potentially through a “reparation loan” mechanism. The most supported hypothesis suggests the EU will proceed cautiously, balancing legal challenges and geopolitical risks. Confidence level: Moderate. Recommended action: EU should enhance diplomatic channels to mitigate Russian retaliation and ensure legal frameworks are robust to withstand potential challenges.

2. Competing Hypotheses

1. **Hypothesis A**: The EU will successfully implement the reparation loan plan using frozen Russian assets, overcoming legal and diplomatic hurdles.

– **Supporting Evidence**: The EU’s urgent need to support Ukraine and the significant amount of frozen assets available.

– **Counterpoints**: Legal complexities and potential for Russian retaliation.

2. **Hypothesis B**: The EU will face insurmountable legal and geopolitical challenges, leading to the abandonment or significant modification of the plan.

– **Supporting Evidence**: Concerns from Belgium and other member states about legal precedents and financial stability.

– **Counterpoints**: Strong political will within the EU to support Ukraine.

Using ACH 2.0, Hypothesis B is slightly more supported due to the legal and geopolitical challenges highlighted by member states and potential Russian retaliation.

3. Key Assumptions and Red Flags

– **Assumptions**: The EU assumes it can legally redirect frozen assets without severe repercussions. It also assumes member states will align on risk-sharing.

– **Red Flags**: Belgium’s reluctance and the potential for Russian legal challenges. The assumption that Russia will not escalate retaliatory measures.

– **Blind Spots**: Potential underestimation of Russia’s capacity for asymmetric retaliation, such as cyberattacks or economic disruptions.

4. Implications and Strategic Risks

– **Economic Risks**: Potential destabilization of global financial systems if legal precedents are set for asset confiscation.

– **Geopolitical Risks**: Escalation of tensions between the EU and Russia, possibly affecting other geopolitical alliances.

– **Cyber Risks**: Increased likelihood of cyberattacks from Russia as a form of retaliation.

– **Psychological Risks**: Erosion of trust in the EU as a safe haven for sovereign assets.

5. Recommendations and Outlook

- **Mitigation**: Strengthen legal frameworks and diplomatic efforts to preempt Russian retaliation.

- **Exploitation**: Leverage the situation to reinforce EU unity and resolve in supporting Ukraine.

- **Scenario Projections**:

– **Best Case**: Successful implementation with minimal legal challenges and effective deterrence of Russian retaliation.

– **Worst Case**: Legal failure, significant Russian retaliation, and destabilization of EU financial systems.

– **Most Likely**: Partial implementation with ongoing legal and diplomatic negotiations.

6. Key Individuals and Entities

– **Maria Zakharova**: Russian Foreign Ministry spokeswoman, vocal against the EU plan.

– **Bart De Wever**: Belgian Prime Minister, expressing concerns about the plan.

– **Alexey Paramonov**: Russian Ambassador to Italy, warning of potential retaliation.

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, legal frameworks