Euronet Worldwide Reports Third Quarter 2025 Financial Results – GlobeNewswire

Published on: 2025-10-23

Intelligence Report: Euronet Worldwide Reports Third Quarter 2025 Financial Results – GlobeNewswire

1. BLUF (Bottom Line Up Front)

Euronet Worldwide’s strategic agreements and financial results indicate a robust growth trajectory, driven by innovation in stablecoin technology and cross-border payment solutions. The most supported hypothesis is that Euronet’s expansion and technological integration will enhance its market position and financial performance. Confidence level: High. Recommended action: Monitor Euronet’s partnerships and technological deployments for potential market disruptions and opportunities.

2. Competing Hypotheses

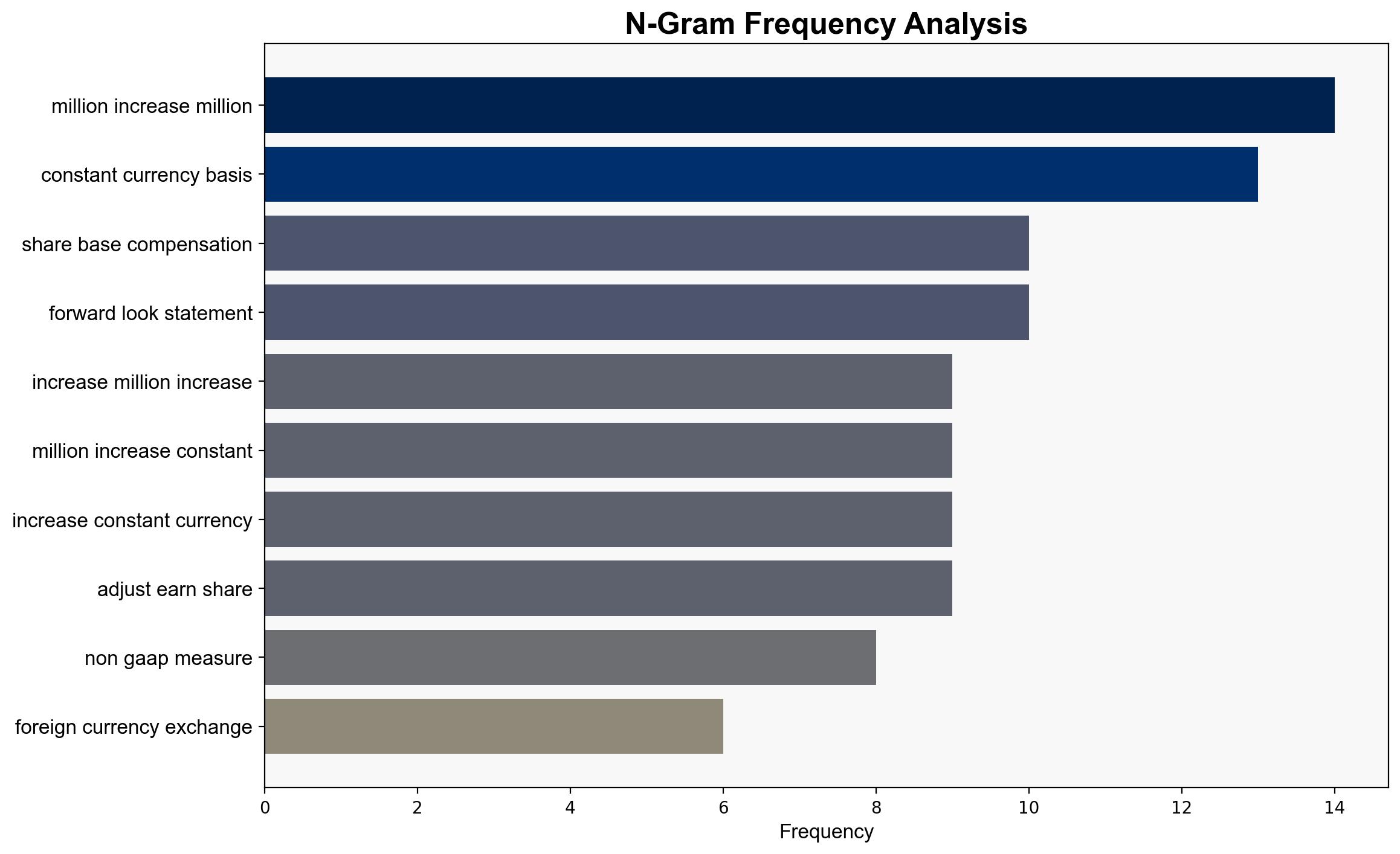

Hypothesis 1: Euronet’s strategic agreements and financial growth are primarily driven by successful integration of stablecoin technology and cross-border payment solutions, positioning it as a leader in digital financial services.

Hypothesis 2: Euronet’s reported financial success is overstated, with potential vulnerabilities in its expansion strategy and reliance on volatile technologies like stablecoins, which could lead to future financial instability.

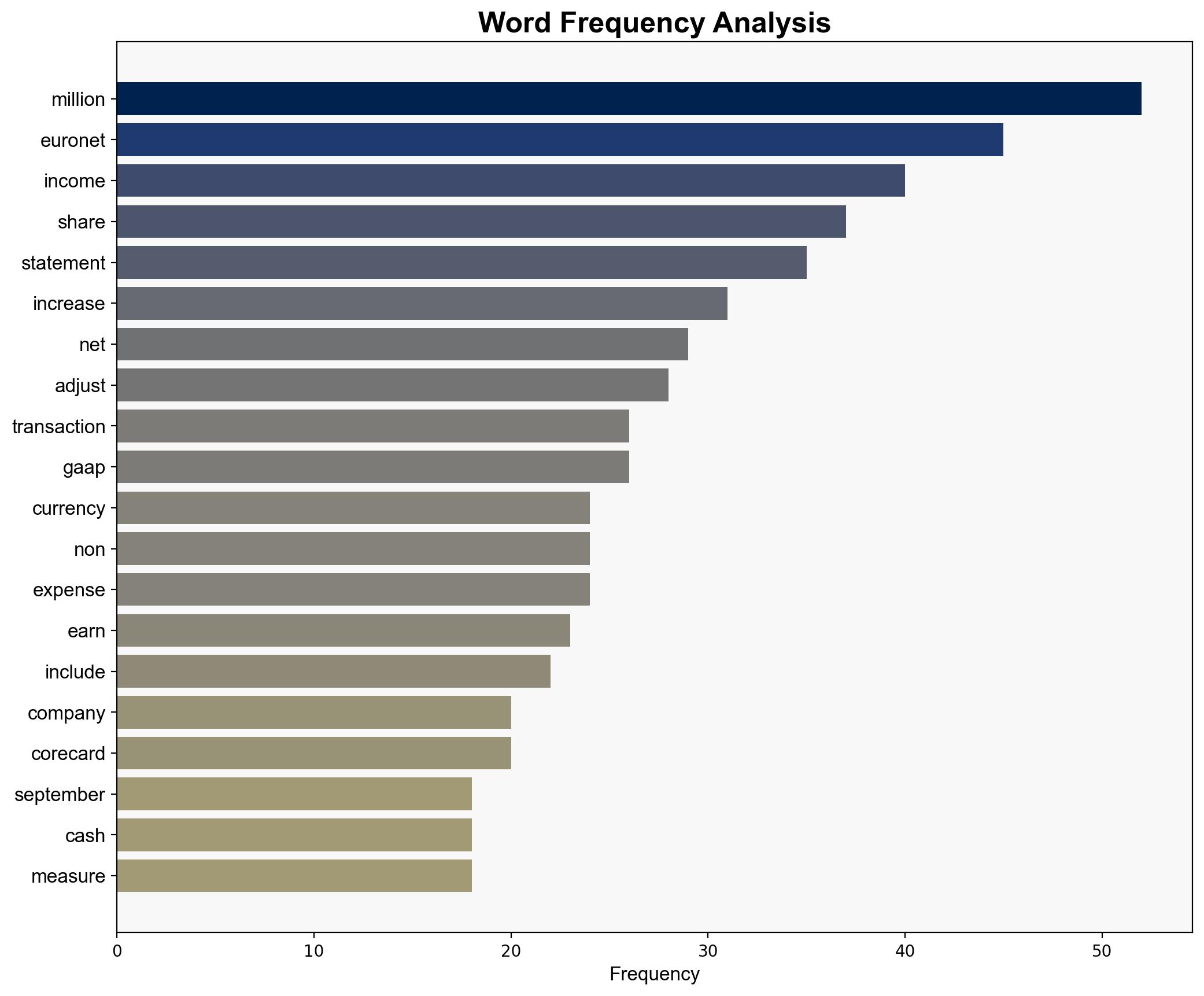

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported by the consistent increase in revenue, operating income, and strategic partnerships with entities like Citigroup and Fireblocks.

3. Key Assumptions and Red Flags

– Assumption: Euronet’s integration of stablecoin technology will be seamless and widely adopted.

– Red Flag: Overreliance on stablecoin technology could expose Euronet to regulatory and market risks.

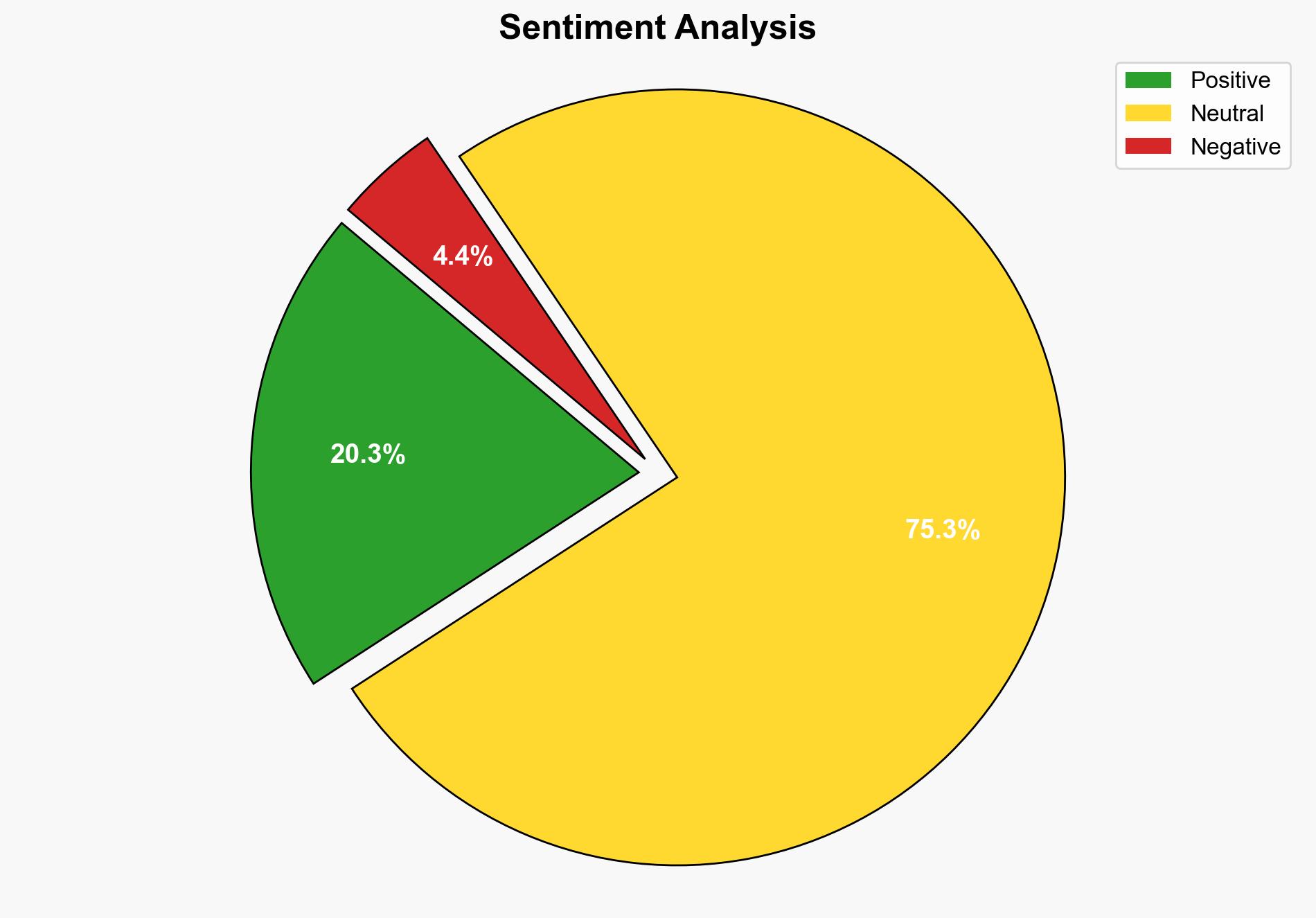

– Potential cognitive bias: Confirmation bias in interpreting financial growth as solely positive without considering external economic pressures.

– Missing data: Detailed breakdown of the impact of economic immigration pressures on financial results.

4. Implications and Strategic Risks

Euronet’s expansion into stablecoin technology and cross-border payments could disrupt traditional financial services, potentially leading to increased competition and regulatory scrutiny. The integration of digital assets with fiat currencies may also expose Euronet to cybersecurity threats and geopolitical tensions, particularly in regions with unstable financial systems.

5. Recommendations and Outlook

- Monitor regulatory developments related to stablecoins and cross-border payments to anticipate potential compliance challenges.

- Enhance cybersecurity measures to protect against potential threats from digital asset integration.

- Scenario projections:

- Best: Euronet successfully integrates stablecoin technology, leading to increased market share and financial stability.

- Worst: Regulatory crackdowns on stablecoins lead to financial losses and strategic setbacks.

- Most likely: Gradual adoption of stablecoin technology with moderate financial growth and increased market presence.

6. Key Individuals and Entities

Michael Brown, Euronet’s chairman and chief executive officer. Entities: Euronet Worldwide, Fireblocks, Citigroup, CoreCard.

7. Thematic Tags

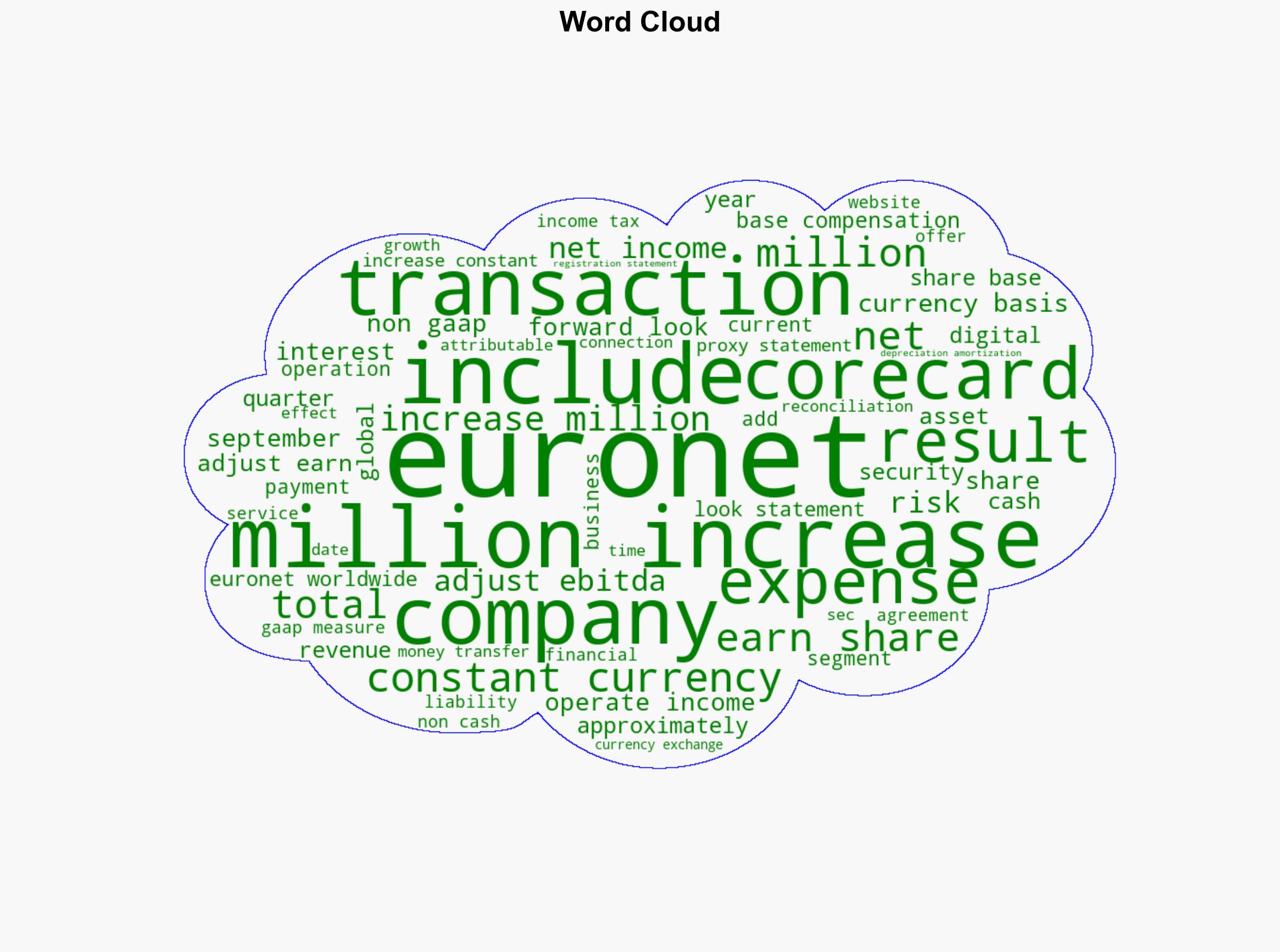

financial technology, digital payments, stablecoin integration, cross-border transactions