European stocks recover as easing US bank jitters drive risk appetite – The Times of India

Published on: 2025-10-21

Intelligence Report: European stocks recover as easing US bank jitters drive risk appetite – The Times of India

1. BLUF (Bottom Line Up Front)

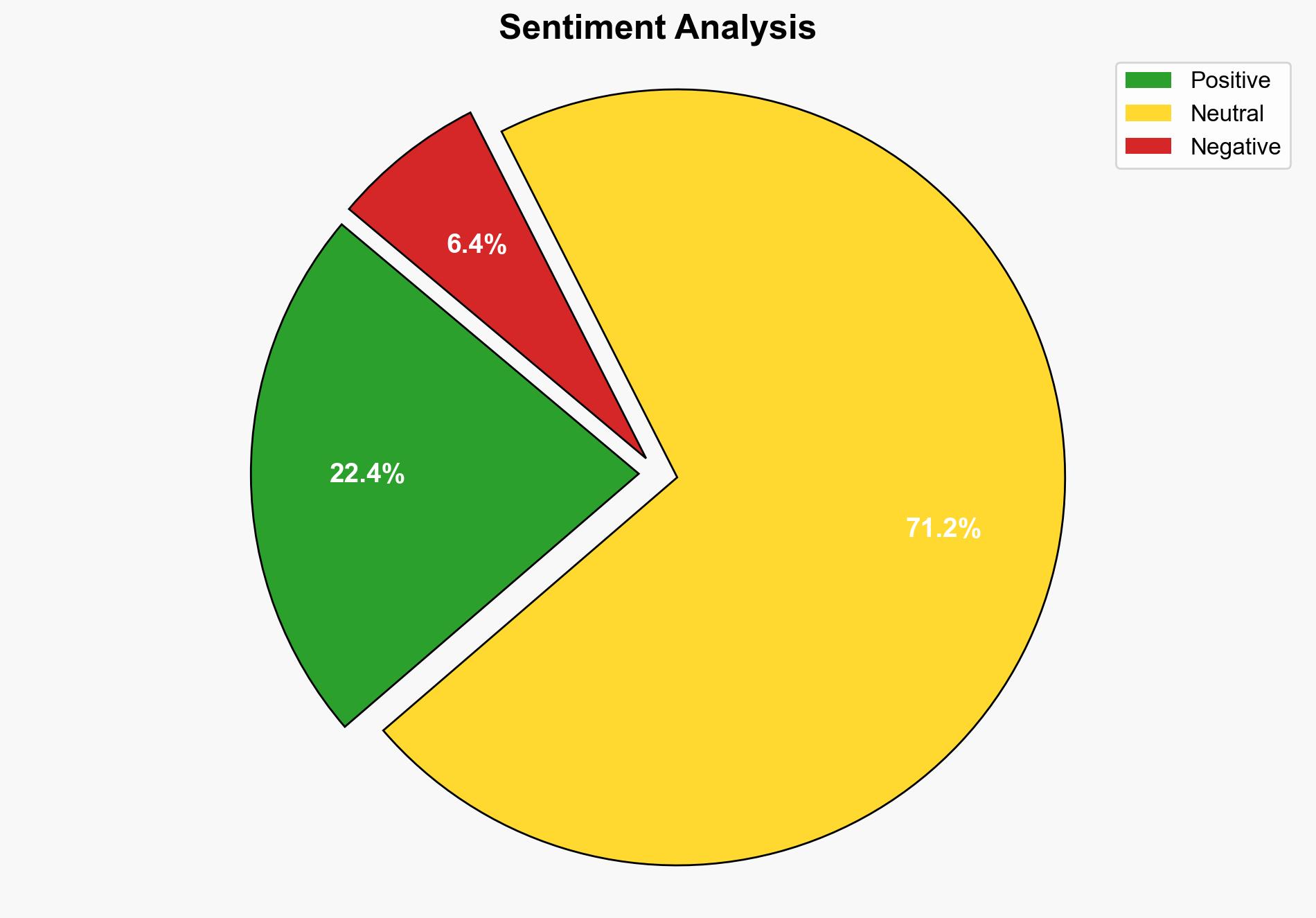

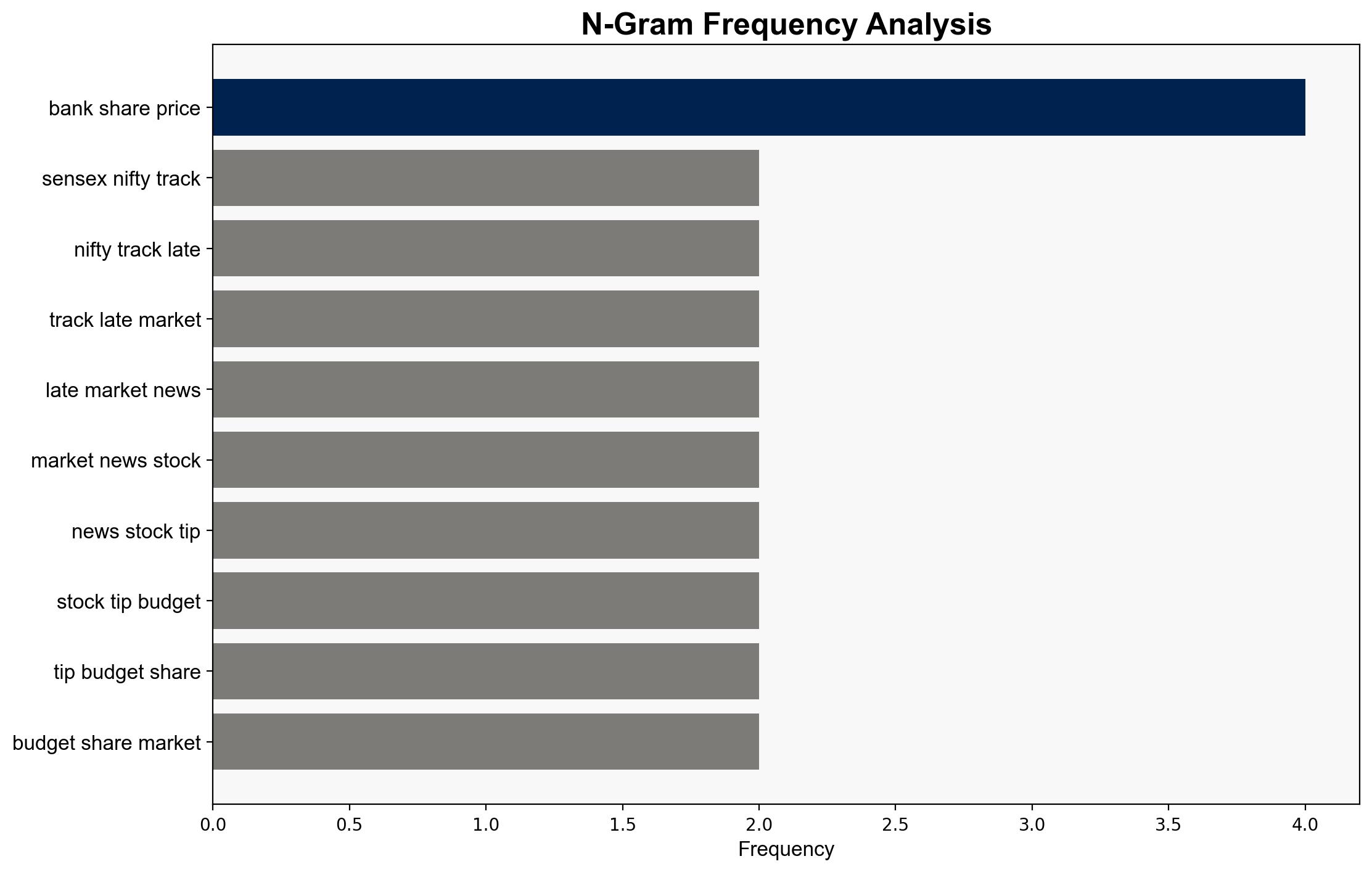

The recovery of European stocks, driven by eased concerns over US banking stability, suggests a temporary boost in market confidence. The most supported hypothesis is that this recovery is primarily due to short-term relief from banking sector fears rather than a fundamental economic improvement. Confidence level: Moderate. Recommended action: Monitor US banking sector developments closely and assess potential impacts on European markets.

2. Competing Hypotheses

Hypothesis 1: The recovery in European stocks is primarily driven by easing concerns over the US banking sector, leading to increased risk appetite among investors.

Hypothesis 2: The recovery is a result of broader economic optimism, including geopolitical developments such as potential trade negotiations between the US and China.

Using ACH 2.0, Hypothesis 1 is better supported due to specific references to easing banking concerns and their direct impact on market sentiment. Hypothesis 2 lacks concrete evidence linking broader economic factors to the immediate stock recovery.

3. Key Assumptions and Red Flags

– Assumptions: Investors are primarily influenced by short-term banking sector news; geopolitical developments have a secondary impact.

– Red Flags: Over-reliance on banking sector stability as a sole driver of market recovery; lack of detailed analysis on geopolitical factors.

– Blind Spots: Potential underestimation of geopolitical tensions and their impact on long-term market stability.

4. Implications and Strategic Risks

The current market recovery may be fragile if underlying banking sector issues resurface. A potential escalation in geopolitical tensions, such as failed US-China trade talks, could reverse gains. Economic interdependencies suggest that regional banking issues could have broader implications for global markets.

5. Recommendations and Outlook

- Monitor US banking sector developments and assess their impact on European markets.

- Prepare for potential market volatility due to geopolitical developments, particularly US-China relations.

- Scenario Projections:

- Best Case: Continued stability in the US banking sector and successful US-China trade negotiations lead to sustained market recovery.

- Worst Case: Resurgence of banking sector issues and geopolitical tensions result in market downturn.

- Most Likely: Short-term recovery with potential volatility due to unresolved geopolitical and economic issues.

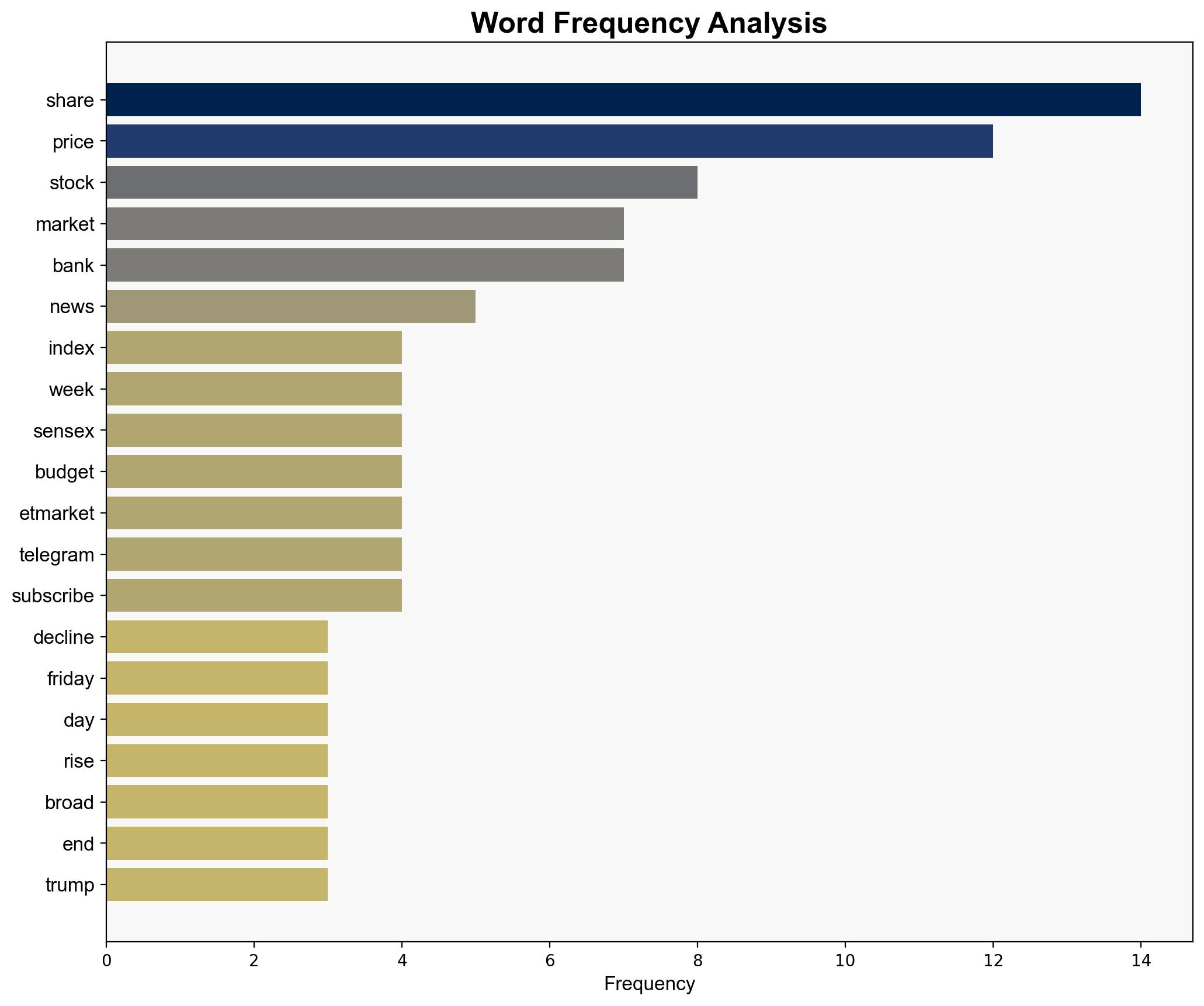

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Ipek Ozkardeskaya

– Rheinmetall

– Hensoldt

– BNP Paribas

– Kering

– L’Oreal

7. Thematic Tags

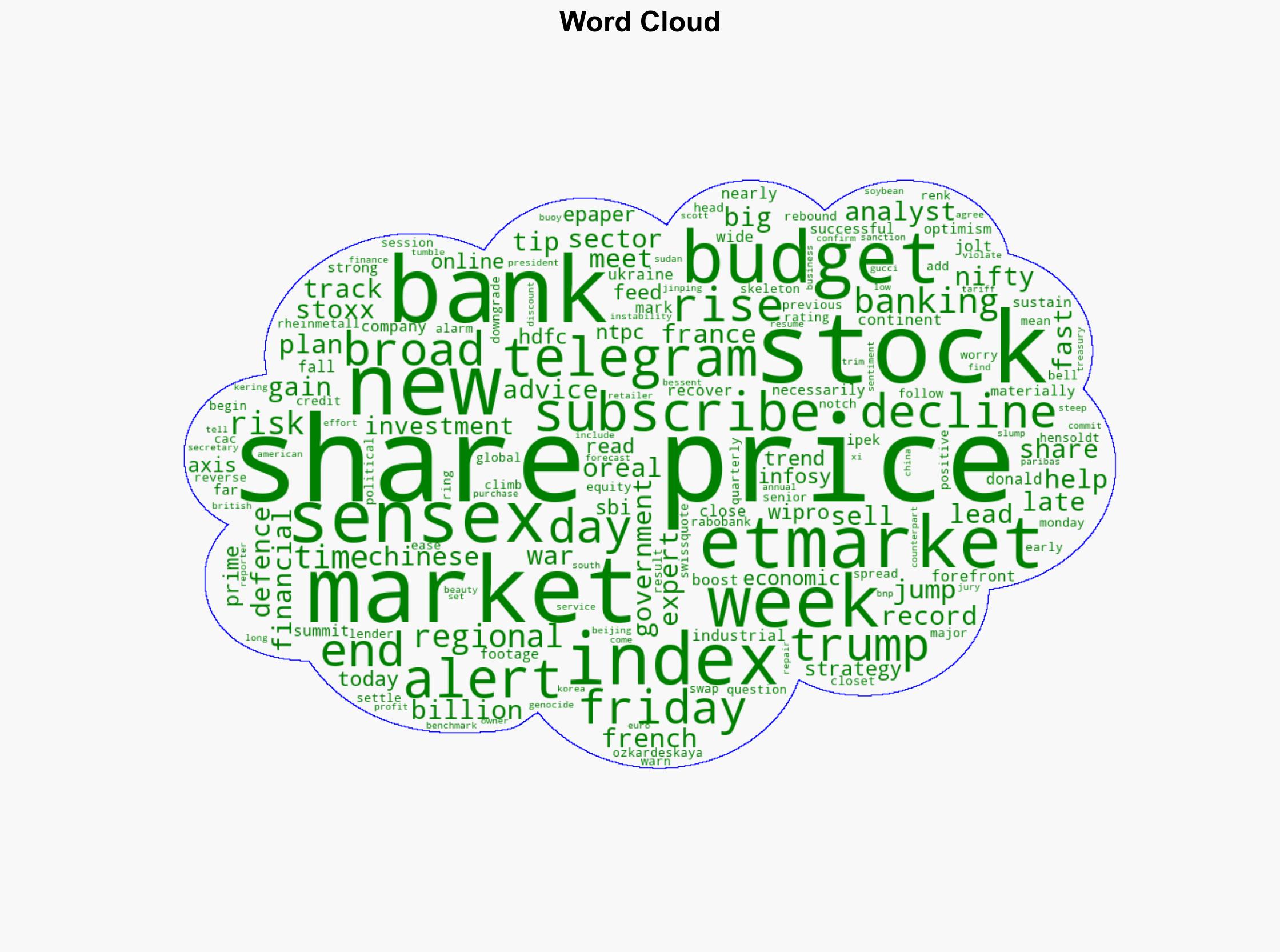

economic stability, market volatility, US banking sector, geopolitical tensions, US-China relations