Europes 31B satellite merger wont rival Musks Starlink – The Next Web

Published on: 2025-06-05

Intelligence Report: Europe’s $31B Satellite Merger Won’t Rival Musk’s Starlink – The Next Web

1. BLUF (Bottom Line Up Front)

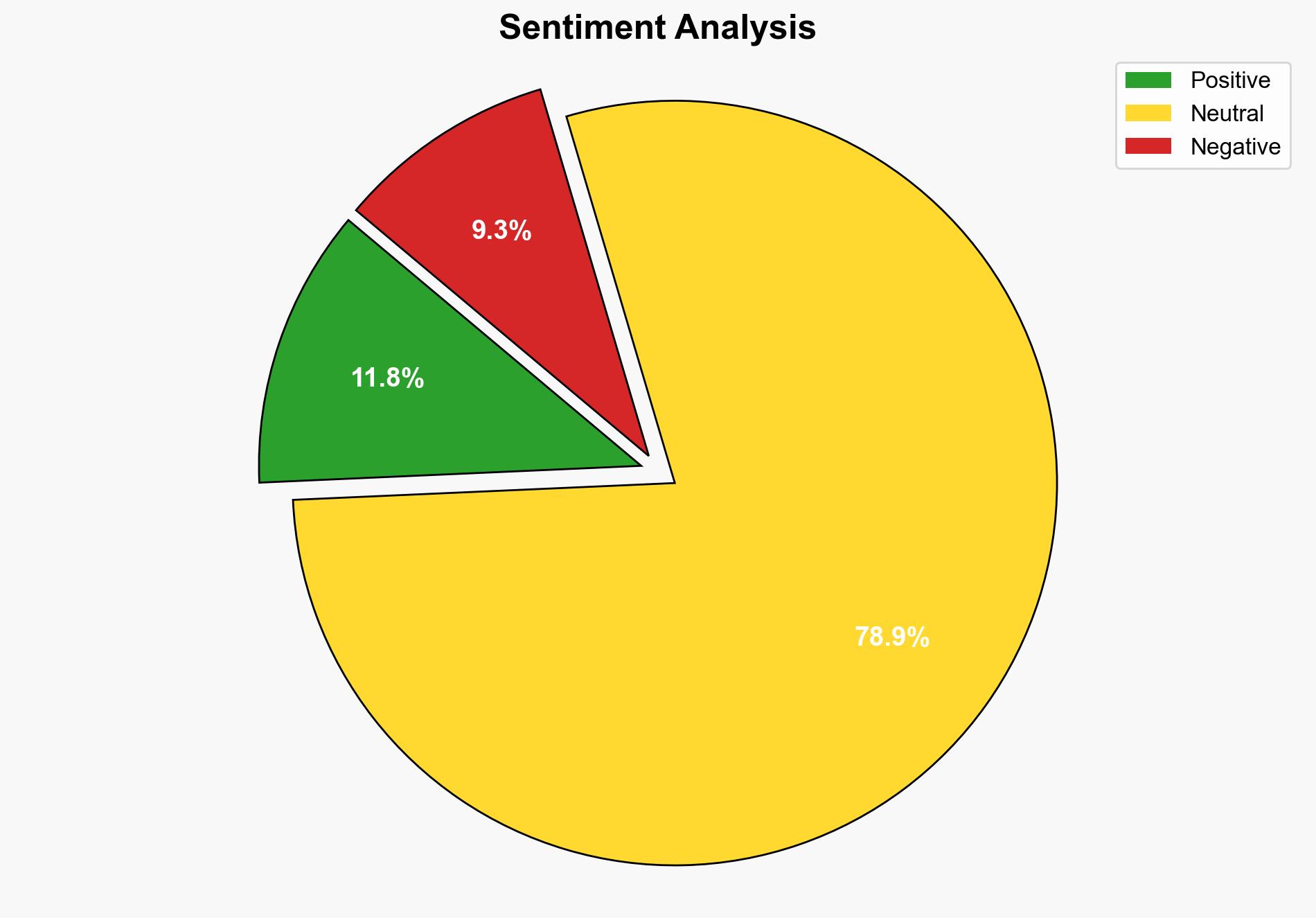

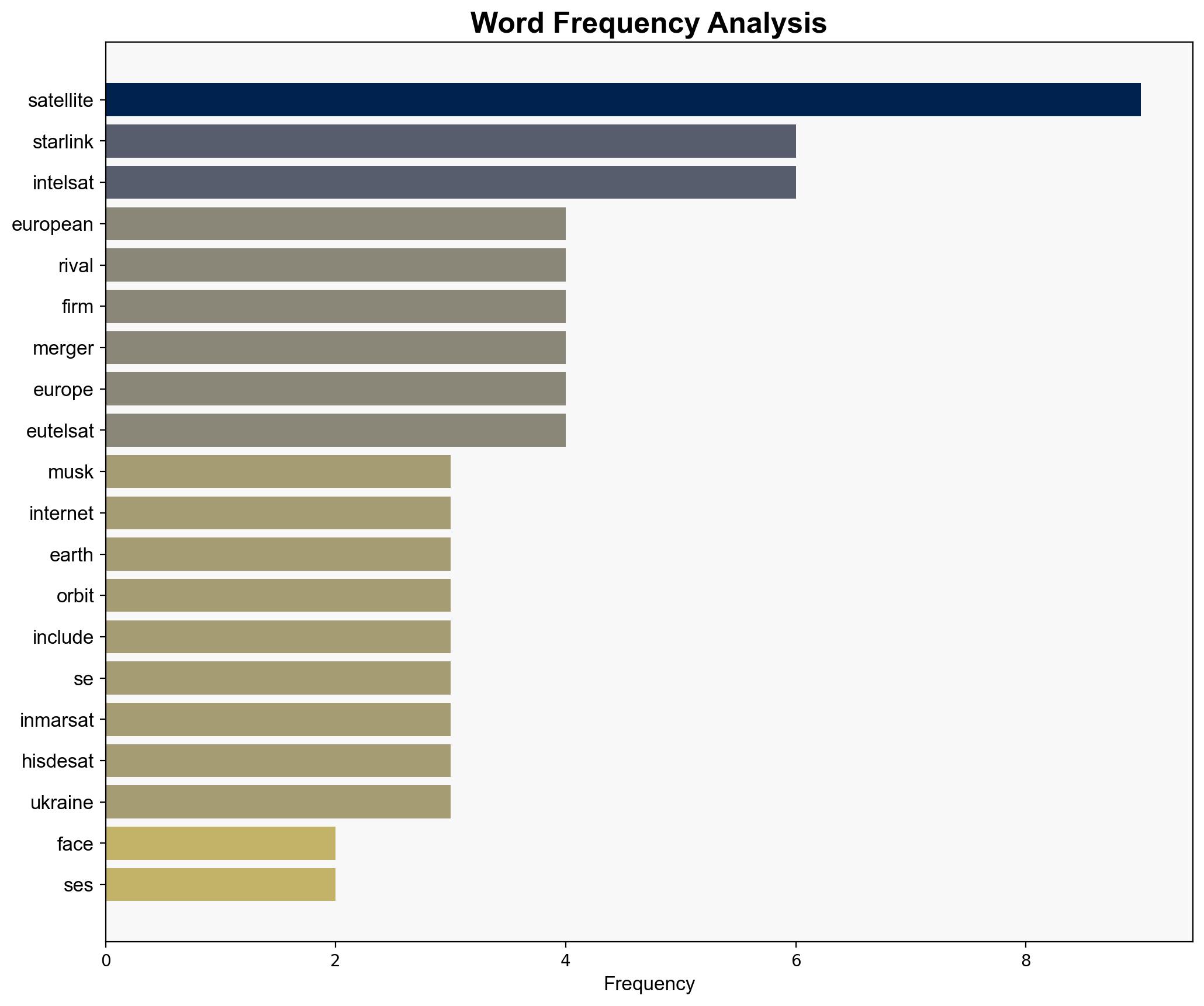

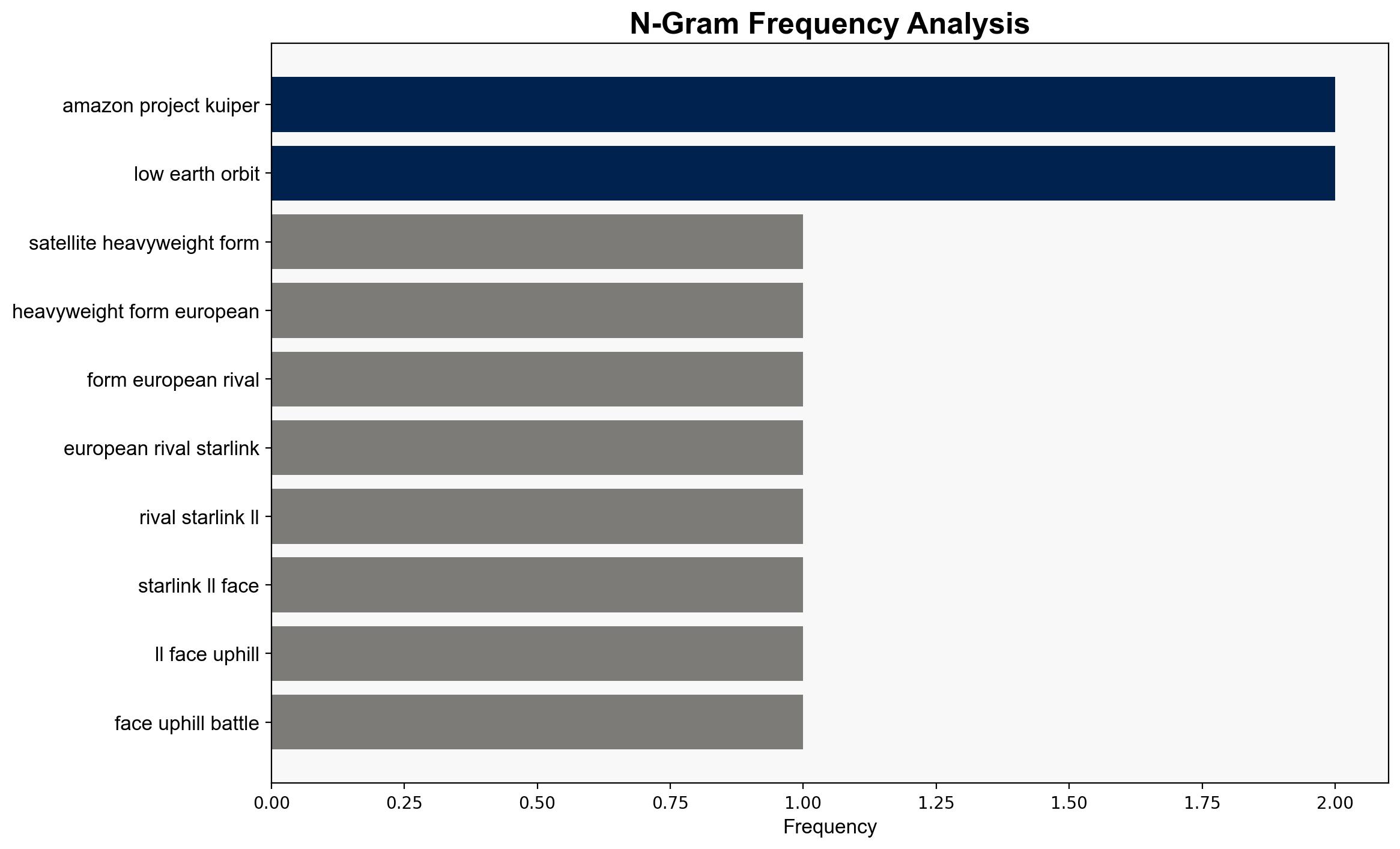

The proposed merger between SES and Intelsat, valued at $31 billion, aims to create a significant European satellite internet provider. However, it is unlikely to challenge the dominance of Elon Musk’s Starlink due to its extensive satellite network and proprietary launch capabilities. The merger represents a strategic move towards European tech sovereignty but faces substantial challenges in competing with established players like Starlink and Amazon’s Project Kuiper.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

At the surface level, the merger is a response to the growing need for European autonomy in satellite communications. Systemically, it highlights Europe’s dependence on external satellite networks. The worldview reflects a desire for strategic independence, while the underlying myth is the belief in technological self-reliance.

Cross-Impact Simulation

The merger could influence regional connectivity strategies, potentially reducing reliance on non-European providers. However, the lack of a proprietary low Earth orbit network limits its immediate impact.

Scenario Generation

Best Case: The merger successfully establishes a competitive European satellite network, enhancing regional connectivity and security.

Worst Case: The merger fails to compete effectively, leaving Europe reliant on external providers.

Most Likely: The merger strengthens Europe’s position but does not significantly alter the competitive landscape.

Network Influence Mapping

The merger involves key players like SES, Intelsat, and European policymakers. Their influence is crucial in shaping the strategic direction of the satellite industry in Europe.

3. Implications and Strategic Risks

The merger could lead to increased competition in the satellite internet market, but the reliance on external launch providers and the absence of a proprietary low Earth orbit network pose significant risks. The strategic push for autonomy may strain relations with existing providers and complicate geopolitical dynamics.

4. Recommendations and Outlook

- Invest in developing proprietary launch capabilities and low Earth orbit networks to reduce dependency on external providers.

- Strengthen partnerships with European tech firms to enhance innovation and competitiveness.

- Monitor geopolitical developments to anticipate and mitigate potential disruptions in satellite services.

5. Key Individuals and Entities

Elon Musk, SES, Intelsat, Eutelsat, Amazon (Project Kuiper), Inmarsat, Hisdesat.

6. Thematic Tags

satellite communications, European tech sovereignty, strategic autonomy, competitive analysis