Europe’s Financial Suicide – Americanthinker.com

Published on: 2025-10-28

Intelligence Report: Europe’s Financial Suicide – Americanthinker.com

1. BLUF (Bottom Line Up Front)

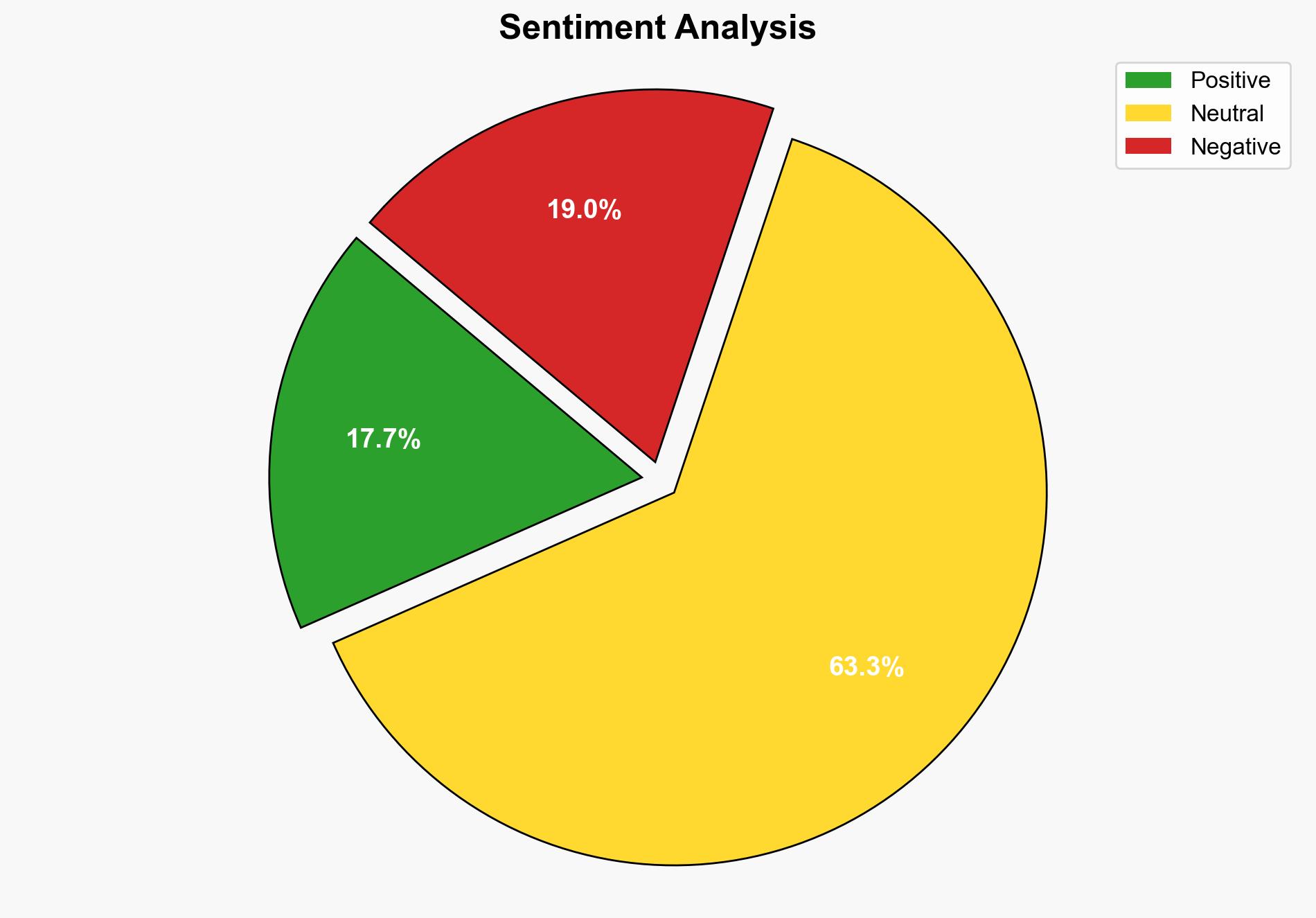

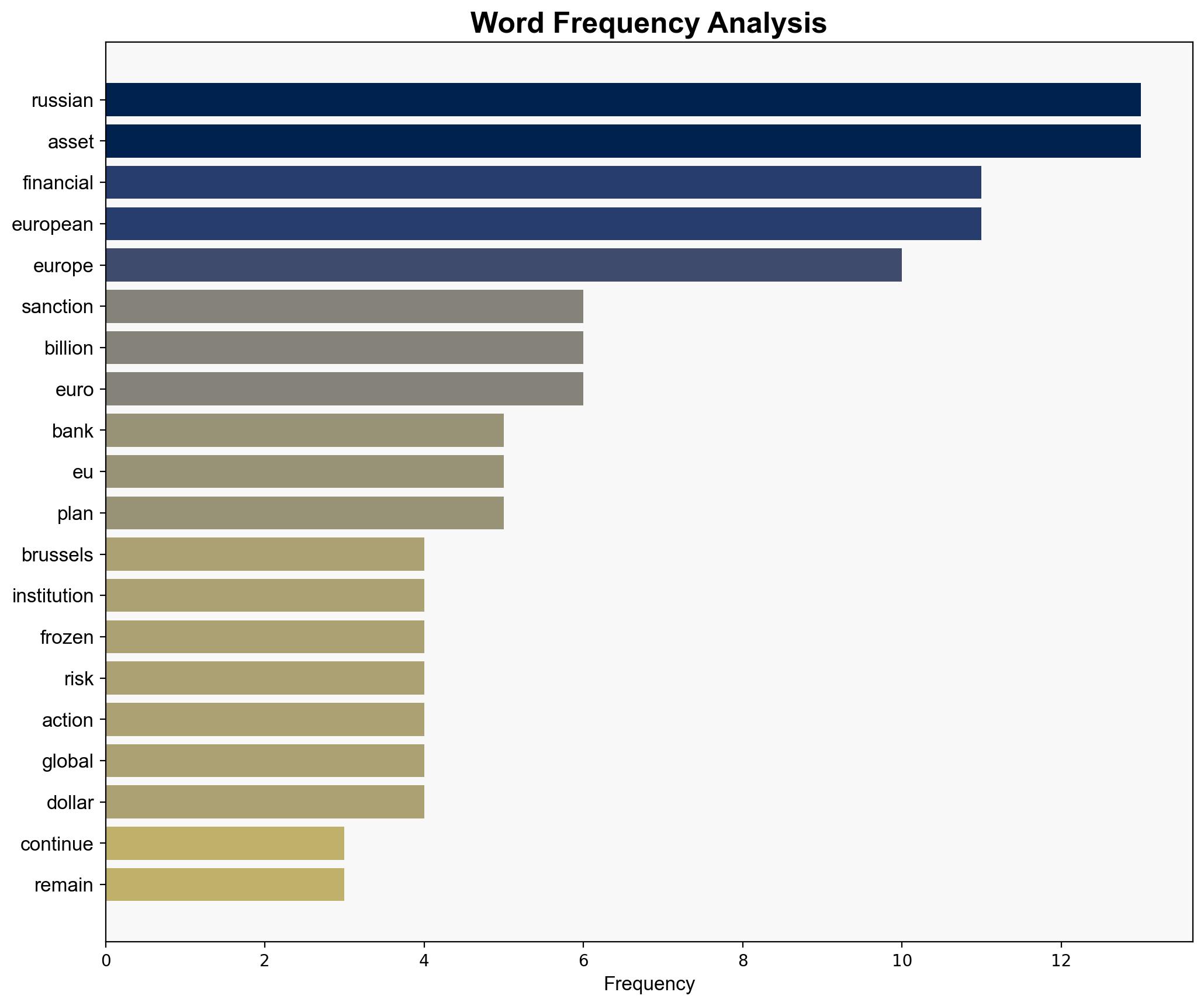

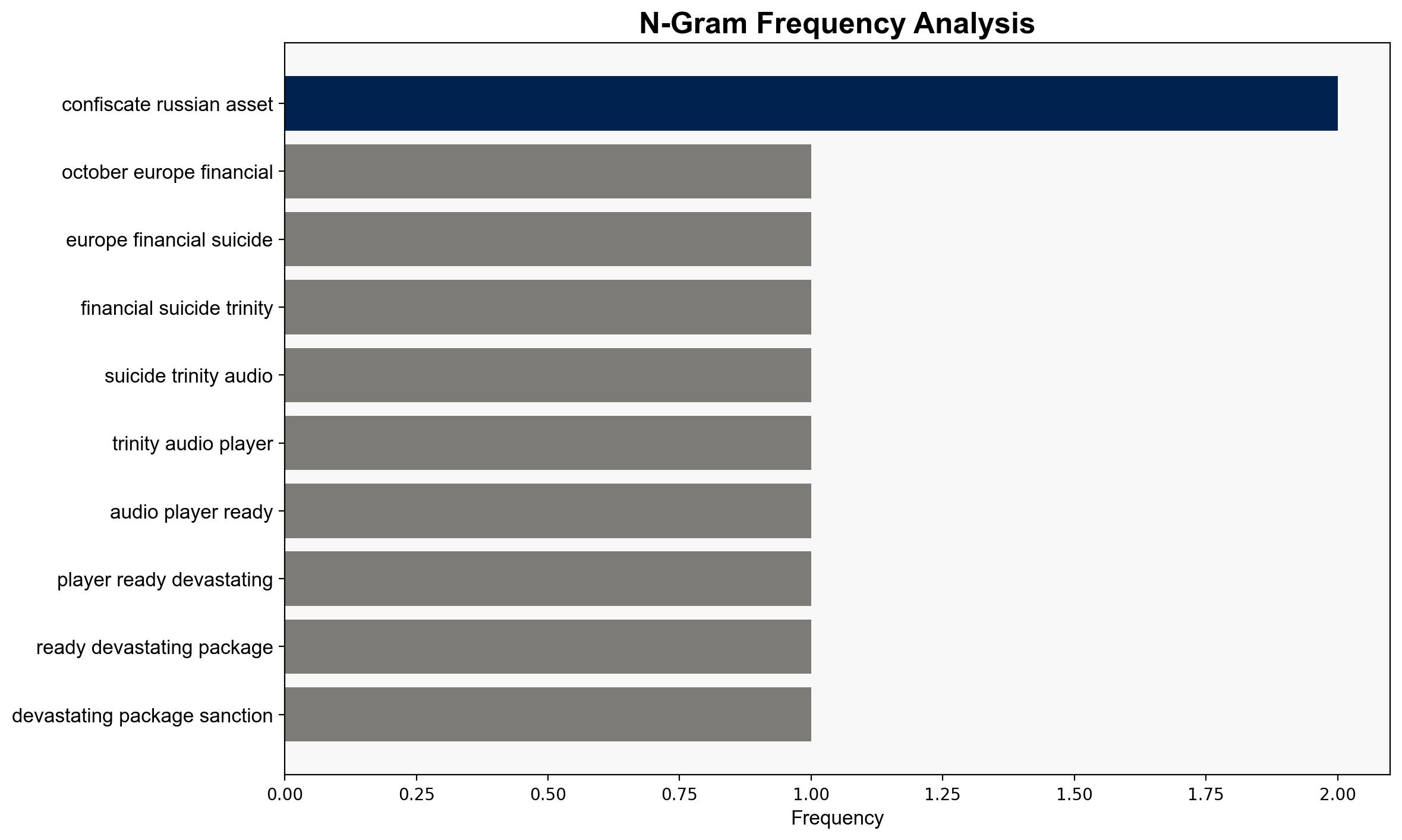

The strategic judgment indicates a high likelihood that European sanctions on Russia, particularly the freezing of assets, will have significant negative repercussions on Europe’s financial stability and global economic influence. The most supported hypothesis is that these actions will lead to increased economic challenges for the EU, potentially reducing its attractiveness to global investors. Recommended action includes reassessing the sanctions’ scope and exploring diplomatic avenues to mitigate financial risks. Confidence level: Moderate.

2. Competing Hypotheses

1. **Hypothesis A**: European sanctions on Russia, including asset freezes, will effectively pressure Russia economically, leading to a strategic advantage for the EU in geopolitical negotiations.

2. **Hypothesis B**: The sanctions will backfire, causing significant economic harm to the EU, reducing its global financial influence, and deterring investment.

Using ACH 2.0, Hypothesis B is better supported due to evidence of increased borrowing costs, legal conflicts over asset seizures, and potential damage to the EU’s financial reputation.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that sanctions will lead to desired geopolitical outcomes without severe economic backlash. This may overlook the complexity of global financial systems and investor behavior.

– **Red Flags**: Legal disputes over asset seizures, reluctance of investors to engage with EU markets, and rising political risks are significant indicators of potential miscalculations.

– **Blind Spots**: Potential for Russia to find alternative markets and financial systems, reducing the impact of EU sanctions.

4. Implications and Strategic Risks

The sanctions may lead to a cascade of economic challenges, including increased borrowing costs, reduced investment, and potential legal battles. Geopolitically, this could weaken the EU’s influence and embolden adversaries. Economically, it could lead to a shift in global reserve currencies and financial alliances.

5. Recommendations and Outlook

- Reevaluate the scope and targets of sanctions to balance geopolitical goals with economic stability.

- Engage in diplomatic efforts to address legal disputes and reassure investors.

- Scenario Projections:

- Best: Sanctions lead to successful negotiations with Russia, stabilizing the EU economy.

- Worst: Sanctions cause severe economic downturn in the EU, leading to political instability.

- Most Likely: Continued economic strain with gradual adaptation by both the EU and Russia.

6. Key Individuals and Entities

– European Commission

– Euroclear

– JPMorgan Chase

– Moscow National Settlement Depository

7. Thematic Tags

national security threats, economic sanctions, geopolitical strategy, EU financial stability