Exclusive Senate Democrats demand top Trump advisor Steve Witkoff provide details on crypto investments lack of divestment – Fortune

Published on: 2025-10-22

Intelligence Report: Exclusive Senate Democrats demand top Trump advisor Steve Witkoff provide details on crypto investments lack of divestment – Fortune

1. BLUF (Bottom Line Up Front)

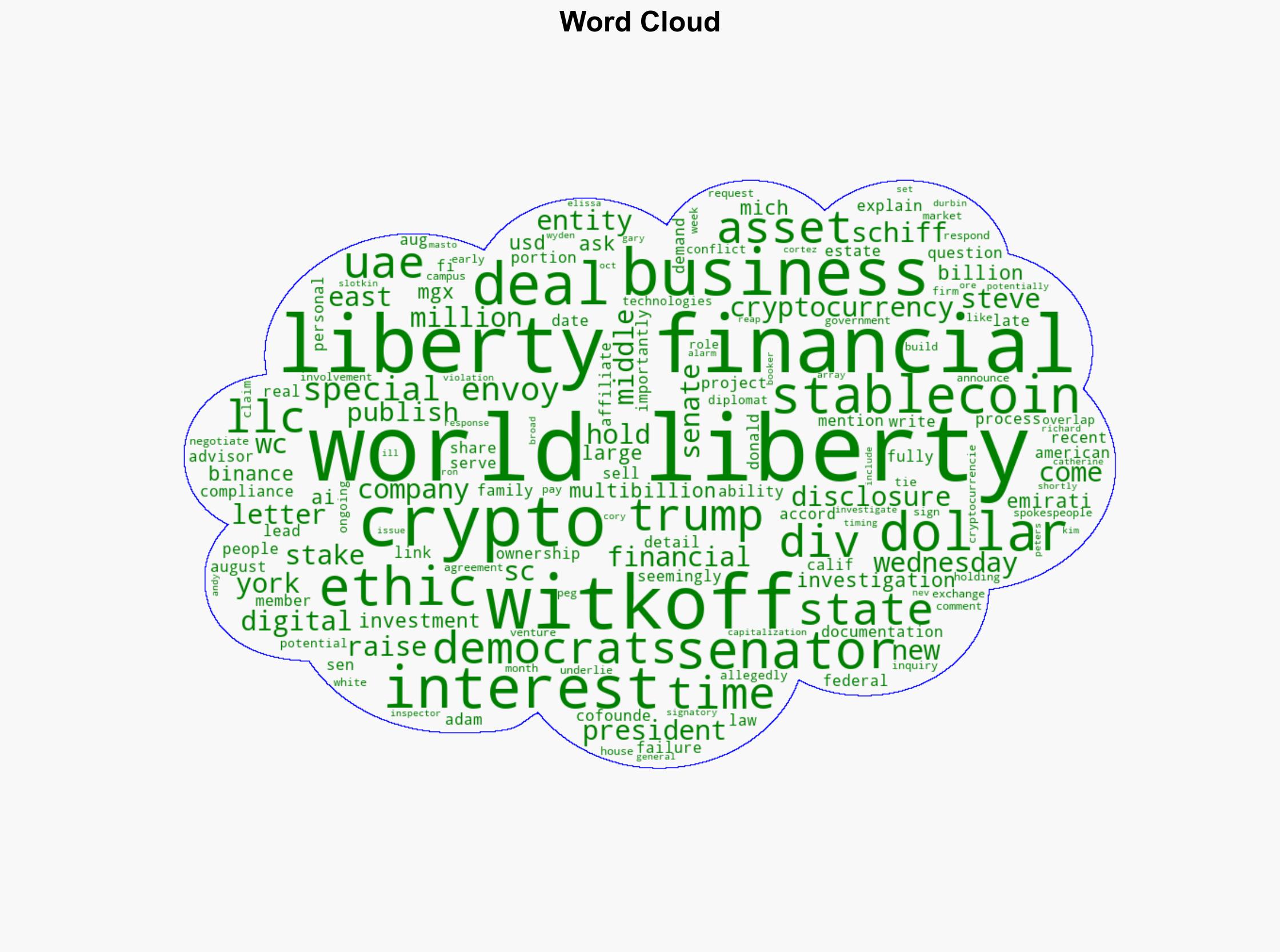

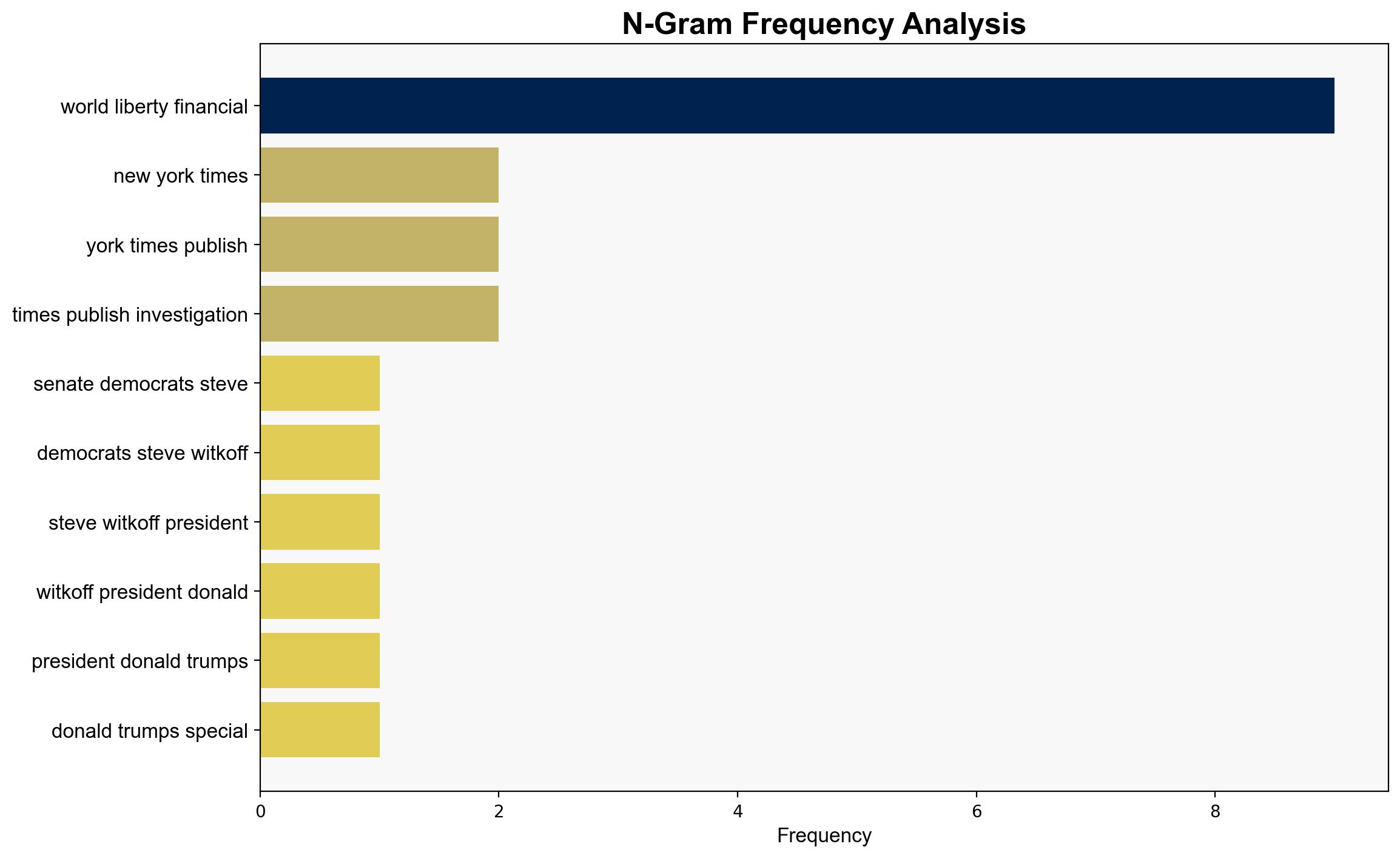

The most supported hypothesis suggests that Steve Witkoff’s undisclosed crypto investments may pose a conflict of interest, potentially affecting his diplomatic role. Confidence level is moderate due to incomplete data on the specifics of the investments and their direct impact. Recommended action includes a thorough investigation into Witkoff’s financial interests and their implications for his diplomatic duties.

2. Competing Hypotheses

1. **Hypothesis A**: Steve Witkoff’s undisclosed crypto investments represent a significant conflict of interest, potentially compromising his diplomatic role in the Middle East due to overlapping business interests with UAE-linked entities.

2. **Hypothesis B**: The allegations of conflict of interest are overstated, and Witkoff’s crypto investments are either minimal or sufficiently separated from his diplomatic responsibilities to avoid any ethical breaches.

Using ACH 2.0, Hypothesis A is better supported by the available evidence, including the timing of the crypto deals and the lack of divestment, which align with concerns raised by Senate Democrats.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that Witkoff’s investments are substantial enough to influence his diplomatic decisions. Hypothesis B assumes that existing ethical guidelines are sufficient to prevent conflicts.

– **Red Flags**: The lack of transparency in Witkoff’s financial disclosures and the timing of the deals with UAE entities are critical red flags. The absence of comments from World Liberty Financial and the White House suggests potential information withholding.

4. Implications and Strategic Risks

– **Economic Risks**: Potential manipulation of crypto markets due to insider information.

– **Geopolitical Risks**: Compromised diplomatic integrity could weaken U.S. influence in Middle East negotiations.

– **Cybersecurity Risks**: Increased scrutiny on crypto transactions may expose vulnerabilities in financial networks.

– **Psychological Risks**: Public trust in government transparency and ethics could be eroded.

5. Recommendations and Outlook

- Conduct an independent investigation into Witkoff’s financial interests and their potential impact on his diplomatic role.

- Implement stricter disclosure requirements for government officials involved in sensitive negotiations.

- Scenario Projections:

- Best Case: Witkoff’s investments are found to be compliant, restoring confidence in his diplomatic role.

- Worst Case: Significant conflicts of interest are confirmed, leading to diplomatic fallout and policy shifts.

- Most Likely: Partial divestment or restructuring of investments to align with ethical standards.

6. Key Individuals and Entities

– Steve Witkoff

– Adam Schiff

– Ron Wyden

– Andy Kim

– Richard Durbin

– Catherine Cortez Masto

– Gary Peters

– Elissa Slotkin

– Cory Booker

– World Liberty Financial

– WC Digital FI LLC

– SC Financial Technologies LLC

7. Thematic Tags

national security threats, cybersecurity, geopolitical risks, financial ethics