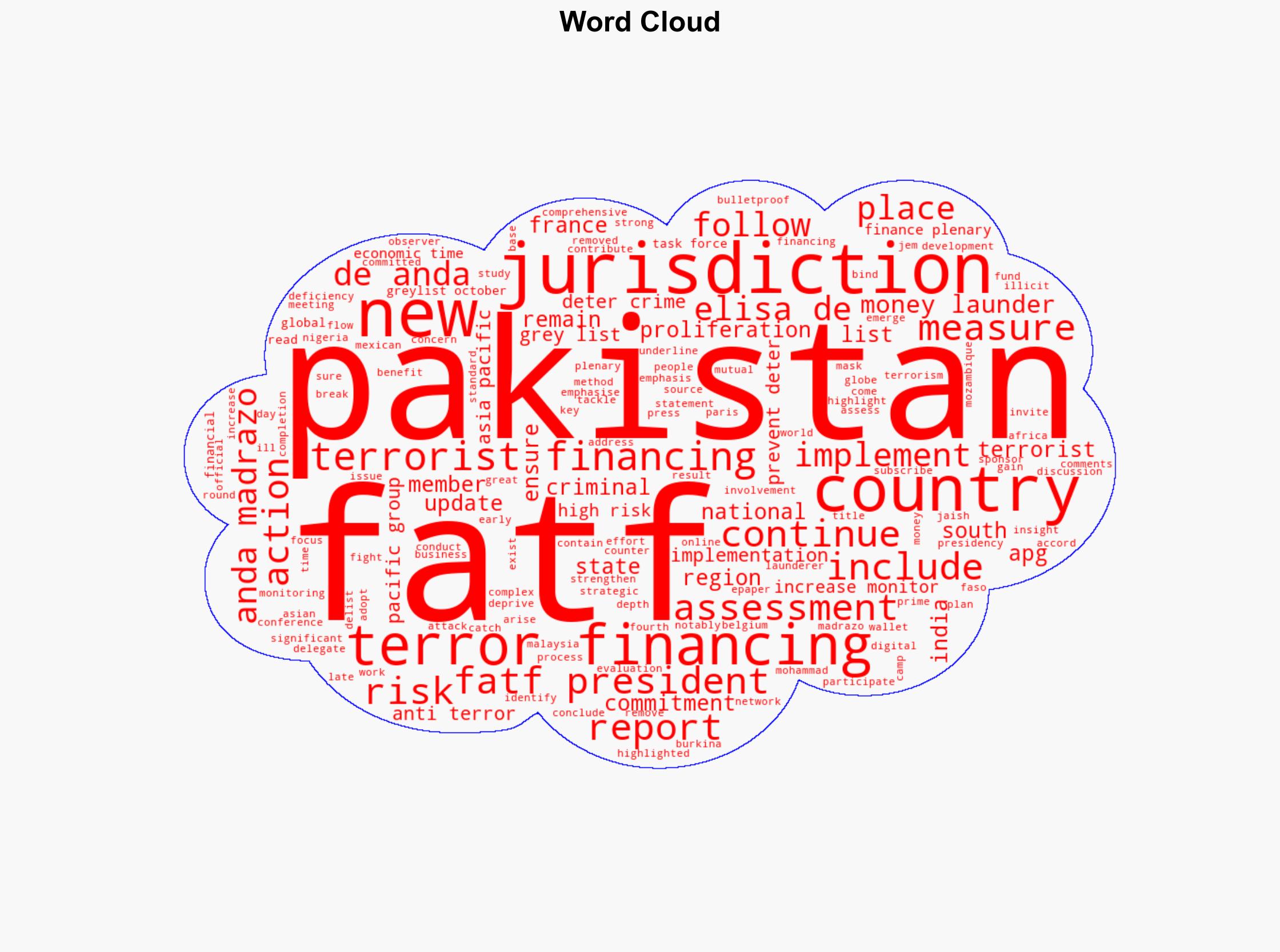

Exit from Greylist not bulletproof FATF warns Pakistan against terror financing – The Times of India

Published on: 2025-10-25

Intelligence Report: Exit from Greylist not bulletproof FATF warns Pakistan against terror financing – The Times of India

1. BLUF (Bottom Line Up Front)

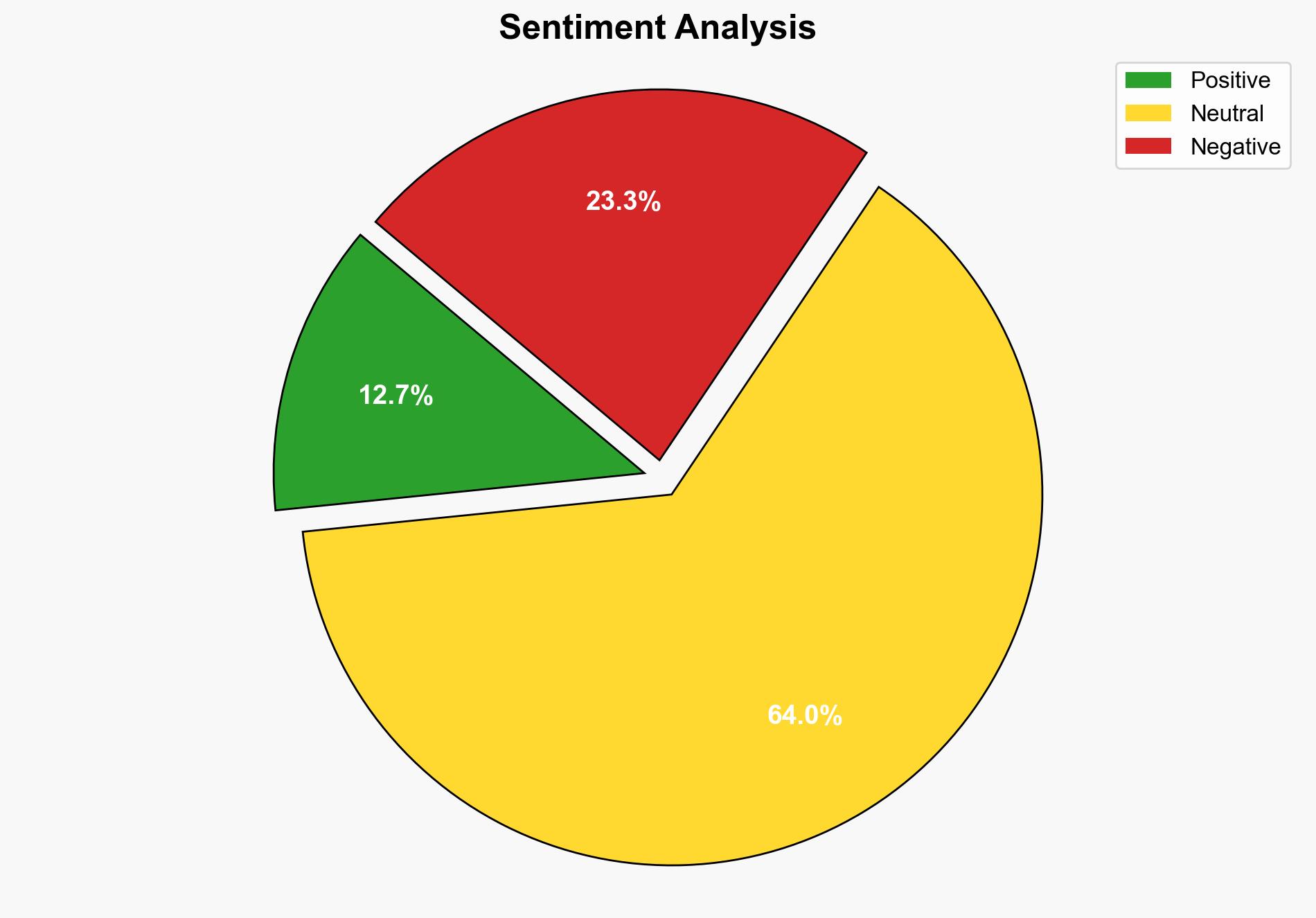

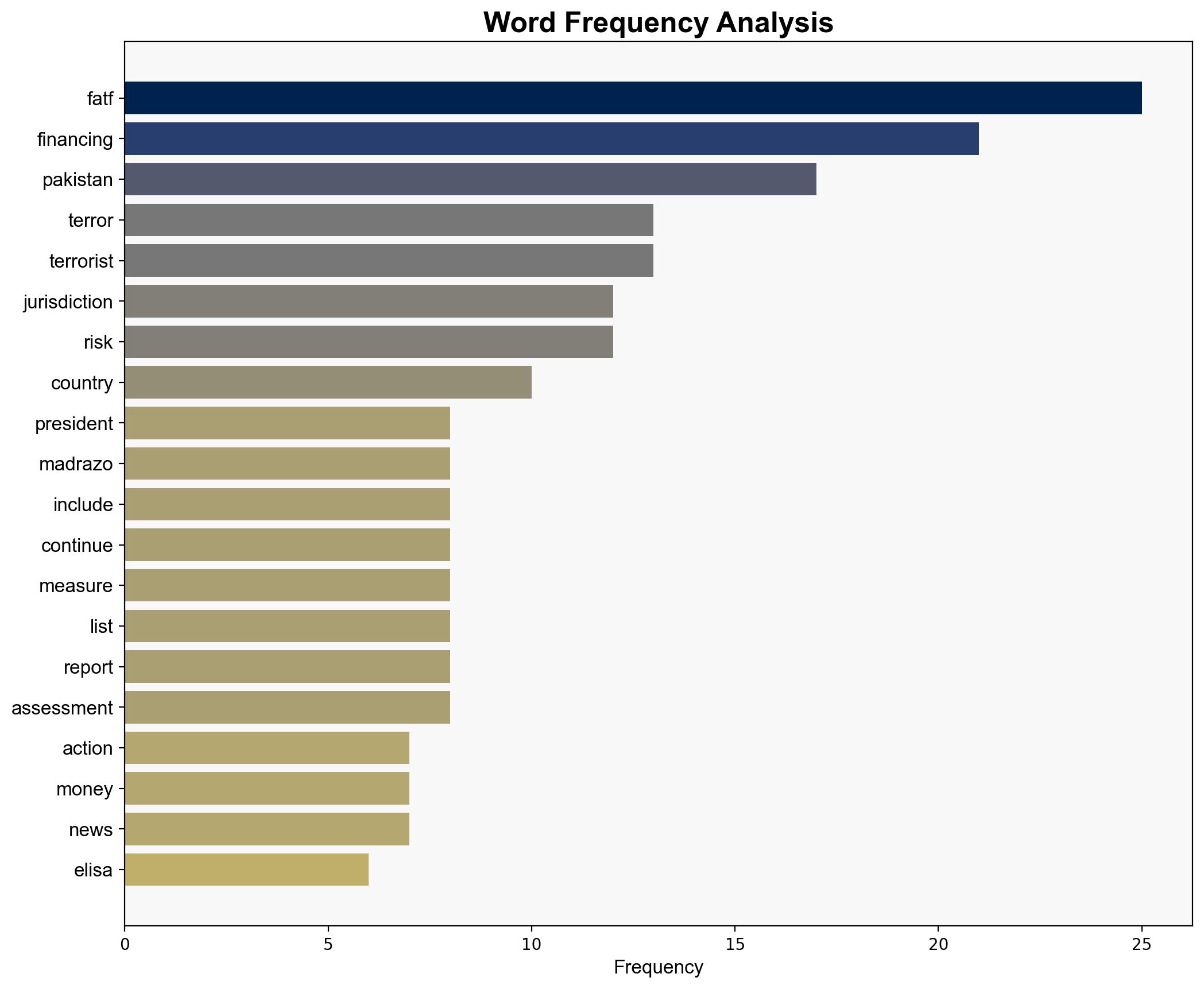

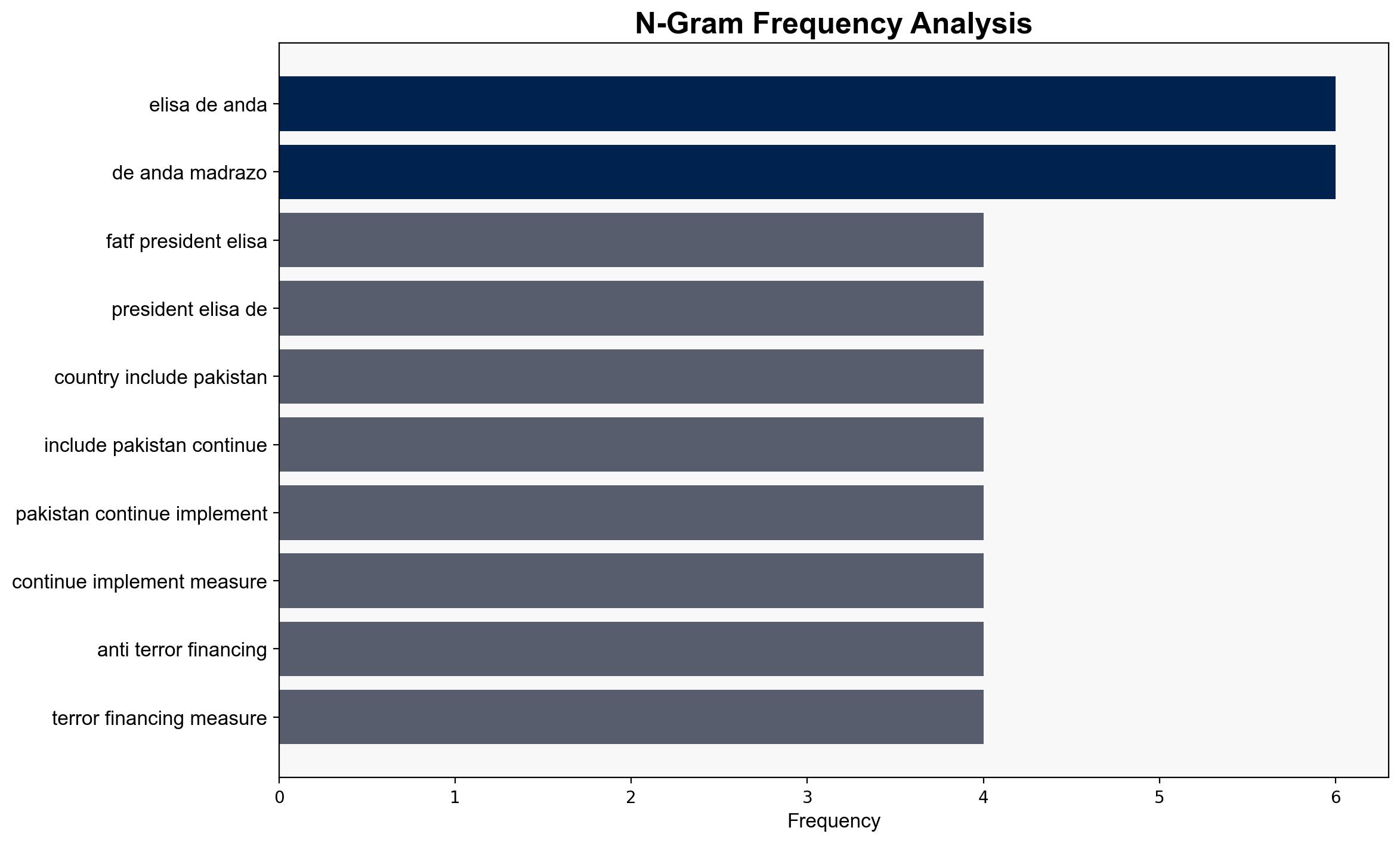

The Financial Action Task Force (FATF) has removed Pakistan from its greylist, but warns that this does not make the country immune to risks of money laundering and terrorist financing. The most supported hypothesis is that Pakistan’s removal is conditional and requires continued vigilance and implementation of anti-terror financing measures. Confidence level: Moderate. Recommended action: Monitor Pakistan’s compliance with FATF standards and prepare for potential re-listing if deficiencies re-emerge.

2. Competing Hypotheses

1. **Conditional Compliance Hypothesis**: Pakistan’s removal from the greylist is contingent upon its continued adherence to FATF’s anti-terror financing measures. This hypothesis suggests that Pakistan has made sufficient progress but must maintain and enhance its efforts to prevent re-listing.

2. **Premature Removal Hypothesis**: Pakistan’s removal from the greylist is premature, and the country remains a high-risk jurisdiction for terror financing. This perspective argues that despite improvements, underlying issues persist, posing ongoing risks to global security.

3. Key Assumptions and Red Flags

– **Assumptions**: The Conditional Compliance Hypothesis assumes Pakistan will continue to implement FATF measures effectively. The Premature Removal Hypothesis assumes existing deficiencies are significant enough to warrant re-listing.

– **Red Flags**: Inconsistent data on Pakistan’s enforcement of anti-terror financing laws. Potential cognitive bias in overestimating Pakistan’s compliance due to political pressures.

– **Deception Indicators**: Possible underreporting or masking of financial flows linked to terrorism.

4. Implications and Strategic Risks

– **Economic**: Continued greylist removal could improve Pakistan’s economic relations and investment climate, but re-listing could reverse these gains.

– **Geopolitical**: Regional tensions may escalate if Pakistan is perceived as a persistent threat in terror financing.

– **Cyber**: Increased use of digital wallets for illicit funding highlights a growing cyber threat.

– **Psychological**: Perception of Pakistan’s commitment to counter-terrorism may influence international trust and cooperation.

5. Recommendations and Outlook

- Enhance monitoring of Pakistan’s compliance with FATF standards through regular audits and assessments.

- Engage in diplomatic efforts to support Pakistan’s capacity-building in anti-terror financing measures.

- Scenario Projections:

- Best: Pakistan fully complies, leading to sustained removal from the greylist and improved international relations.

- Worst: Pakistan fails to maintain compliance, resulting in re-listing and economic sanctions.

- Most Likely: Pakistan shows partial compliance, requiring ongoing monitoring and support.

6. Key Individuals and Entities

– Elisa de Anda Madrazo, FATF President

– Jaish-e-Mohammad (JeM), identified as a terror group with potential financial ties to Pakistan

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus