Exxon and Chevron hike oil production despite global glut and see more frontier exploration as US shale boom slows – Fortune

Published on: 2025-10-31

Intelligence Report: Exxon and Chevron hike oil production despite global glut and see more frontier exploration as US shale boom slows – Fortune

1. BLUF (Bottom Line Up Front)

Exxon and Chevron are increasing oil production despite a global surplus, driven by strategic shifts towards frontier exploration as US shale production matures. The most supported hypothesis suggests these companies are positioning for long-term gains in anticipation of future demand increases. Confidence level: Moderate. Recommended action: Monitor global oil market dynamics and geopolitical developments that may impact oil prices and production strategies.

2. Competing Hypotheses

Hypothesis 1: Exxon and Chevron are increasing production to capture market share, anticipating future demand growth despite current oversupply. This strategy involves leveraging efficient production in established regions while exploring new frontiers for long-term resource security.

Hypothesis 2: The production increase is a defensive measure to maintain profitability amidst low prices, with frontier exploration serving as a hedge against the decline of US shale production. This approach suggests a short-term focus on sustaining financial performance while preparing for potential shifts in the energy landscape.

Using ACH 2.0, Hypothesis 1 is better supported due to the emphasis on strategic long-term exploration and investment in frontier regions, aligning with statements from company leadership about future demand and resource security.

3. Key Assumptions and Red Flags

– Assumptions: Future global oil demand will increase; frontier exploration will yield profitable resources; current low prices are temporary.

– Red Flags: Over-reliance on uncertain future demand; potential geopolitical instability in frontier regions; financial risks from sustained low prices.

– Missing Data: Detailed financial projections and geopolitical risk assessments for frontier exploration areas.

4. Implications and Strategic Risks

– Economic: Prolonged low oil prices could strain financial resources, impacting profitability and investment capacity.

– Geopolitical: Increased exploration in politically unstable regions could expose companies to geopolitical risks and regulatory challenges.

– Strategic: Failure to accurately predict demand shifts could result in overproduction and financial losses.

5. Recommendations and Outlook

- Monitor global oil demand indicators and adjust production strategies accordingly.

- Enhance geopolitical risk assessments for frontier exploration areas to mitigate potential disruptions.

- Scenario Projections:

- Best Case: Global demand increases, leading to higher prices and profitable frontier exploration.

- Worst Case: Prolonged low prices and geopolitical instability result in financial losses and exploration setbacks.

- Most Likely: Moderate demand growth stabilizes prices, with gradual success in frontier exploration.

6. Key Individuals and Entities

– Darren Wood

– Mike Wirth

– ExxonMobil

– Chevron

7. Thematic Tags

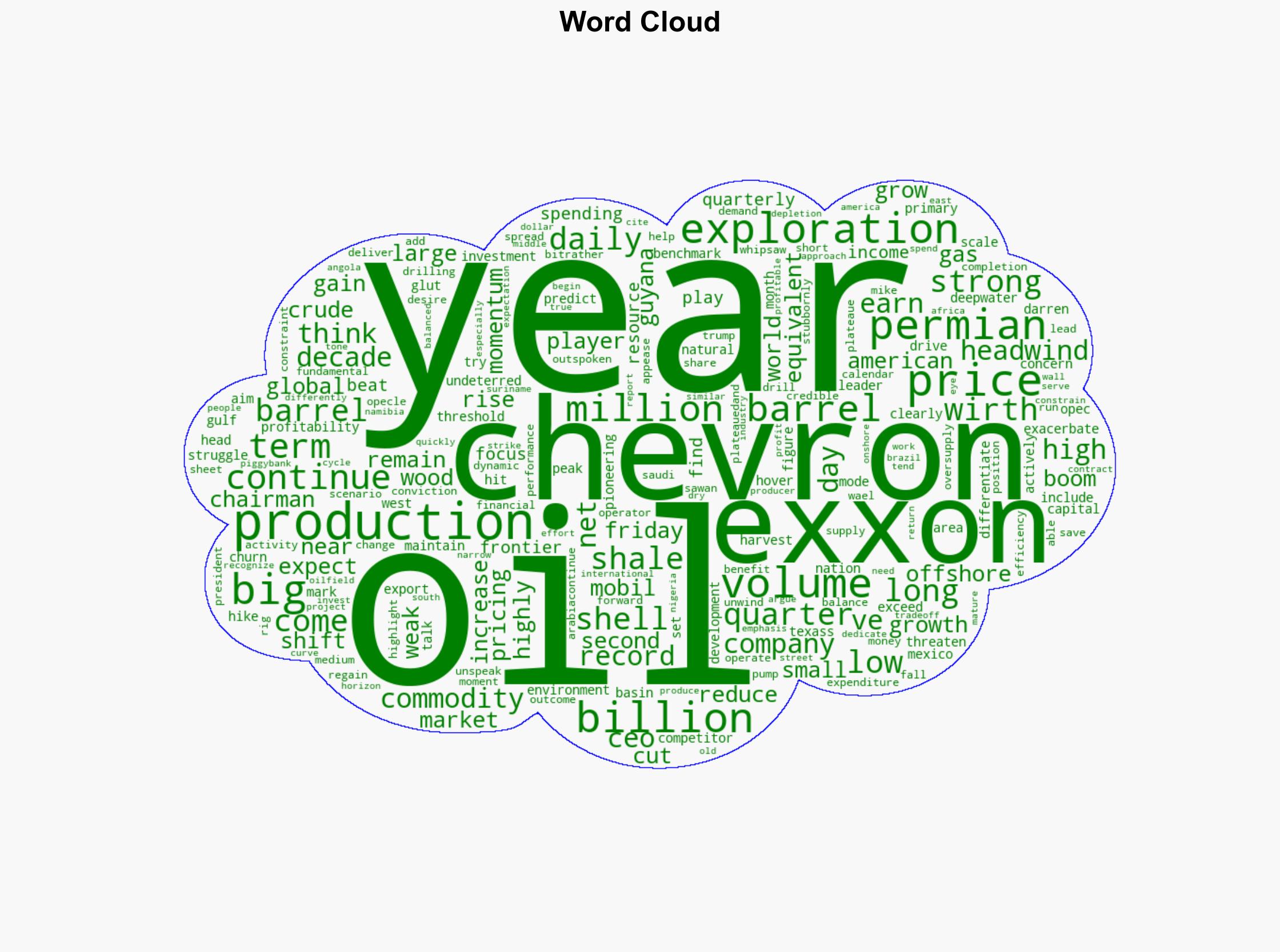

energy strategy, market dynamics, geopolitical risk, resource exploration