Faraday Future Founder and Co-CEO YT Jia Shares Weekly Investor Update FX Finalizes US Production Assembly Plan – GlobeNewswire

Published on: 2025-10-06

Intelligence Report: Faraday Future Founder and Co-CEO YT Jia Shares Weekly Investor Update FX Finalizes US Production Assembly Plan – GlobeNewswire

1. BLUF (Bottom Line Up Front)

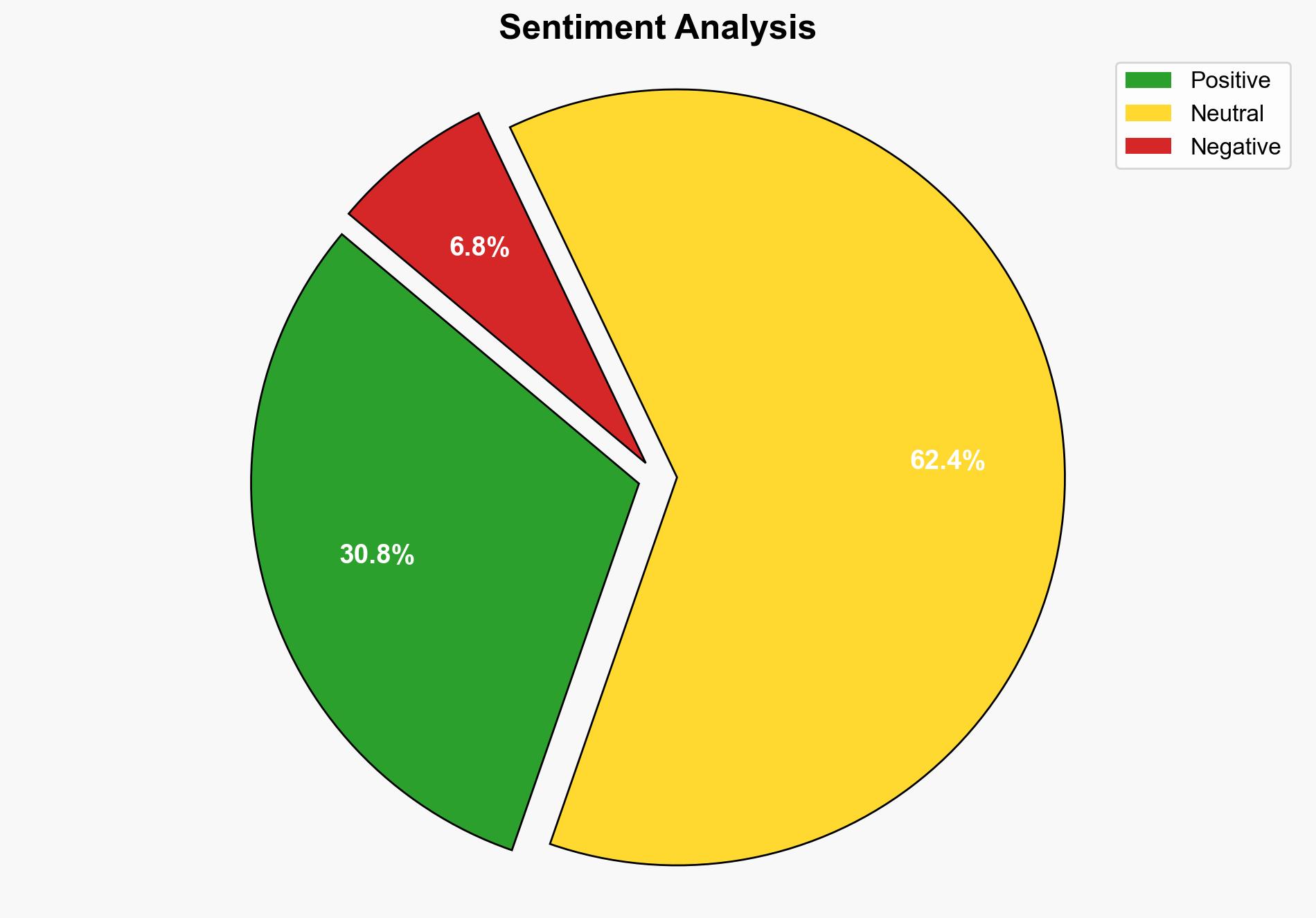

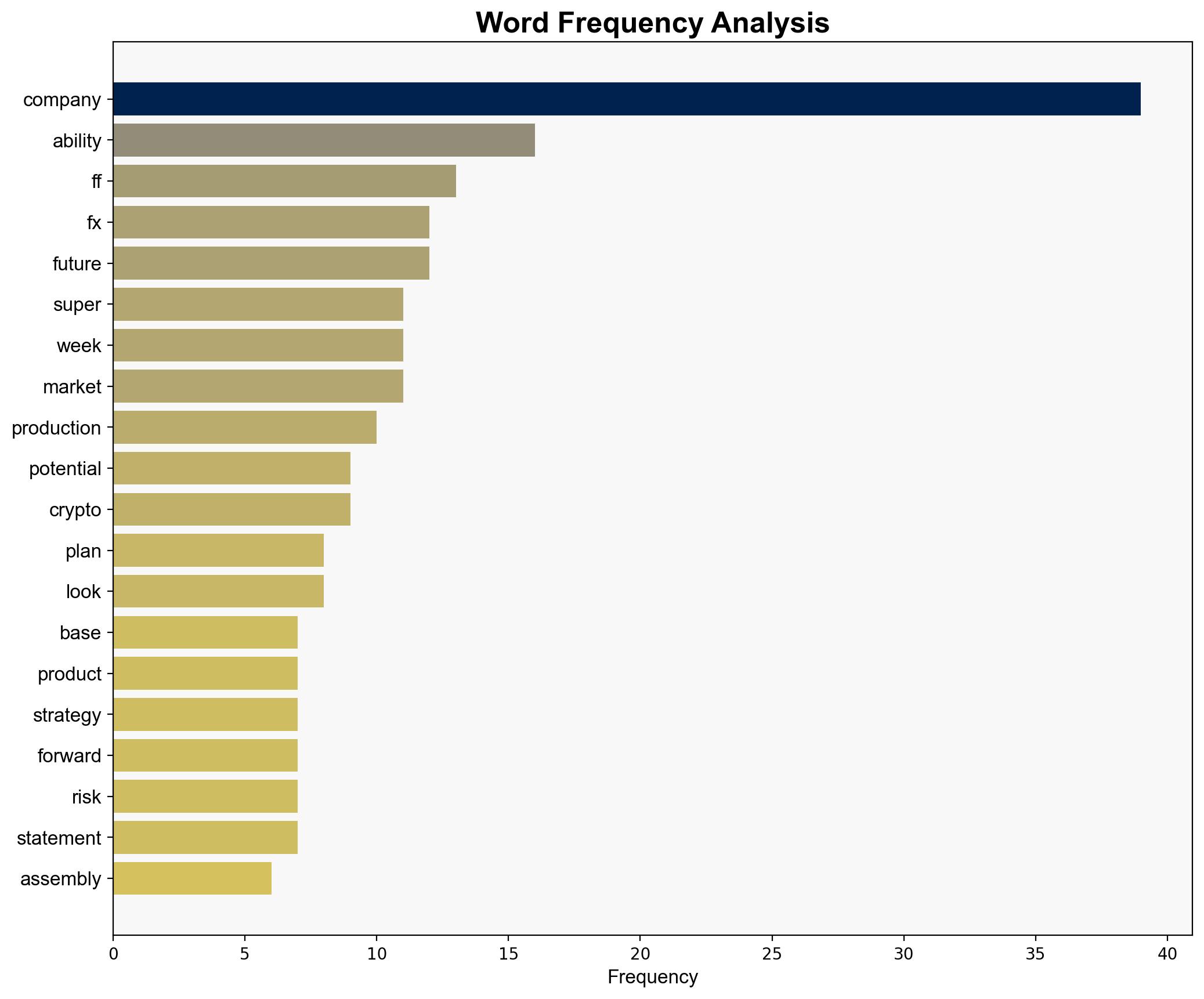

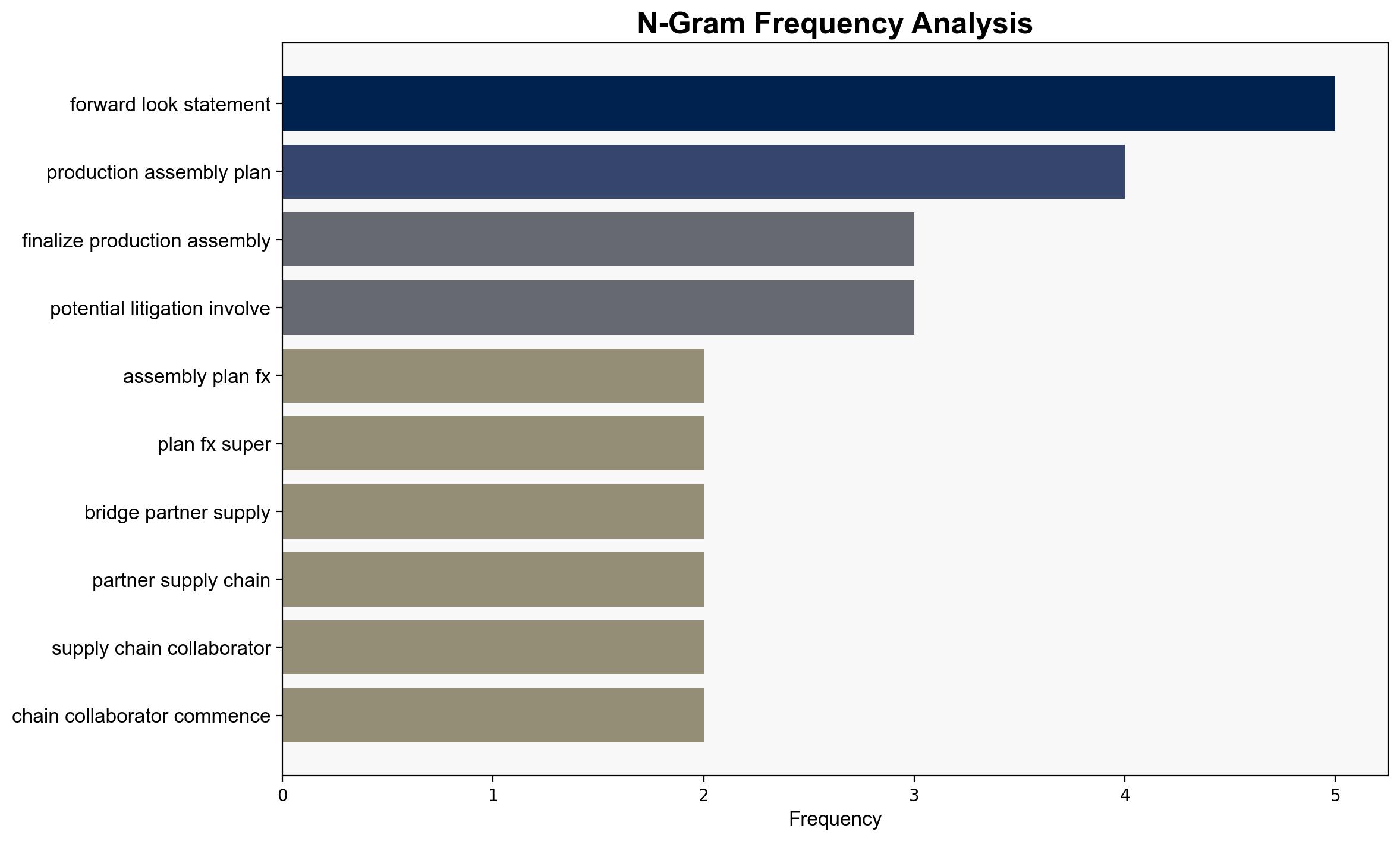

Faraday Future’s announcement of finalizing its US production assembly plan for the FX Super vehicle suggests a strategic move to capitalize on potential tariff reductions and enhance its market position in North America. The most supported hypothesis is that Faraday Future is leveraging geopolitical shifts to optimize its production and pricing strategy. Confidence level: Moderate. Recommended action: Monitor developments in US tariff policies and Faraday Future’s production milestones to assess potential impacts on the automotive market.

2. Competing Hypotheses

Hypothesis 1: Faraday Future is strategically positioning itself to benefit from anticipated US tariff reductions, enhancing its competitive edge and profitability in the North American market.

Hypothesis 2: The announcement is primarily a public relations effort to boost investor confidence and market perception amidst ongoing financial challenges, with less emphasis on actual production advancements.

3. Key Assumptions and Red Flags

Assumptions:

– The US government will follow through on significant tariff reductions.

– Faraday Future has the operational capacity to meet its production timelines.

Red Flags:

– Lack of detailed financial data supporting the investment gains.

– Potential over-reliance on geopolitical factors that may not materialize as expected.

4. Implications and Strategic Risks

The potential reduction in tariffs could lower production costs, making Faraday Future’s vehicles more competitive. However, failure to achieve production milestones or changes in US trade policies could pose significant financial risks. Additionally, geopolitical tensions or policy reversals could impact the strategic advantage anticipated from tariff reductions.

5. Recommendations and Outlook

- Monitor US trade policy developments closely to anticipate shifts that could affect Faraday Future’s strategy.

- Engage in scenario planning to prepare for best (successful tariff reduction and production), worst (policy reversal and production delays), and most likely (partial tariff reduction with moderate production success) outcomes.

- Encourage diversified investment to mitigate risks associated with geopolitical dependencies.

6. Key Individuals and Entities

– YT Jia

– Faraday Future

– FX Super

– Trump Administration

7. Thematic Tags

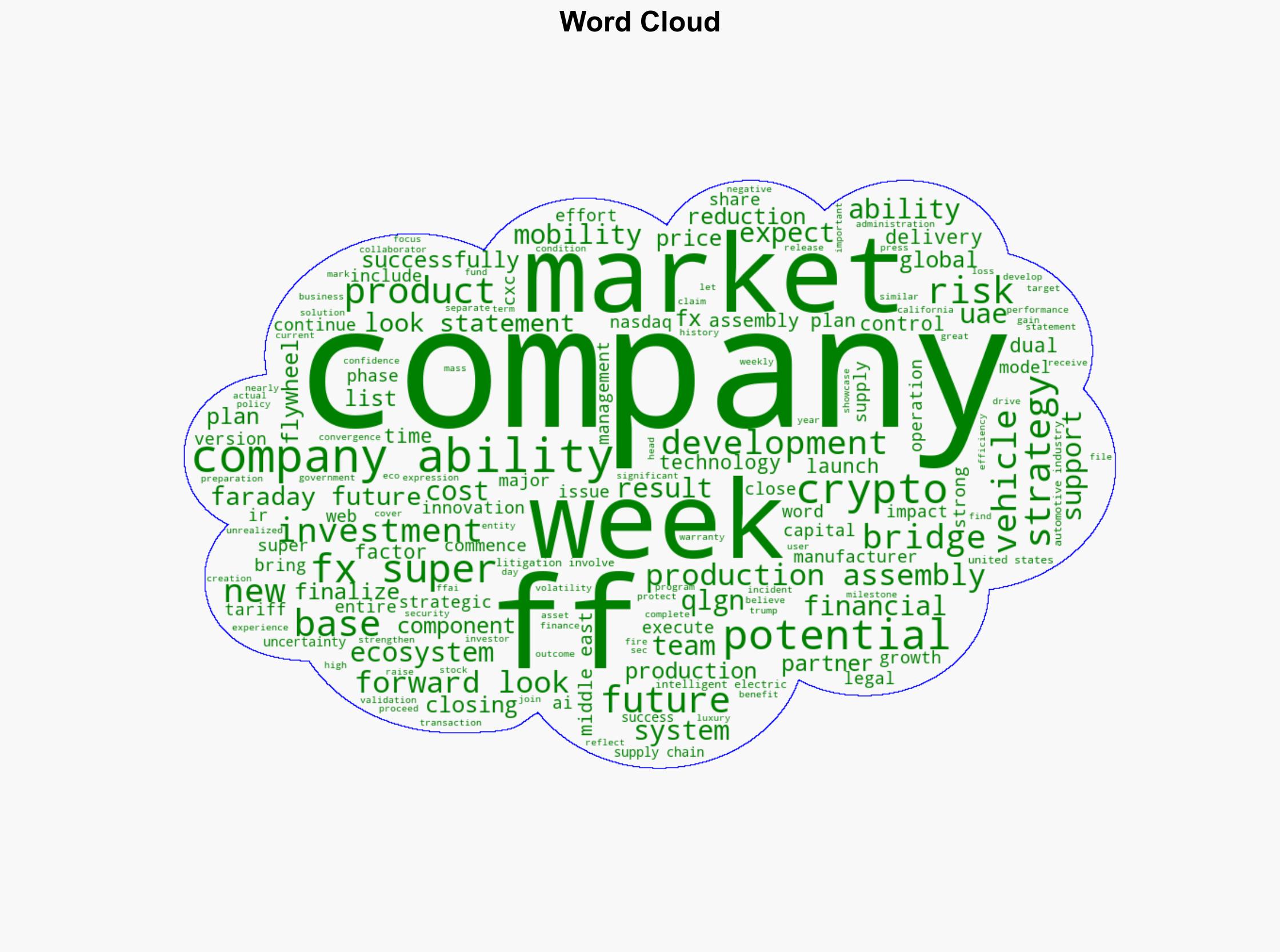

national security threats, economic strategy, geopolitical shifts, automotive industry