Floating Oil Storage Surge Puts Market Balance on Edge – OilPrice.com

Published on: 2025-11-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Floating Oil Storage Surge Puts Market Balance on Edge

1. BLUF (Bottom Line Up Front)

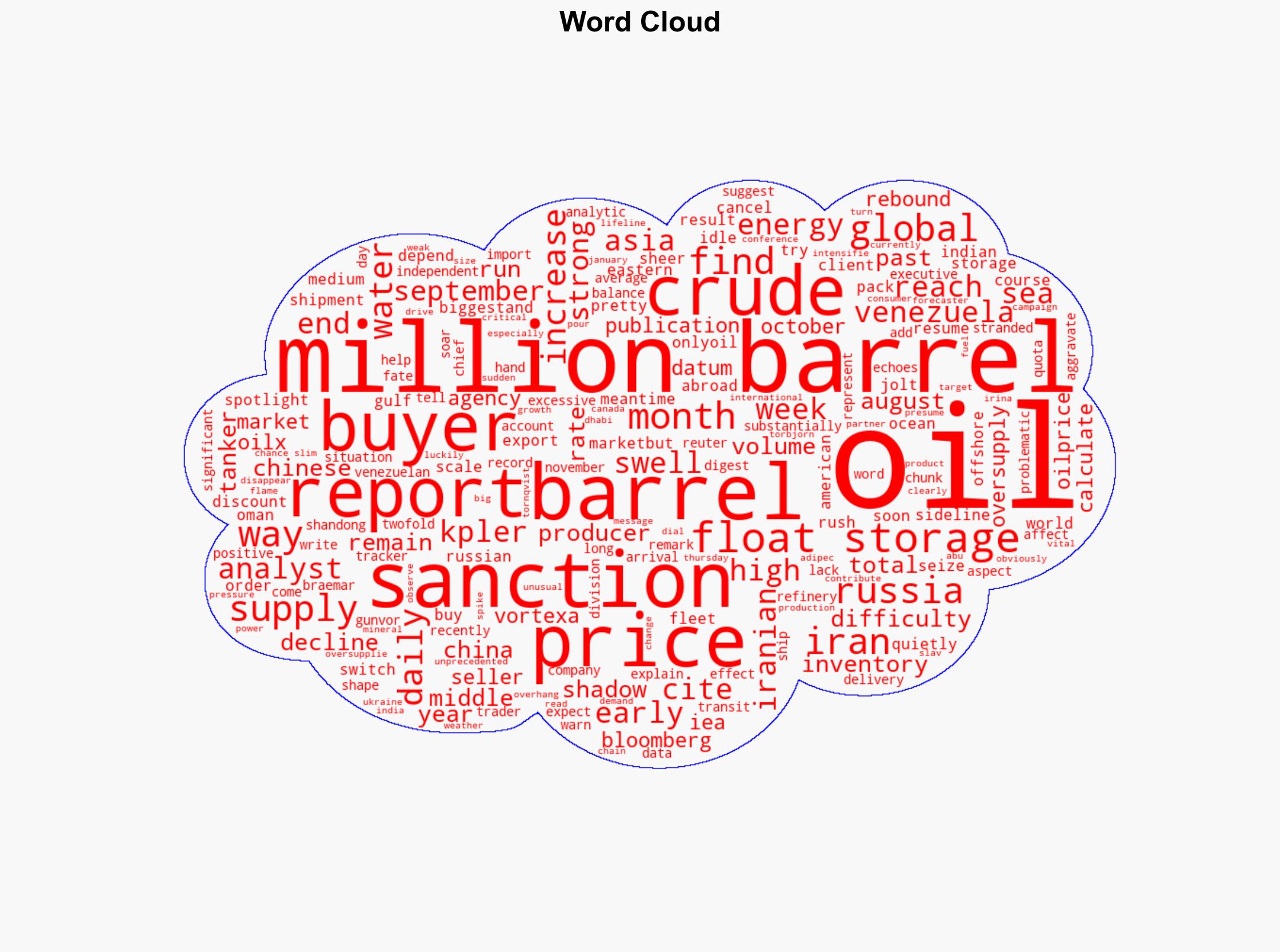

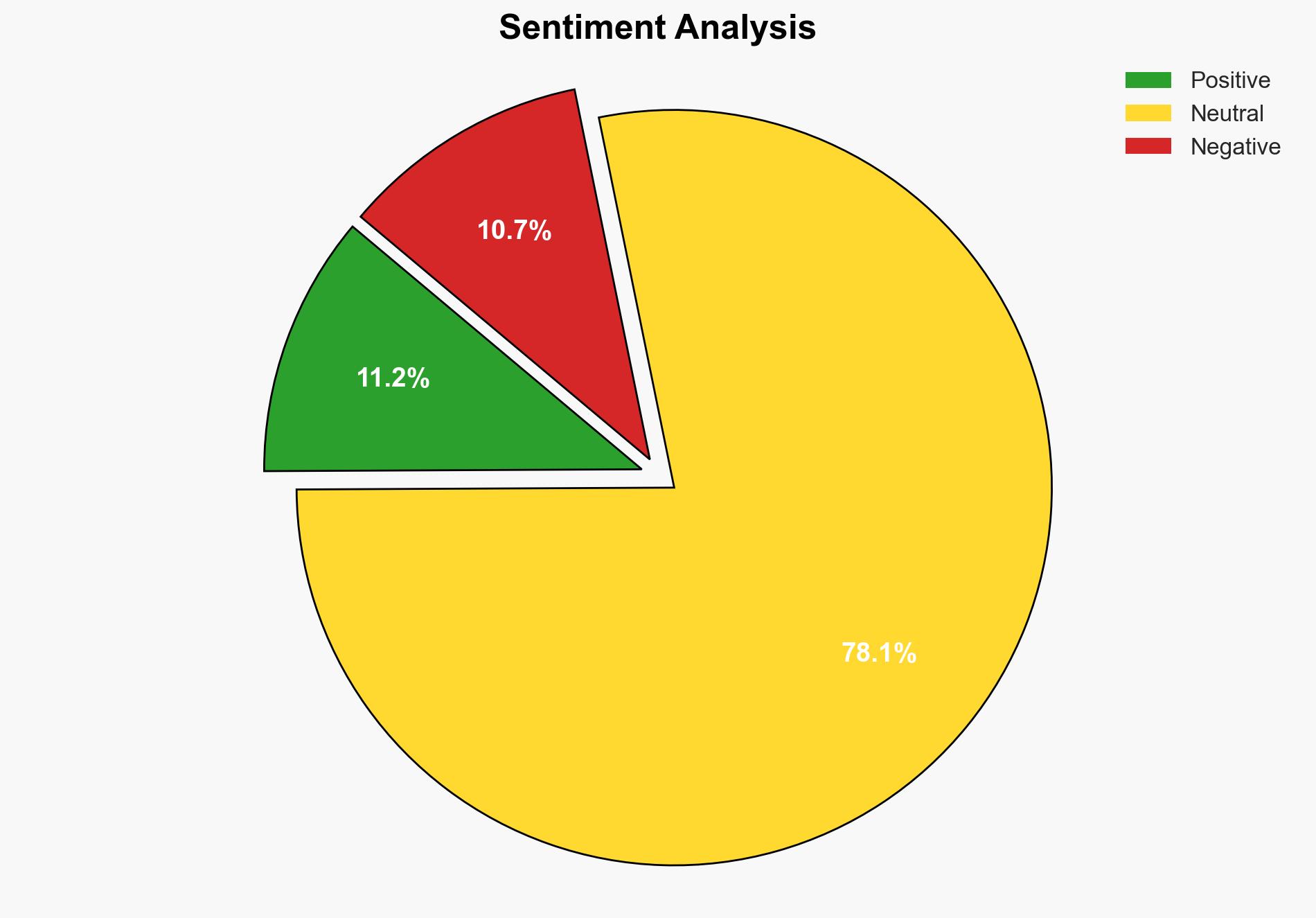

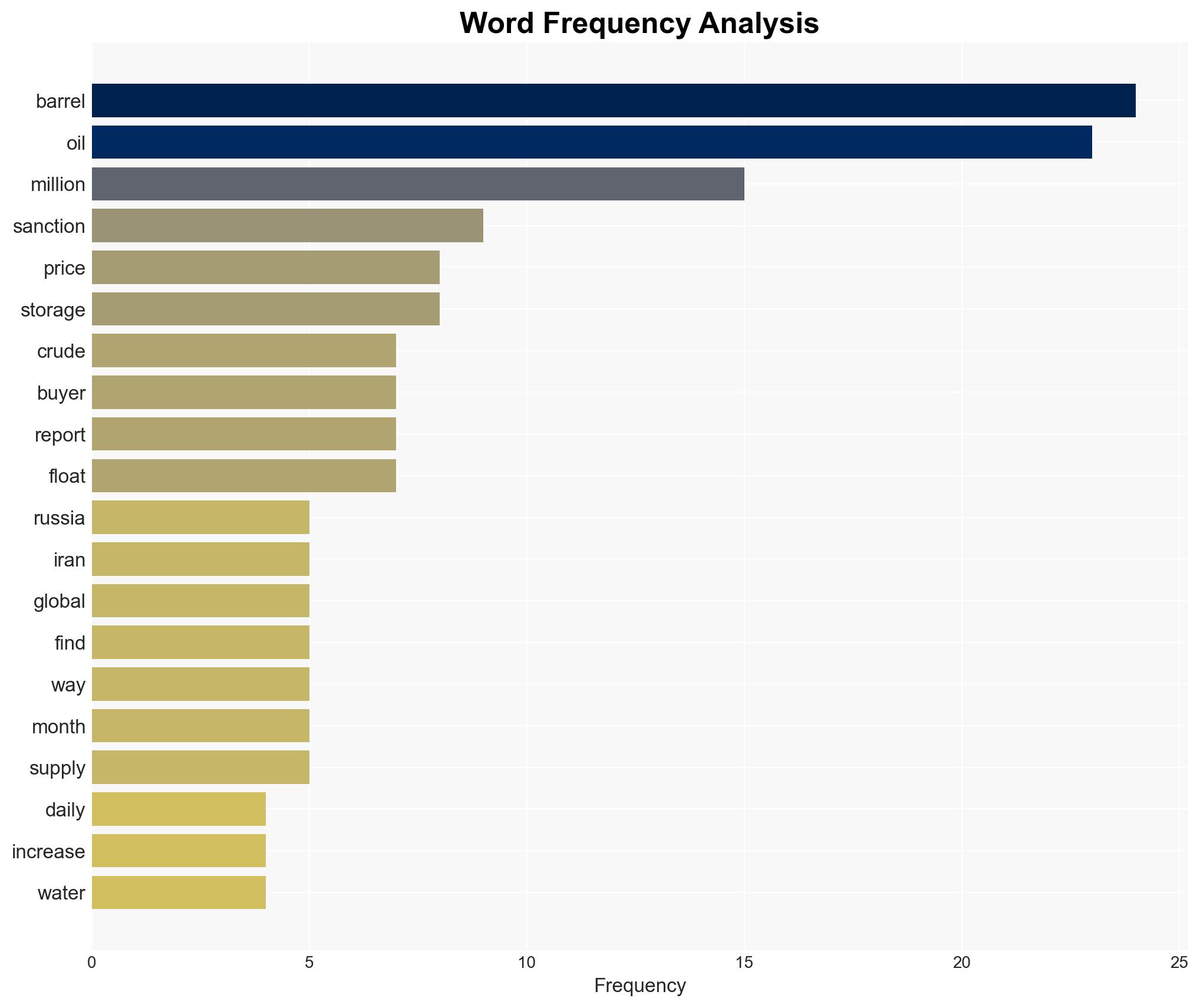

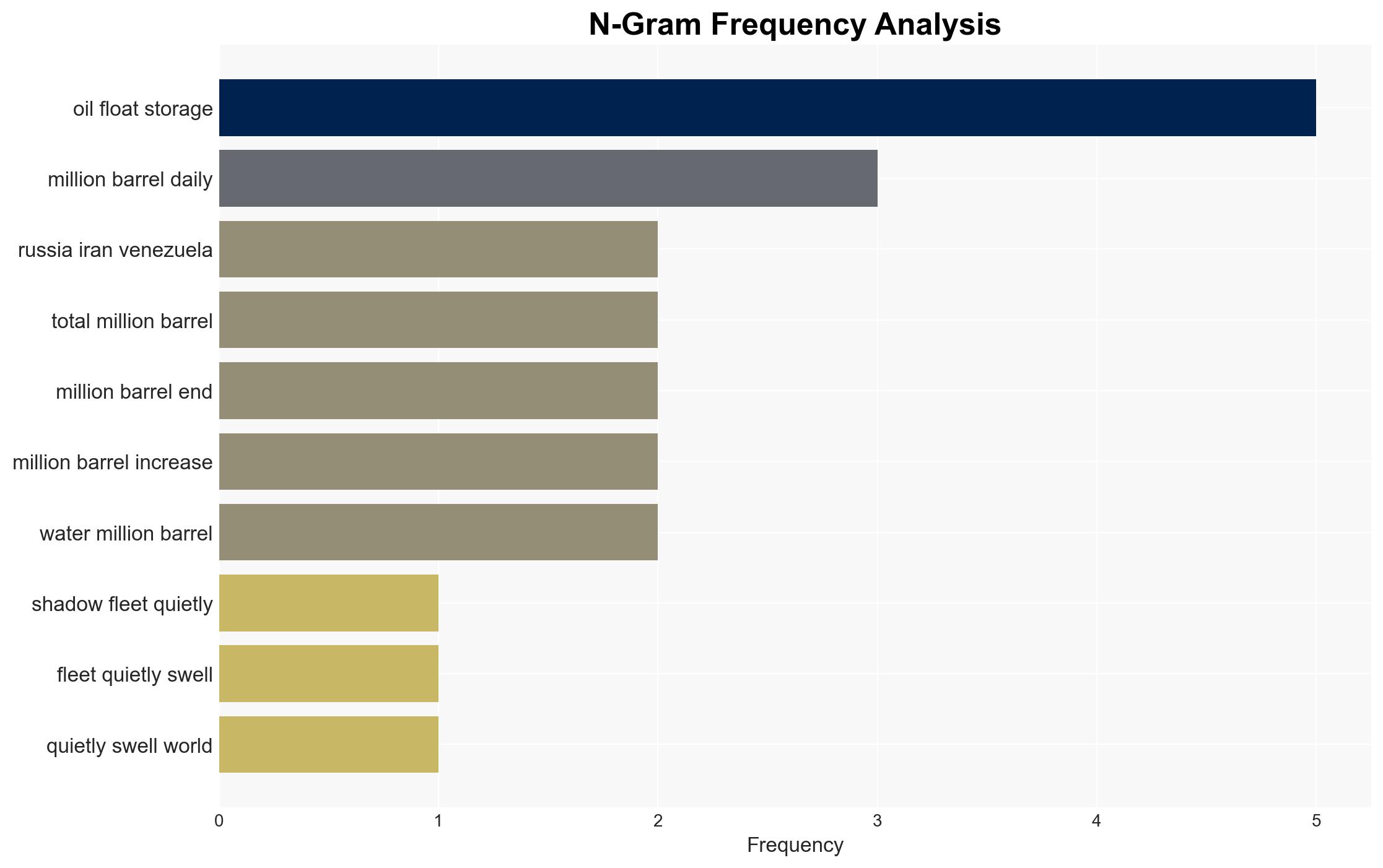

The surge in floating oil storage, particularly from sanctioned producers like Russia, Iran, and Venezuela, is creating an oversupply that could depress global oil prices if these barrels find buyers. The most supported hypothesis is that the current oversupply will continue to pressure prices unless geopolitical shifts alter market dynamics. Confidence Level: Moderate. Recommended action includes monitoring geopolitical developments and market responses to potential sanctions adjustments.

2. Competing Hypotheses

Hypothesis 1: The increase in floating storage will lead to a significant drop in oil prices as the market struggles to absorb the excess supply. This is supported by the current high levels of unsold oil at sea and reports of canceled orders from major buyers like China and India.

Hypothesis 2: Despite the current oversupply, geopolitical factors or a sudden increase in demand could stabilize or even increase oil prices. This could occur if sanctions are lifted or if there is a disruption in supply from other major producers.

The first hypothesis is more likely given the current data on floating storage levels and the lack of immediate geopolitical developments that would significantly alter supply dynamics.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that current geopolitical tensions and sanctions will remain unchanged in the short term. Additionally, it is assumed that global demand will not experience a sudden, significant increase.

Red Flags: A potential red flag is the reliance on data from sources like Kpler and Vortexa, which may have varying degrees of accuracy. Another red flag is the possibility of misinformation or strategic deception by oil-producing countries to influence market perceptions.

4. Implications and Strategic Risks

The main risk is an extended period of low oil prices, which could impact the economies of oil-dependent nations and lead to political instability. Additionally, if sanctioned countries find ways to circumvent restrictions, it could undermine the effectiveness of international sanctions regimes. Cyber threats could also emerge as countries seek to protect their oil trade data and infrastructure from espionage or sabotage.

5. Recommendations and Outlook

- Actionable Steps: Monitor geopolitical developments closely, particularly any changes in sanctions policies. Engage with allies to ensure coordinated responses to market shifts.

- Best Scenario: Geopolitical tensions ease, leading to a balanced market with stable prices.

- Worst Scenario: Prolonged oversupply leads to a significant drop in prices, causing economic strain on oil-dependent countries.

- Most-likely Scenario: Continued oversupply keeps prices low, with periodic fluctuations based on geopolitical developments.

6. Key Individuals and Entities

Torbjorn Tornqvist, CEO of Gunvor, has highlighted the unprecedented size of the current oversupply. His insights could be influential in understanding market dynamics.

7. Thematic Tags

Regional Focus, Regional Focus: Global, with emphasis on Asia, Russia, Iran, Venezuela, and China

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·