Foreign investors can exploit cheaper dollar hedges as Fed easing resumes – The Times of India

Published on: 2025-10-04

Intelligence Report: Foreign investors can exploit cheaper dollar hedges as Fed easing resumes – The Times of India

1. BLUF (Bottom Line Up Front)

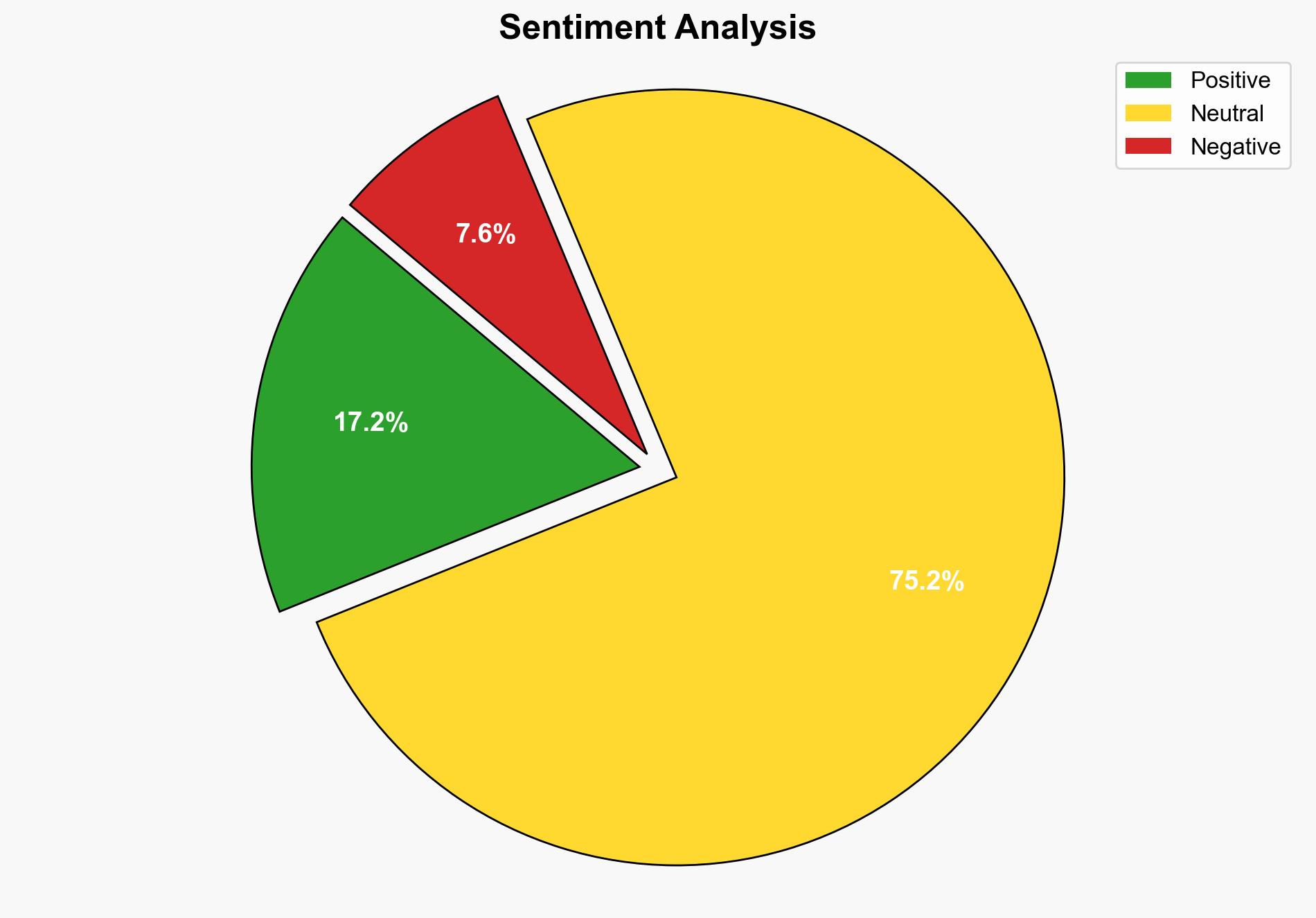

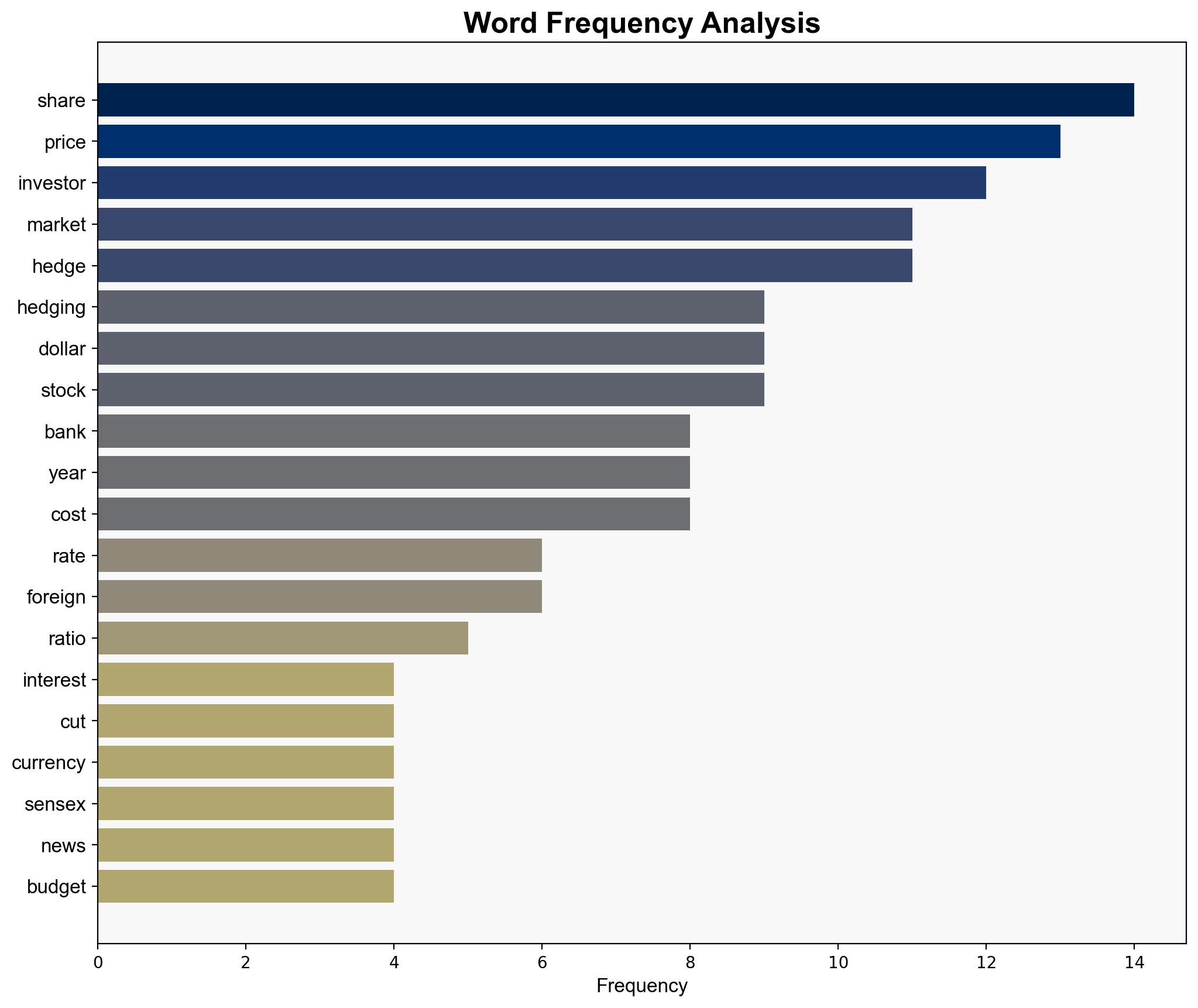

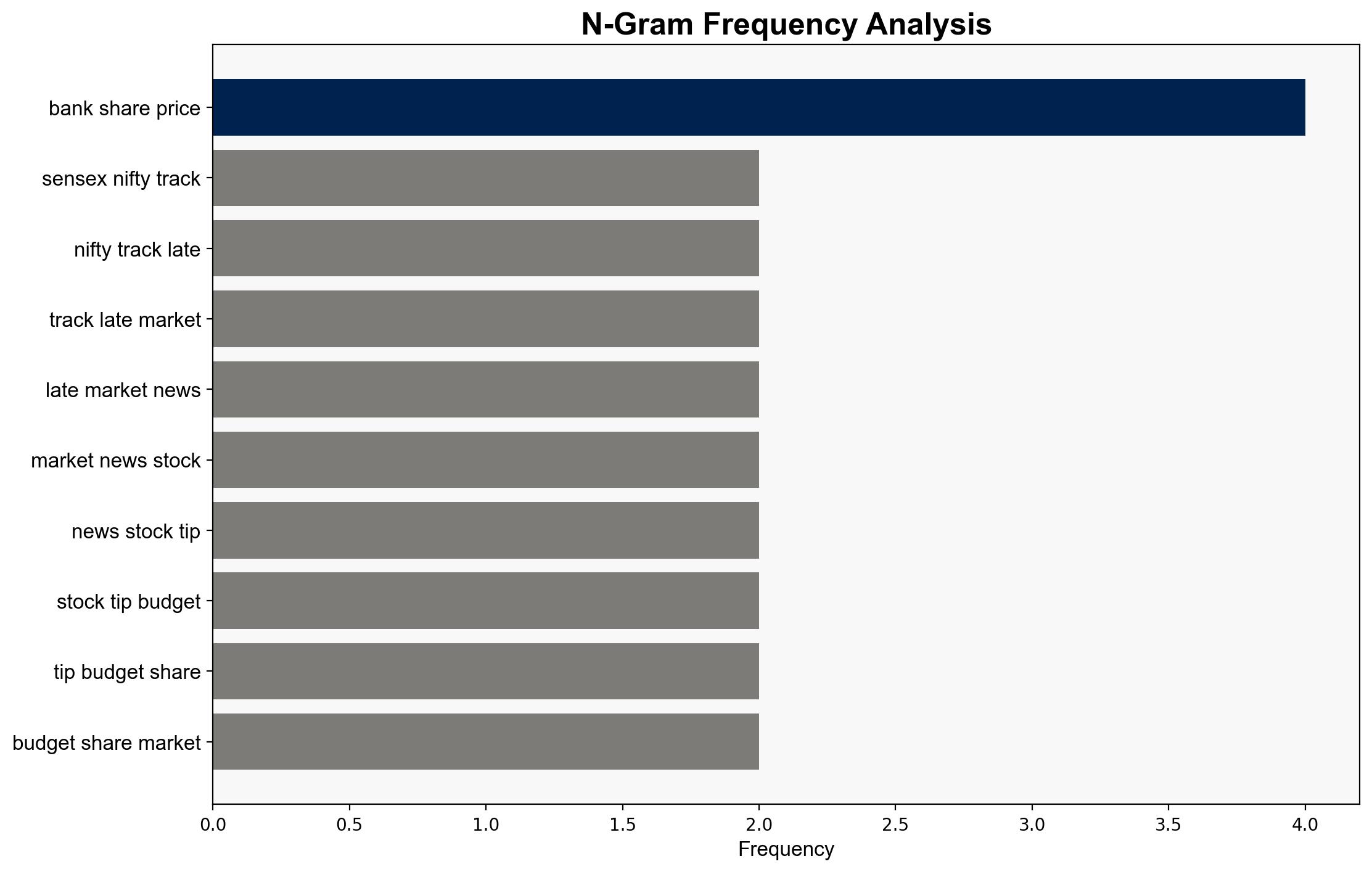

The most supported hypothesis is that foreign investors will increase their hedging activities due to the anticipated weakening of the US dollar as the Federal Reserve resumes interest rate cuts. This is supported by the current economic indicators and market expectations. Confidence Level: Moderate. Recommended action is to monitor hedging trends and prepare for potential impacts on global financial markets.

2. Competing Hypotheses

1. **Hypothesis A**: Foreign investors will increase hedging activities to protect against a weakening US dollar, driven by expected Federal Reserve interest rate cuts and ongoing geopolitical uncertainties.

2. **Hypothesis B**: Despite the potential for a weaker US dollar, foreign investors will maintain or reduce hedging activities due to high hedging costs and a belief in the dollar’s long-term strength.

Using ACH 2.0, Hypothesis A is better supported by the current data, including the Fed’s anticipated policy changes and the historical response of investors to similar economic conditions.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the Fed will continue to cut interest rates and that geopolitical tensions will persist, impacting the dollar’s strength.

– **Red Flags**: Potential cognitive bias includes over-reliance on historical patterns without considering new economic variables. Missing data on the specific timing and magnitude of Fed actions could alter investor behavior.

4. Implications and Strategic Risks

Increased hedging could lead to further weakening of the US dollar, impacting global trade balances and potentially leading to retaliatory economic measures by other nations. There is a risk of increased market volatility as investors adjust their portfolios in response to currency fluctuations.

5. Recommendations and Outlook

- Monitor Federal Reserve announcements and geopolitical developments closely to anticipate shifts in investor behavior.

- Prepare for increased market volatility by diversifying investment portfolios and considering alternative hedging strategies.

- Scenario Projections:

- Best Case: The dollar stabilizes, and hedging costs remain manageable, minimizing market disruption.

- Worst Case: Rapid dollar depreciation leads to significant global financial instability.

- Most Likely: Gradual increase in hedging activities with moderate dollar weakening.

6. Key Individuals and Entities

– Van Luu

– Steve Dooley

– Thierry Wizman

– Joseph Hoffman

7. Thematic Tags

economic strategy, global finance, currency hedging, Federal Reserve policy, geopolitical risk