Forget MBAs Japans Banks Are Hiring Math PhDs and AI Wizards – BeInCrypto

Published on: 2025-11-03

Intelligence Report: Forget MBAs Japans Banks Are Hiring Math PhDs and AI Wizards – BeInCrypto

1. BLUF (Bottom Line Up Front)

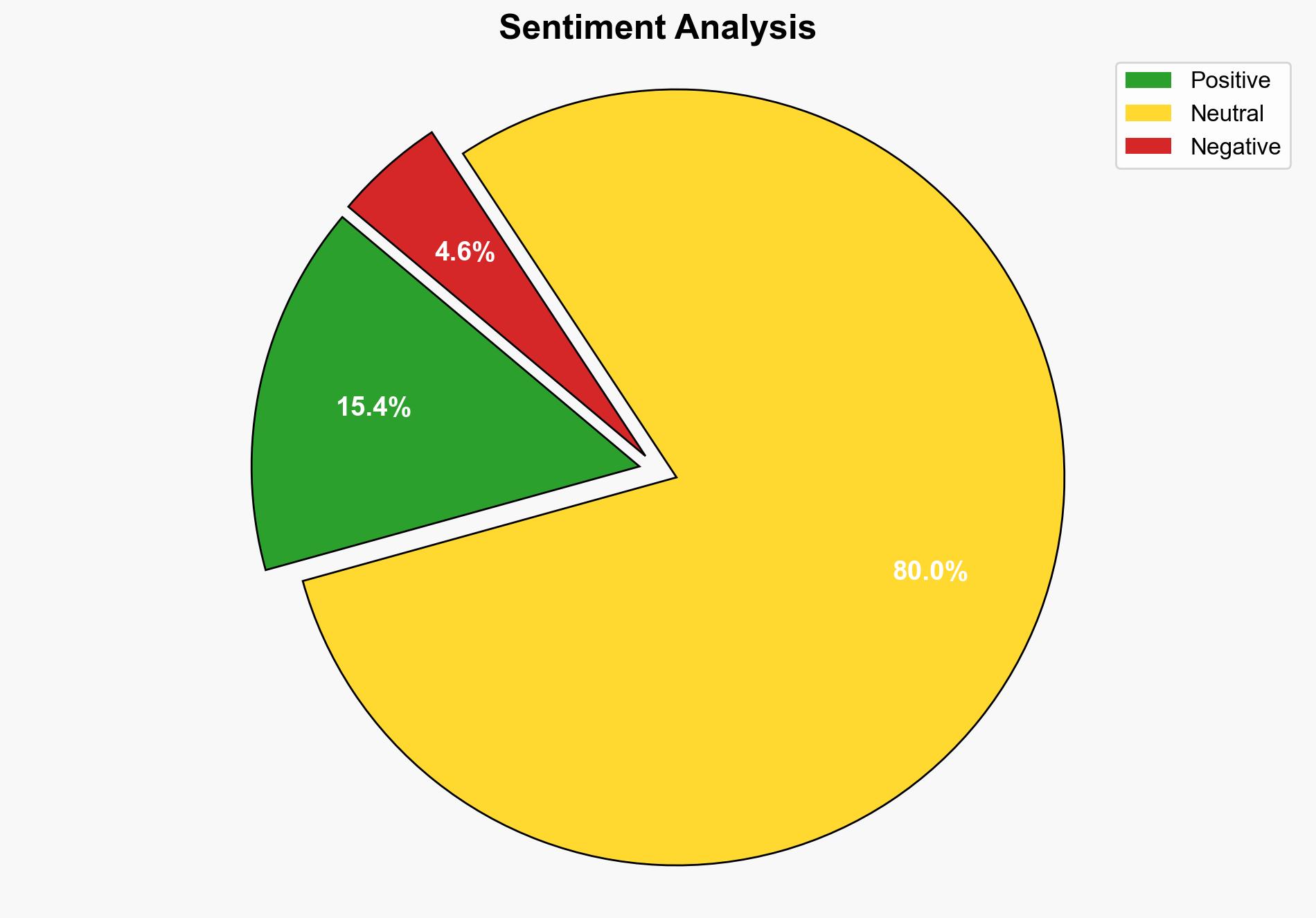

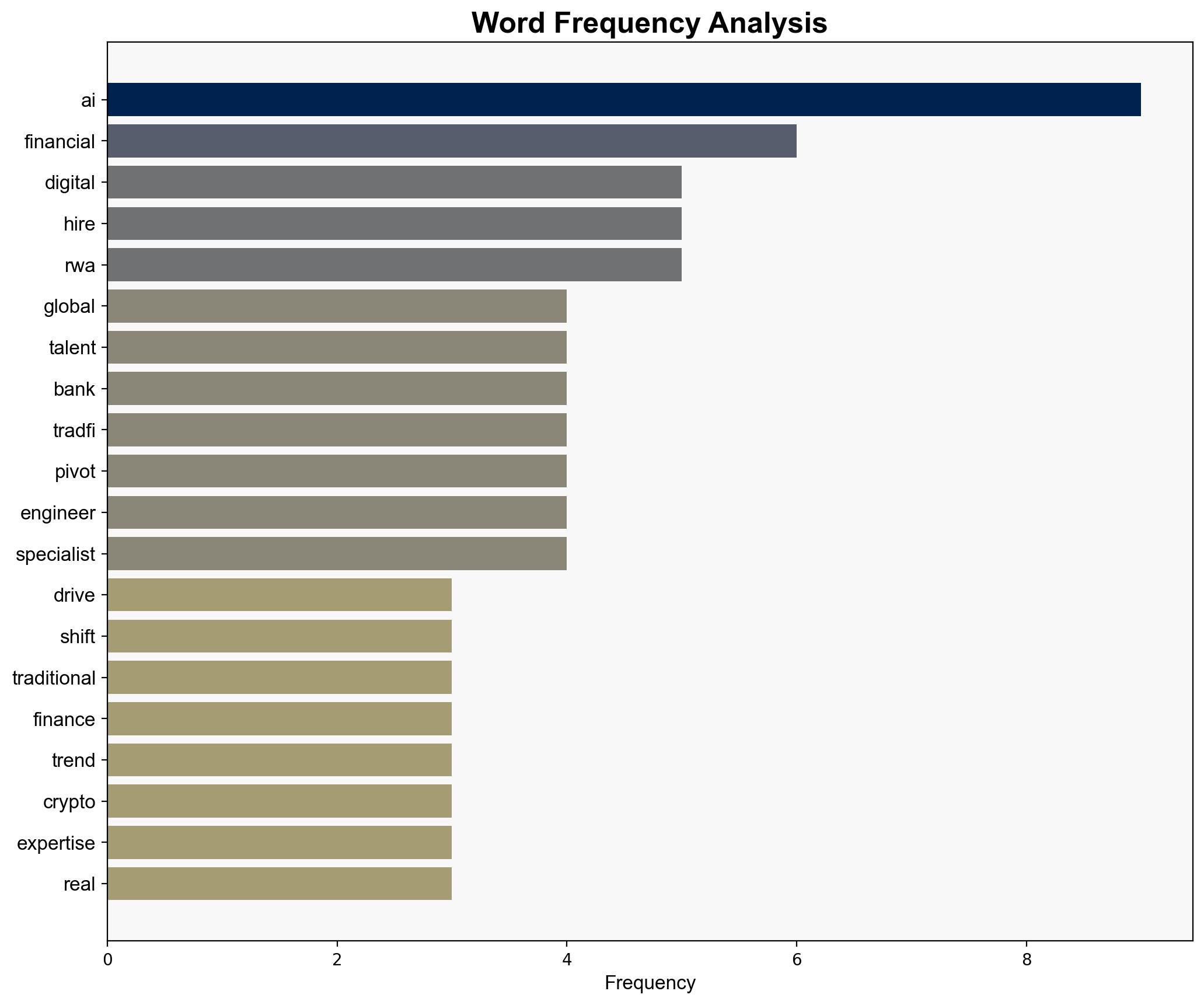

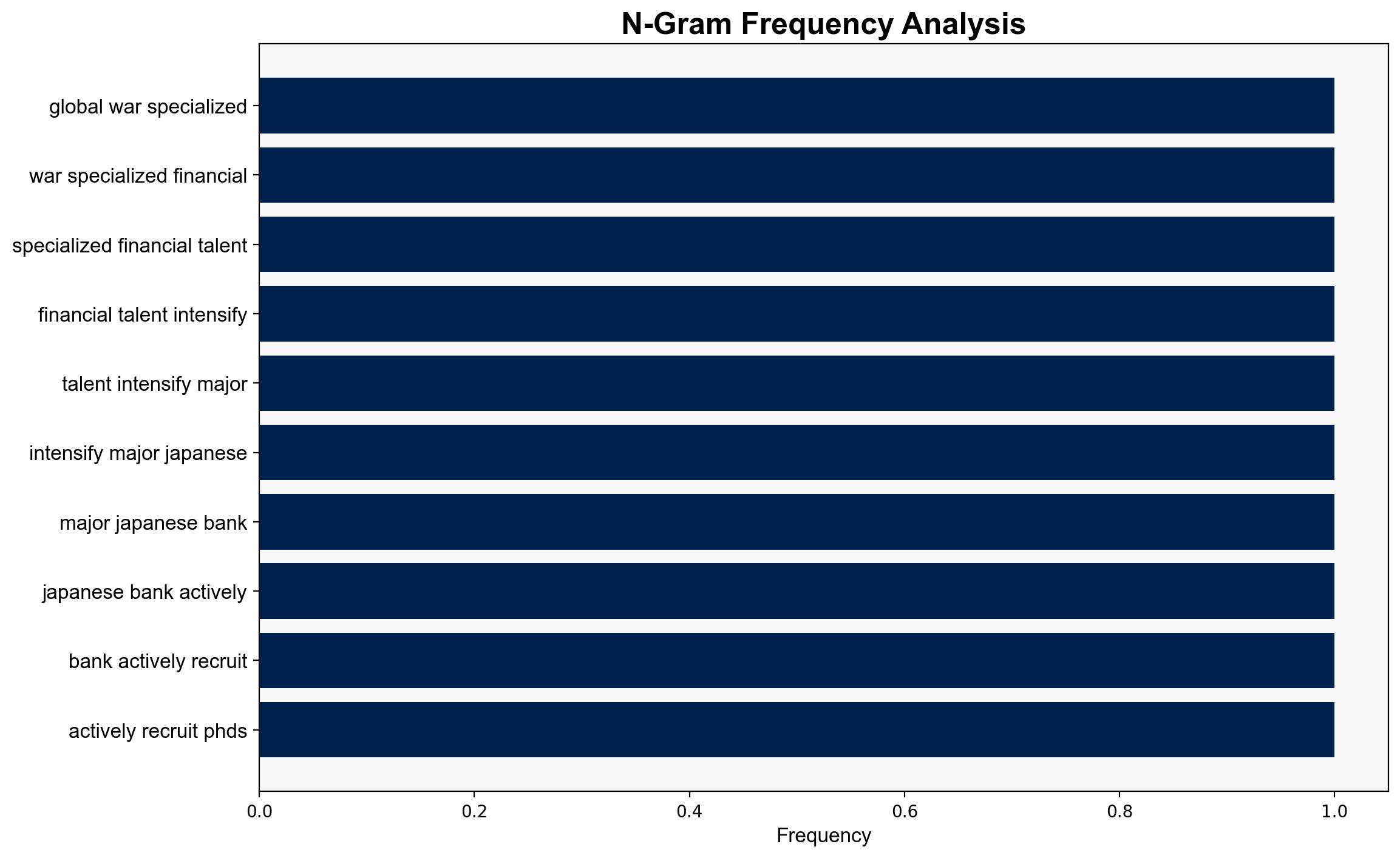

Japanese banks are strategically shifting their hiring practices towards STEM specialists, particularly in AI and mathematics, to drive digital transformation and maintain competitiveness in a rapidly evolving financial landscape. This trend aligns with global movements in fintech and crypto sectors. The hypothesis that Japanese banks are prioritizing digital transformation over traditional finance models is better supported. Confidence Level: High. Recommended action is to monitor this shift for potential impacts on global financial markets and talent acquisition strategies.

2. Competing Hypotheses

Hypothesis 1: Japanese banks are hiring STEM specialists to lead a comprehensive digital transformation, aiming to integrate AI and advanced analytics into their core operations, thus enhancing efficiency and competitiveness.

Hypothesis 2: The shift in hiring practices is primarily a response to competitive pressures from fintech and crypto sectors, with banks seeking to protect their market share by adopting similar technological advancements.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the explicit mention of strategic shifts and structural pivots in hiring practices aimed at digital transformation within traditional finance institutions.

3. Key Assumptions and Red Flags

Assumptions:

– Japanese banks believe that AI and STEM expertise are critical for future competitiveness.

– There is an assumption that traditional finance models are insufficient in the current technological landscape.

Red Flags:

– Lack of detailed evidence on the effectiveness of these new hires in achieving the desired transformation.

– Potential over-reliance on technology without addressing underlying cultural and operational challenges within banks.

4. Implications and Strategic Risks

The strategic shift towards STEM hiring could lead to significant changes in the global financial sector, influencing talent acquisition and retention strategies worldwide. There is a risk of increased competition for specialized talent, potentially driving up costs. Additionally, the integration of AI and advanced technologies may expose banks to new cybersecurity threats and regulatory challenges, particularly concerning data privacy and compliance.

5. Recommendations and Outlook

- Monitor the effectiveness of these hiring practices in achieving digital transformation goals.

- Develop strategies to mitigate potential cybersecurity risks associated with increased AI integration.

- Scenario-based projections:

- Best Case: Successful integration of AI leads to enhanced operational efficiency and market competitiveness.

- Worst Case: Cybersecurity breaches and regulatory challenges undermine the benefits of digital transformation.

- Most Likely: Gradual improvement in operational processes with ongoing adjustments to address emerging challenges.

6. Key Individuals and Entities

– Mizuho Financial Group

– Mitsubishi UFJ Financial Group (MUFG)

– Sumitomo Mitsui Financial Group (SMFG)

– Hironori Kamezawa

7. Thematic Tags

national security threats, cybersecurity, financial transformation, talent acquisition, AI integration