Fraud controls dont guarantee consumer trust – Help Net Security

Published on: 2025-08-08

Intelligence Report: Fraud controls don’t guarantee consumer trust – Help Net Security

1. BLUF (Bottom Line Up Front)

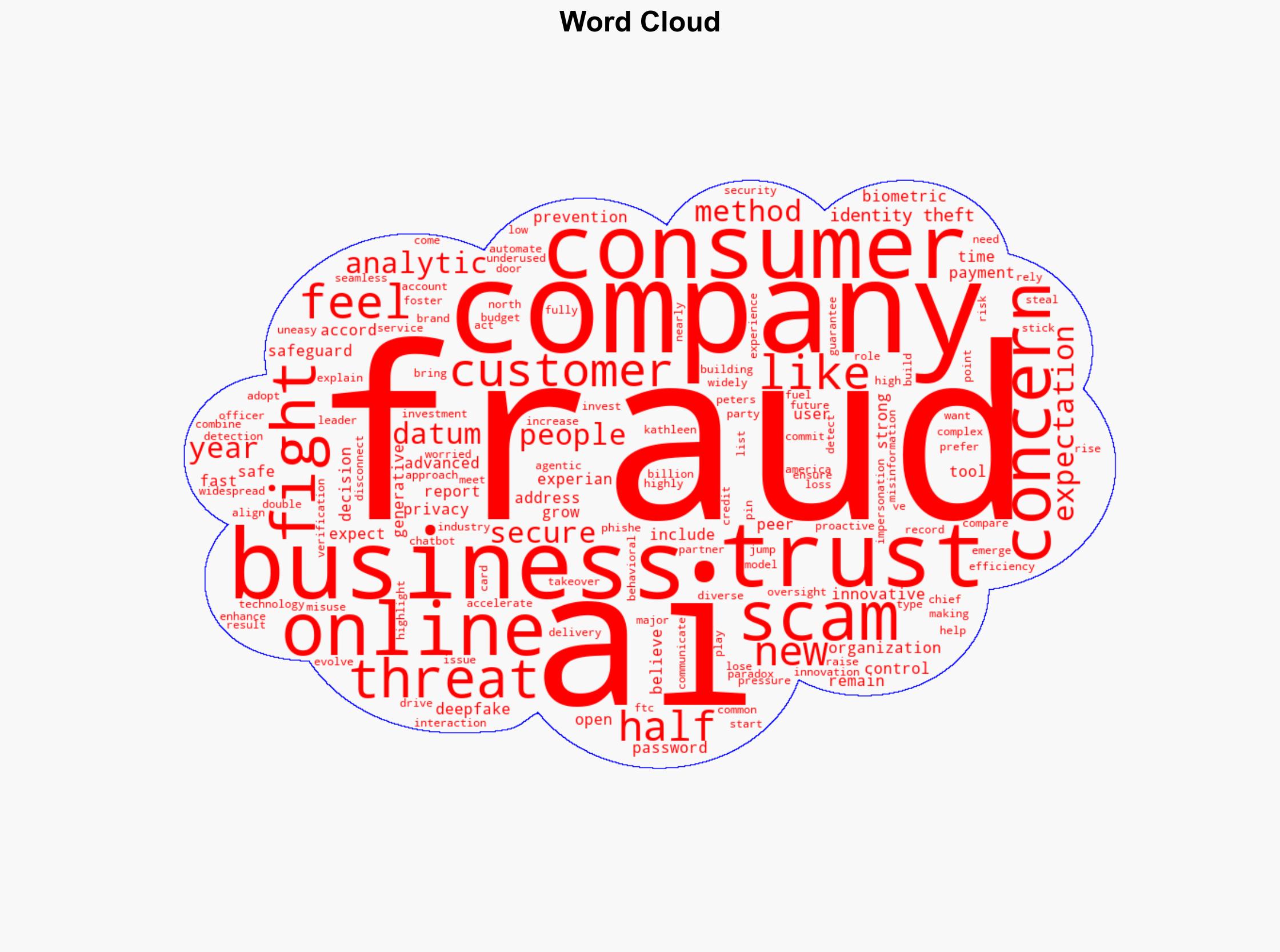

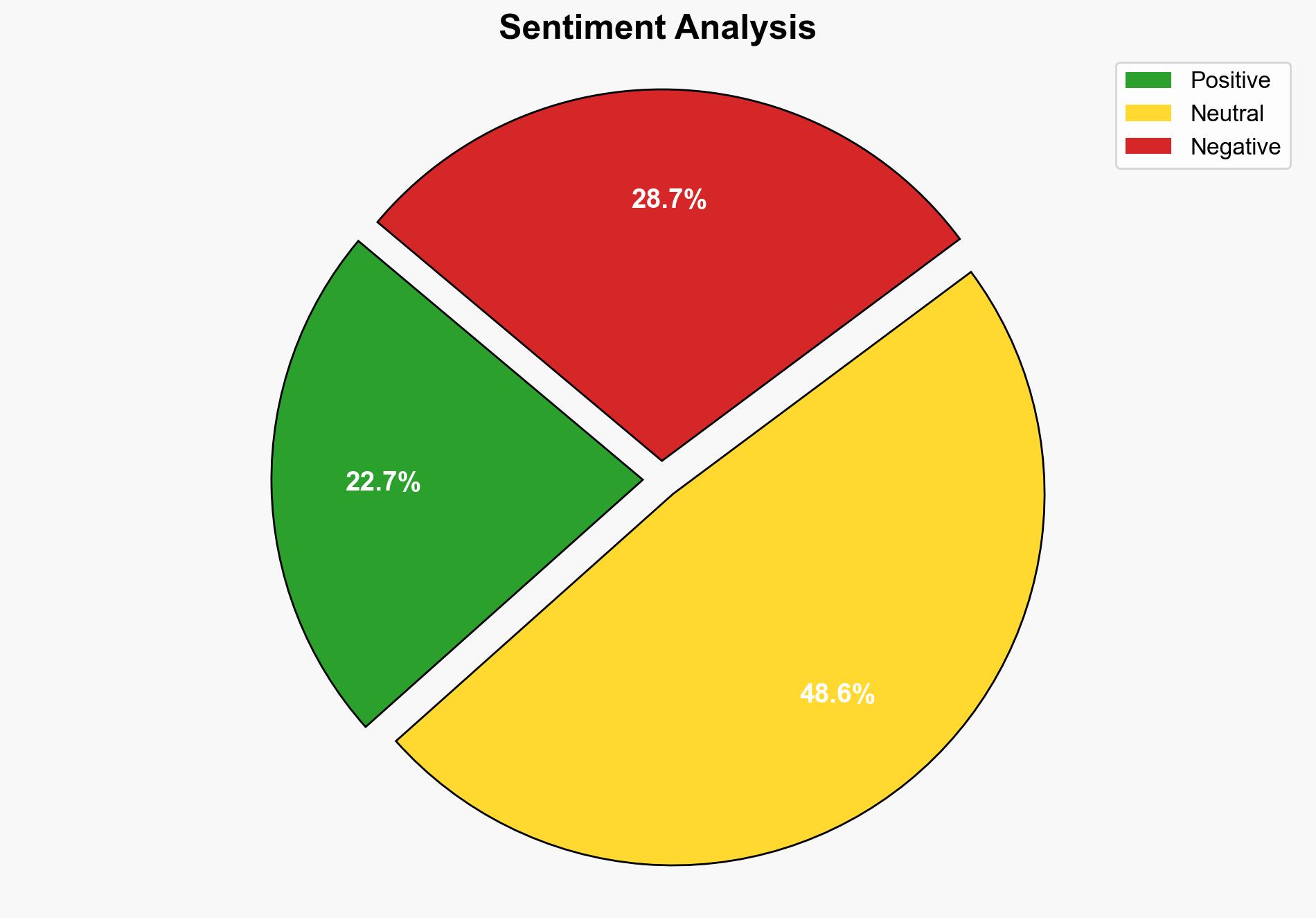

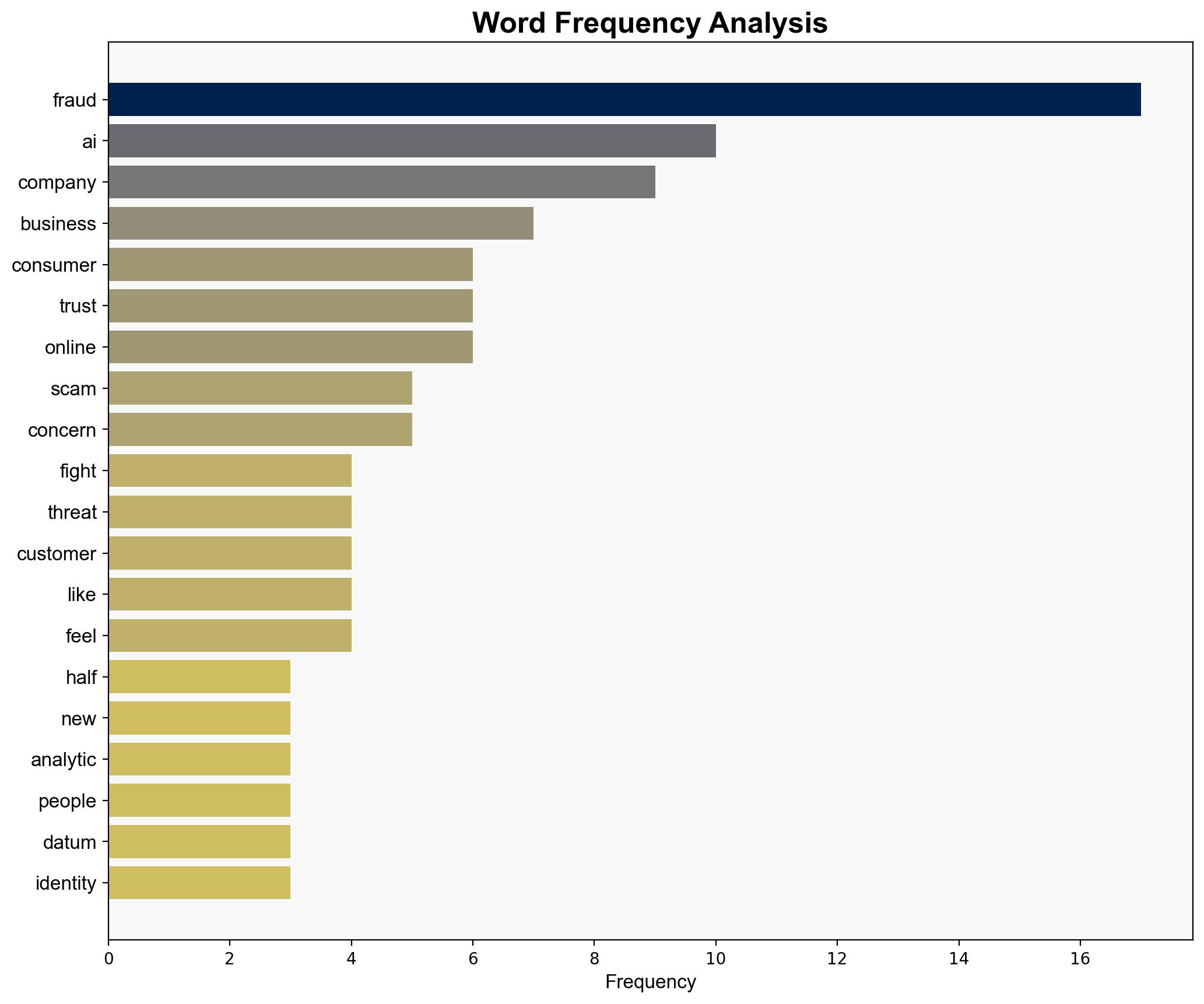

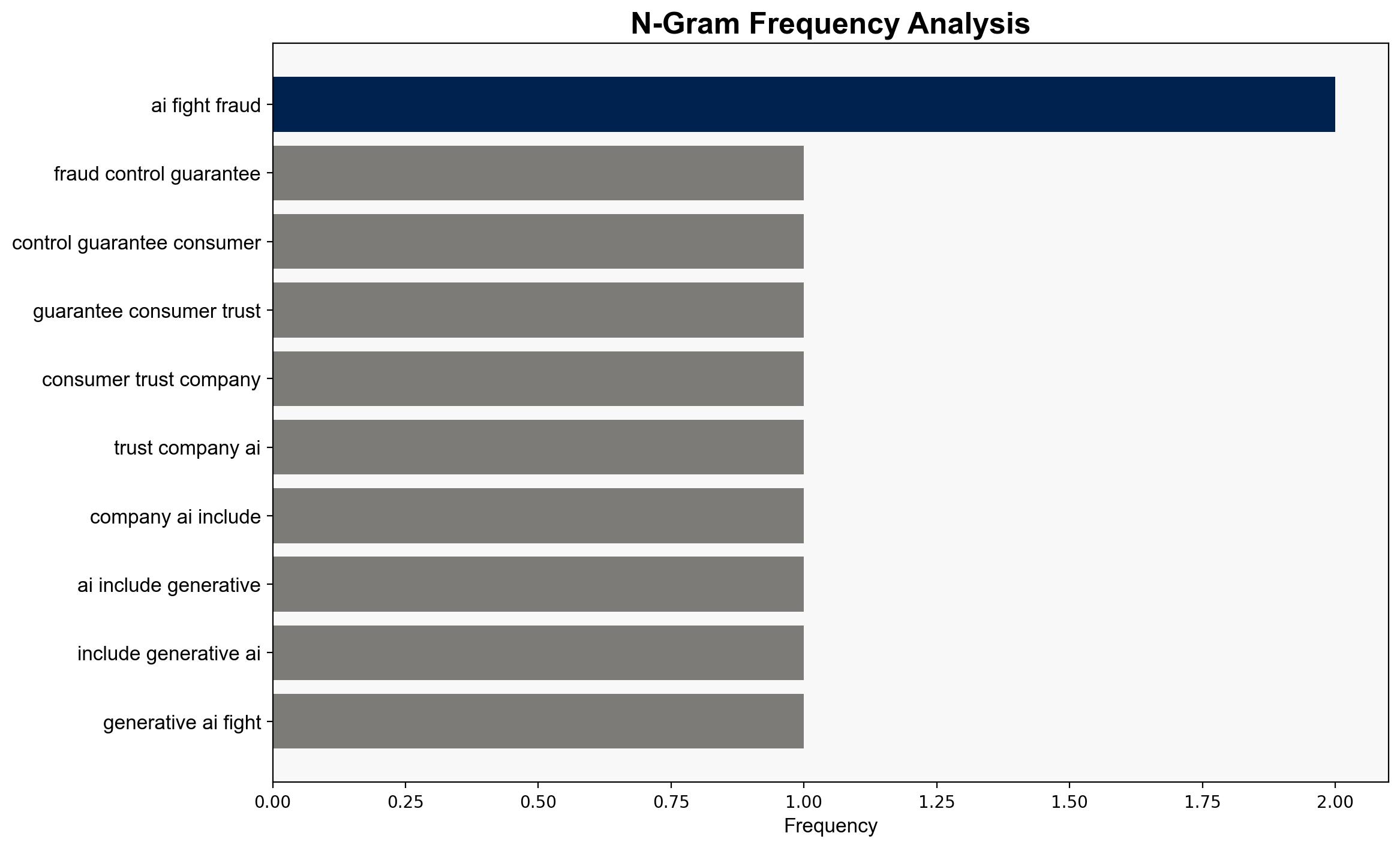

The most supported hypothesis is that while AI-driven fraud controls are increasingly sophisticated, they do not align with consumer trust expectations, leading to a persistent gap in perceived security. Confidence level: Moderate. Recommended action: Companies should enhance transparency and communication regarding their fraud prevention measures and consider integrating more consumer-friendly security technologies like biometrics.

2. Competing Hypotheses

1. **Hypothesis A**: AI-driven fraud controls are effective in reducing fraud incidents but fail to build consumer trust due to a lack of transparency and communication about these measures.

2. **Hypothesis B**: AI-driven fraud controls are not only ineffective in preventing fraud but also contribute to consumer distrust due to their dual role in both preventing and facilitating fraud (e.g., deepfakes).

Using ACH 2.0, Hypothesis A is better supported as the data indicates that while companies are investing in AI models, consumer trust remains low due to insufficient communication and transparency. Hypothesis B is less supported as there is evidence of AI’s effectiveness in fraud detection, despite its potential misuse.

3. Key Assumptions and Red Flags

– **Assumptions**: Companies are assumed to be adequately investing in AI technologies for fraud prevention. Consumers are assumed to be aware of these technologies and their benefits.

– **Red Flags**: The paradox of AI being both a tool for fraud prevention and a potential enabler of fraud is a significant concern. The lack of consumer trust despite technological advancements suggests a disconnect that may not be fully addressed by current strategies.

– **Blind Spots**: The potential for AI-driven fraud methods to evolve faster than prevention measures is a critical blind spot.

4. Implications and Strategic Risks

The disconnect between fraud control measures and consumer trust could lead to increased consumer hesitancy in online transactions, impacting business revenues. The dual role of AI in fraud prevention and facilitation could escalate into a broader cybersecurity threat if not managed with robust oversight and regulation. Economic implications include potential losses from reduced consumer engagement and increased costs in fraud prevention.

5. Recommendations and Outlook

- Enhance transparency and communication with consumers about fraud prevention measures to build trust.

- Invest in consumer-friendly security technologies like biometrics to align with consumer expectations.

- Scenario-based projections:

- Best: Companies successfully bridge the trust gap, leading to increased consumer confidence and reduced fraud incidents.

- Worst: Continued consumer distrust leads to decreased online engagement and increased fraud incidents.

- Most Likely: Incremental improvements in consumer trust as companies gradually adopt more transparent and consumer-friendly measures.

6. Key Individuals and Entities

Kathleen Peters, Experian North America

7. Thematic Tags

cybersecurity, consumer trust, AI technology, fraud prevention