From FinCEN Treasury Convenes Financial Institutions Law Enforcement in Washington DC in Support of the US Maximum Pressure Campaign Against Iran – Globalsecurity.org

Published on: 2025-04-03

Intelligence Report: From FinCEN Treasury Convenes Financial Institutions Law Enforcement in Washington DC in Support of the US Maximum Pressure Campaign Against Iran – Globalsecurity.org

1. BLUF (Bottom Line Up Front)

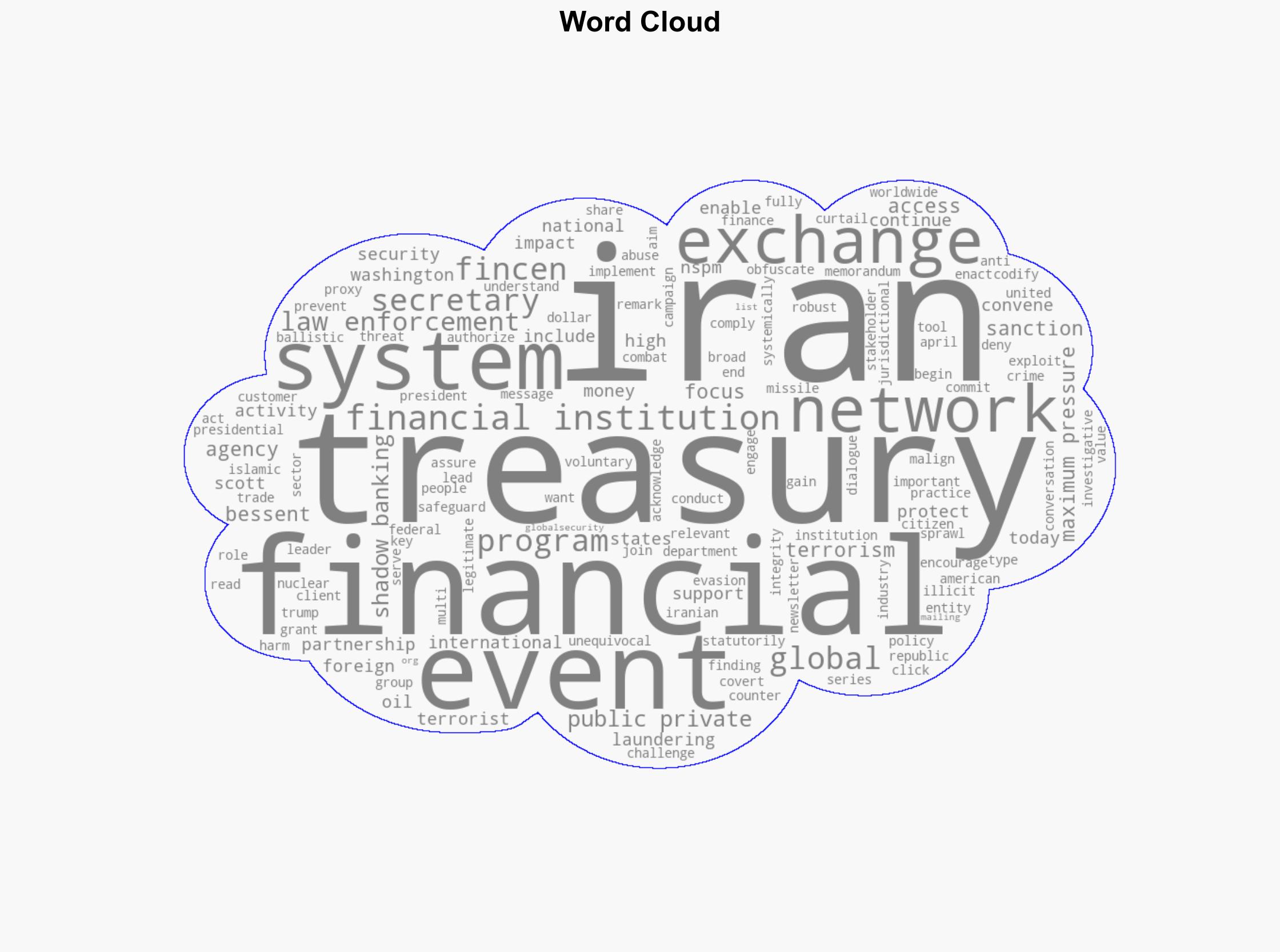

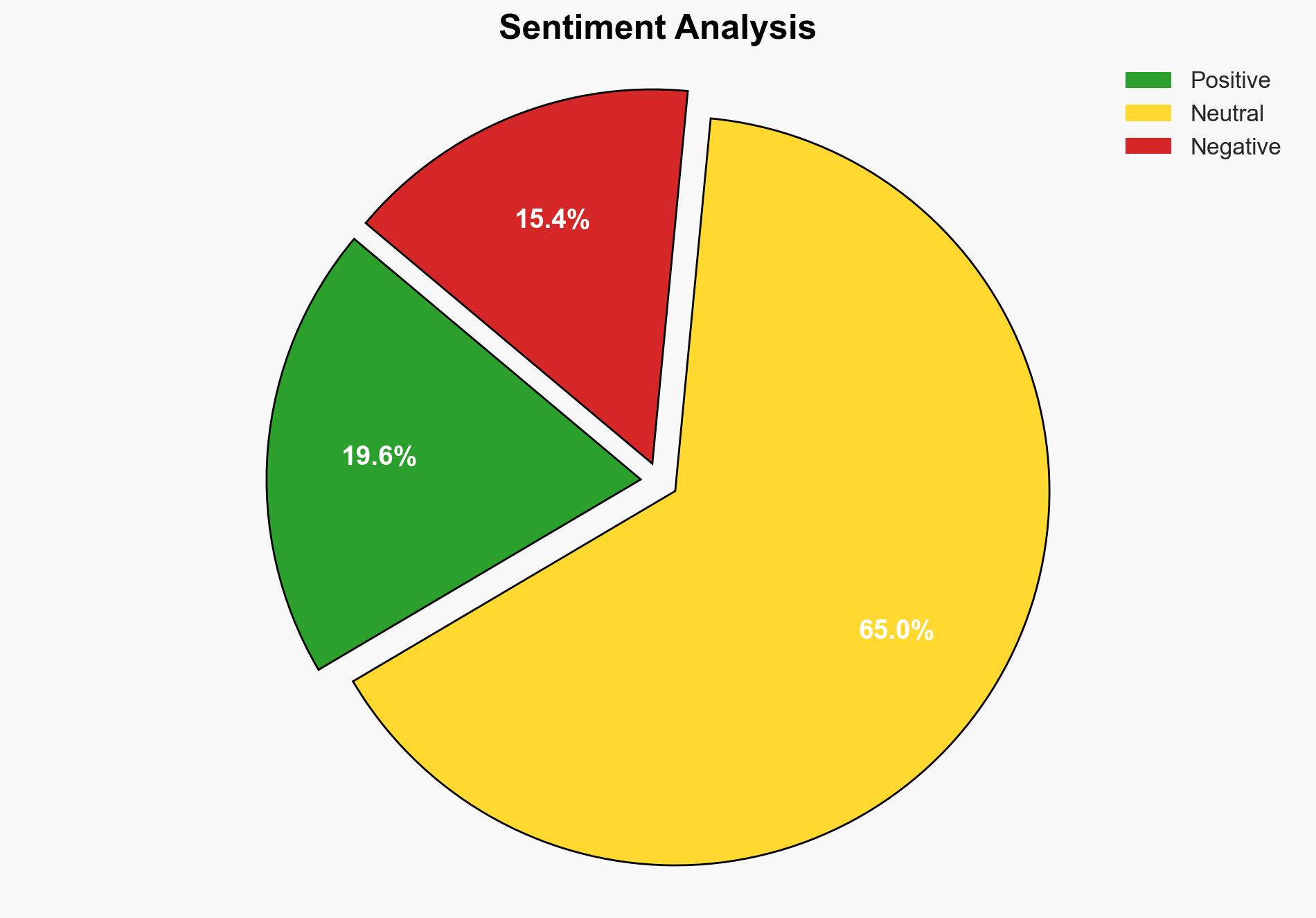

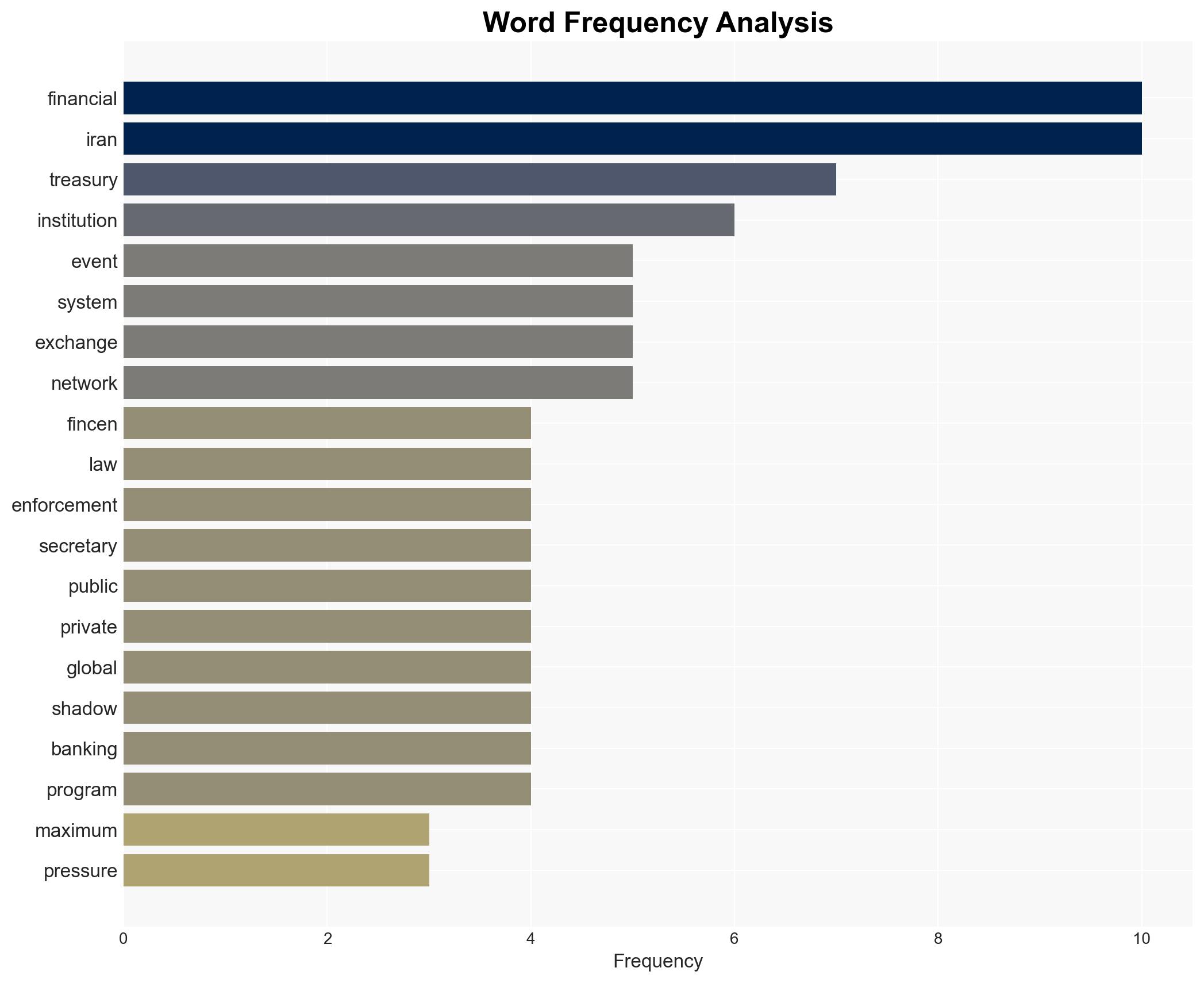

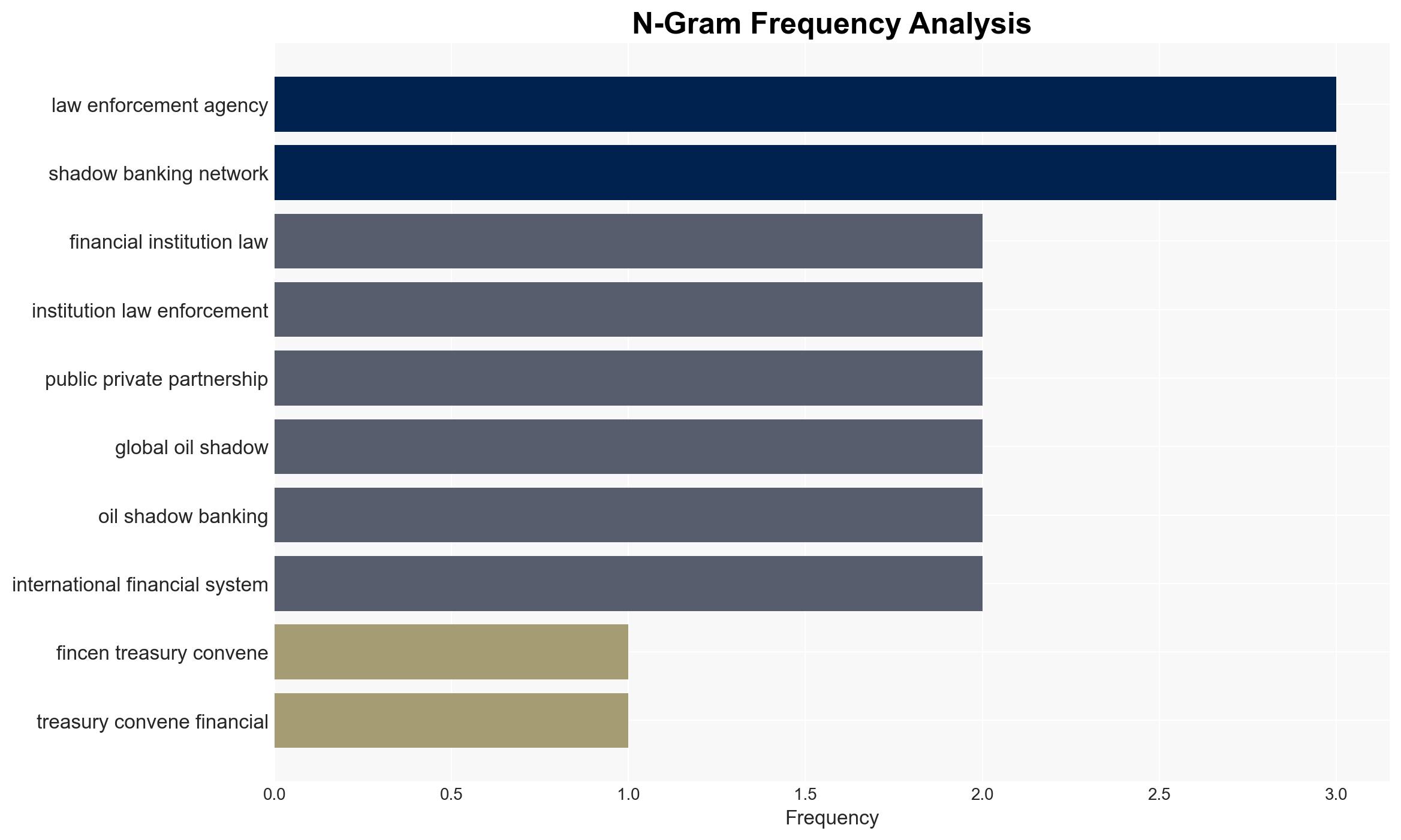

The FinCEN Treasury convened a meeting with financial institutions and law enforcement in Washington, DC, to bolster the US maximum pressure campaign against Iran. The event, led by Scott Bessent, focused on denying Iran access to the global financial system, particularly targeting Iran’s covert foreign exchange activities and shadow banking networks. The initiative aims to prevent Iran from funding terrorism and circumventing sanctions.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The event highlighted the US Treasury’s commitment to enforcing sanctions against Iran, emphasizing the importance of public-private partnerships in maintaining the integrity of the global financial system. The focus was on Iran’s use of multi-jurisdictional illicit finance systems to evade sanctions. The discussions underscored the need for financial institutions to implement robust safeguards against exploitation by malign networks.

3. Implications and Strategic Risks

The continued evasion of sanctions by Iran poses significant risks to national security and regional stability. The use of shadow banking networks threatens the integrity of the international financial system, potentially enabling the funding of terrorist activities. Economic interests are at risk as Iran’s actions could destabilize global oil markets and undermine international trade norms.

4. Recommendations and Outlook

Recommendations:

- Enhance collaboration between financial institutions and law enforcement to improve detection and prevention of illicit financial activities.

- Implement advanced technological solutions for monitoring and compliance to identify and disrupt shadow banking networks.

- Strengthen regulatory frameworks to close loopholes exploited by Iran and similar entities.

Outlook:

Best-case scenario: Effective implementation of sanctions and international cooperation leads to the dismantling of Iran’s shadow banking networks, reducing its ability to fund terrorism.

Worst-case scenario: Iran successfully circumvents sanctions, increasing its influence and destabilizing regional security.

Most likely outcome: Continued pressure and enhanced measures by the international community gradually weaken Iran’s financial networks, though challenges in enforcement persist.

5. Key Individuals and Entities

The report mentions significant individuals and organizations involved in the event:

- Scott Bessent

- FinCEN Treasury

- Global financial institutions

- Federal law enforcement agencies