Gamblers Now Bet on AI Models Like Racehorses – Slashdot.org

Published on: 2025-08-18

Intelligence Report: Gamblers Now Bet on AI Models Like Racehorses – Slashdot.org

1. BLUF (Bottom Line Up Front)

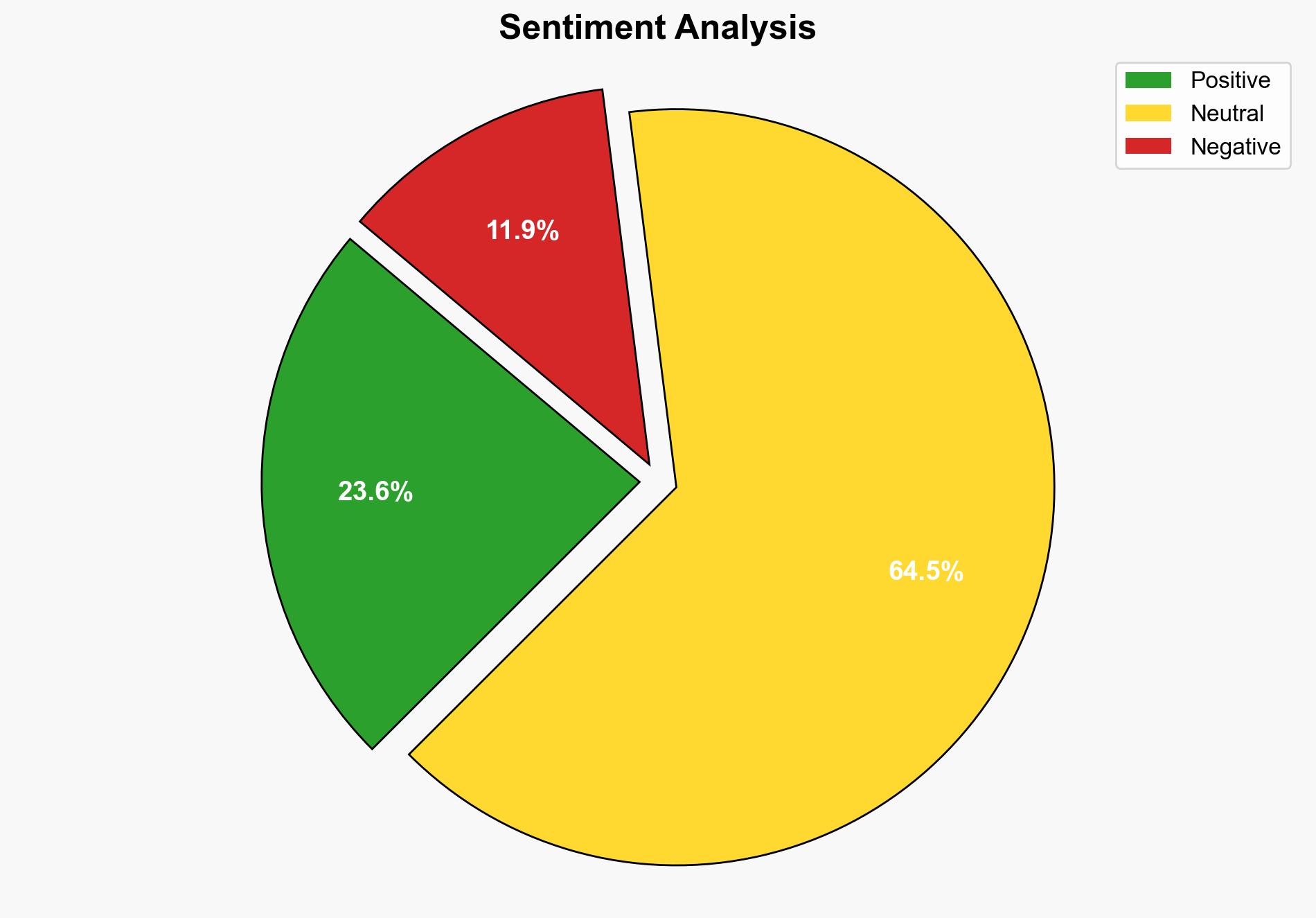

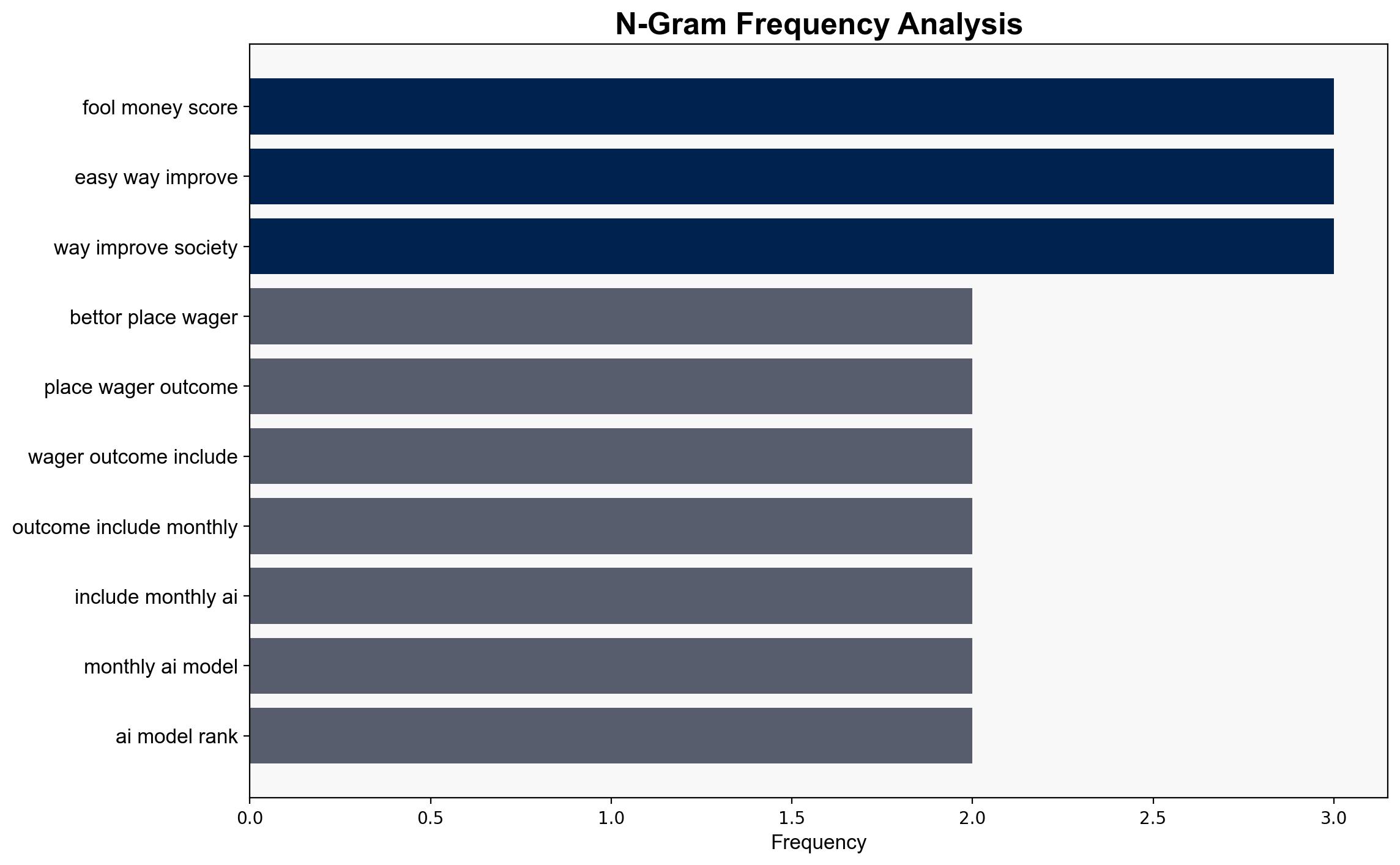

The emergence of AI model betting as a form of gambling presents a novel intersection of technology and financial speculation. The most supported hypothesis suggests that this trend is driven by the increasing integration of AI in financial markets, potentially leading to regulatory challenges and market volatility. Confidence Level: Moderate. Recommended action includes monitoring regulatory developments and assessing the impact on financial markets.

2. Competing Hypotheses

Hypothesis 1: The rise in AI model betting is primarily driven by technological advancements and the growing influence of AI in financial markets. As AI models become more sophisticated, they attract gamblers looking for new opportunities to speculate, similar to traditional financial instruments.

Hypothesis 2: The trend is a speculative bubble fueled by hype around AI, with limited long-term viability. This could lead to a short-lived surge in interest, followed by a rapid decline as the novelty wears off and regulatory scrutiny increases.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that AI models will continue to evolve and integrate into financial systems.

– Hypothesis 2 assumes that regulatory bodies will intervene to curb speculative practices.

Red Flags:

– Lack of clear regulatory frameworks for AI betting markets.

– Potential for manipulation or insider trading within AI prediction markets.

4. Implications and Strategic Risks

The integration of AI in gambling could lead to increased market volatility and potential regulatory challenges. There is a risk of financial instability if AI model betting becomes widespread without adequate oversight. Additionally, the trend could attract cybercriminals seeking to exploit vulnerabilities in AI systems.

5. Recommendations and Outlook

- Monitor regulatory developments concerning AI in financial markets to anticipate changes that could impact market dynamics.

- Encourage collaboration between technology developers and regulators to establish clear guidelines for AI model betting.

- Scenario Projections:

- Best Case: AI betting integrates smoothly with existing financial systems, enhancing market efficiency.

- Worst Case: A speculative bubble leads to significant financial losses and regulatory crackdowns.

- Most Likely: Gradual integration with increased regulatory oversight to mitigate risks.

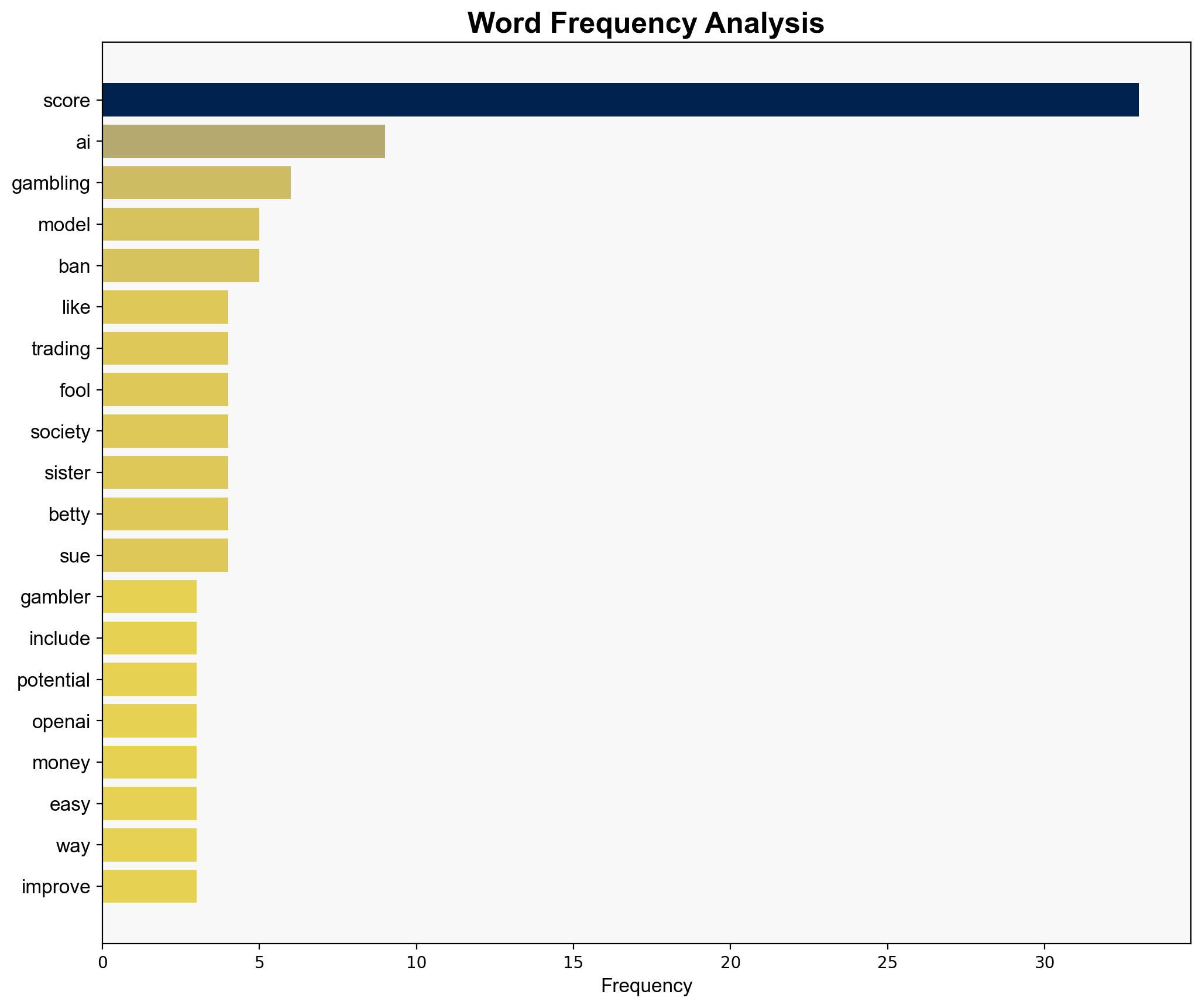

6. Key Individuals and Entities

– Sam Altman

– OpenAI

– Platforms: Kalshi, Polymarket

7. Thematic Tags

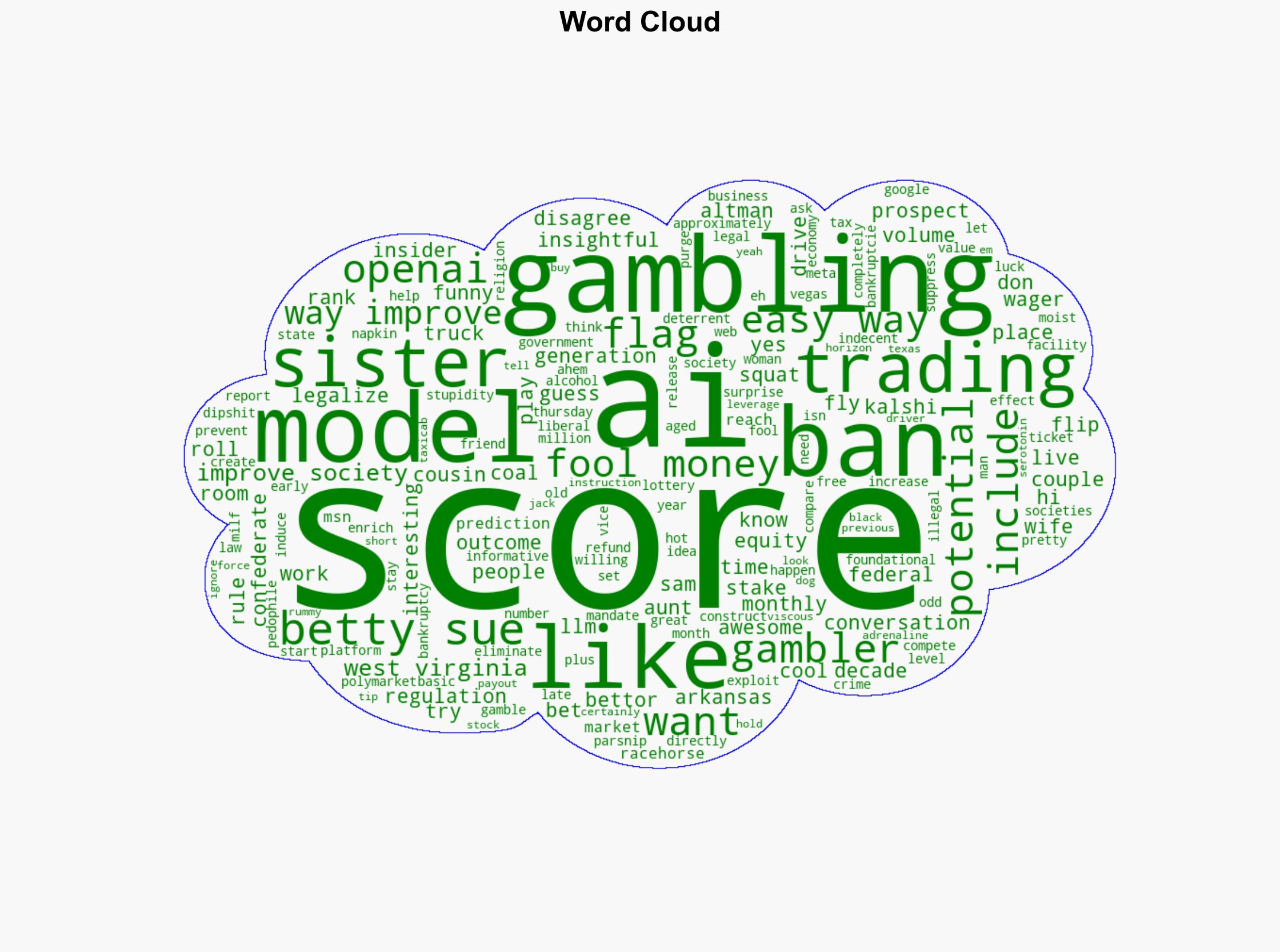

financial markets, AI technology, regulatory challenges, market volatility