GENIUS Act Lacks Necessary Guardrails For Investor Protection NYAG Letitia James Tells Congress – CoinDesk

Published on: 2025-07-01

Intelligence Report: GENIUS Act Lacks Necessary Guardrails For Investor Protection NYAG Letitia James Tells Congress – CoinDesk

1. BLUF (Bottom Line Up Front)

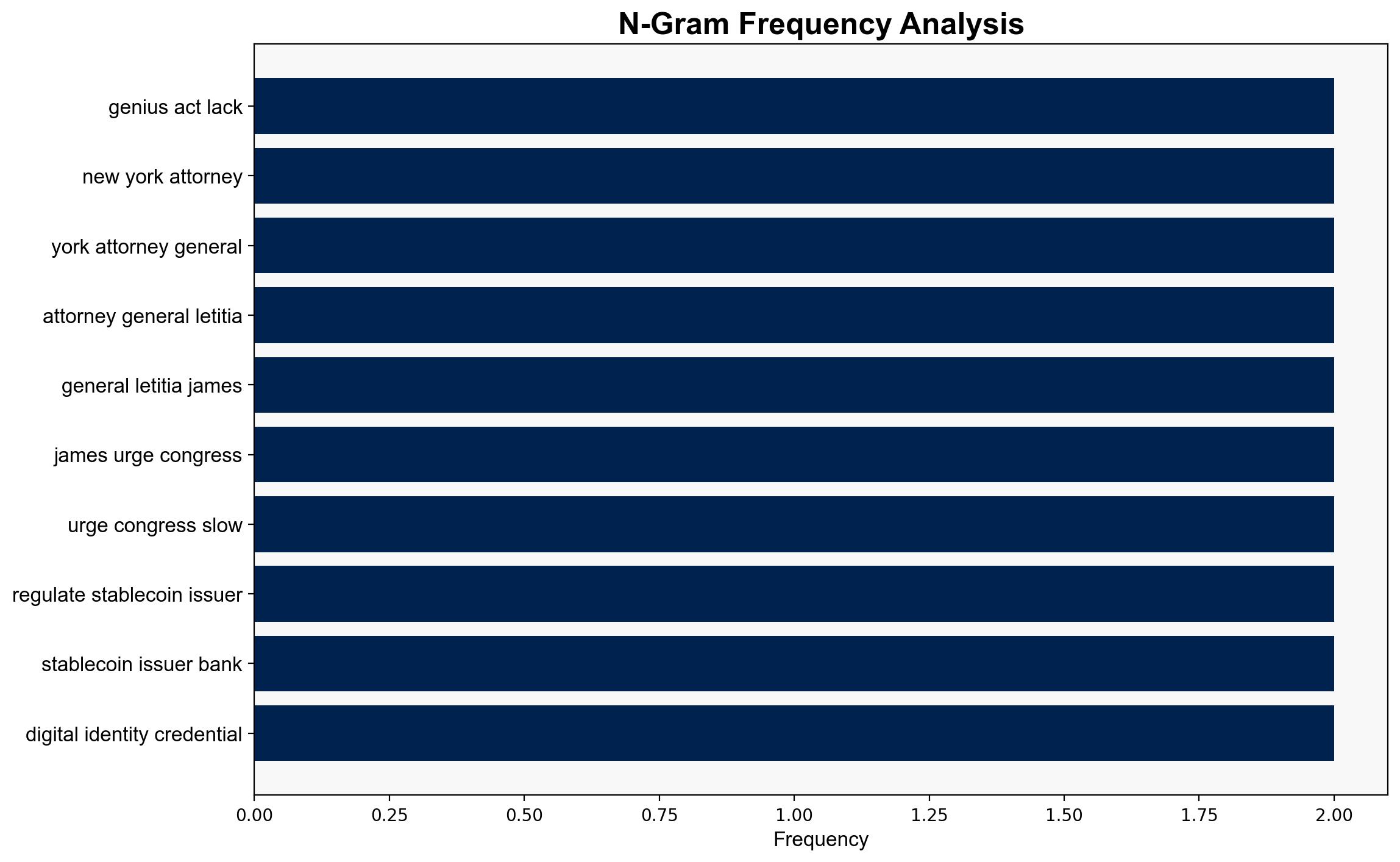

The GENIUS Act, as currently proposed, lacks sufficient safeguards to protect investors and national security, according to Letitia James. She urges Congress to slow down the legislative process to ensure that stablecoin regulations adequately balance innovation with necessary protections. Key recommendations include requiring stablecoin issuers to be regulated as banks and implementing digital identity technologies for transactions.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

Potential biases in the assessment of the GENIUS Act’s effectiveness were identified and addressed through structured challenge methods, ensuring a balanced view of its implications.

Bayesian Scenario Modeling

Probabilistic forecasting suggests a moderate likelihood of increased regulatory scrutiny if the GENIUS Act passes without amendments, potentially leading to conflicts between innovation and security.

Network Influence Mapping

Influence mapping indicates significant involvement from both domestic and foreign entities in the stablecoin market, highlighting potential vulnerabilities in national economic security.

3. Implications and Strategic Risks

The lack of regulatory guardrails in the GENIUS Act could lead to increased risks of financial instability and exploitation by malicious actors. The potential for foreign-controlled stablecoin issuers to impact the U.S. market poses a strategic economic threat. Additionally, insufficient digital identity measures may hinder law enforcement’s ability to combat illicit activities.

4. Recommendations and Outlook

- Amend the GENIUS Act to include mandatory regulation of stablecoin issuers as banks and implement digital identity requirements for transactions.

- Conduct a comprehensive risk assessment to identify potential vulnerabilities in the stablecoin market.

- Scenario Projections:

- Best Case: Enhanced regulations lead to a secure and innovative stablecoin market.

- Worst Case: Lack of regulation results in financial instability and increased illicit activities.

- Most Likely: Incremental regulatory improvements with ongoing debates about innovation versus security.

5. Key Individuals and Entities

Letitia James

6. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus