Geopolitical Risk and Tariff Delays Push Oil Prices Higher – OilPrice.com

Published on: 2025-07-11

Intelligence Report: Geopolitical Risk and Tariff Delays Push Oil Prices Higher – OilPrice.com

1. BLUF (Bottom Line Up Front)

The recent geopolitical tensions and tariff delays have led to a rise in oil prices. Key factors include the temporary postponement of tariff announcements by the U.S., increased geopolitical risks in the Middle East, and OPEC’s revised global demand outlook. Immediate attention is required to manage potential economic impacts and leverage strategic energy partnerships.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

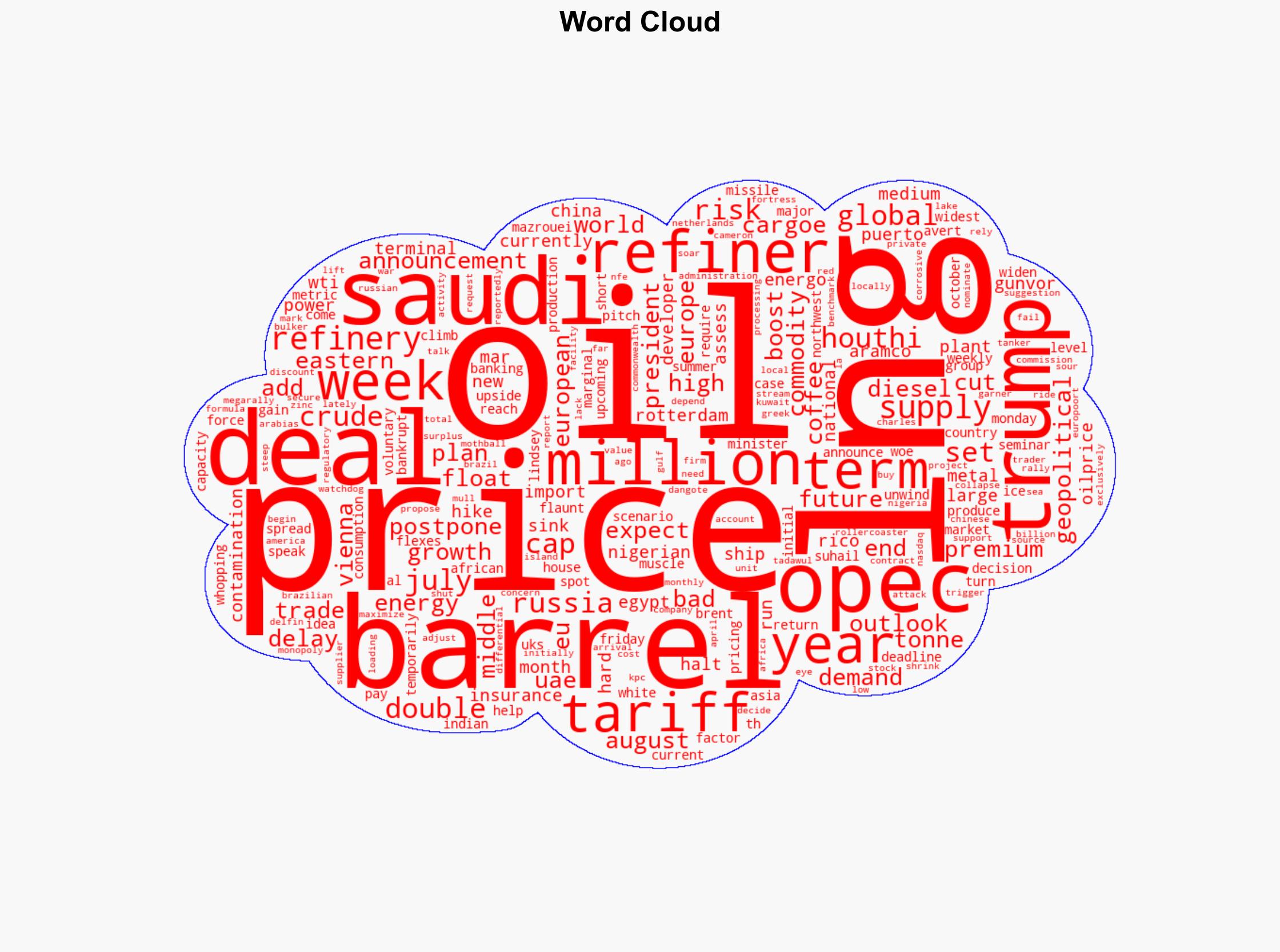

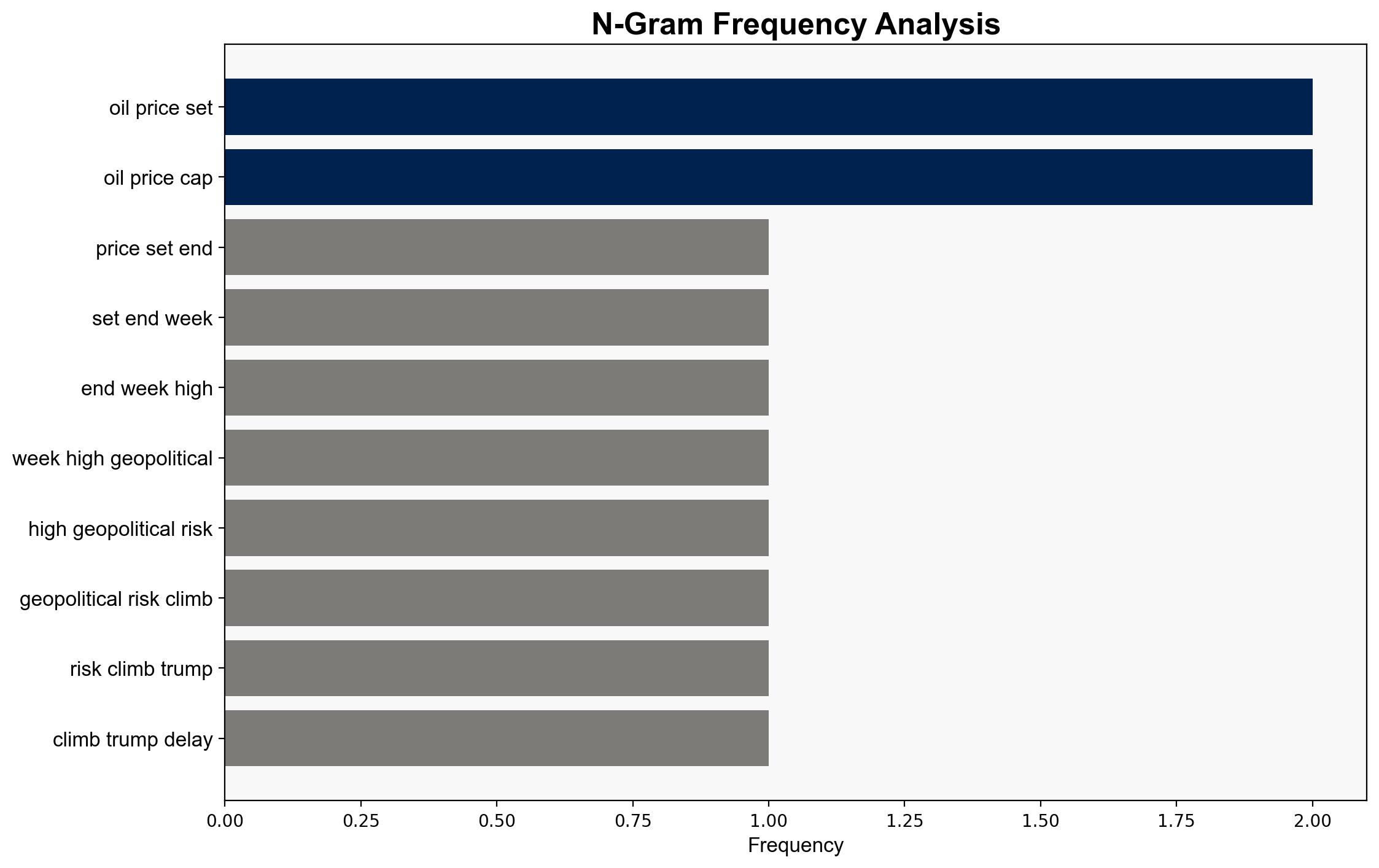

Surface events include the U.S. tariff delay and Houthi missile activities. Systemic structures involve OPEC’s production strategies and geopolitical alliances. Worldviews reflect the global dependency on oil and regional power dynamics. Myths pertain to the perceived stability of oil markets.

Cross-Impact Simulation

The delay in tariffs impacts global trade dynamics, potentially affecting U.S. relations with China and the EU. Middle Eastern tensions could disrupt oil supply chains, influencing global markets.

Scenario Generation

Potential scenarios include a stable oil market with moderated prices if geopolitical tensions ease, or a volatile market with price spikes if conflicts escalate.

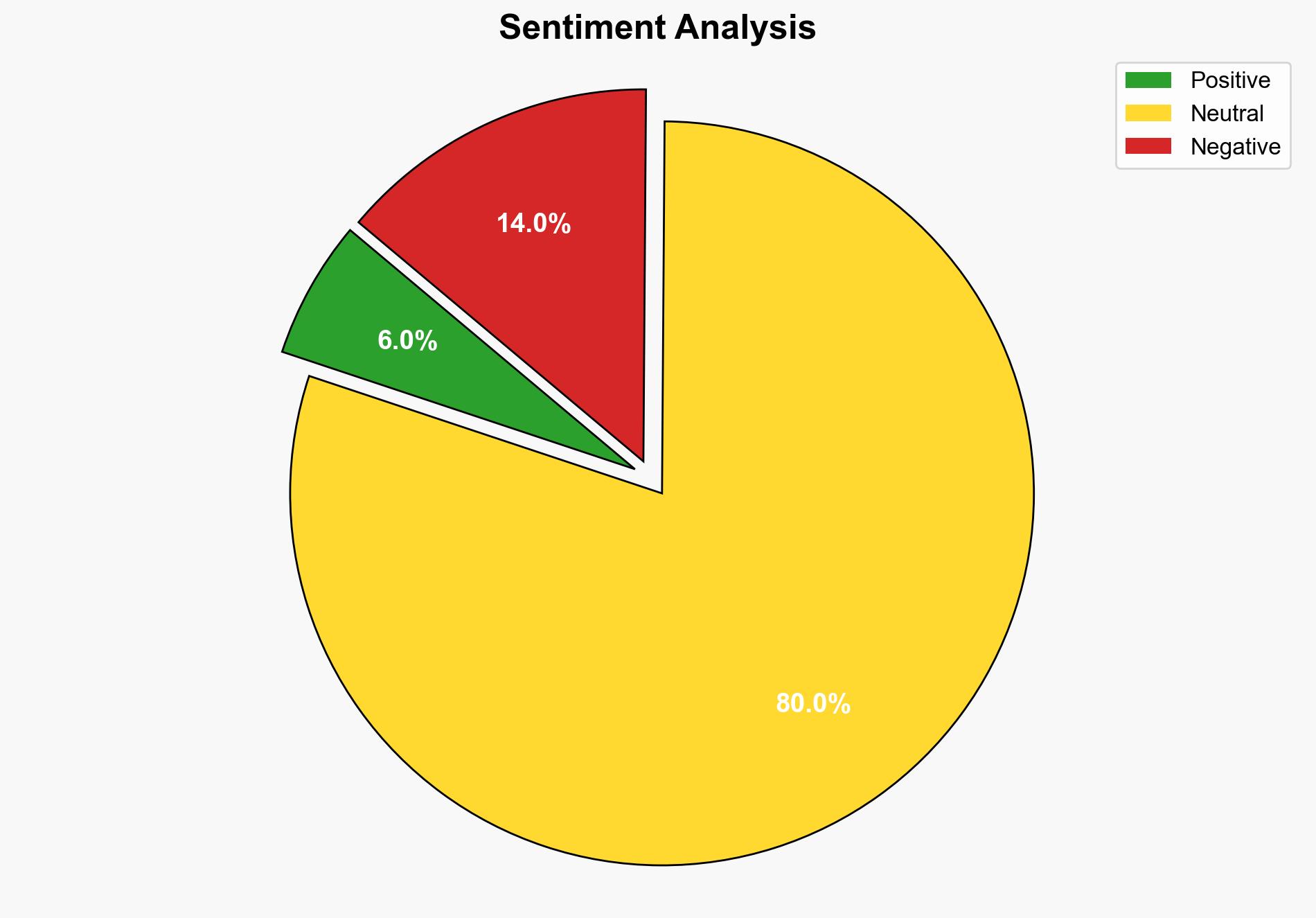

Cognitive Bias Stress Test

Biases such as over-reliance on historical stability in oil markets have been challenged to ensure robust analysis.

Bayesian Scenario Modeling

Probabilistic forecasts suggest a 60% likelihood of moderate price increases, with a 30% chance of significant spikes if geopolitical tensions worsen.

3. Implications and Strategic Risks

The rising oil prices pose economic risks, particularly for oil-importing nations. Geopolitical tensions could lead to supply disruptions, impacting global markets. The potential for increased cyber threats targeting energy infrastructure is also a concern.

4. Recommendations and Outlook

- Enhance diplomatic efforts to stabilize Middle Eastern tensions and secure energy supply chains.

- Develop strategic reserves and diversify energy sources to mitigate economic impacts.

- Best case: Stabilized oil prices with improved geopolitical relations. Worst case: Escalated conflicts leading to significant market volatility. Most likely: Moderate price increases with ongoing geopolitical uncertainties.

5. Key Individuals and Entities

Donald Trump, Suhail Al Mazrouei, Saudi Aramco, OPEC, New Fortress Energy, Dangote Refinery.

6. Thematic Tags

national security threats, energy security, geopolitical tensions, trade dynamics