Gift cards key money laundering net – Boston Herald

Published on: 2025-10-19

Intelligence Report: Gift cards key money laundering net – Boston Herald

1. BLUF (Bottom Line Up Front)

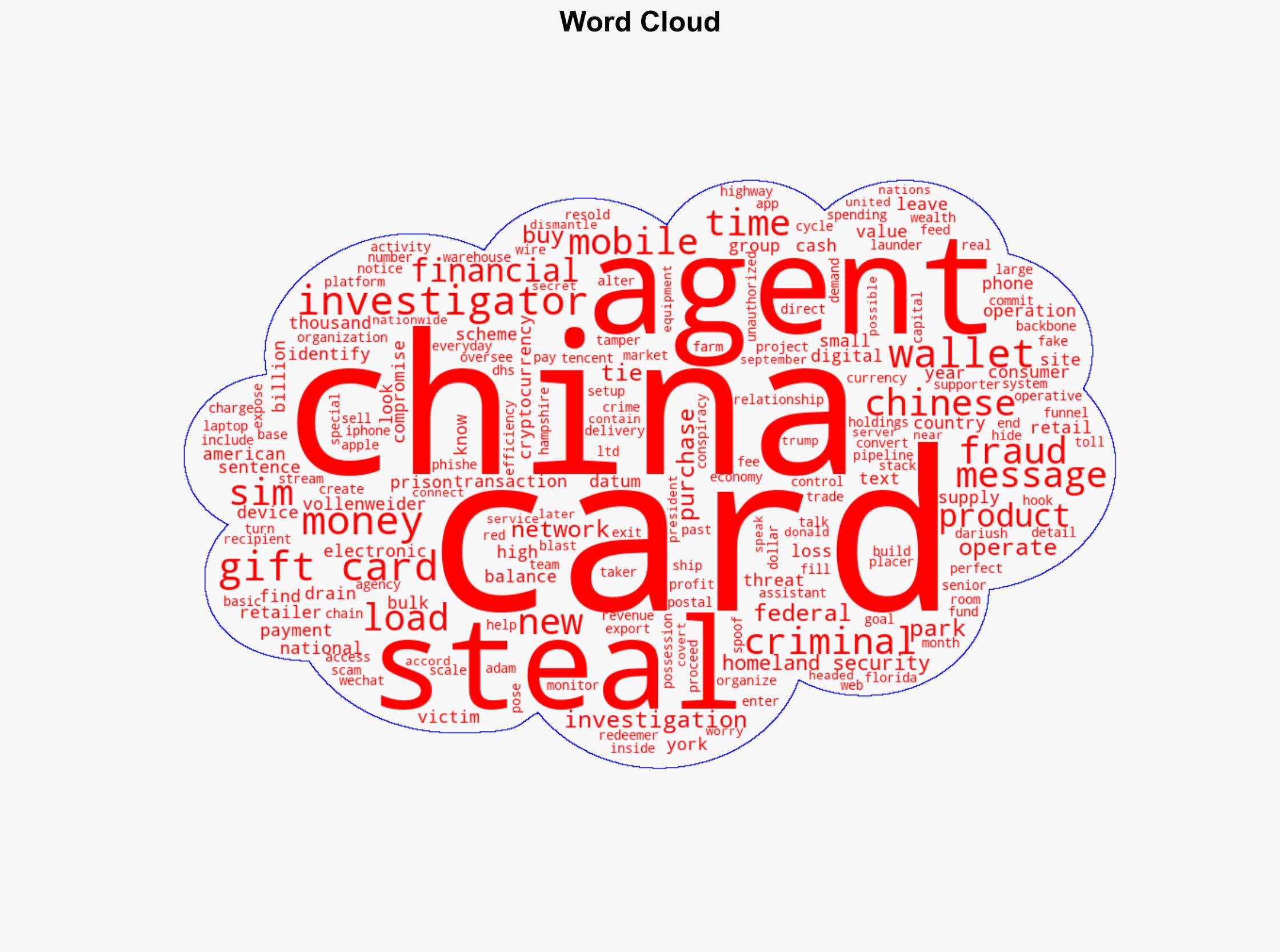

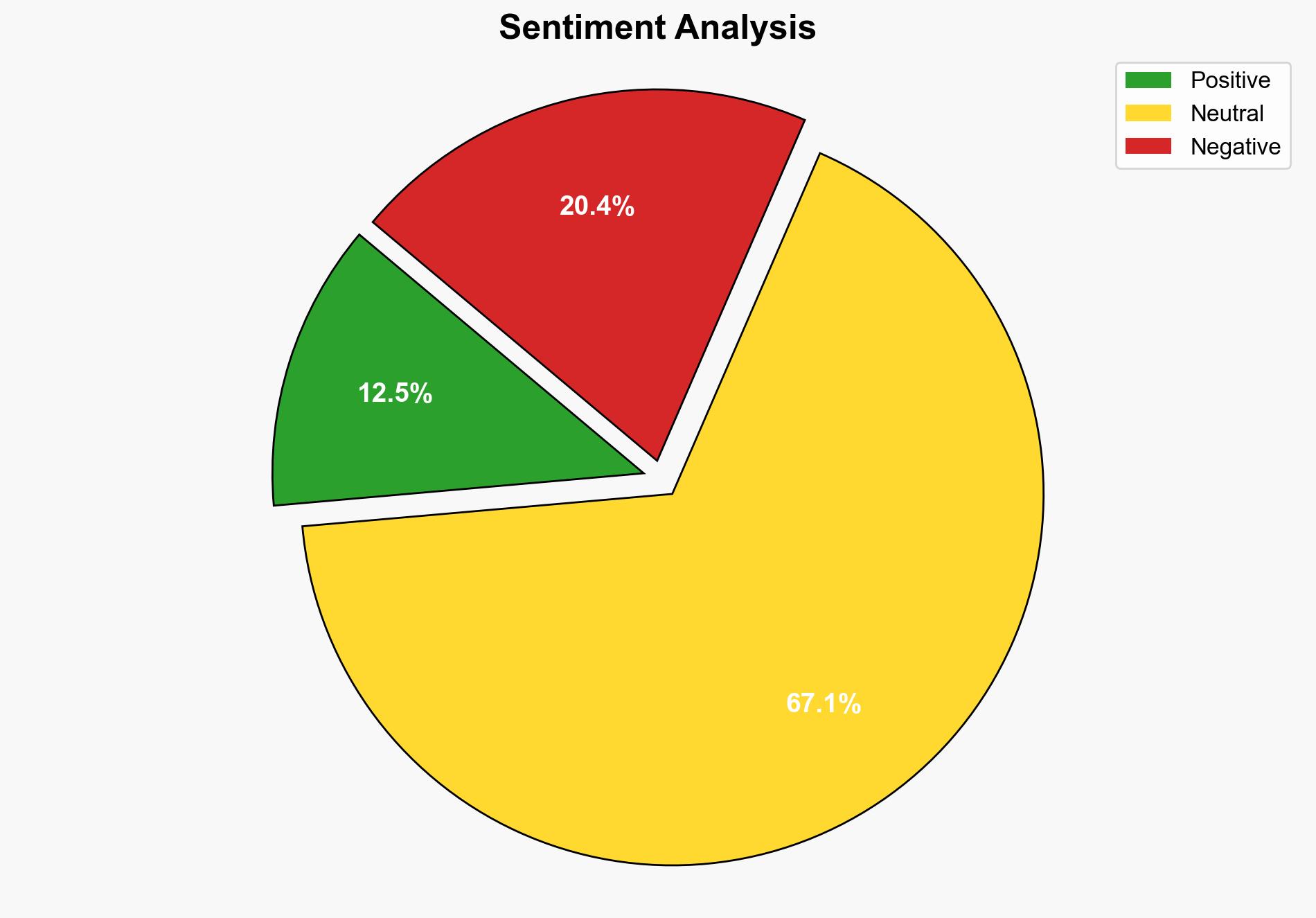

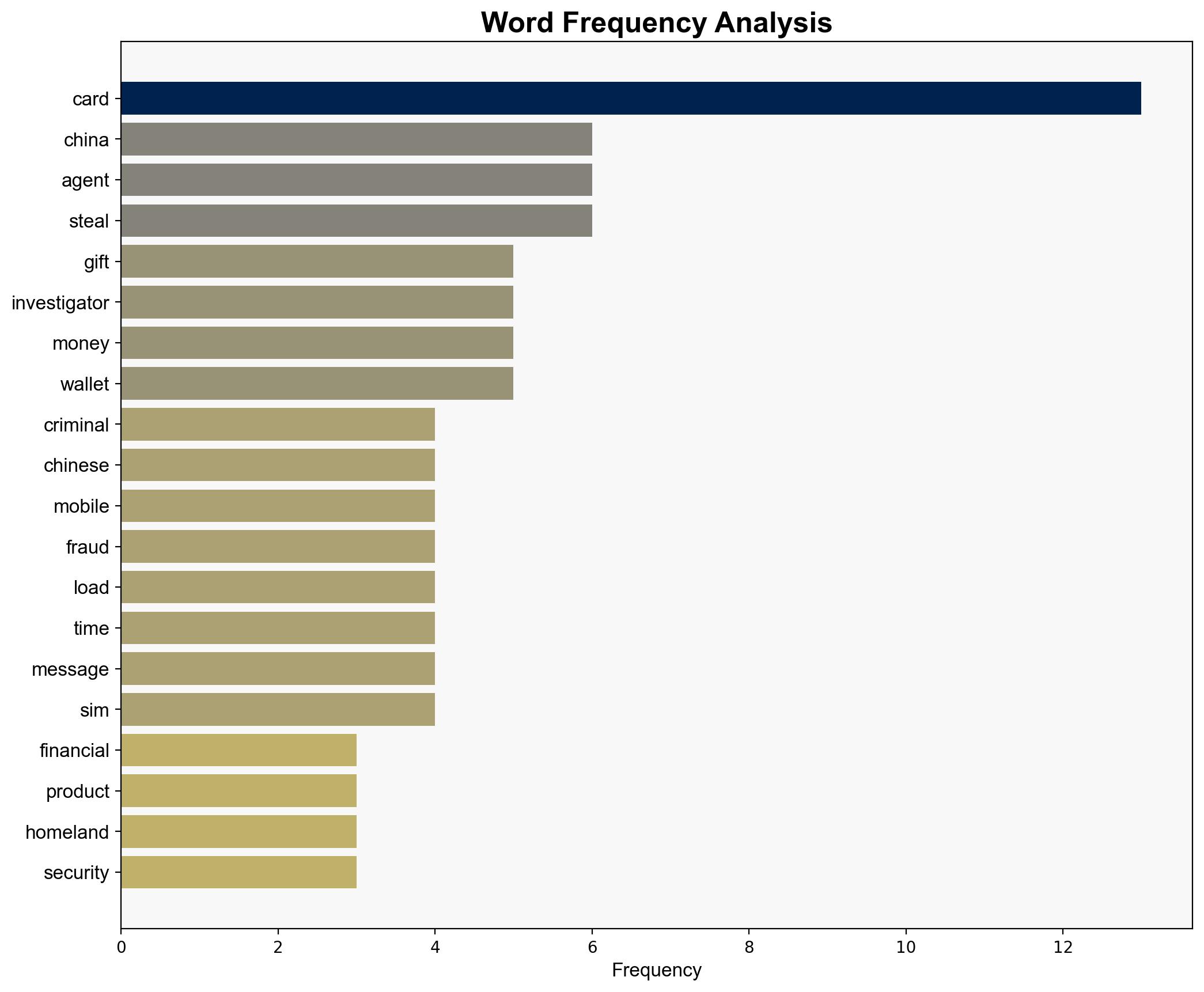

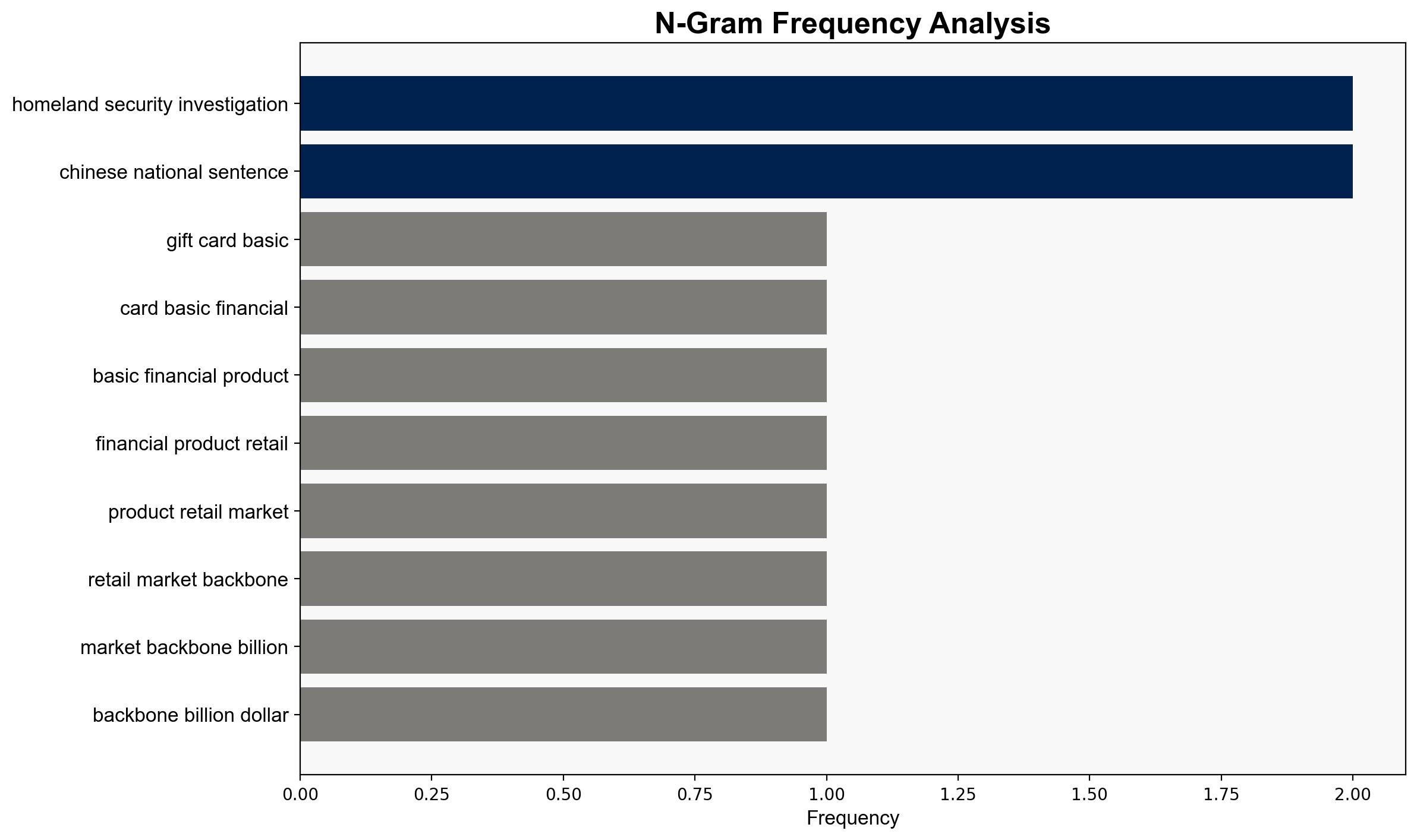

The intelligence suggests a sophisticated money laundering operation using gift cards as a conduit to transfer funds from the U.S. to China, facilitated by Chinese organized crime groups. The most supported hypothesis is that this network exploits retail and digital payment systems to obscure financial flows, posing significant economic and security threats. Confidence level: High. Recommended action: Enhance cross-border financial monitoring and strengthen cybersecurity defenses to disrupt these operations.

2. Competing Hypotheses

1. **Hypothesis A**: Chinese organized crime groups are using gift cards as a primary method to launder money, leveraging retail and digital platforms to facilitate the transfer of illicit funds from the U.S. to China.

2. **Hypothesis B**: The use of gift cards is a secondary method in a broader scheme involving multiple channels, including cryptocurrency and other digital payment systems, with the primary goal of circumventing traditional financial oversight mechanisms.

Structured Analytic Technique: Using Analysis of Competing Hypotheses (ACH), Hypothesis A is better supported due to specific evidence of organized crime involvement, the use of compromised gift cards, and the conversion of proceeds into digital currency. Hypothesis B lacks direct evidence linking it as the primary method.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the primary motivation is financial gain through laundering. The effectiveness of law enforcement in tracking digital transactions is presumed limited.

– **Red Flags**: The scale of operations suggests possible underestimation of network size and sophistication. The reliance on digital platforms may indicate evolving tactics not fully understood.

– **Blind Spots**: Potential involvement of other international actors or networks is not explored, and the impact of regulatory changes on these operations is unclear.

4. Implications and Strategic Risks

The operation poses significant risks to financial institutions and national security by undermining financial integrity and enabling capital flight. The use of digital platforms for laundering increases vulnerability to cyber threats. Geopolitically, this could strain U.S.-China relations, particularly if state actors are perceived to be complicit or negligent.

5. Recommendations and Outlook

- Enhance collaboration between financial institutions and law enforcement to improve detection of suspicious transactions.

- Invest in advanced analytics and AI to monitor and predict laundering patterns.

- Scenario Projections:

- Best Case: Disruption of the network through coordinated international efforts and improved regulatory frameworks.

- Worst Case: Expansion of operations with increased sophistication, leading to greater financial losses and security threats.

- Most Likely: Continued adaptation by criminal networks, requiring ongoing vigilance and innovation in countermeasures.

6. Key Individuals and Entities

– Adam Parks

– Dariush Vollenweider

– Tencent Holdings Ltd.

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus