Global Climate Risk Index Ranks 188 Countries by Vulnerability and Access to Finance – Columbia.edu

Published on: 2025-06-25

Intelligence Report: Global Climate Risk Index Ranks 188 Countries by Vulnerability and Access to Finance – Columbia.edu

1. BLUF (Bottom Line Up Front)

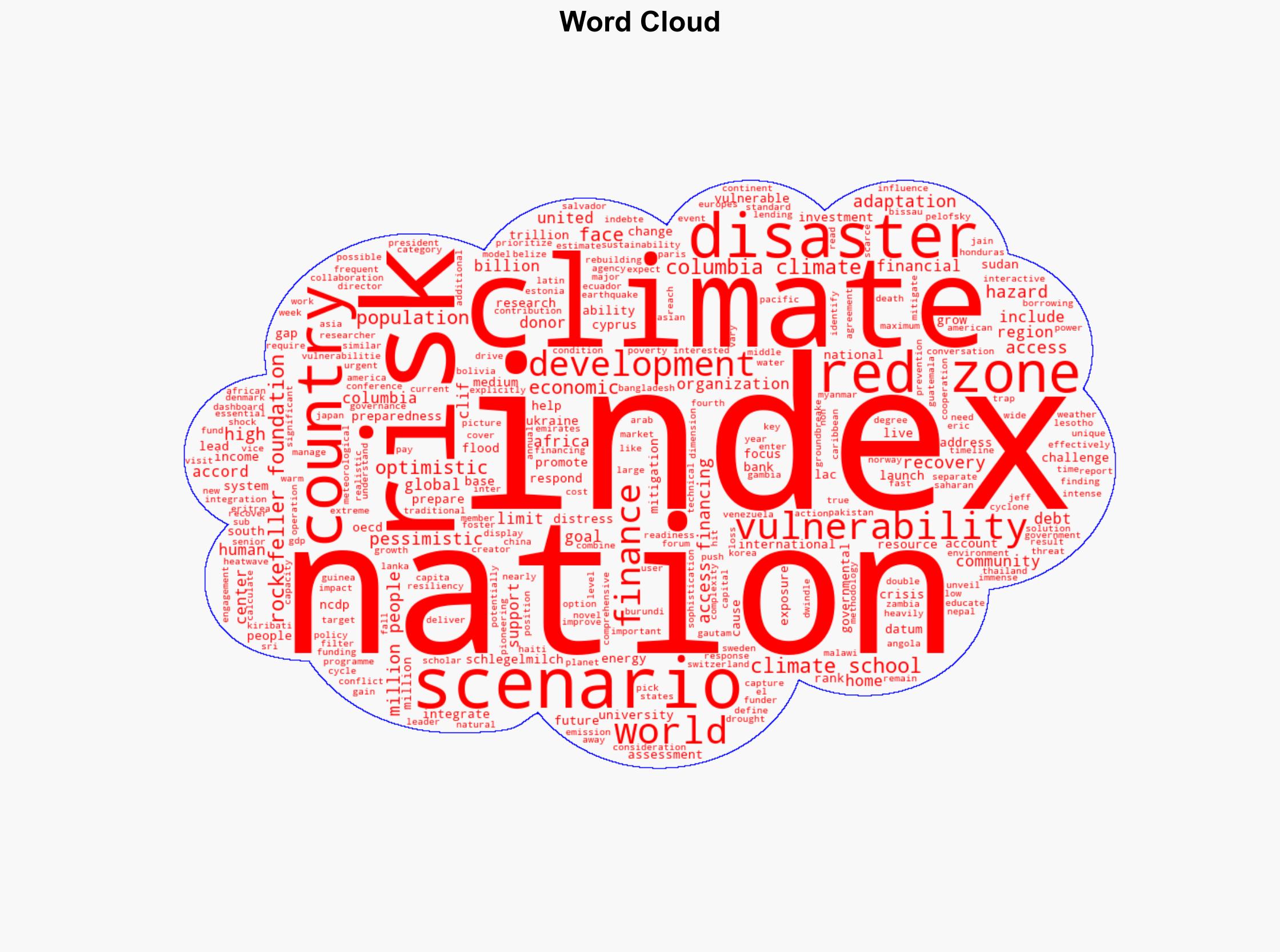

The Global Climate Risk Index, developed by Columbia Climate School with support from the Rockefeller Foundation, ranks 188 countries based on their vulnerability to climate hazards and their access to finance for mitigation and adaptation. The index highlights that many nations, particularly in Africa, face significant risks due to limited financial access, which hampers their ability to effectively manage climate-related disasters. Key recommendations include prioritizing resource allocation to high-risk nations and enhancing financial accessibility to improve resilience.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

The index reveals systemic vulnerabilities in countries with low GDP and high debt levels, which are often overlooked in traditional models. These nations face compounded risks from climate events due to inadequate financial systems.

Cross-Impact Simulation

The interconnectedness of financial markets suggests that climate shocks in one region can have ripple effects on global economic stability, particularly affecting countries with shared economic dependencies.

Scenario Generation

The index provides scenarios based on varying degrees of emissions and international collaboration, highlighting potential futures where nations either mitigate risks effectively or face escalating disasters.

Bayesian Scenario Modeling

Probabilistic models suggest that without increased financial access, nations in the “red zone” are likely to experience heightened disaster impacts, exacerbating poverty and economic instability.

Narrative Pattern Analysis

The prevailing narrative underscores the urgency of climate finance as a critical component of global security, emphasizing the need for a shift in how financial aid is prioritized and distributed.

3. Implications and Strategic Risks

The index identifies systemic risks where nations with limited financial access are trapped in a cycle of disaster and recovery, hindering sustainable development. This poses a strategic risk to global economic stability and security, as these vulnerabilities can lead to increased migration, regional conflicts, and economic disruptions.

4. Recommendations and Outlook

- Enhance financial mechanisms to provide targeted support to high-risk nations, focusing on debt relief and access to climate finance.

- Encourage international collaboration to develop comprehensive risk assessment standards and resource allocation strategies.

- Scenario-based projections suggest that improved financial access could significantly reduce disaster impacts, while inaction may lead to worsening conditions and increased global instability.

5. Key Individuals and Entities

Jeff Schlegelmilch, Eric Pelofsky, Gautam Jain

6. Thematic Tags

climate risk, financial access, global security, economic stability, disaster resilience