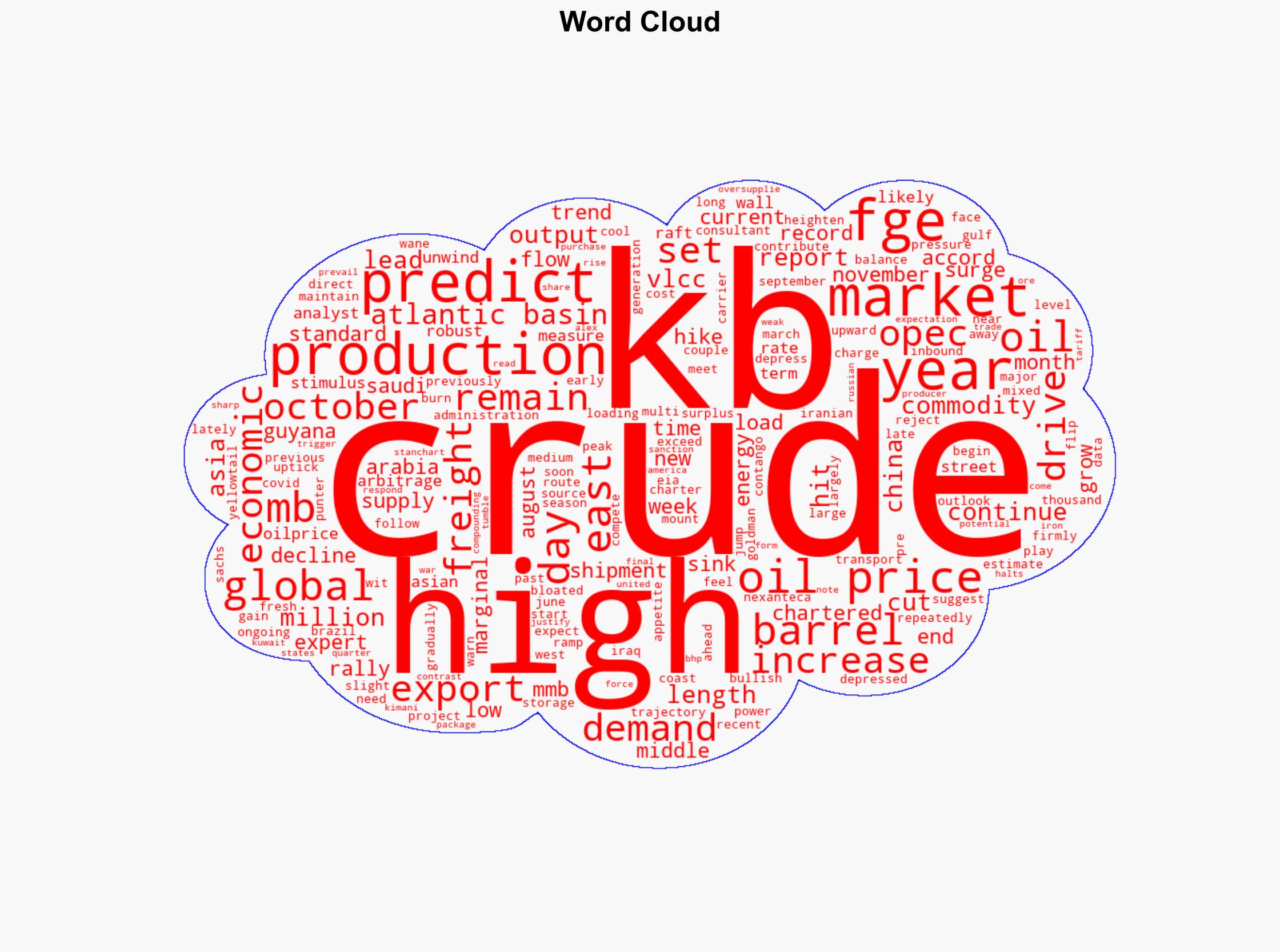

Global Crude Exports Set To Hit All-Time High In October – OilPrice.com

Published on: 2025-10-01

Intelligence Report: Global Crude Exports Set To Hit All-Time High In October – OilPrice.com

1. BLUF (Bottom Line Up Front)

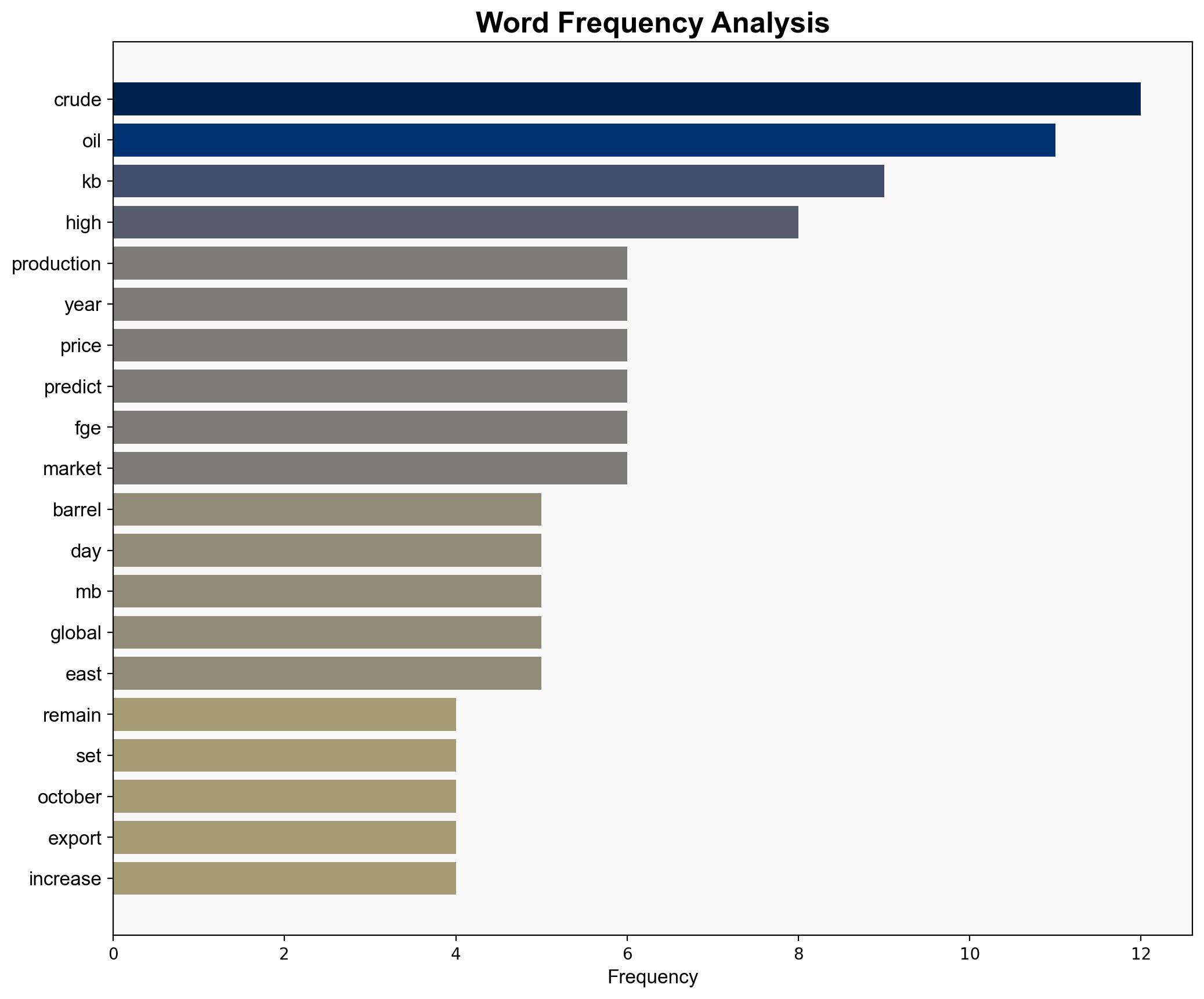

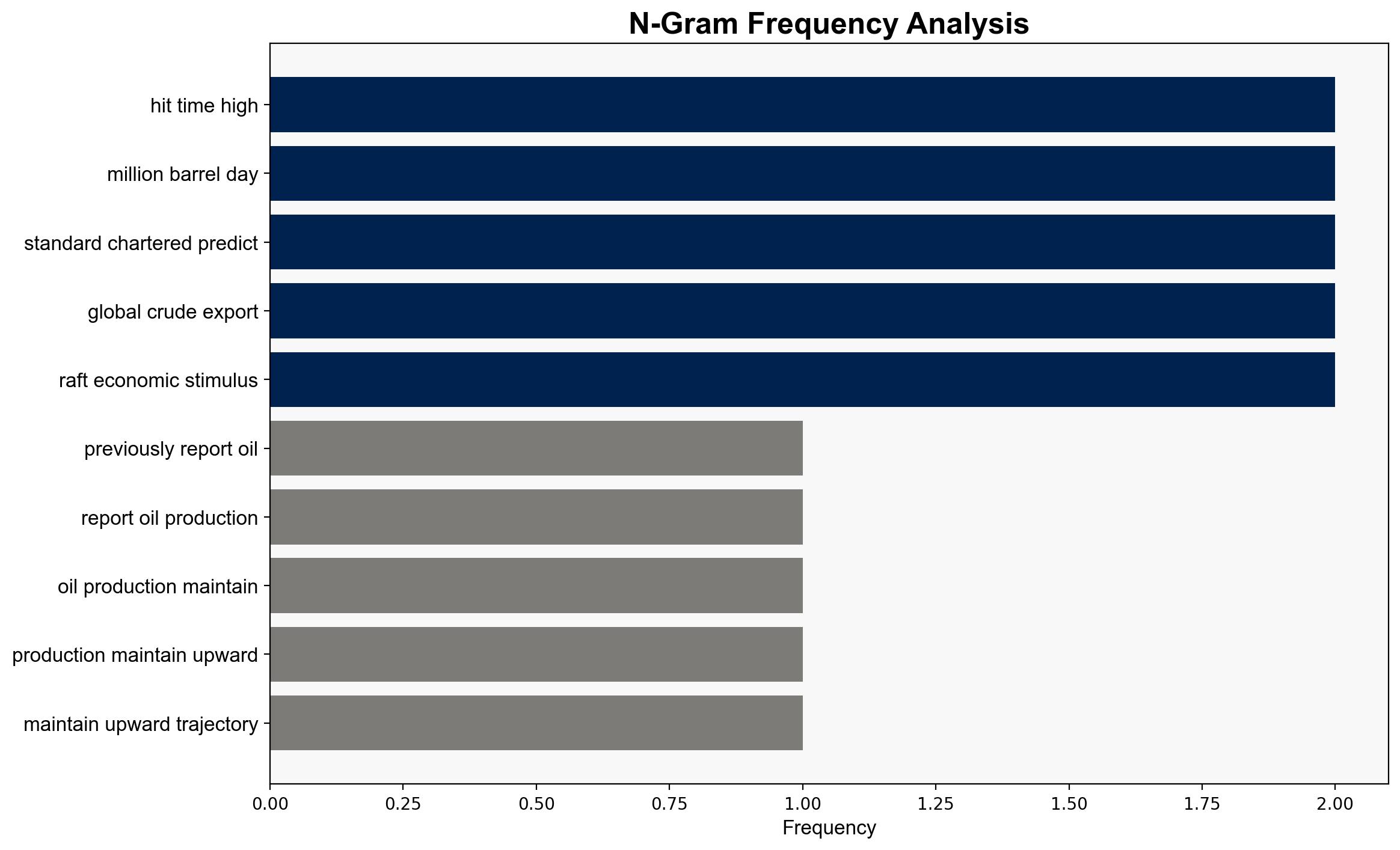

Global crude exports are projected to reach unprecedented levels in October, driven by increased production from key exporters like Saudi Arabia and Iraq. The most supported hypothesis suggests that this surge is primarily due to seasonal factors and strategic production increases. Confidence in this assessment is moderate due to potential geopolitical and economic disruptions. Recommended action includes monitoring geopolitical developments and preparing for potential market volatility.

2. Competing Hypotheses

Hypothesis 1: The increase in global crude exports is driven by strategic production increases from major oil-producing countries, aiming to capitalize on current market conditions and offset potential future demand declines.

Hypothesis 2: The surge in crude exports is primarily a result of seasonal demand fluctuations and temporary geopolitical factors, such as the end of the crude burn season and regional power generation needs.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that producers are strategically increasing output despite potential oversupply risks.

– Hypothesis 2 assumes that seasonal and geopolitical factors are the primary drivers, with less emphasis on strategic long-term planning.

Red Flags:

– Potential underestimation of geopolitical tensions that could disrupt supply chains.

– Overreliance on projections without accounting for unforeseen economic shifts or policy changes.

4. Implications and Strategic Risks

The projected increase in crude exports could lead to market oversupply, exerting downward pressure on oil prices. This scenario may prompt producers to reconsider output levels, potentially leading to economic instability in oil-dependent regions. Additionally, geopolitical tensions, such as those involving Iran, could exacerbate supply chain vulnerabilities, impacting global energy security.

5. Recommendations and Outlook

- Monitor geopolitical developments, particularly in the Middle East, to anticipate potential disruptions.

- Prepare for market volatility by diversifying energy sources and investing in strategic reserves.

- Scenario Projections:

- Best Case: Stable geopolitical environment and balanced supply-demand dynamics maintain moderate oil prices.

- Worst Case: Geopolitical conflicts disrupt supply chains, leading to significant price volatility and economic instability.

- Most Likely: Short-term oversupply leads to moderate price declines, with potential stabilization as demand adjusts.

6. Key Individuals and Entities

– Saudi Arabia

– Iraq

– FGE (Global Energy Consultant)

– Standard Chartered (Commodity Expert)

– Goldman Sachs

7. Thematic Tags

energy markets, geopolitical risks, economic stability, global trade dynamics