Global LNG Glut Could Upend Prices by 2026 – OilPrice.com

Published on: 2025-11-17

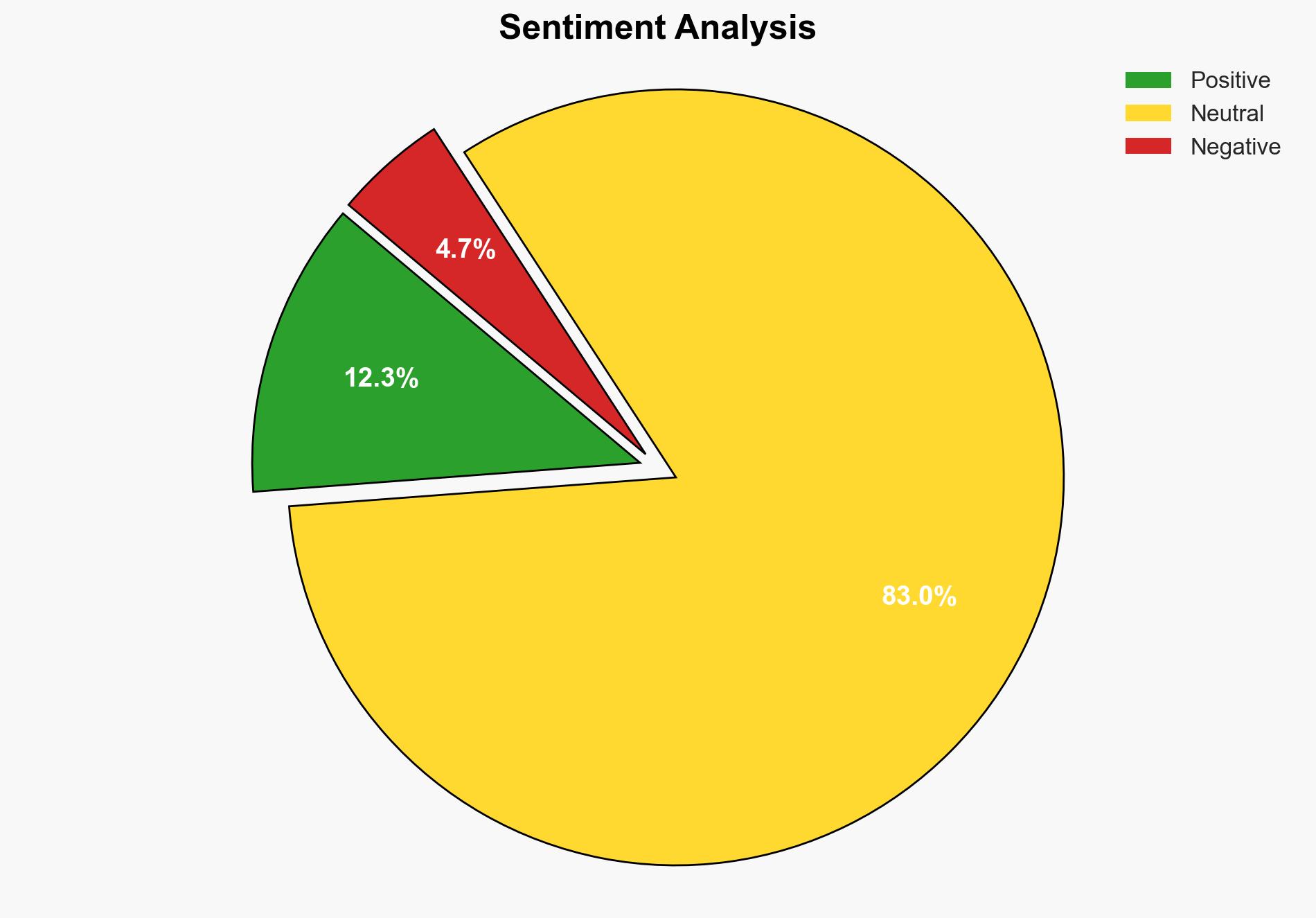

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Global LNG Market Dynamics and Strategic Implications

1. BLUF (Bottom Line Up Front)

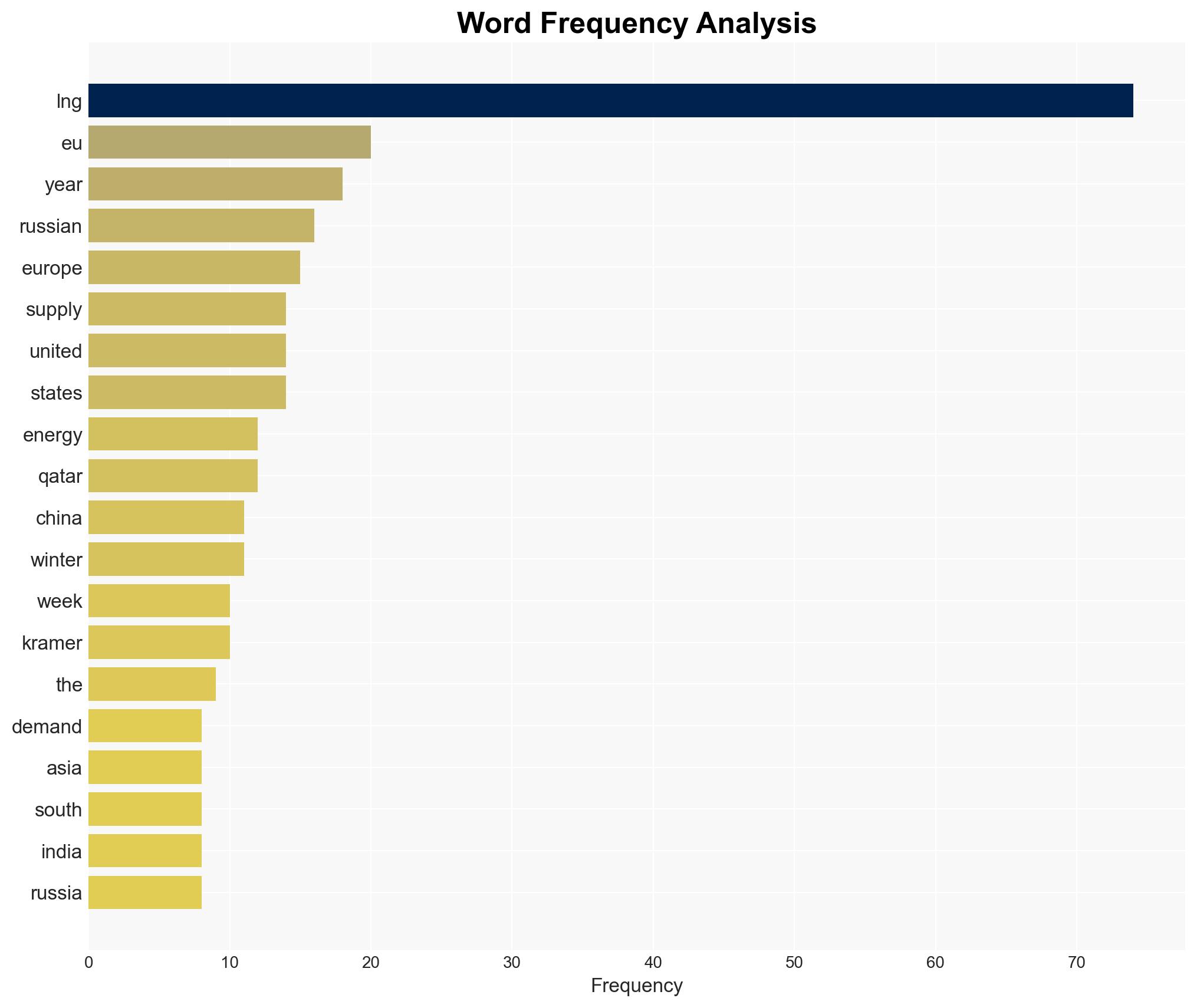

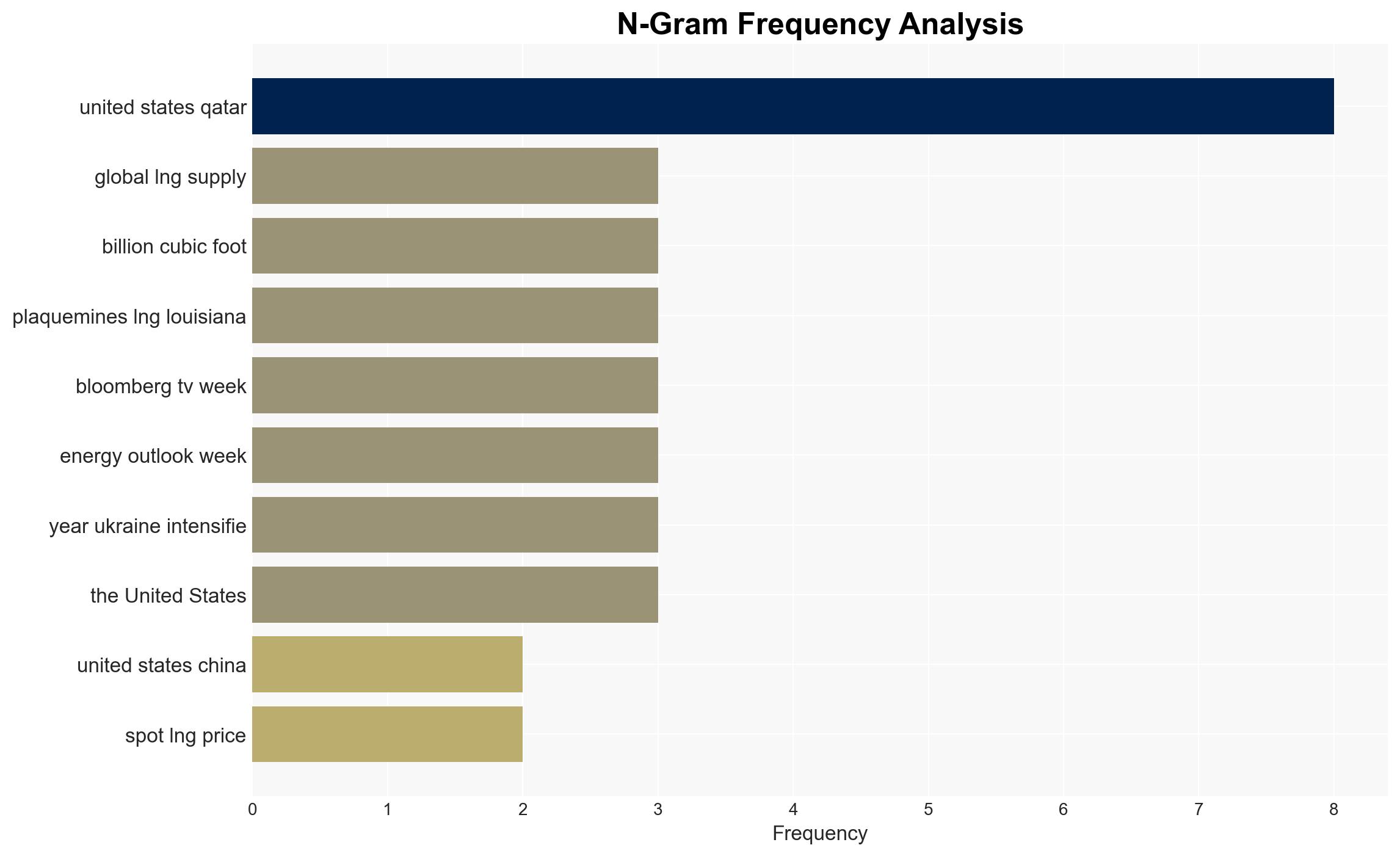

There is a moderate confidence level that the global LNG market will experience a significant oversupply by 2026, leading to depressed spot prices. The most supported hypothesis is that this oversupply will benefit price-sensitive buyers in Asia and Europe, potentially altering geopolitical energy dependencies. Recommended actions include monitoring regulatory changes in the EU and strategic partnerships with LNG exporters to secure favorable terms.

2. Competing Hypotheses

Hypothesis 1: The global LNG market will face a substantial oversupply by 2026, resulting in lower spot prices and increased competition among exporters.

Hypothesis 2: Despite the projected increase in LNG supply, unforeseen demand surges or geopolitical disruptions could absorb the excess supply, stabilizing or even increasing prices.

Hypothesis 1 is more likely due to the consistent expansion of LNG projects in the U.S. and Qatar, coupled with the EU’s strategic pivot away from Russian gas, which is expected to create a supply surplus. Hypothesis 2, while plausible, hinges on unpredictable factors such as extreme weather events or sudden geopolitical shifts, which are less certain.

3. Key Assumptions and Red Flags

Assumptions include the continued expansion of LNG projects as planned and the EU’s successful implementation of its energy diversification strategy. A red flag is the potential for regulatory changes in the EU that could restrict LNG imports, as indicated by the Corporate Sustainability Due Diligence Directive. Deception indicators include overly optimistic supply forecasts from LNG producers that may not account for potential project delays or cancellations.

4. Implications and Strategic Risks

The oversupply of LNG could lead to economic shifts, with Asian and European countries benefiting from lower energy costs, potentially enhancing their economic competitiveness. However, this could also escalate geopolitical tensions as traditional energy exporters face reduced revenues. Cyber threats may increase as energy infrastructure becomes a target for state and non-state actors seeking to disrupt supply chains. Economically, prolonged low prices could deter future investments in LNG infrastructure, impacting long-term energy security.

5. Recommendations and Outlook

- Monitor EU regulatory developments closely to anticipate potential barriers to LNG imports.

- Engage in strategic dialogues with key LNG exporters like the U.S. and Qatar to secure long-term supply agreements at favorable rates.

- Invest in LNG infrastructure and storage capabilities to capitalize on low prices and enhance energy security.

- Best-case scenario: Oversupply leads to stable, low prices, benefiting global economic growth.

- Worst-case scenario: Geopolitical tensions disrupt supply chains, causing price volatility and energy insecurity.

- Most-likely scenario: A moderate oversupply results in competitive pricing, with regional variations based on regulatory and geopolitical factors.

6. Key Individuals and Entities

Mike Wirth (Chevron CEO), Kristy Kramer (Wood Mackenzie), Tsvetana Paraskova (OilPrice.com)

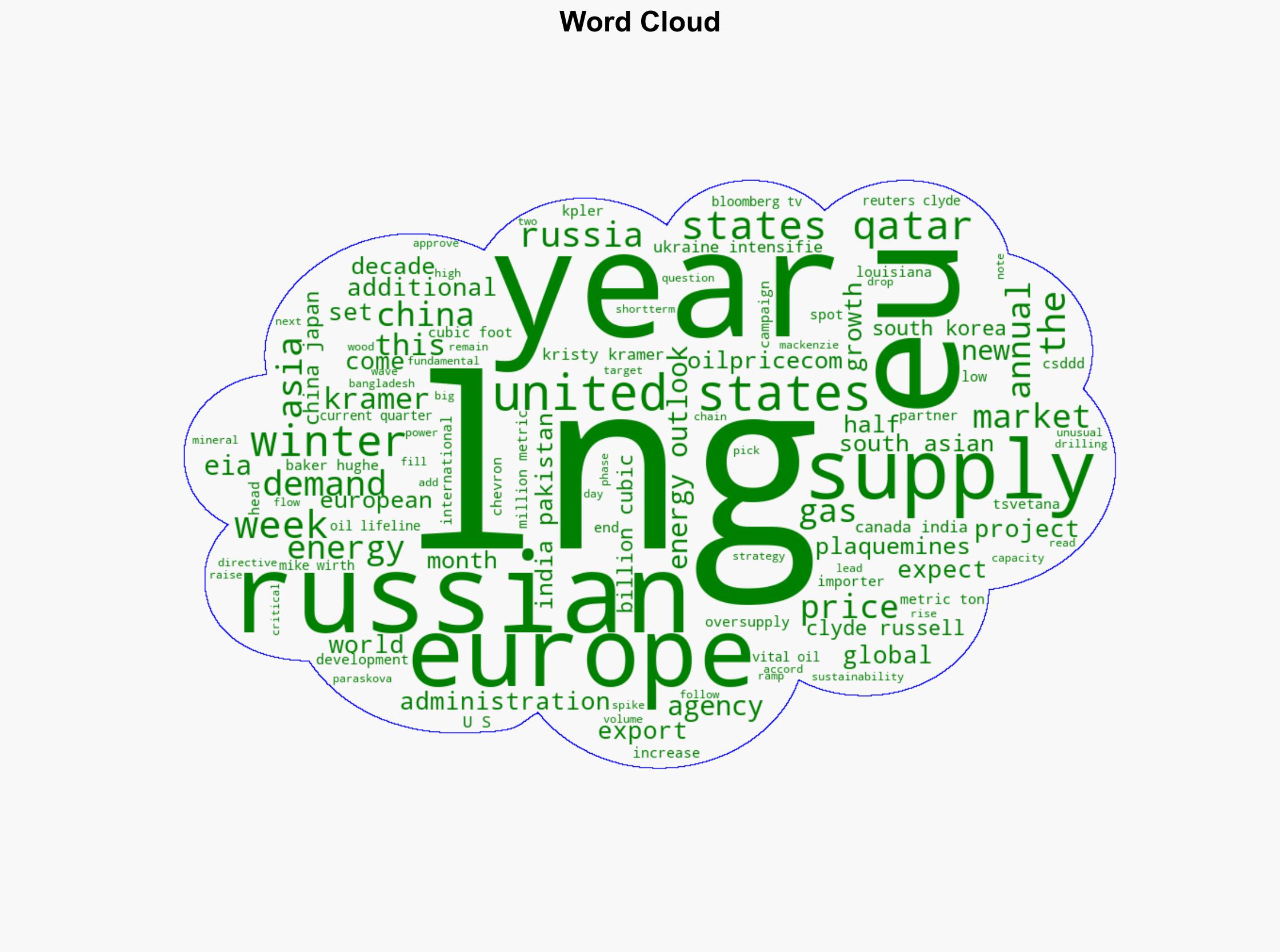

7. Thematic Tags

Regional Focus, Regional Focus: Asia, Europe, United States, Qatar

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·