Global stock markets up amid Trump tariffs exemptions for electronics – ABC News

Published on: 2025-04-14

Intelligence Report: Global Stock Markets Up Amid Trump Tariffs Exemptions for Electronics – ABC News

1. BLUF (Bottom Line Up Front)

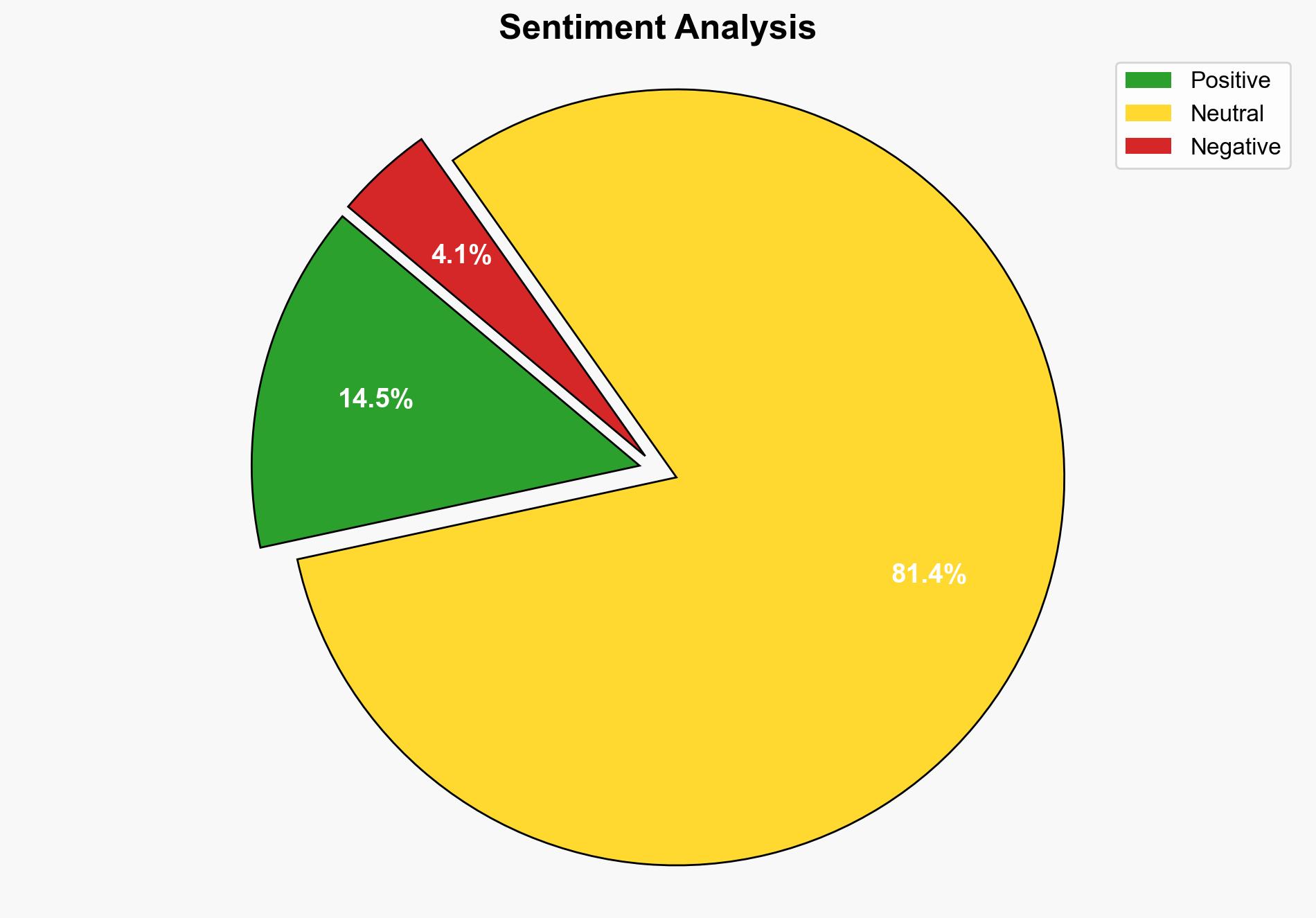

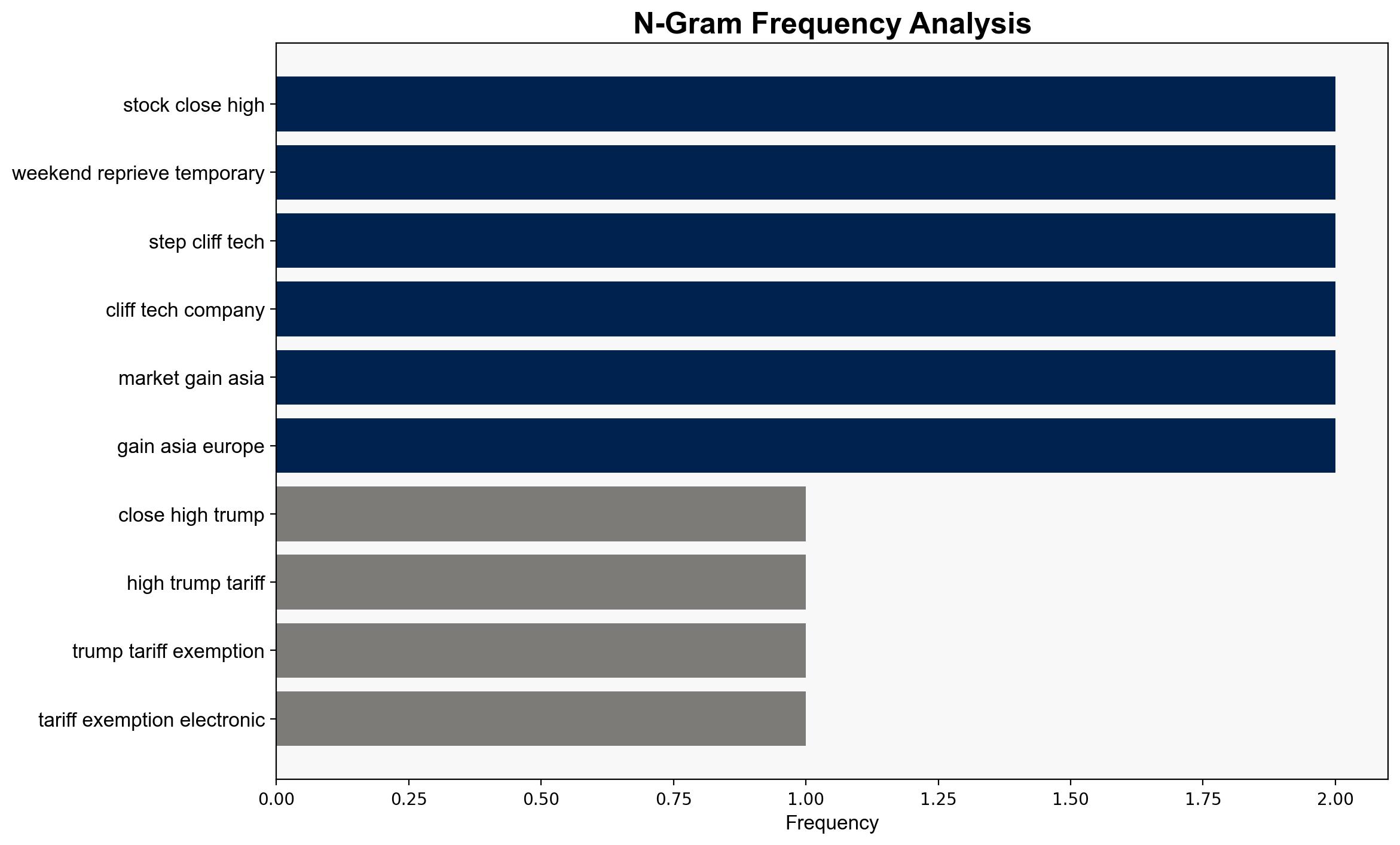

The U.S. stock markets experienced a positive surge following the announcement of temporary tariff exemptions on key consumer electronics. This development has provided a temporary relief to tech companies, particularly those with supply chains in China. However, the reprieve is expected to be short-lived, as further tariffs may be imposed under new national security classifications. Stakeholders should prepare for potential volatility in the tech sector.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

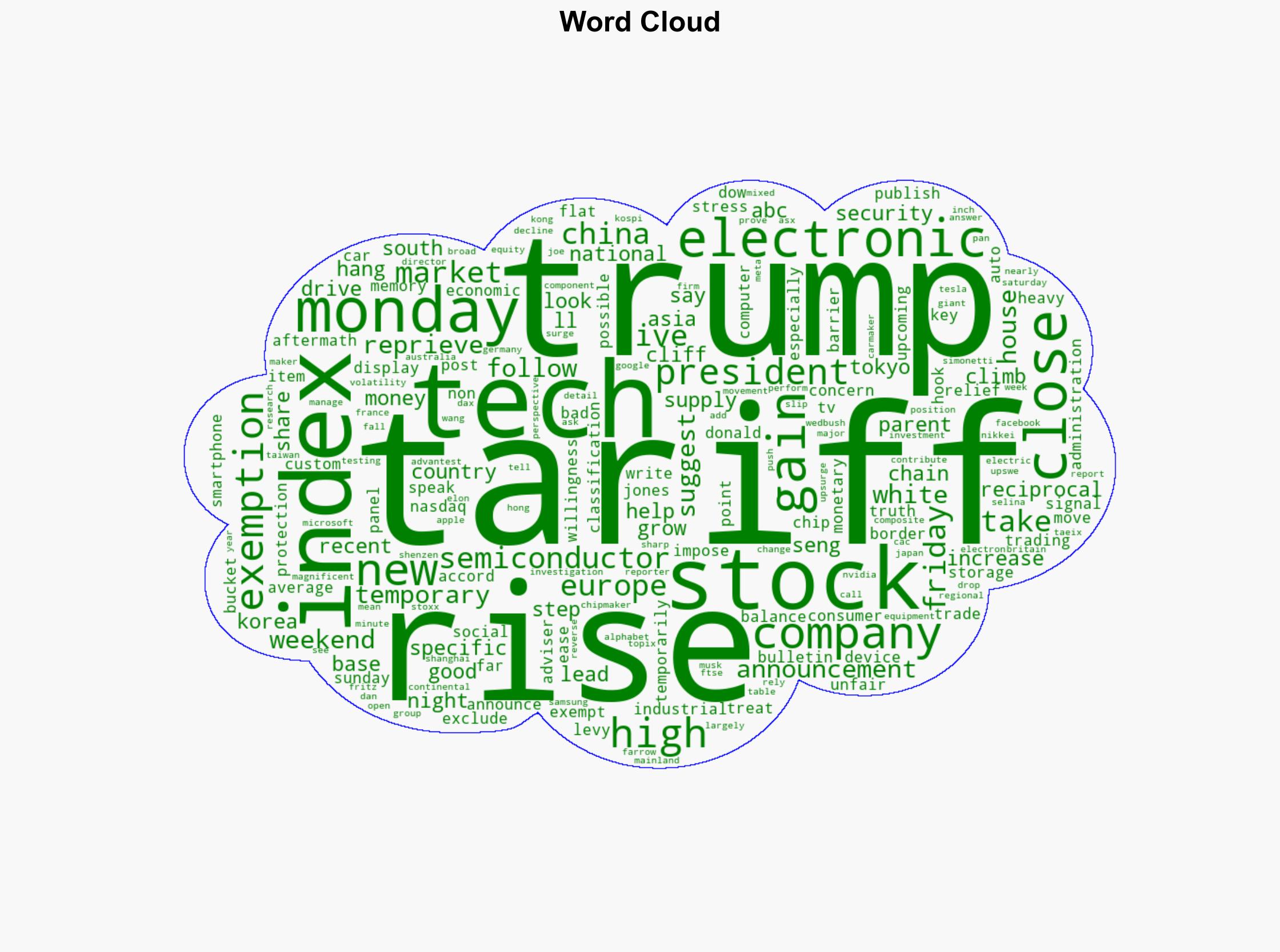

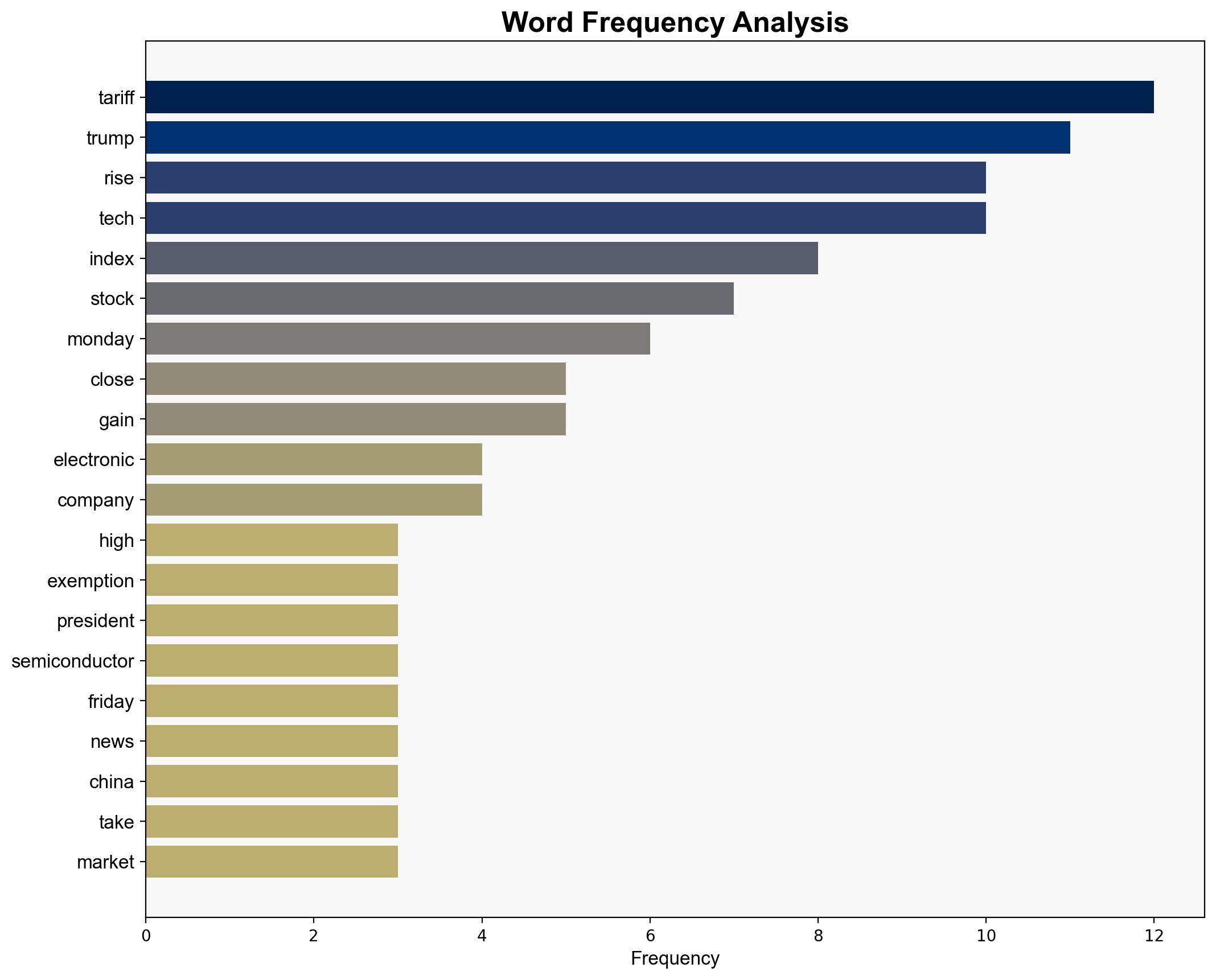

The announcement of tariff exemptions led to a significant rise in U.S. stock indices, with the Dow Jones Industrial Average increasing by 312 points, the S&P 500 climbing 0.8%, and the Nasdaq rising 0.6%. Key consumer electronics, including smartphones, computers, and semiconductor-based devices, were temporarily exempted from tariffs, alleviating immediate pressure on tech companies. However, the exemptions are temporary, and further tariffs may be introduced under national security considerations. This creates an environment of uncertainty, particularly for companies heavily reliant on Chinese supply chains.

3. Implications and Strategic Risks

The temporary nature of the tariff exemptions poses strategic risks to the tech sector, with potential impacts on stock market stability and economic interests. The uncertainty surrounding future tariff impositions could lead to increased volatility in stock prices, affecting investor confidence. Additionally, the focus on national security tariffs may strain U.S.-China trade relations, impacting regional stability and global supply chains.

4. Recommendations and Outlook

Recommendations:

- Stakeholders should monitor developments in U.S.-China trade relations closely and prepare for potential tariff adjustments.

- Tech companies should consider diversifying supply chains to mitigate risks associated with reliance on Chinese manufacturing.

- Government agencies should evaluate the impact of national security tariffs on domestic industries and international trade agreements.

Outlook:

Best-case scenario: The temporary exemptions lead to a negotiated reduction in tariffs, stabilizing the tech sector and improving U.S.-China trade relations.

Worst-case scenario: The exemptions are revoked, leading to increased tariffs and heightened trade tensions, negatively impacting global markets.

Most likely outcome: Continued volatility in the tech sector as stakeholders navigate the uncertain trade environment, with periodic adjustments to tariff policies.

5. Key Individuals and Entities

The report mentions significant individuals and organizations including Donald Trump, Dan Ives, Apple, Alphabet, Tesla, Meta, Microsoft, and Nvidia. These entities are central to the developments discussed, influencing and being influenced by the current trade policies.