Gold Blasts Past 3100 for the First Time Ever Amid Trade War Jitters – Sputnikglobe.com

Published on: 2025-03-31

Intelligence Report: Gold Blasts Past 3100 for the First Time Ever Amid Trade War Jitters – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

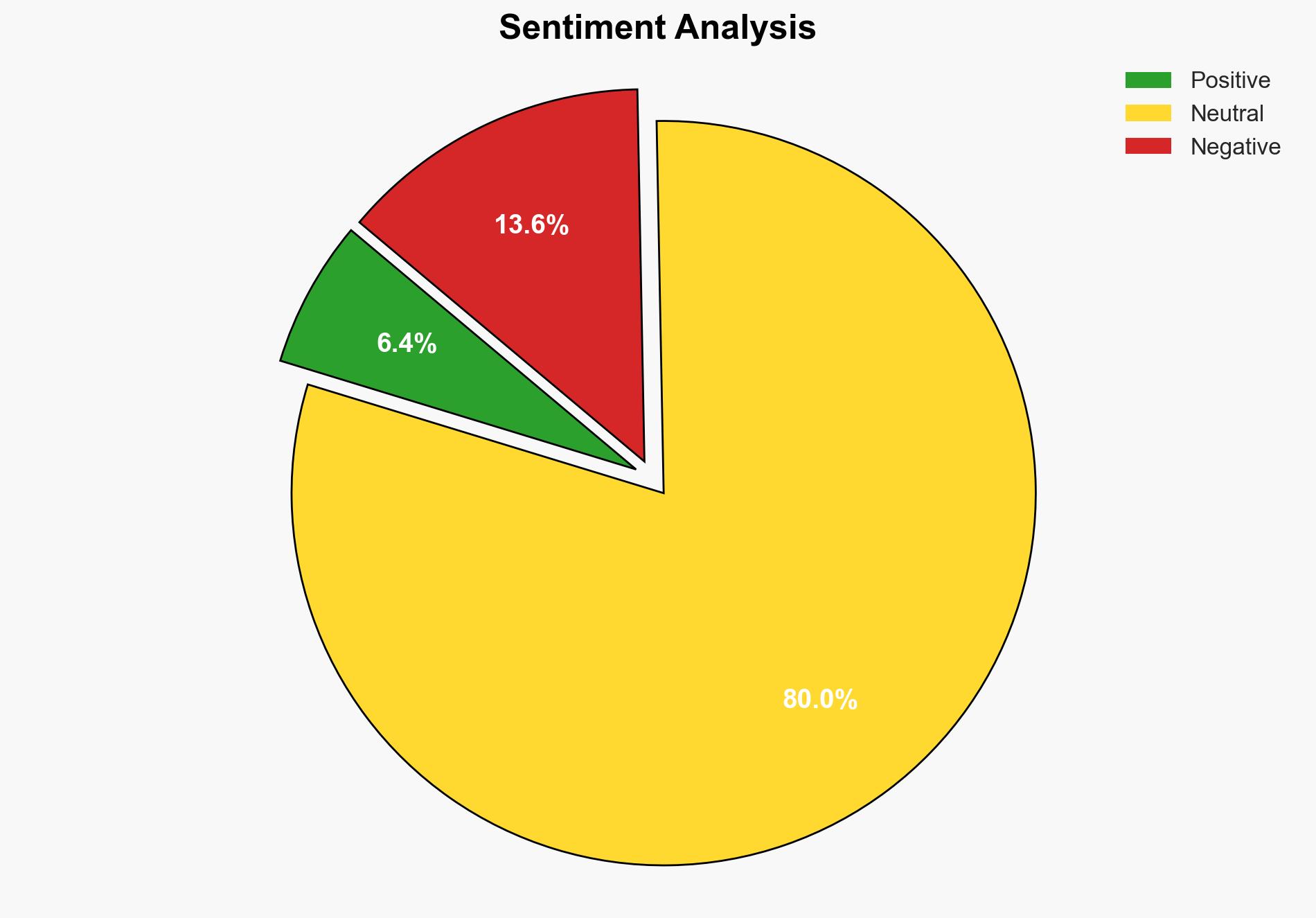

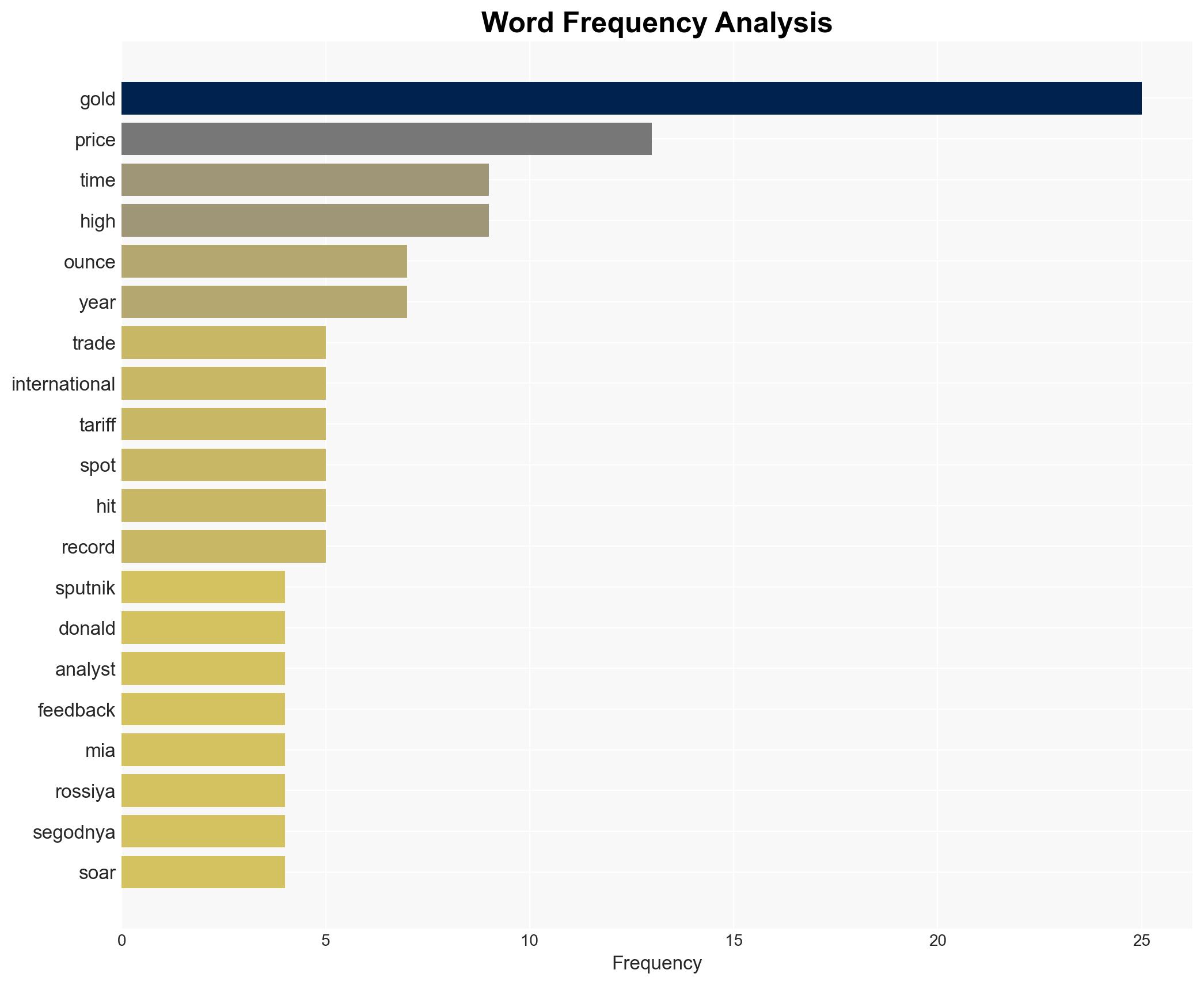

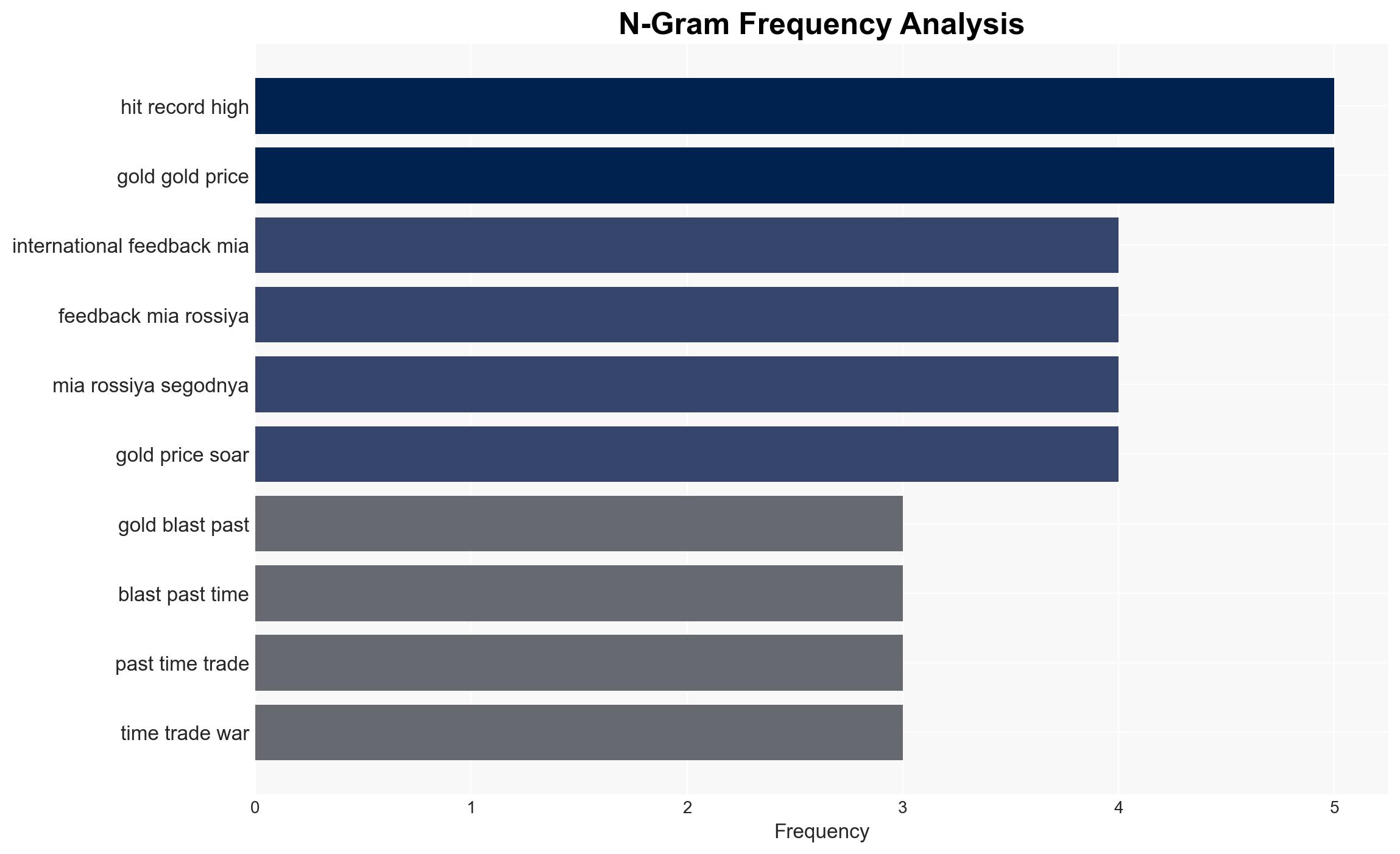

The recent surge in gold prices, reaching a record high of over $3100 per ounce, is primarily driven by escalating trade tensions and economic uncertainty. The looming reciprocal tariffs announced by Donald Trump have triggered investor anxiety, prompting a shift towards gold as a safe haven asset. This trend is expected to continue, with analysts from Goldman Sachs predicting further increases by year-end. Stakeholders should prepare for potential economic volatility and consider strategic investments in stable assets.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

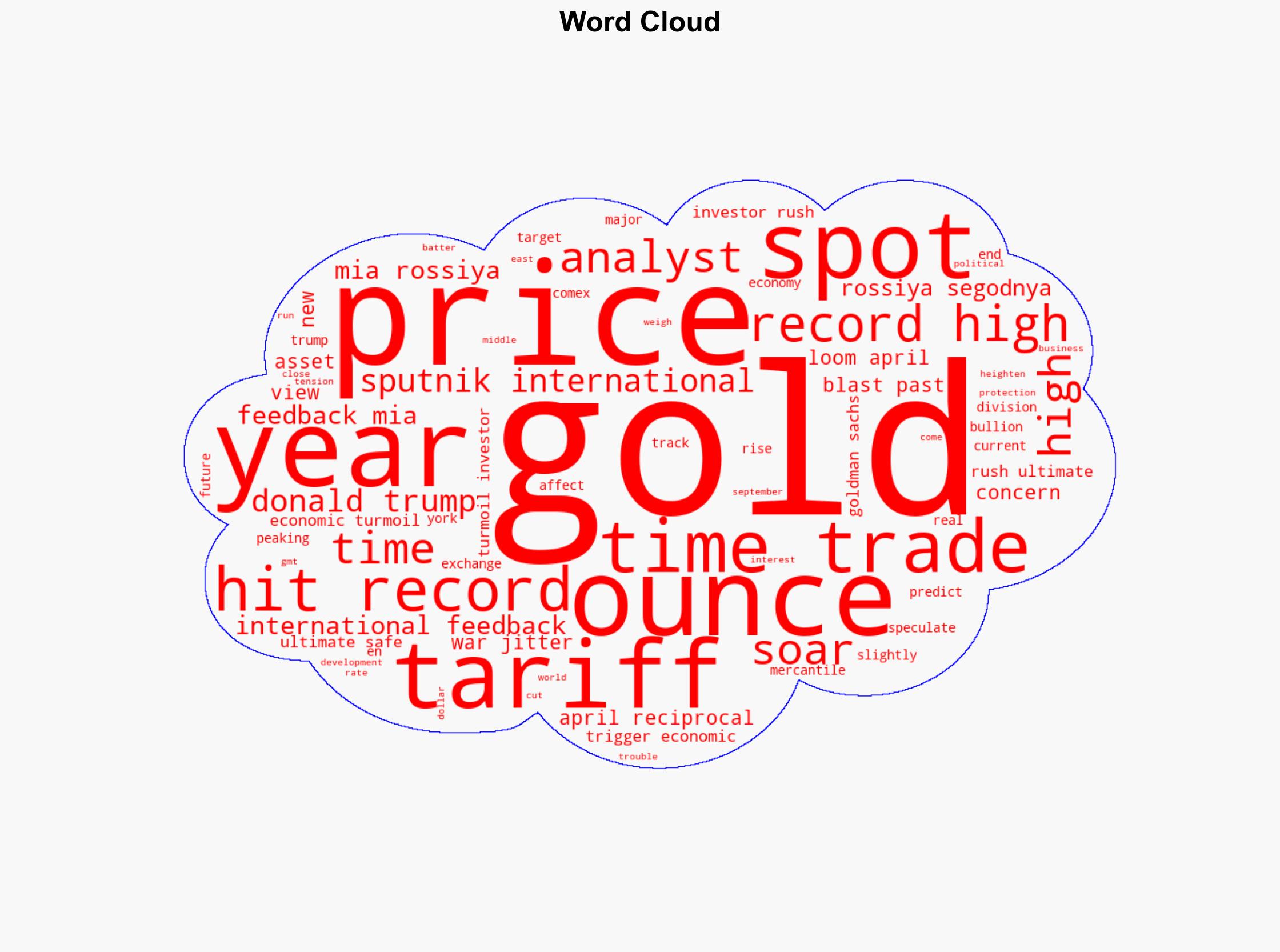

General Analysis

The current geopolitical climate, marked by trade disputes and tariff implementations, has heightened economic instability. The announcement of reciprocal tariffs by Donald Trump has exacerbated fears of a trade war, leading to increased demand for gold. Historically, gold is perceived as a hedge against economic turmoil, and its recent price surge reflects investor sentiment. The price of gold on the COMEX division of the New York Mercantile Exchange has reached unprecedented levels, with analysts speculating further growth.

3. Implications and Strategic Risks

The rise in gold prices signals potential risks to global economic stability. Key implications include:

- Increased market volatility as investors seek safe haven assets.

- Potential strain on international trade relations, impacting regional stability.

- Economic repercussions for countries heavily reliant on exports affected by tariffs.

The ongoing trade tensions could lead to broader economic disruptions, affecting national security and economic interests.

4. Recommendations and Outlook

Recommendations:

- Encourage diversification of investment portfolios to mitigate risks associated with market volatility.

- Advocate for diplomatic engagement to de-escalate trade tensions and prevent further economic turmoil.

- Consider regulatory measures to stabilize financial markets and protect economic interests.

Outlook:

Best-case scenario: Diplomatic resolutions to trade disputes lead to stabilized markets and a gradual decrease in gold prices.

Worst-case scenario: Escalation of trade tensions results in prolonged economic instability and further increases in gold prices.

Most likely outcome: Continued fluctuations in gold prices as trade negotiations progress, with potential for short-term spikes.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump and Goldman Sachs. Their actions and analyses play a crucial role in shaping market dynamics and investor behavior.