Gold builds on historic rally soars past 4000oz for first time – CNA

Published on: 2025-10-08

Intelligence Report: Gold builds on historic rally soars past 4000oz for first time – CNA

1. BLUF (Bottom Line Up Front)

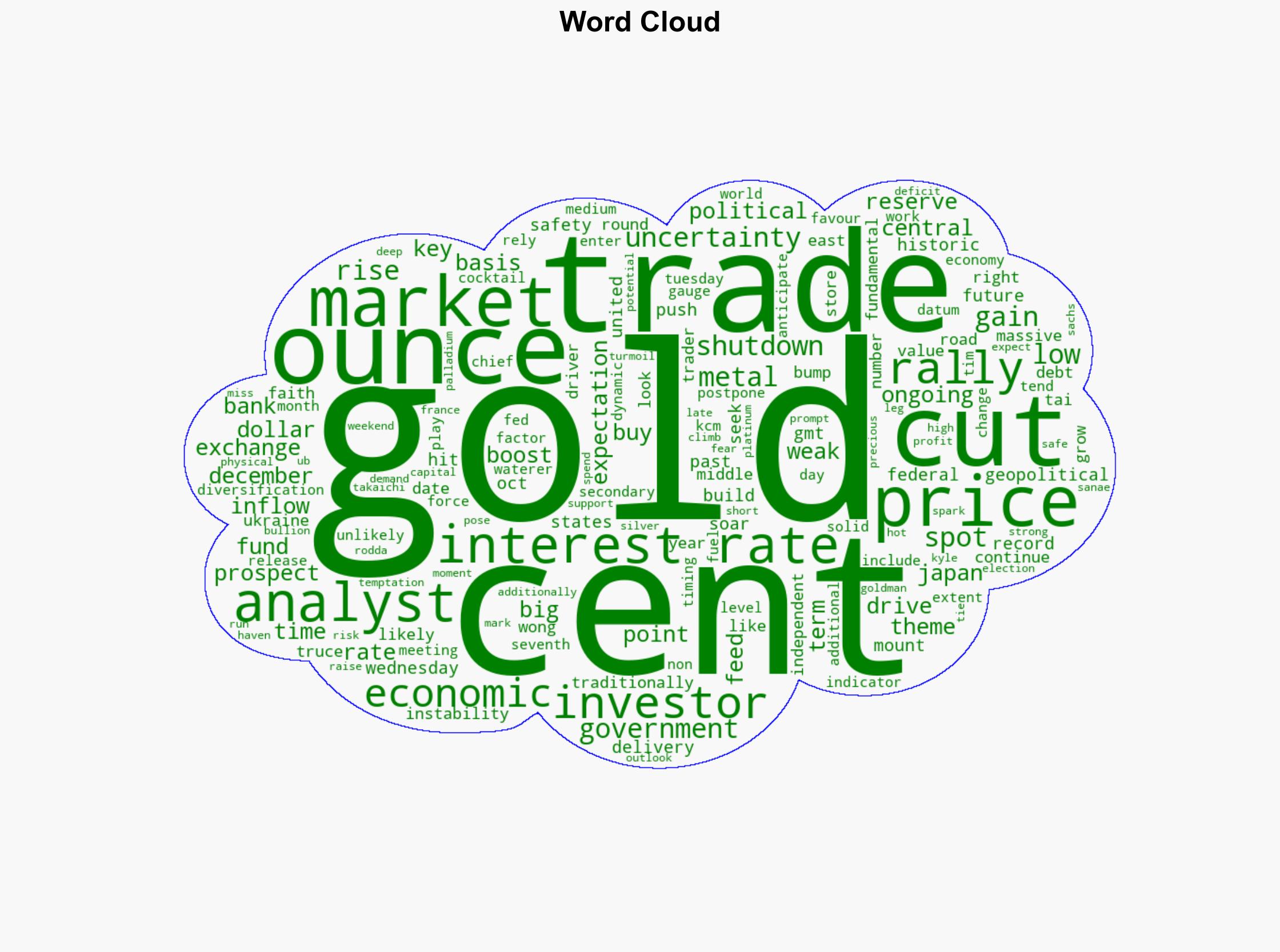

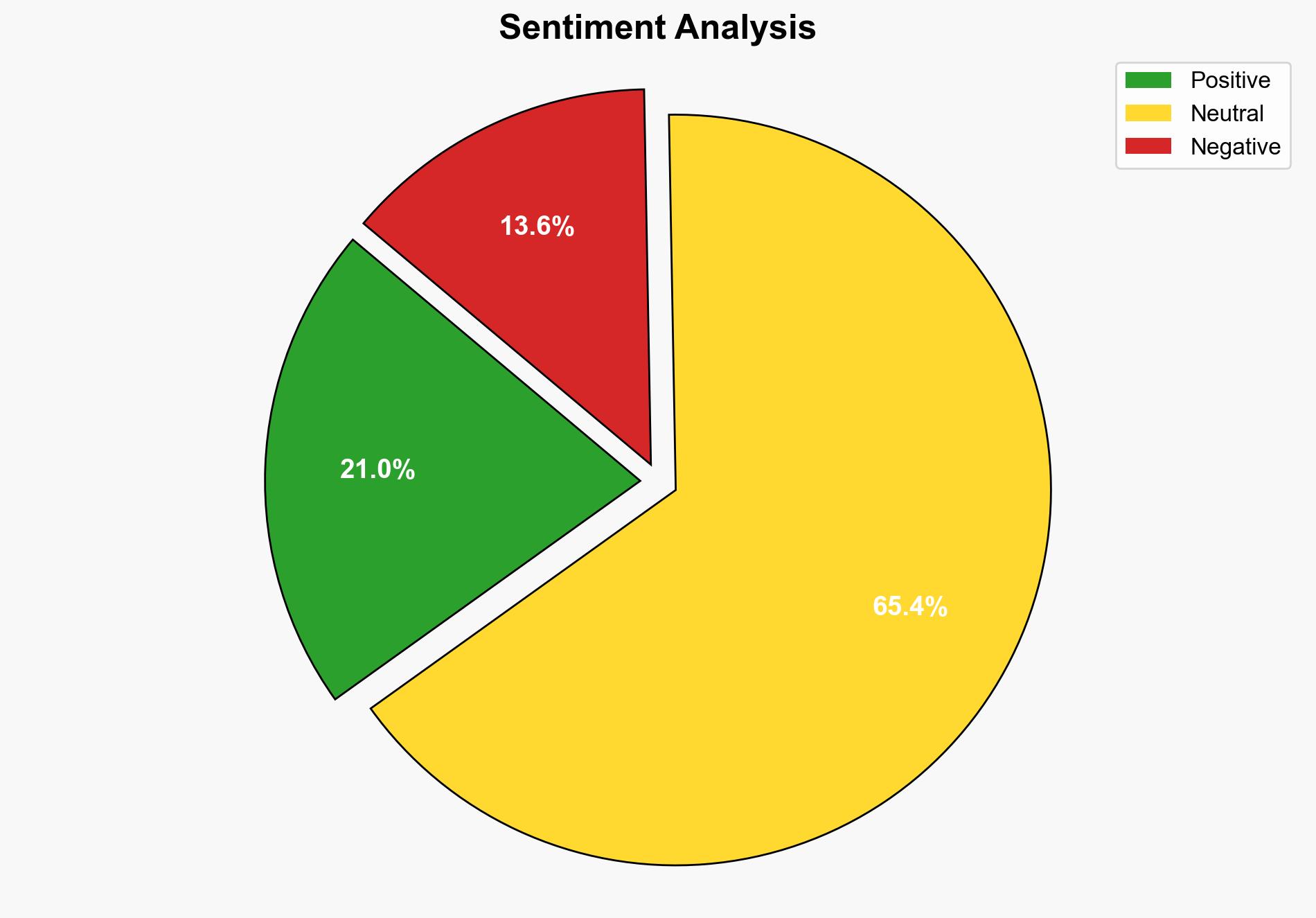

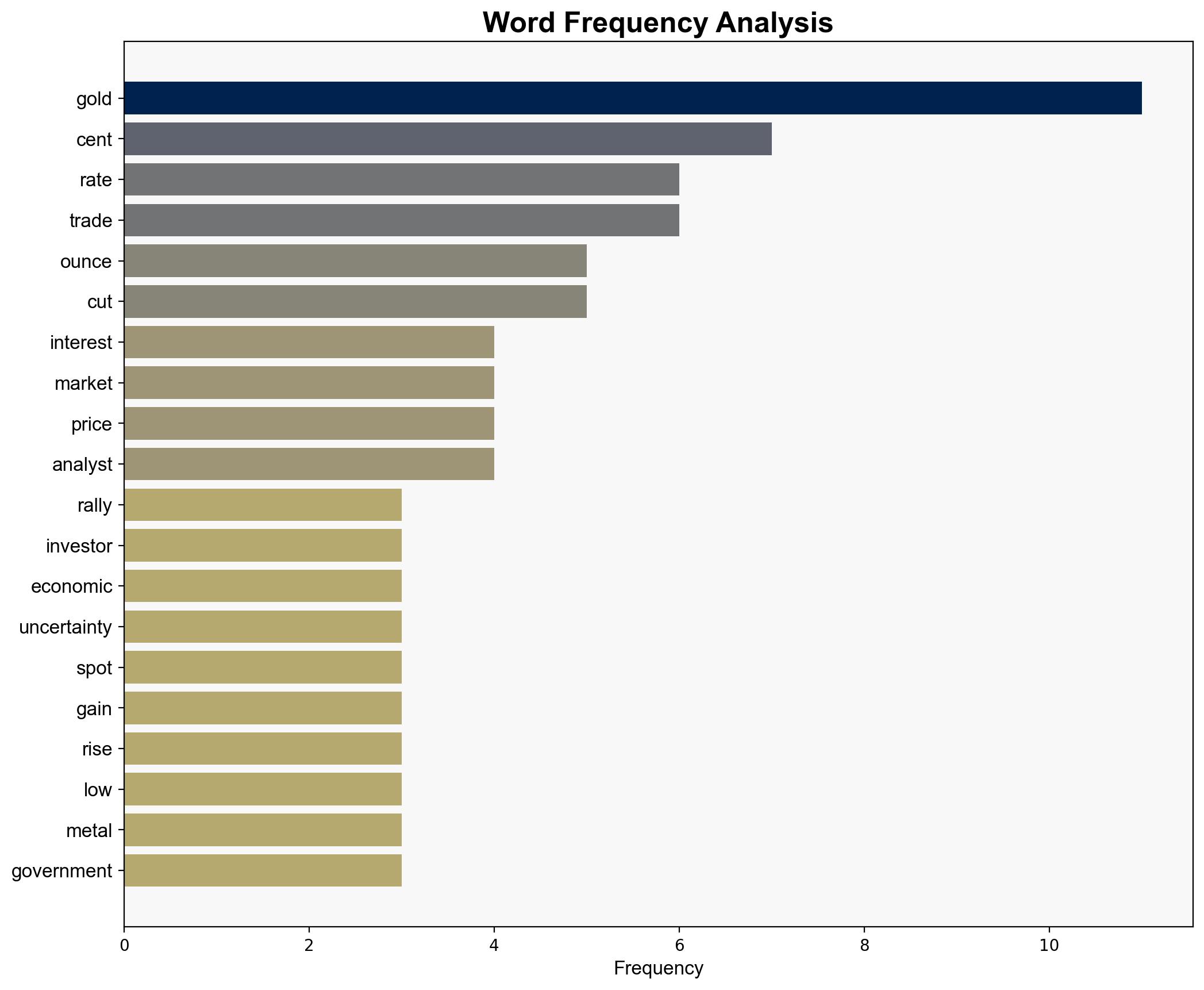

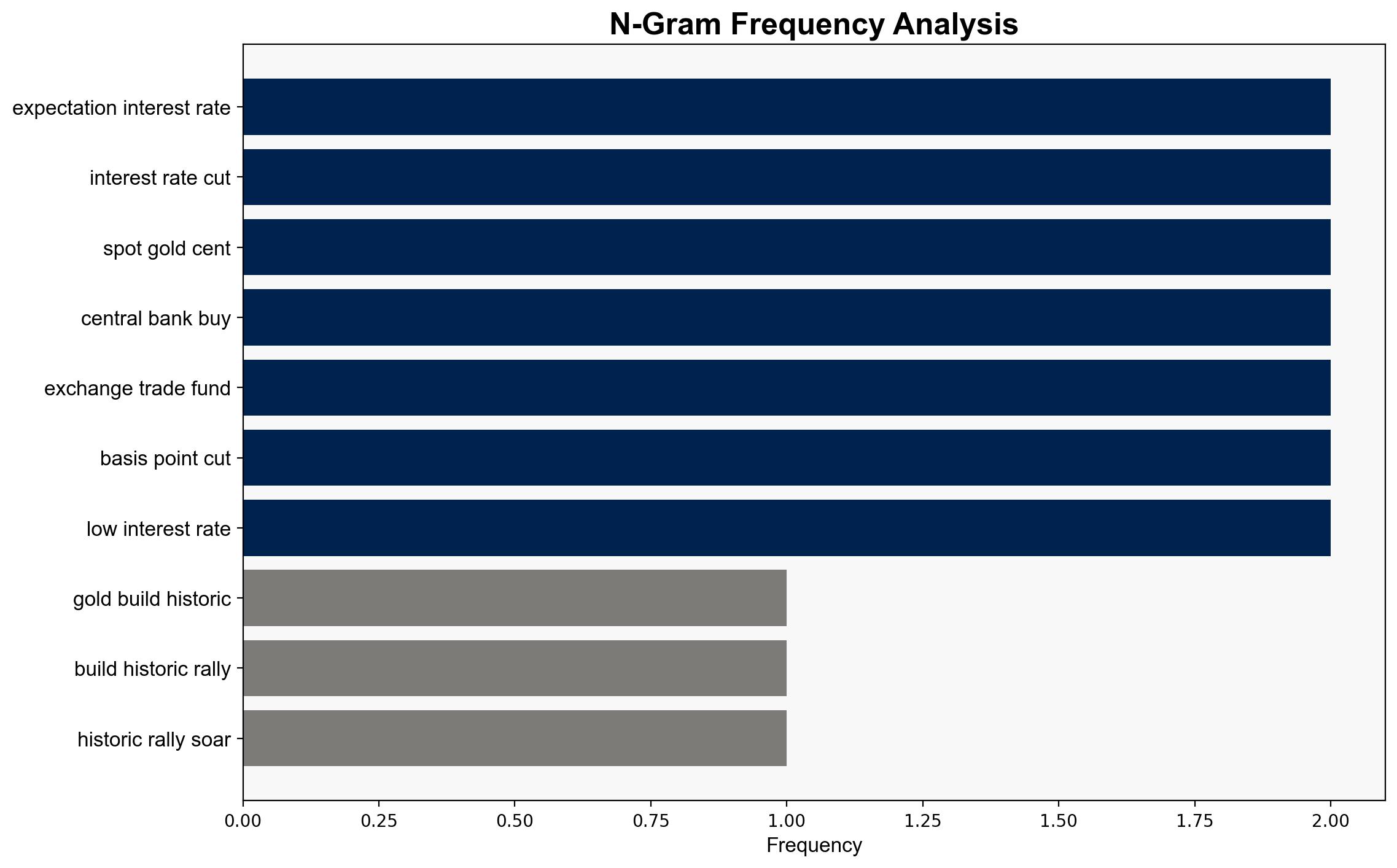

The most supported hypothesis is that the gold price surge is driven by a combination of geopolitical instability, economic uncertainty, and expectations of interest rate cuts by the U.S. Federal Reserve. Confidence level: Moderate. Recommended action: Monitor central bank policies and geopolitical developments closely to anticipate further market movements.

2. Competing Hypotheses

1. **Hypothesis A**: The gold price surge is primarily due to geopolitical instability and economic uncertainty, prompting investors to seek safe-haven assets.

2. **Hypothesis B**: The gold price increase is driven by speculative trading and market manipulation, rather than fundamental economic factors.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the alignment of multiple factors such as geopolitical tensions, central bank buying, and expectations of interest rate cuts. Hypothesis B lacks substantial evidence in the provided data.

3. Key Assumptions and Red Flags

– Assumptions: Investors perceive gold as a safe-haven asset during times of instability. Central banks will continue their current buying trends.

– Red Flags: Potential over-reliance on secondary data due to the U.S. government shutdown. Lack of direct evidence for speculative trading or manipulation.

– Blind Spots: The impact of other commodities and currencies on gold prices is not considered.

4. Implications and Strategic Risks

– Economic: Continued gold price increases could signal broader economic instability, affecting global markets.

– Geopolitical: Escalating tensions in the Middle East and Ukraine could further drive gold prices.

– Psychological: Investor sentiment may shift rapidly, leading to increased volatility.

5. Recommendations and Outlook

- Monitor Federal Reserve announcements and geopolitical developments for early indicators of market shifts.

- Scenario Projections:

- Best Case: Stabilization of geopolitical tensions leads to a gradual decline in gold prices.

- Worst Case: Escalation of conflicts and economic downturns drive gold prices higher, impacting global markets.

- Most Likely: Continued moderate increases in gold prices as uncertainty persists.

6. Key Individuals and Entities

– Tai Wong

– Tim Waterer

– Kyle Rodda

– Goldman Sachs

– UBS

7. Thematic Tags

economic instability, geopolitical tensions, market volatility, central bank policies