Gold extends record rally above 4300 eyes best weekly gain since 2008 – The Times of India

Published on: 2025-10-17

Intelligence Report: Gold extends record rally above 4300 eyes best weekly gain since 2008 – The Times of India

1. BLUF (Bottom Line Up Front)

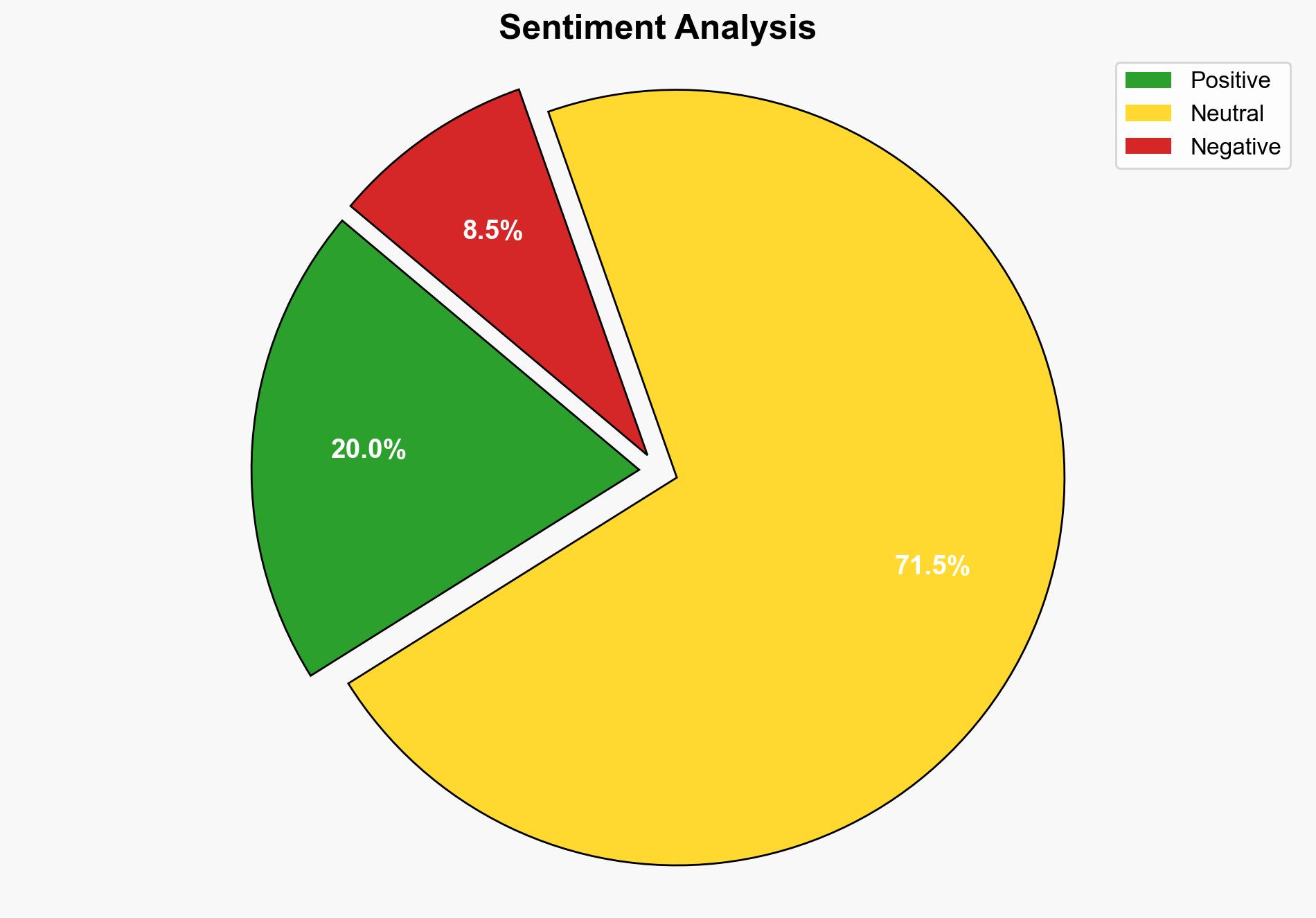

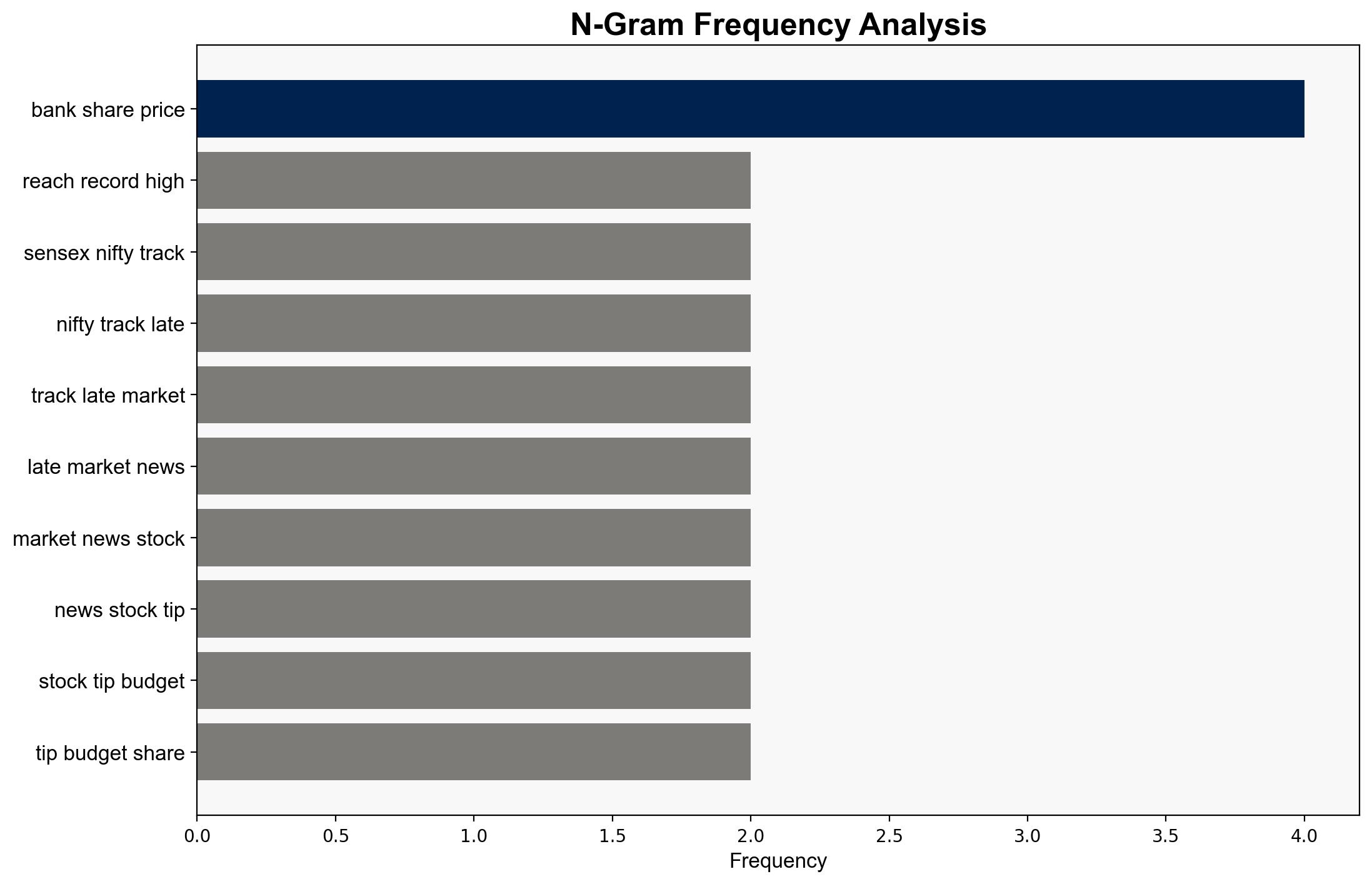

The most supported hypothesis is that the surge in gold prices is primarily driven by geopolitical tensions, central bank policies, and market sentiment shifts. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and central bank announcements closely, as these will likely continue to influence gold prices and broader market dynamics.

2. Competing Hypotheses

1. **Geopolitical and Economic Drivers Hypothesis**: The increase in gold prices is driven by geopolitical tensions, such as the Ukraine conflict and China-U.S. trade tensions, combined with central bank policies favoring rate cuts and de-dollarization strategies.

2. **Market Manipulation Hypothesis**: The rise in gold prices is influenced by market manipulation, including short squeezes and speculative trading, rather than purely economic fundamentals or geopolitical factors.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Geopolitical tensions directly impact investor behavior towards safe-haven assets like gold.

– Central bank policies, including potential rate cuts, are expected to continue influencing gold prices.

– **Red Flags**:

– Lack of detailed data on the extent of central bank gold purchases.

– Potential over-reliance on geopolitical narratives without sufficient economic data support.

– The possibility of speculative trading influencing market trends more than acknowledged.

4. Implications and Strategic Risks

– **Economic Risks**: Continued volatility in gold prices could impact global financial markets, particularly if central banks adjust their monetary policies unexpectedly.

– **Geopolitical Risks**: Escalating tensions between major powers could further drive gold prices up, affecting global trade and economic stability.

– **Market Risks**: If market manipulation is a significant factor, it could lead to sudden corrections, impacting investors and economies reliant on gold.

5. Recommendations and Outlook

- Monitor geopolitical developments, particularly in Ukraine and U.S.-China relations, for their potential impact on gold prices.

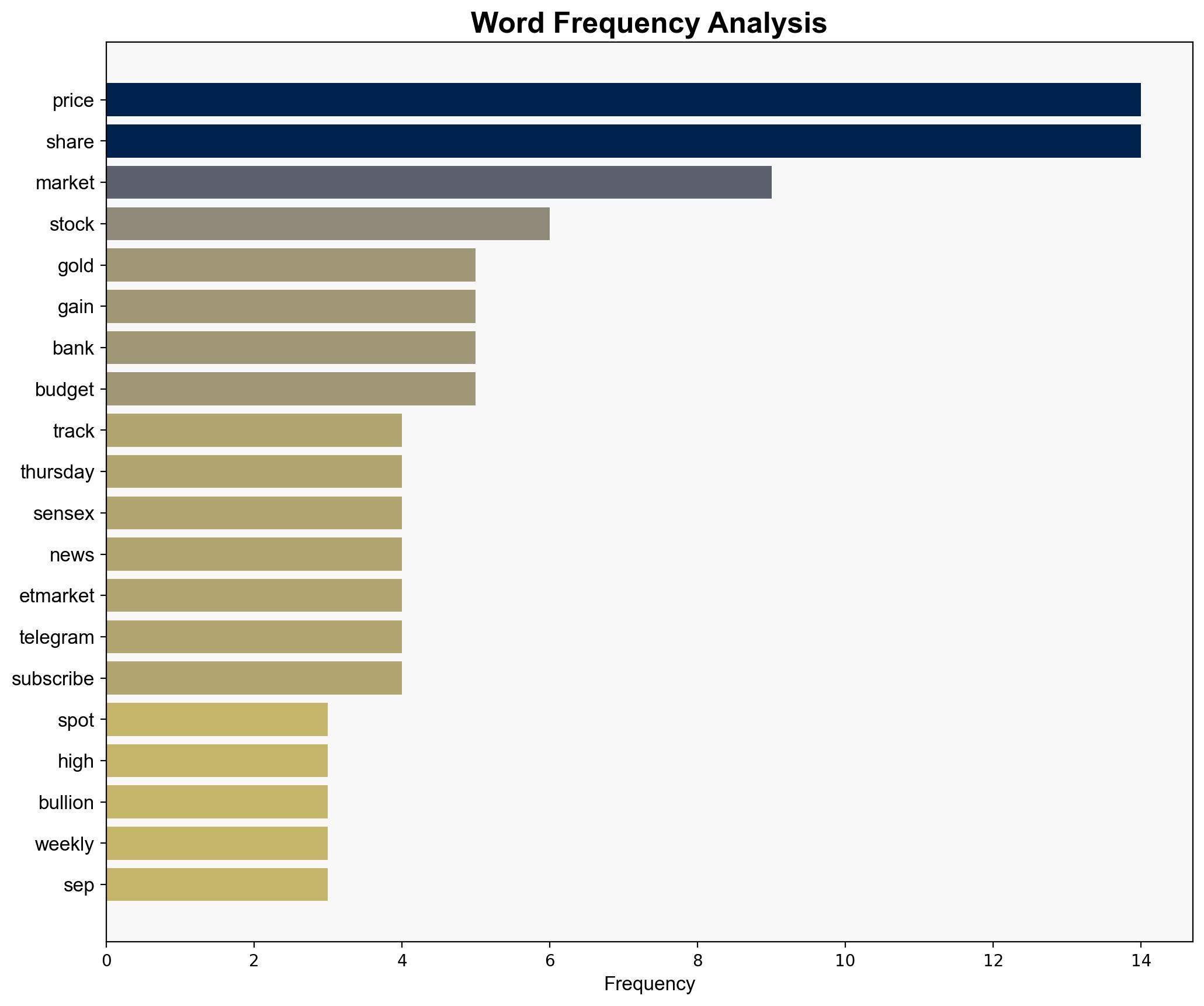

- Track central bank announcements and policy changes, especially regarding interest rates and gold reserves.

- Scenario Projections:

- Best Case: Stabilization of geopolitical tensions and clear central bank policies lead to a gradual normalization of gold prices.

- Worst Case: Escalation of conflicts and erratic central bank actions cause further volatility and economic disruption.

- Most Likely: Continued moderate increase in gold prices driven by ongoing geopolitical uncertainties and cautious central bank policies.

6. Key Individuals and Entities

– Christopher Waller

– Donald Trump

– Vladimir Putin

– SPDR Gold Trust

7. Thematic Tags

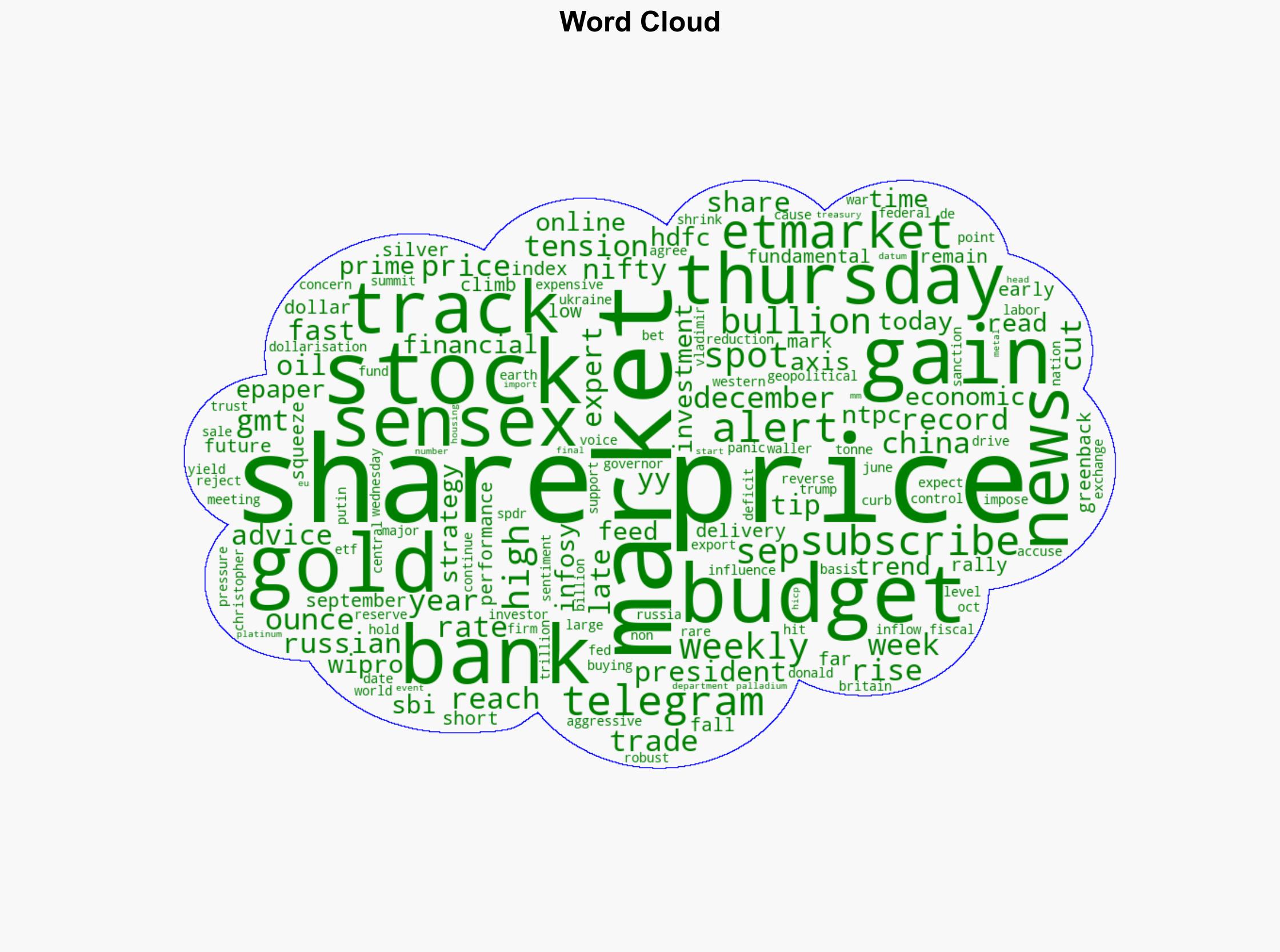

national security threats, economic stability, geopolitical tensions, market volatility