Gold firms above key 4000 level on US rate cut bets – CNA

Published on: 2025-10-09

Intelligence Report: Gold firms above key 4000 level on US rate cut bets – CNA

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that gold’s price increase is primarily driven by expectations of US interest rate cuts and geopolitical tensions, with a moderate confidence level. Strategic recommendation: Monitor central bank announcements and geopolitical developments closely to anticipate further market movements.

2. Competing Hypotheses

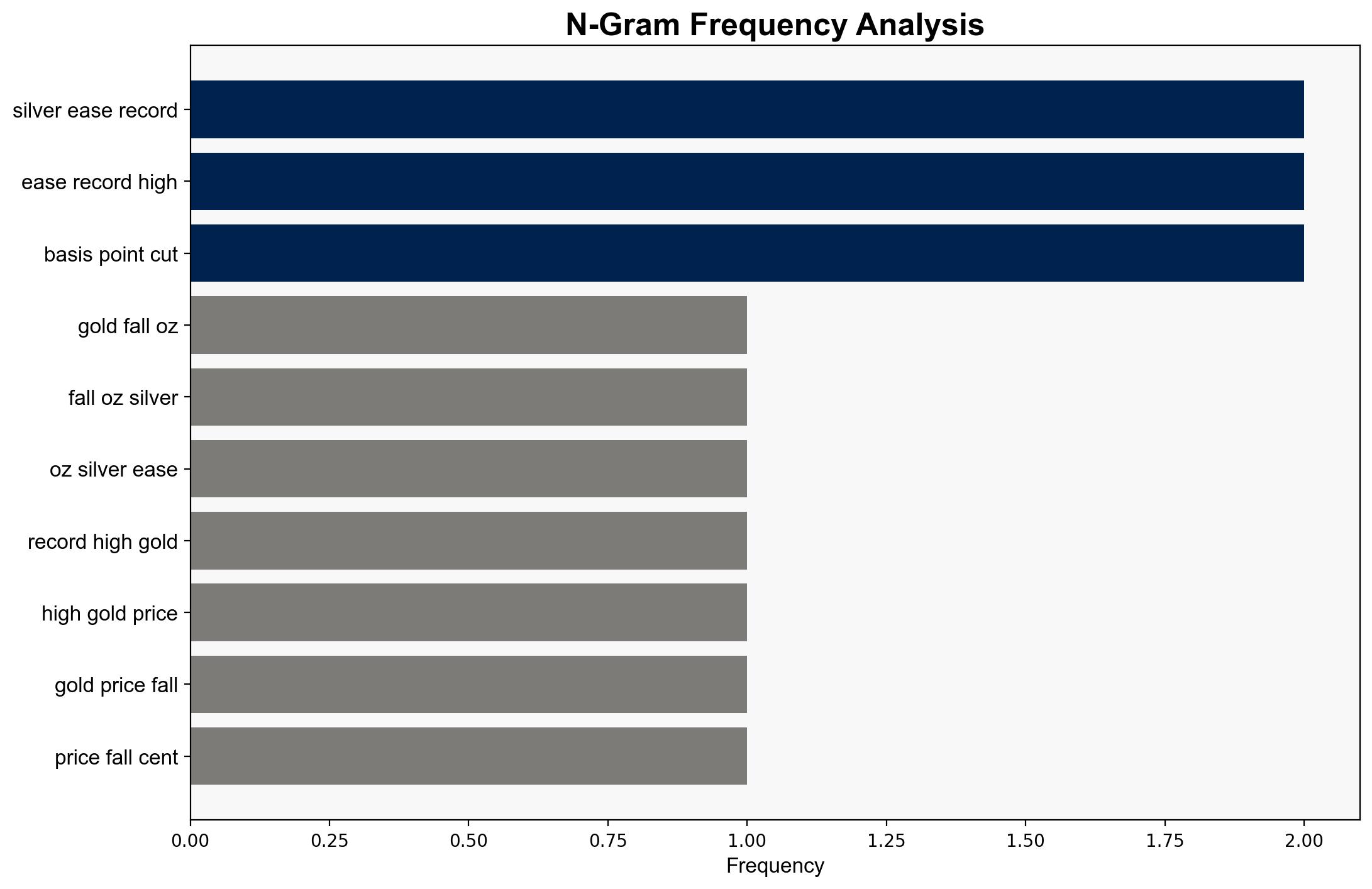

Hypothesis 1: The rise in gold prices is primarily due to expectations of US interest rate cuts, which reduce the opportunity cost of holding non-yielding assets like gold.

Hypothesis 2: The increase in gold prices is driven by geopolitical tensions, particularly in the Middle East, which heighten demand for gold as a safe-haven asset.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the explicit mention of rate cut expectations and the historical correlation between rate cuts and gold price increases. Hypothesis 2 is less supported as the ceasefire in Gaza suggests a de-escalation of tensions, reducing immediate geopolitical risk.

3. Key Assumptions and Red Flags

Assumptions:

– Central banks will continue to cut rates in response to economic conditions.

– Geopolitical tensions will not escalate significantly in the short term.

Red Flags:

– Potential over-reliance on central bank actions as the sole driver of gold prices.

– Incomplete data on other macroeconomic factors influencing gold demand.

4. Implications and Strategic Risks

The current gold price trend suggests potential volatility in financial markets, influenced by central bank policies and geopolitical developments. A failure to anticipate changes in these areas could lead to significant economic impacts. Additionally, a sudden escalation in geopolitical tensions could rapidly alter market dynamics.

5. Recommendations and Outlook

- Monitor Federal Reserve communications for indications of future rate policy changes.

- Track geopolitical developments, particularly in the Middle East, for signs of renewed tensions.

- Scenario Projections:

- Best Case: Stable geopolitical environment and gradual rate cuts lead to a controlled increase in gold prices.

- Worst Case: Escalation of geopolitical tensions and unexpected economic downturns cause a sharp spike in gold prices, leading to market instability.

- Most Likely: Continued moderate increase in gold prices driven by rate cut expectations and managed geopolitical risks.

6. Key Individuals and Entities

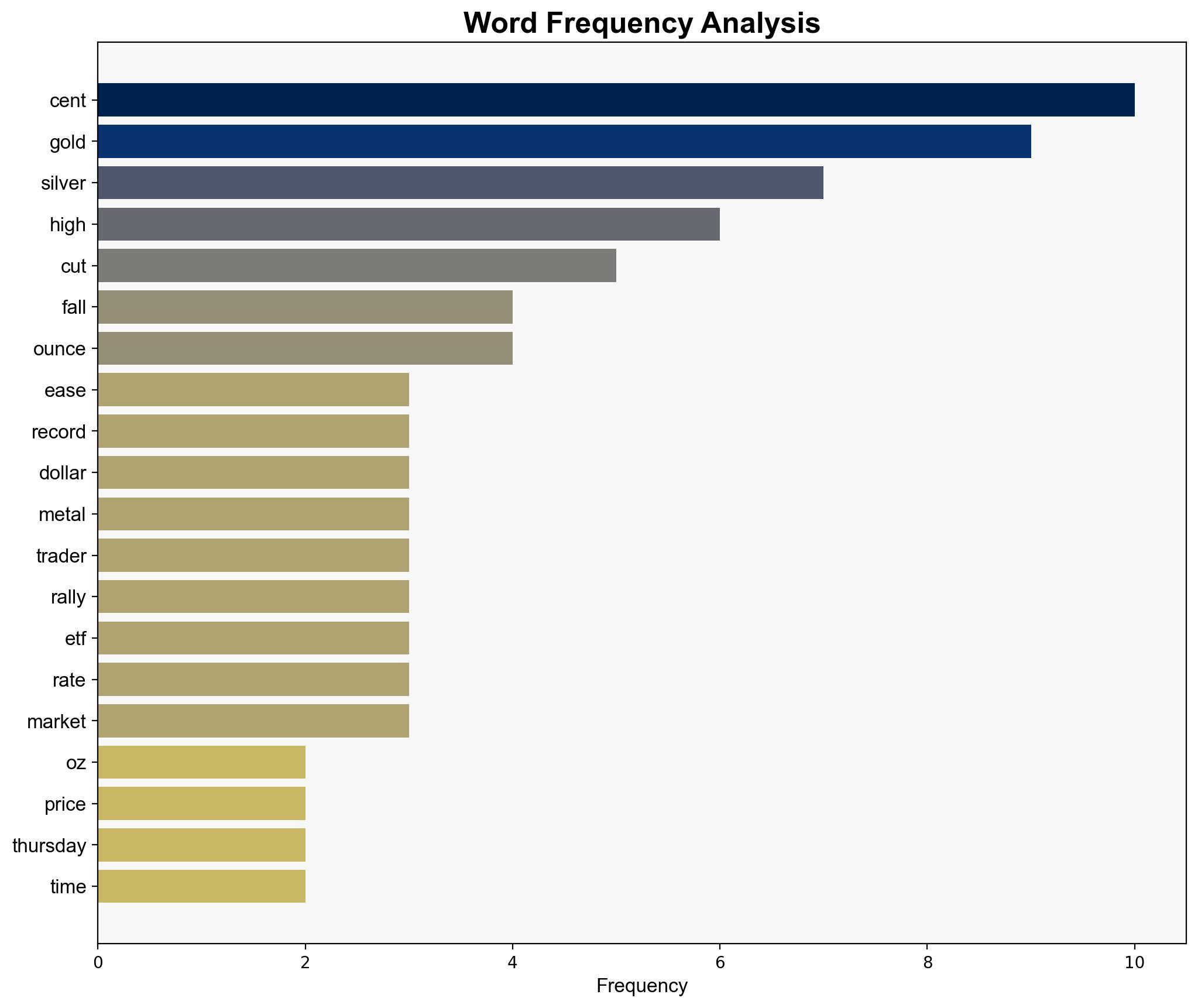

– Tai Wong, independent metal trader, provides insights into market drivers.

– Federal Reserve officials, influencing rate cut expectations.

7. Thematic Tags

economic stability, financial markets, geopolitical risk, monetary policy