Goldman Sachs expands wealth management services in Saudi Arabia – Privatebankerinternational.com

Published on: 2025-10-22

Intelligence Report: Goldman Sachs expands wealth management services in Saudi Arabia – Privatebankerinternational.com

1. BLUF (Bottom Line Up Front)

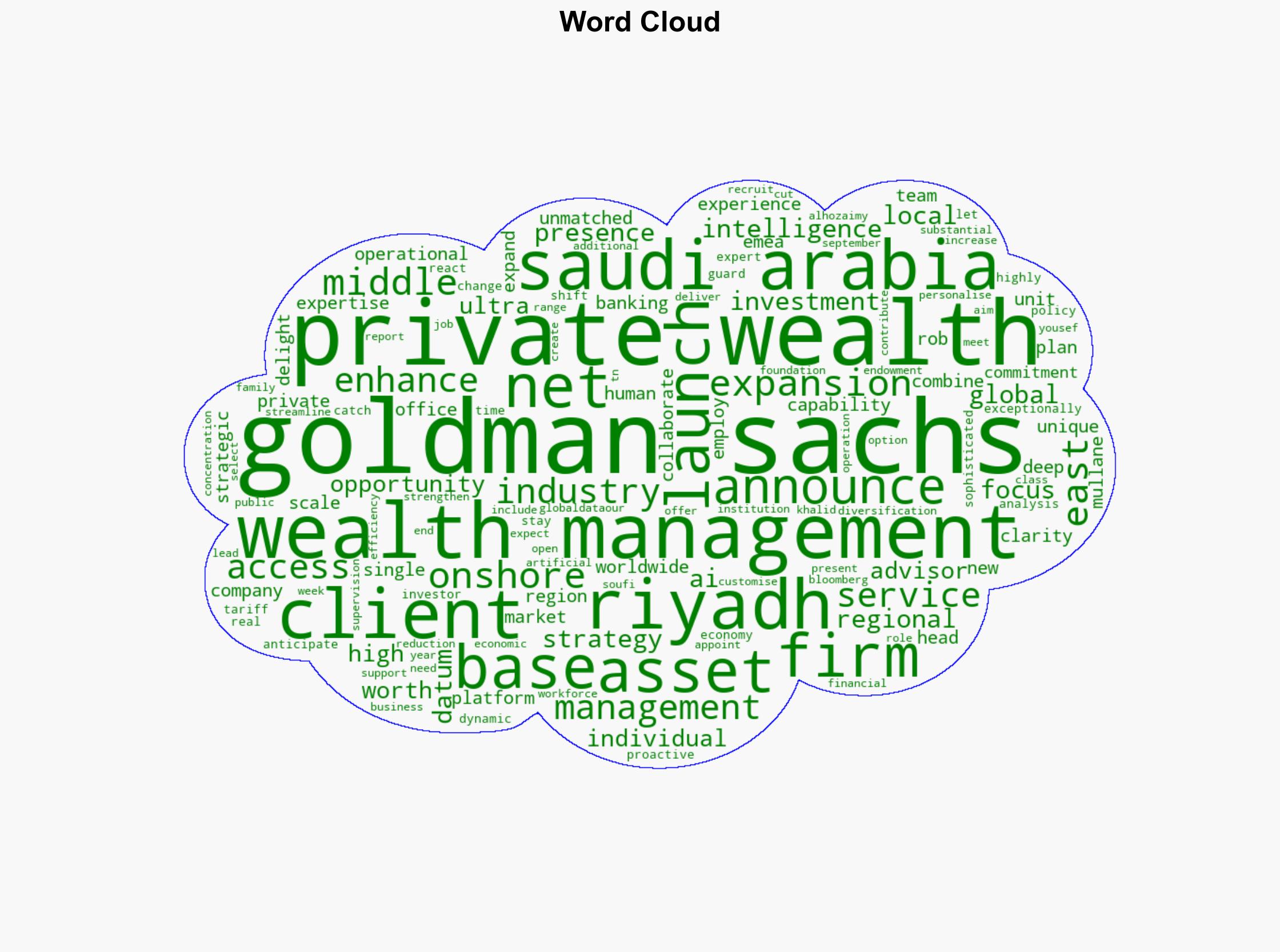

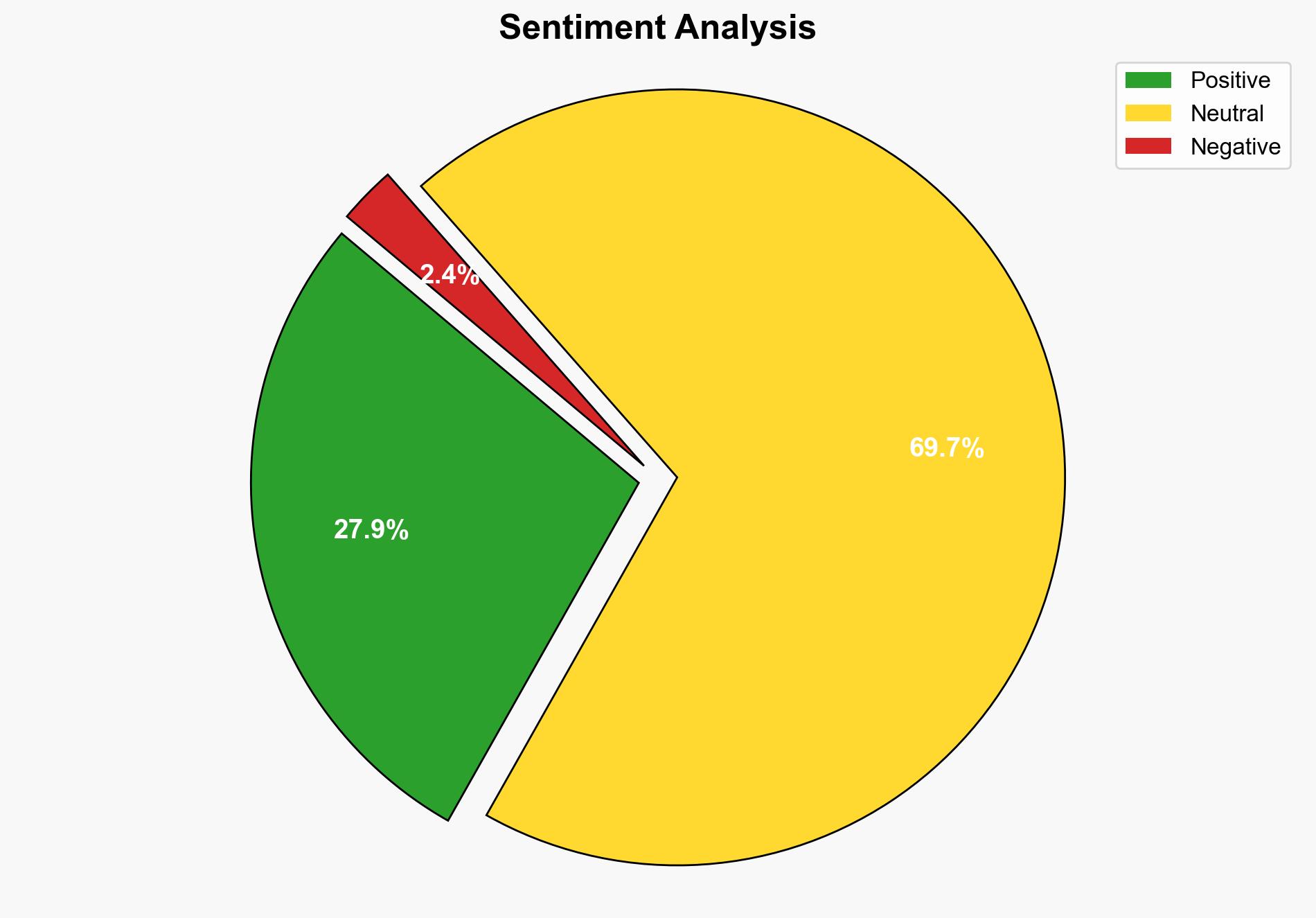

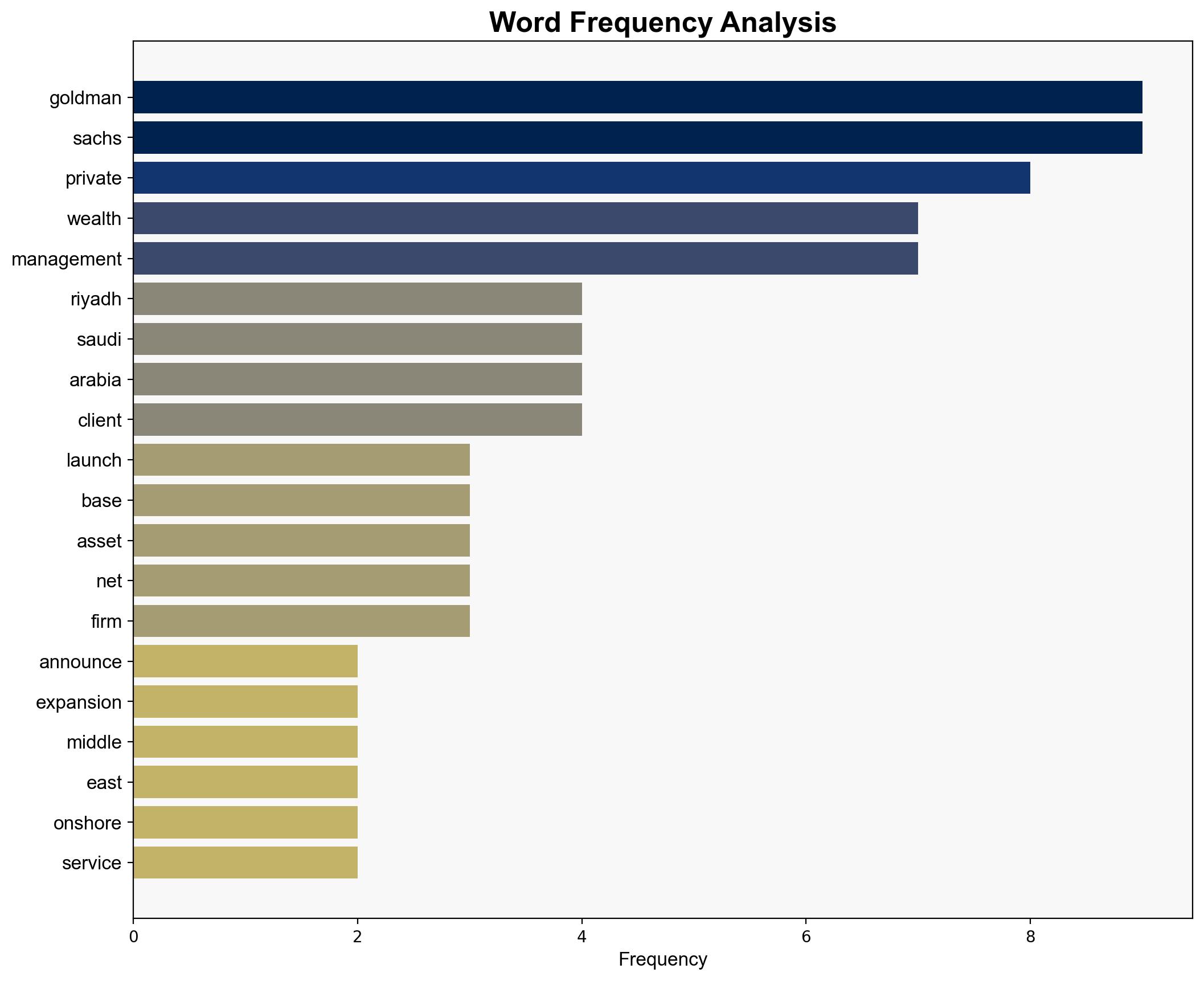

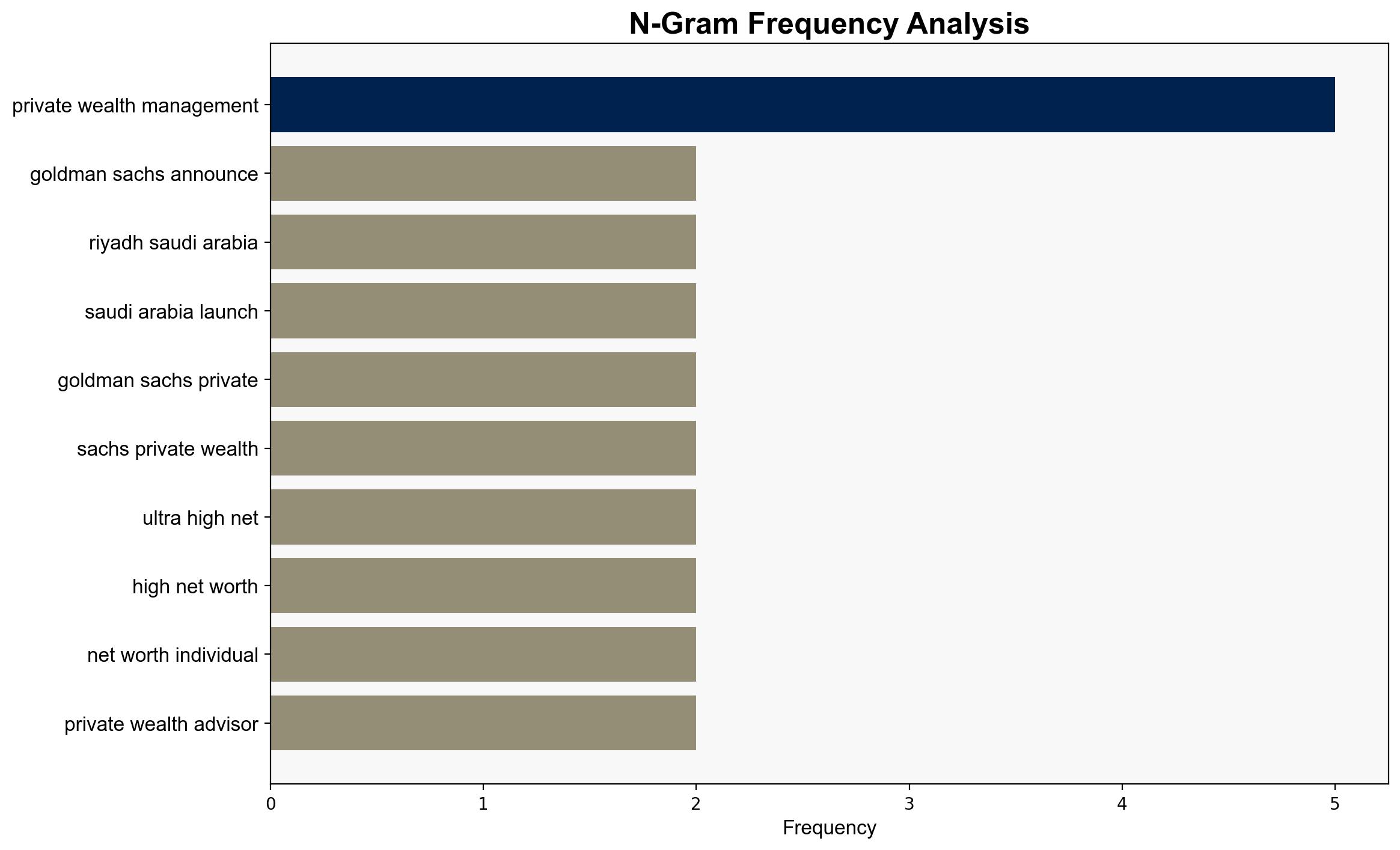

Goldman Sachs’ expansion into Saudi Arabia’s wealth management sector is strategically aligned with the region’s economic diversification and the growing demand for sophisticated financial services. The most supported hypothesis is that this move is primarily driven by the opportunity to capitalize on the concentration of ultra-high-net-worth individuals in Saudi Arabia. Confidence Level: High. Recommended action is to monitor the regulatory environment and potential geopolitical shifts that could impact operations.

2. Competing Hypotheses

Hypothesis 1: Goldman Sachs is expanding its wealth management services in Saudi Arabia to leverage the country’s economic diversification and the presence of ultra-high-net-worth individuals, aiming to establish a strong regional foothold.

Hypothesis 2: The expansion is a strategic maneuver to mitigate risks associated with potential economic downturns in other regions by diversifying its client base and tapping into the Middle East’s growing financial market.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the explicit mention of Saudi Arabia’s dynamic economy and sophisticated investor base in the source. The focus on ultra-high-net-worth individuals aligns with Goldman Sachs’ strategic objectives.

3. Key Assumptions and Red Flags

Assumptions:

– Saudi Arabia’s economic diversification will continue to progress without significant setbacks.

– The regulatory environment will remain favorable for foreign financial institutions.

Red Flags:

– Potential geopolitical tensions in the Middle East could disrupt operations.

– Unforeseen regulatory changes could impact the feasibility of Goldman Sachs’ expansion.

4. Implications and Strategic Risks

The expansion could enhance Goldman Sachs’ global market presence and influence in the Middle East. However, it also exposes the firm to risks such as regulatory changes, geopolitical instability, and competition from local financial institutions. The reliance on AI and technology may present cybersecurity vulnerabilities.

5. Recommendations and Outlook

- Monitor geopolitical developments and regulatory changes in Saudi Arabia to anticipate potential disruptions.

- Strengthen cybersecurity measures to protect against potential threats.

- Scenario-based projections:

- Best Case: Successful integration into the Saudi market, leading to increased market share and profitability.

- Worst Case: Geopolitical tensions or regulatory changes force a scale-back of operations.

- Most Likely: Gradual growth in market presence with moderate challenges from local competition.

6. Key Individuals and Entities

Yousef Alhozaimy, Khalid Soufi

7. Thematic Tags

economic diversification, wealth management, geopolitical risk, regulatory environment