Greek economy upgraded to a higher investment grade Fitch lifts rating to BBB – Protothema.gr

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Greek Economy Rating Upgrade

1. BLUF (Bottom Line Up Front)

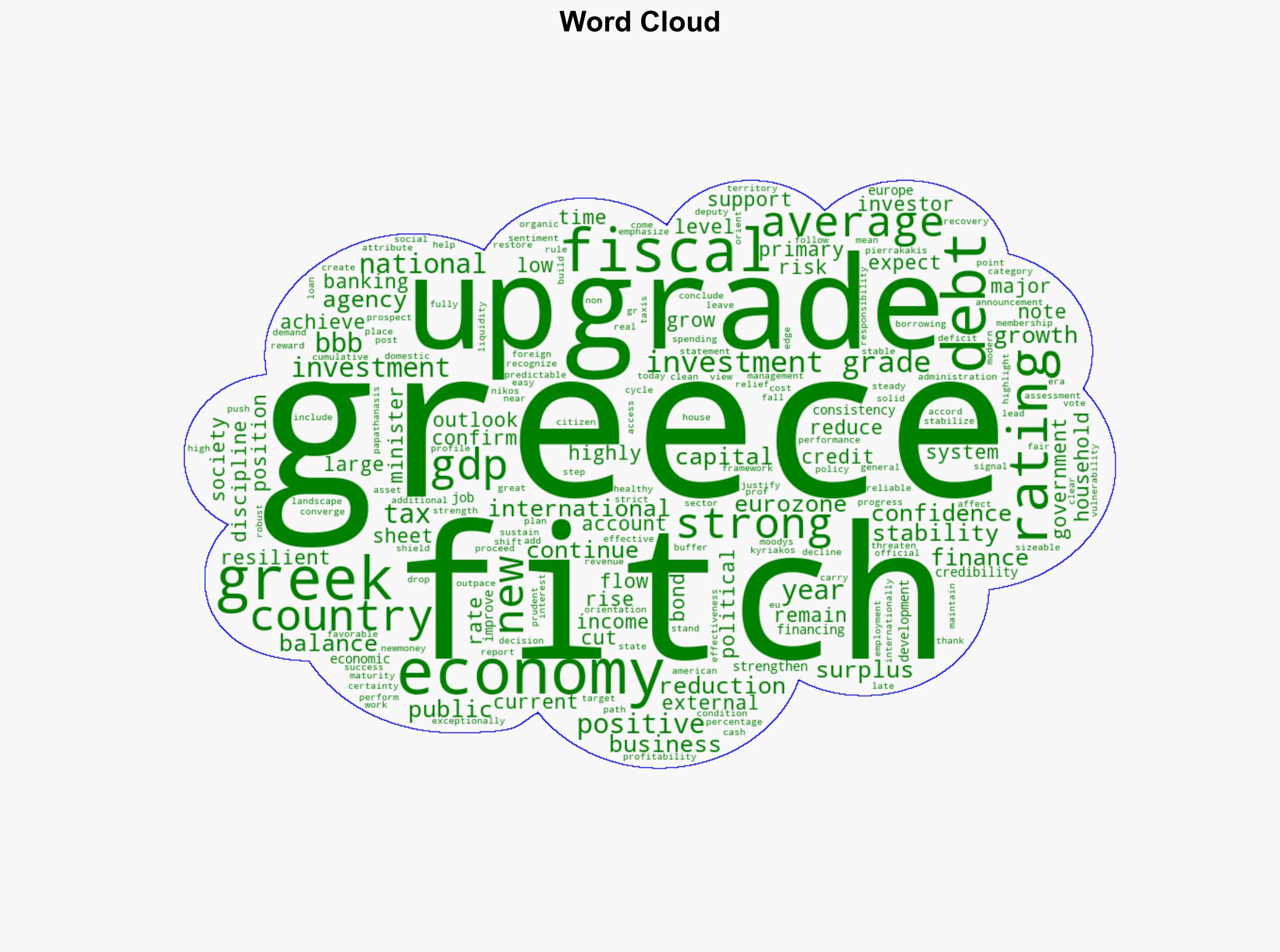

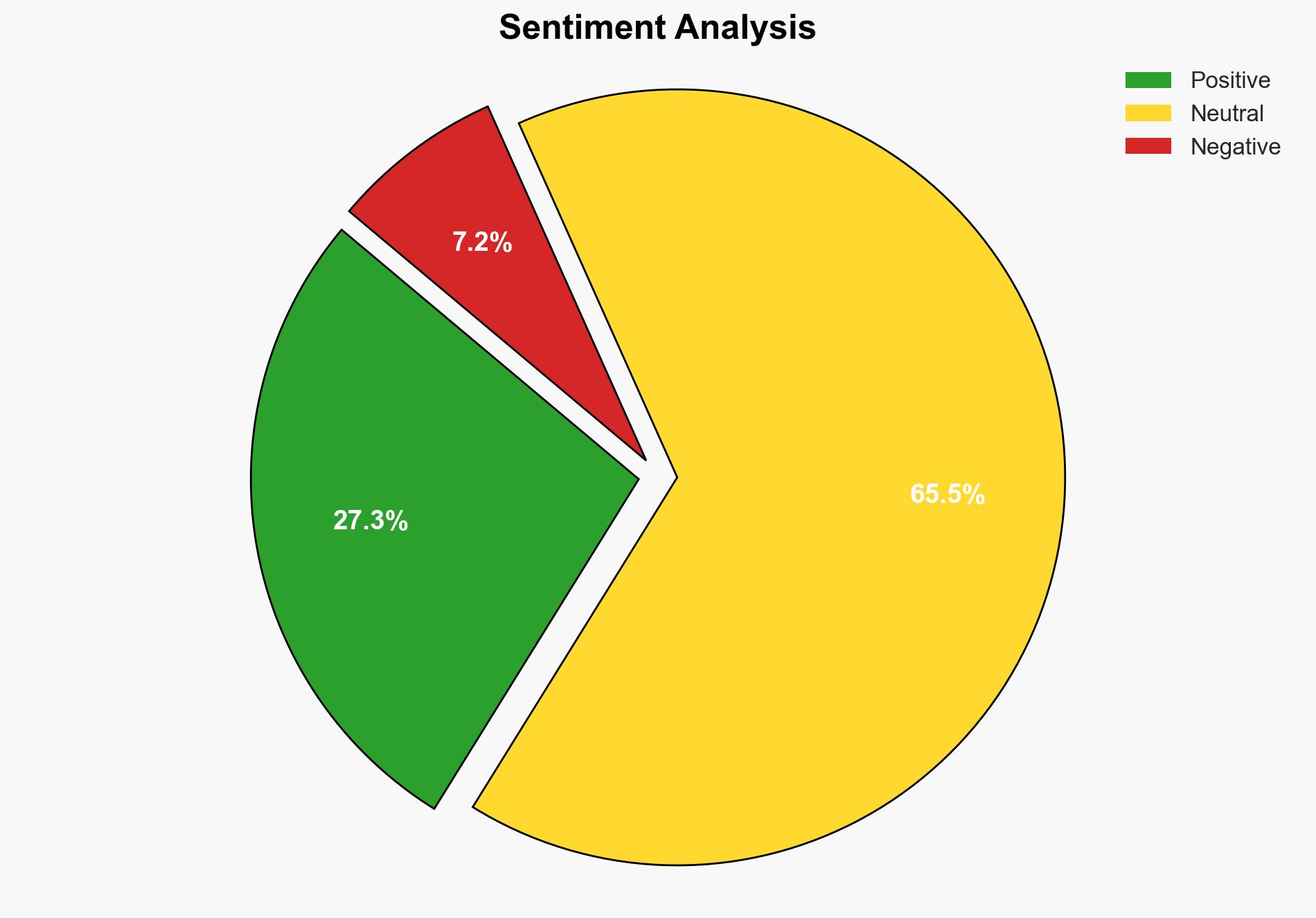

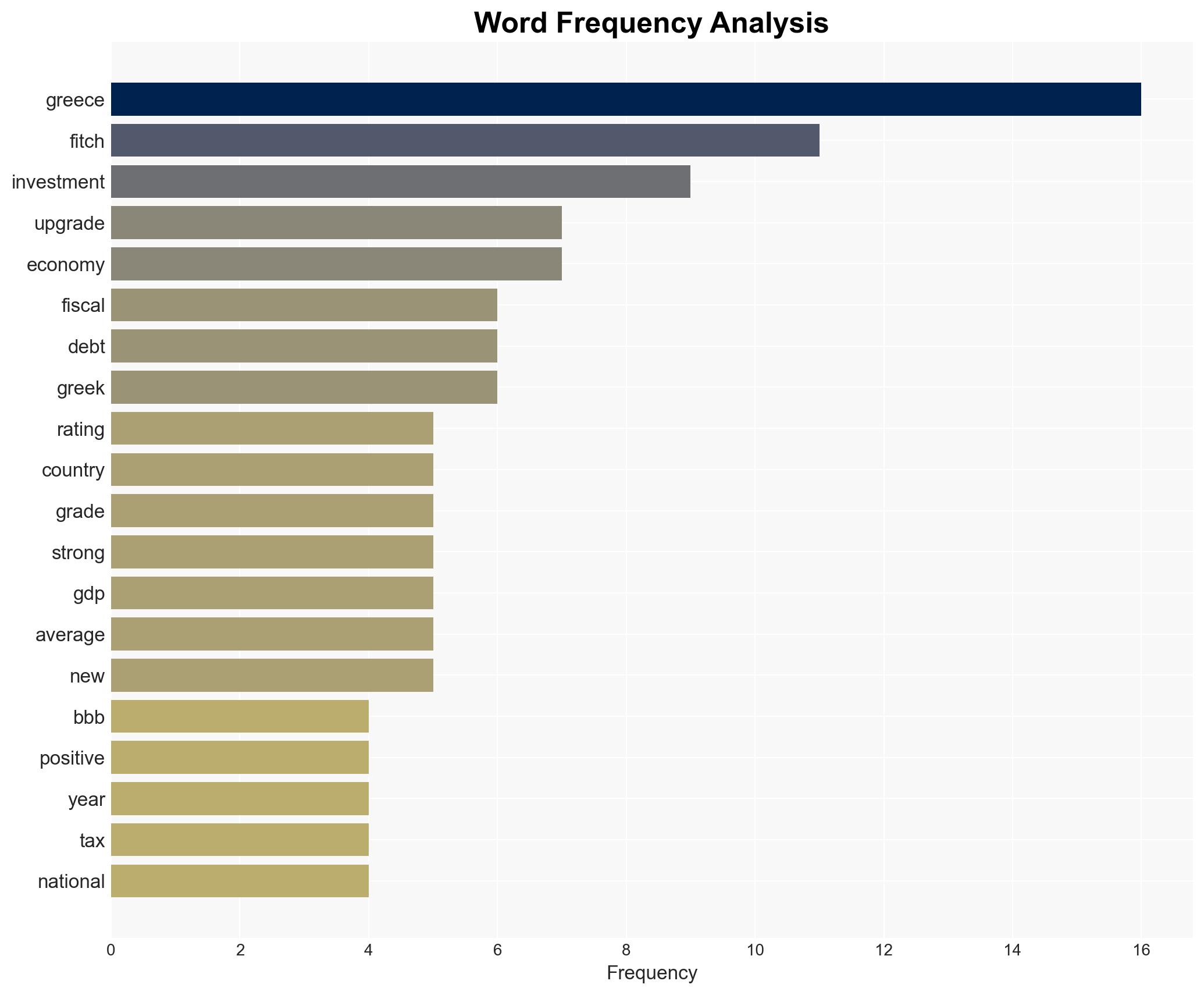

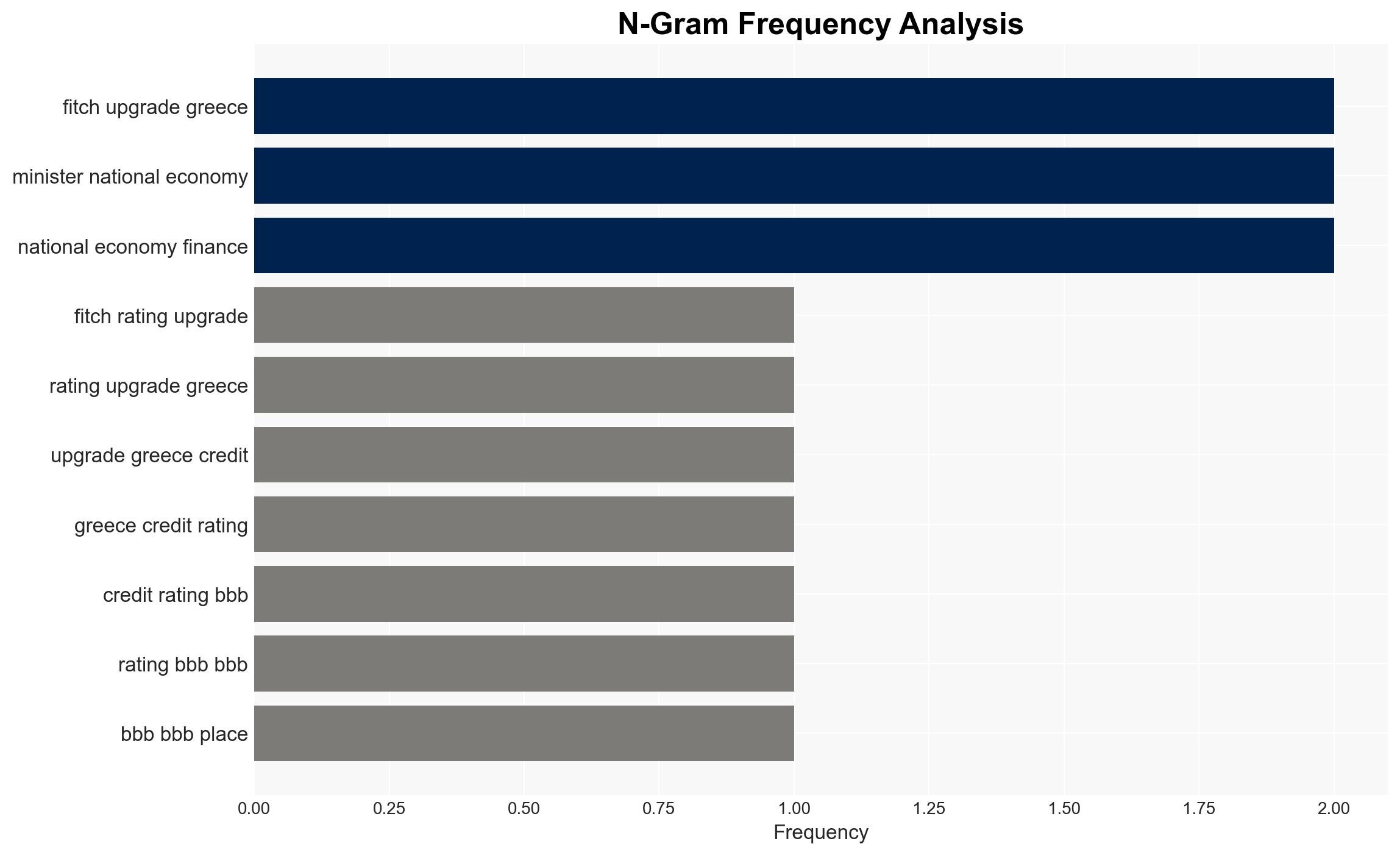

The recent upgrade of Greece’s credit rating by Fitch to BBB indicates a positive shift in international sentiment towards the Greek economy. This upgrade reflects Greece’s strong fiscal discipline and economic reforms. The most supported hypothesis is that Greece will continue to stabilize and grow economically, enhancing its position within the Eurozone. Confidence level: Moderate. Recommended action: Monitor Greece’s fiscal policies and economic reforms to assess long-term stability and investment opportunities.

2. Competing Hypotheses

Hypothesis 1: The upgrade reflects genuine and sustainable economic improvements in Greece, driven by effective fiscal policies and debt management. This will lead to increased investor confidence and economic growth.

Hypothesis 2: The upgrade is primarily a result of temporary fiscal measures and external factors, and underlying economic vulnerabilities, such as the current account deficit, may undermine long-term stability.

Hypothesis 1 is more likely due to the consistent fiscal discipline and debt reduction efforts noted by Fitch, along with the positive outlook for growth and banking stability.

3. Key Assumptions and Red Flags

Assumptions: The Greek government will maintain its current fiscal discipline and continue implementing economic reforms. The Eurozone will remain stable, providing a conducive environment for Greece’s growth.

Red Flags: Potential political instability or policy reversals in Greece could undermine fiscal discipline. Over-reliance on external capital flows due to the current account deficit poses a risk if Eurozone conditions change.

4. Implications and Strategic Risks

The upgrade may attract foreign investment, improving Greece’s economic landscape. However, reliance on external capital and the current account deficit could pose risks if global economic conditions deteriorate. Political changes or fiscal policy shifts could also impact Greece’s economic trajectory.

5. Recommendations and Outlook

- Monitor Greece’s fiscal policies and reforms to assess long-term stability.

- Encourage diversification of Greece’s economic activities to reduce reliance on external capital.

- Best Scenario: Greece continues its economic reforms, attracting significant foreign investment and achieving sustained growth.

- Worst Scenario: Political instability or policy reversals lead to fiscal indiscipline, undermining investor confidence and economic stability.

- Most-likely Scenario: Greece maintains moderate growth with ongoing fiscal discipline, gradually improving its economic position within the Eurozone.

6. Key Individuals and Entities

Kyriakos Pierrakakis (Minister of National Economy and Finance), Nikos Papathanasis (Deputy Minister of National Economy and Finance), Fitch Ratings.

7. Thematic Tags

Cybersecurity, Economic Stability, Fiscal Policy, Eurozone, Investment, Credit Rating

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·