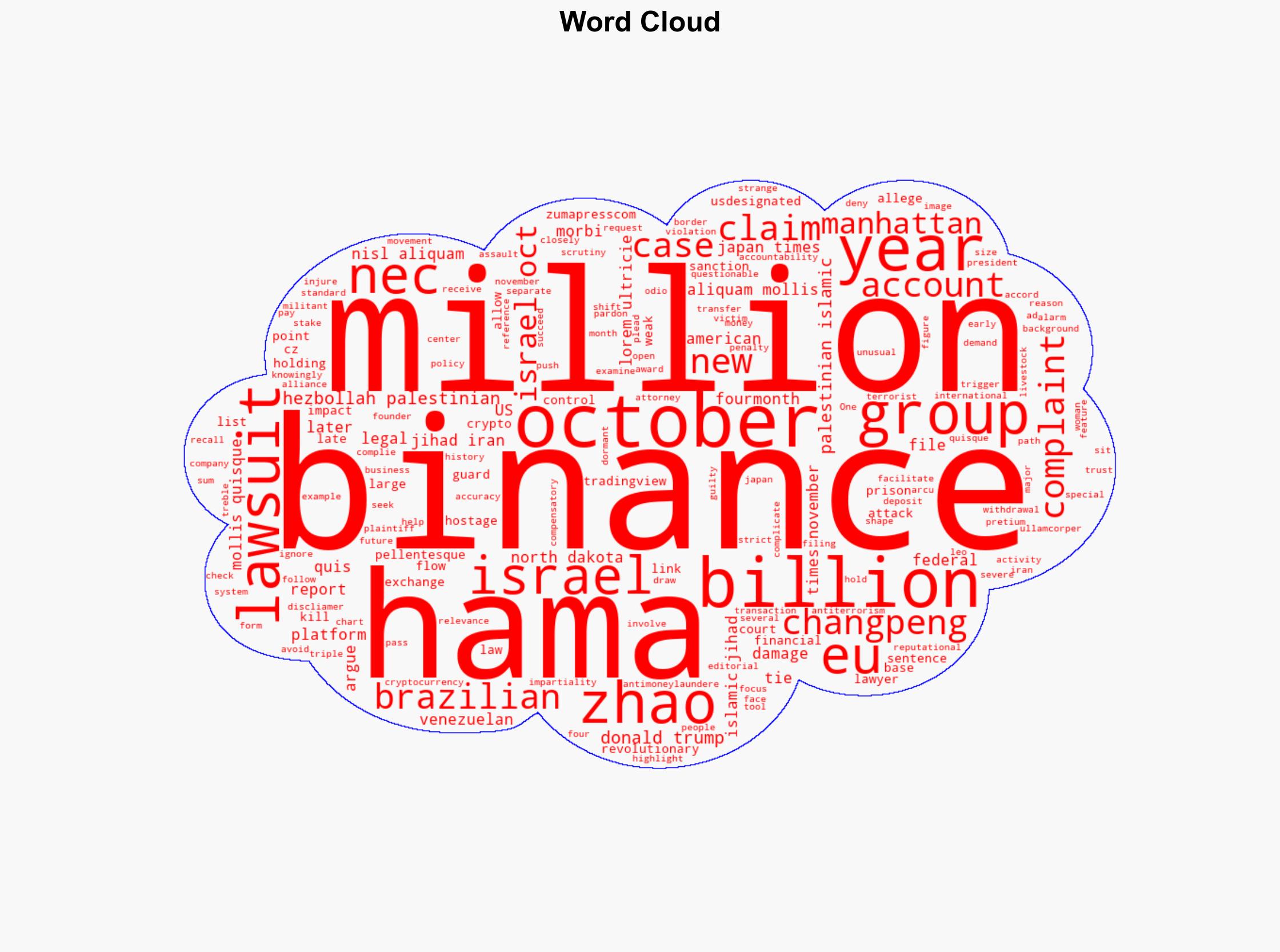

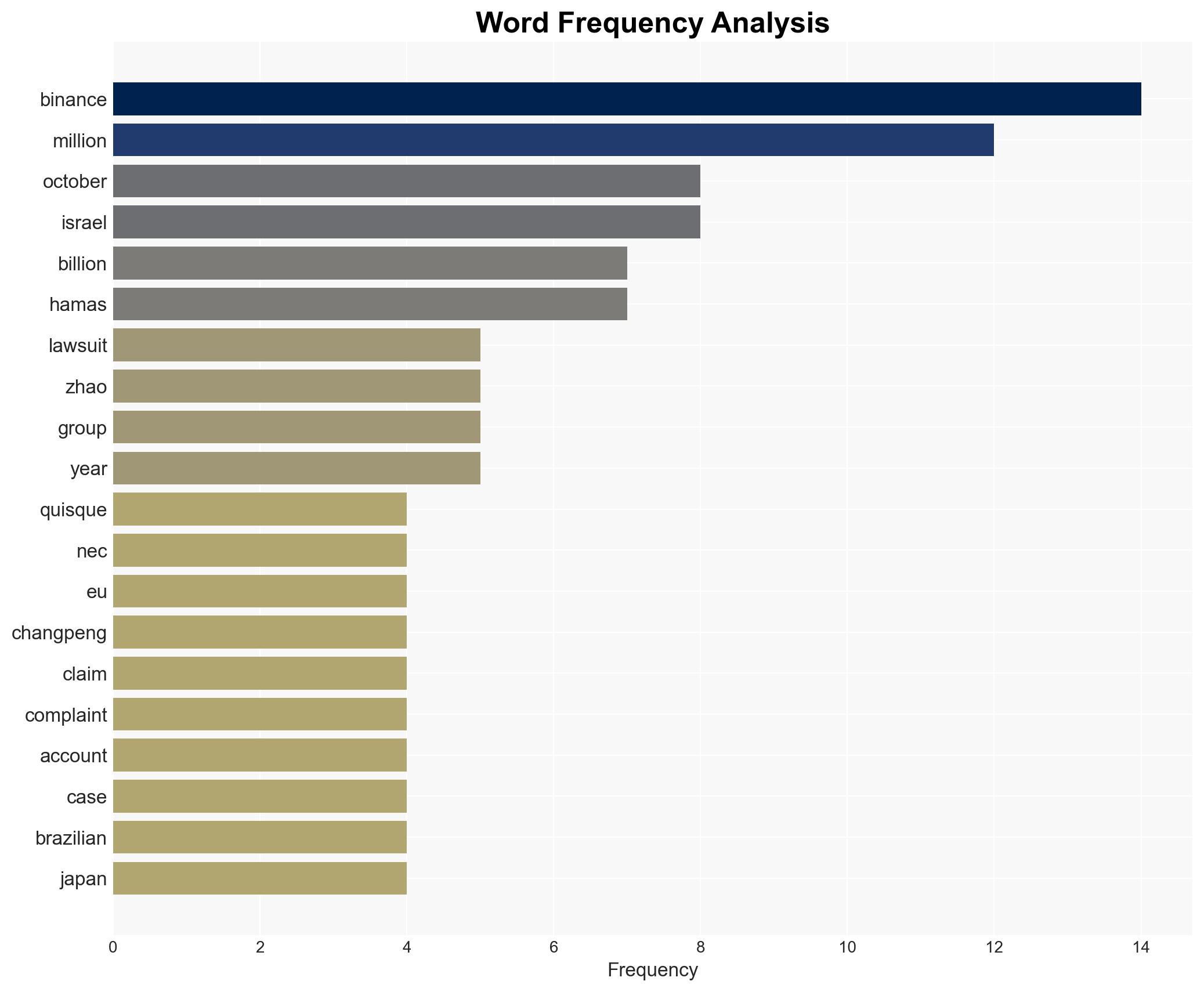

Hamas Victims Sue Binance And CZ Accusations Of Terror Financing Rock Crypto World

Published on: 2025-11-25

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

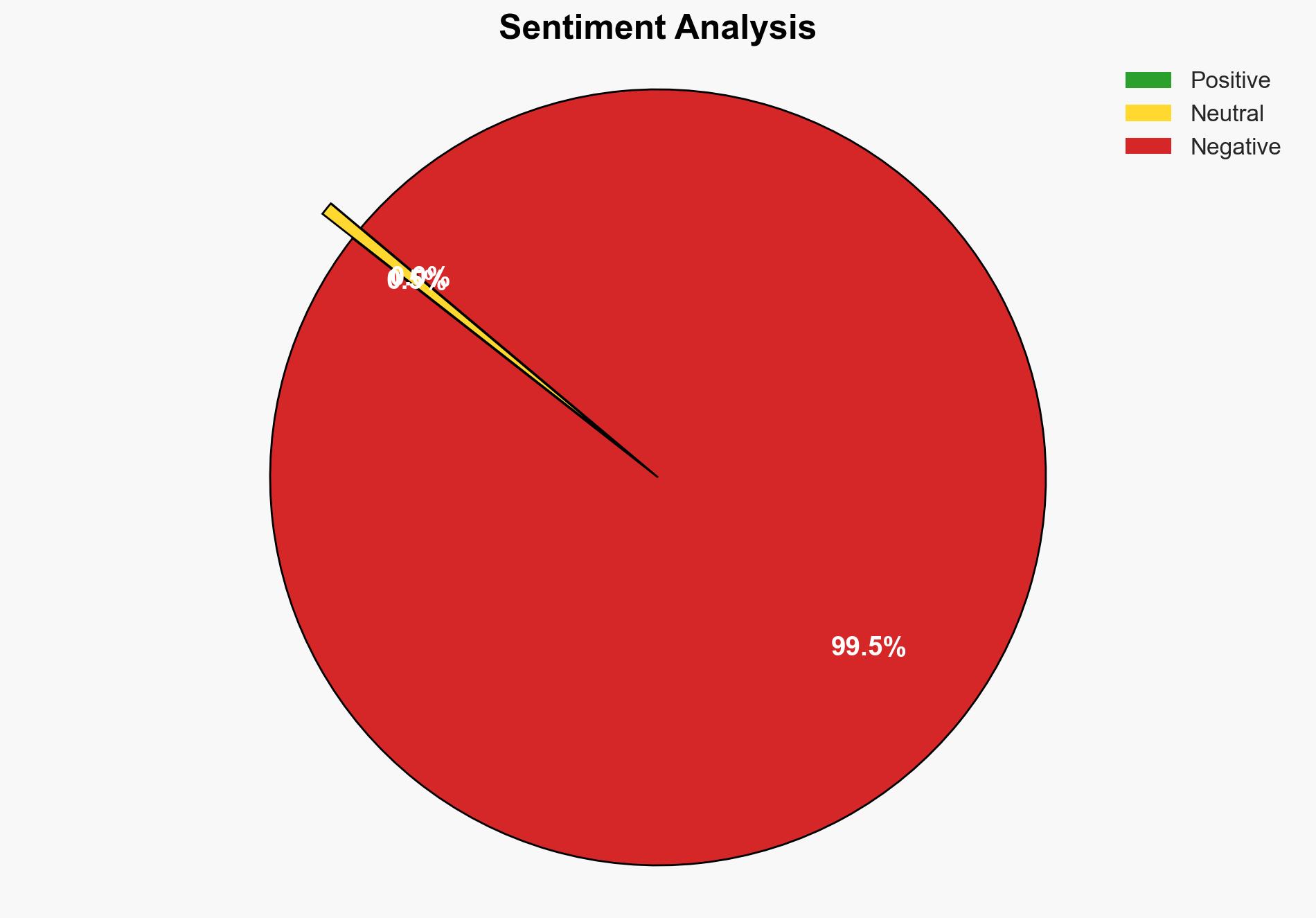

There is a moderate confidence level that Binance’s alleged facilitation of transactions for Hamas and other groups could lead to significant legal and reputational repercussions for the company. The most supported hypothesis is that Binance’s compliance controls were insufficient, allowing illicit transactions to occur. Recommended actions include strengthening regulatory compliance and enhancing transaction monitoring systems.

2. Competing Hypotheses

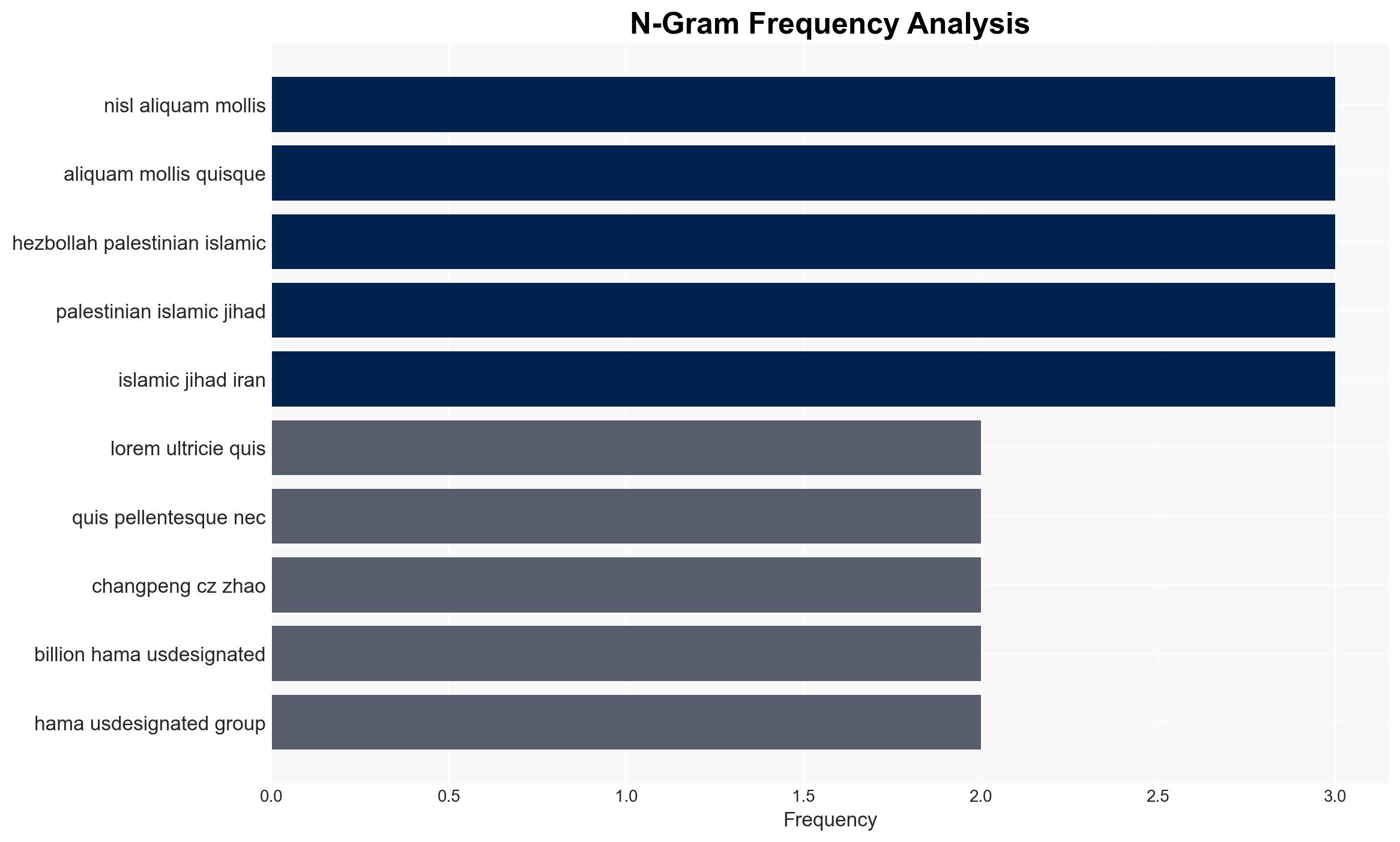

Hypothesis 1: Binance knowingly facilitated transactions for Hamas and other designated terrorist groups, prioritizing profit over compliance with international sanctions and anti-terrorism laws.

Hypothesis 2: Binance’s compliance controls were inadequate, leading to unintentional facilitation of transactions for Hamas and other groups due to oversight failures rather than deliberate complicity.

Hypothesis 2 is more likely given the historical context of Binance’s previous compliance issues and the complexity of monitoring cryptocurrency transactions. However, the possibility of deliberate facilitation cannot be entirely ruled out without further evidence.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the legal system will thoroughly investigate the claims and that Binance’s past compliance issues are indicative of systemic weaknesses rather than isolated incidents.

Red Flags: The involvement of a Venezuelan account linked to a Brazilian business raises questions about potential money laundering schemes. The timing of large transactions around significant geopolitical events is also suspicious.

Deception Indicators: Binance’s denial of any special ties to terrorist groups could be a strategic deflection if internal controls were knowingly bypassed.

4. Implications and Strategic Risks

The lawsuit could lead to increased regulatory scrutiny of cryptocurrency exchanges globally, potentially resulting in stricter regulations and compliance requirements. Economically, Binance could face significant financial penalties and loss of market trust. Politically, this case may exacerbate tensions between nations regarding the use of cryptocurrencies in illicit activities. Cyber risks include potential retaliatory actions by affected groups or individuals against Binance or related entities.

5. Recommendations and Outlook

- Enhance Binance’s compliance and monitoring systems to detect and prevent illicit transactions.

- Engage with international regulatory bodies to demonstrate commitment to compliance and transparency.

- Best-case scenario: Binance strengthens its compliance framework and regains market trust.

- Worst-case scenario: Binance faces severe financial penalties and a significant loss of market position.

- Most-likely scenario: Binance undergoes regulatory reforms and incurs moderate financial and reputational damage.

6. Key Individuals and Entities

Changpeng “CZ” Zhao: Founder of Binance, central to the allegations.

Binance Holdings: The cryptocurrency exchange facing the lawsuit.

Hamas: Designated terrorist group allegedly facilitated by Binance.

7. Thematic Tags

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us