Hotels show mixed performance in H2 2025 – Hotelmanagement-network.com

Published on: 2025-10-15

Intelligence Report: Hotels show mixed performance in H2 2025 – Hotelmanagement-network.com

1. BLUF (Bottom Line Up Front)

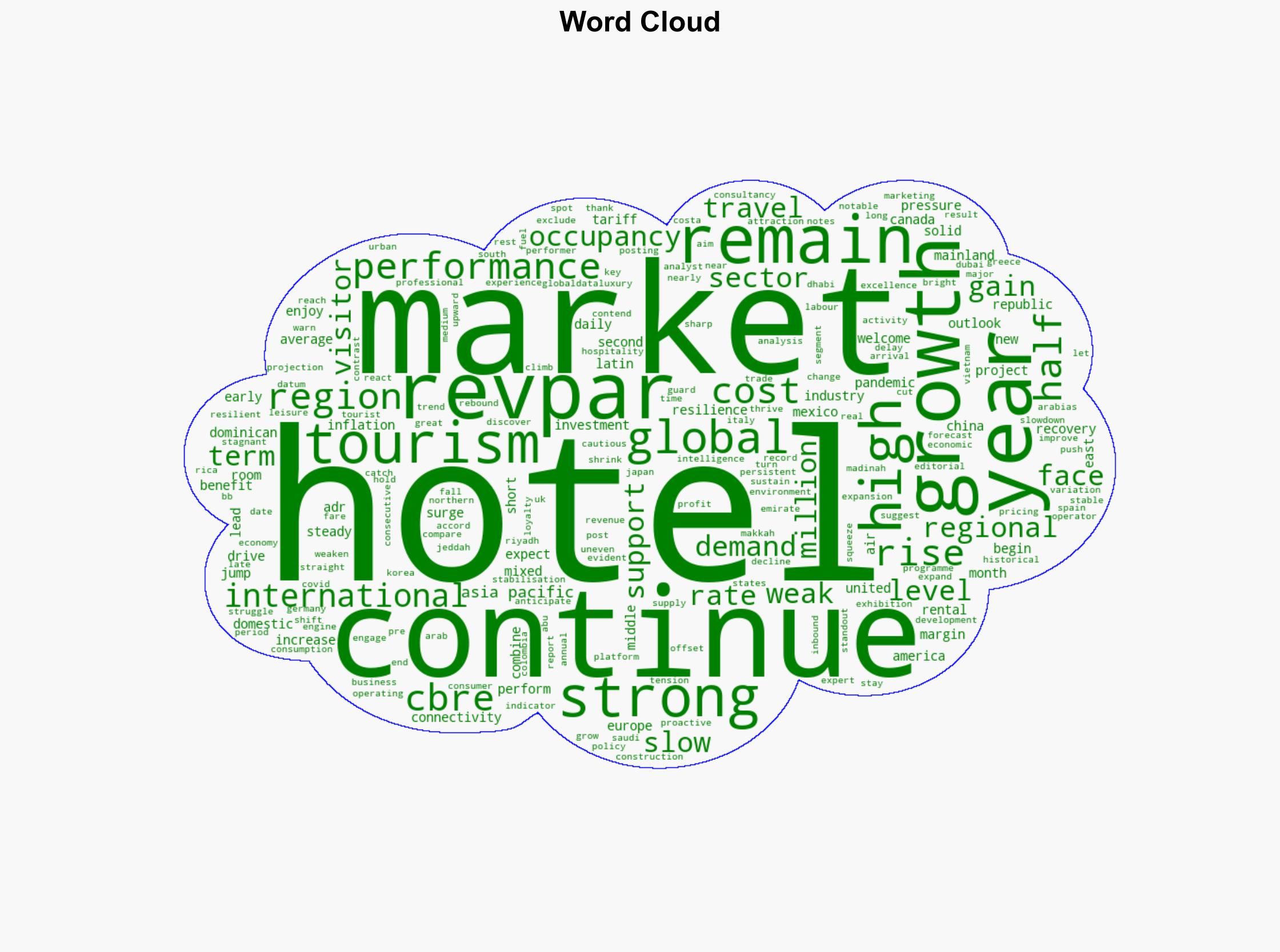

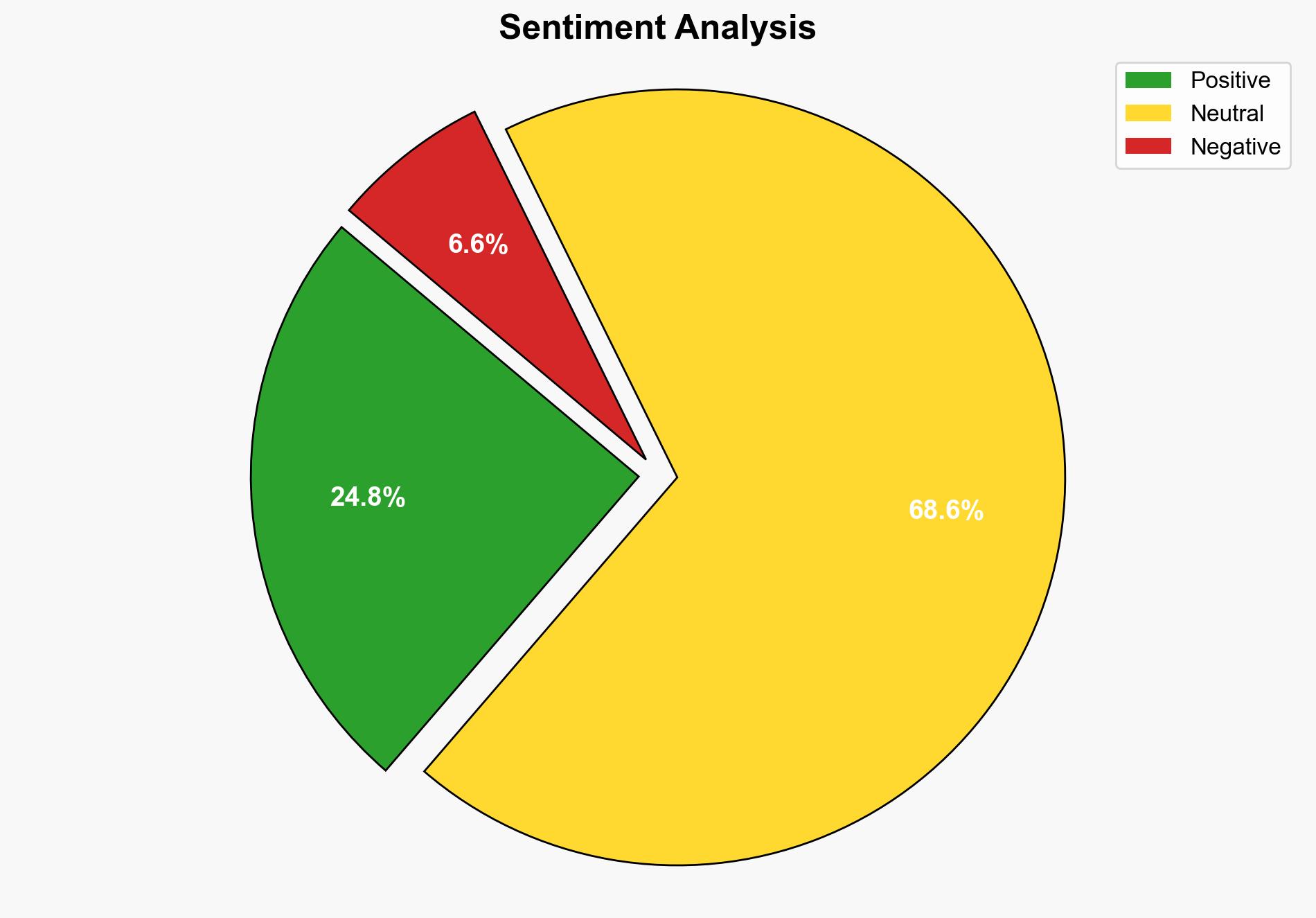

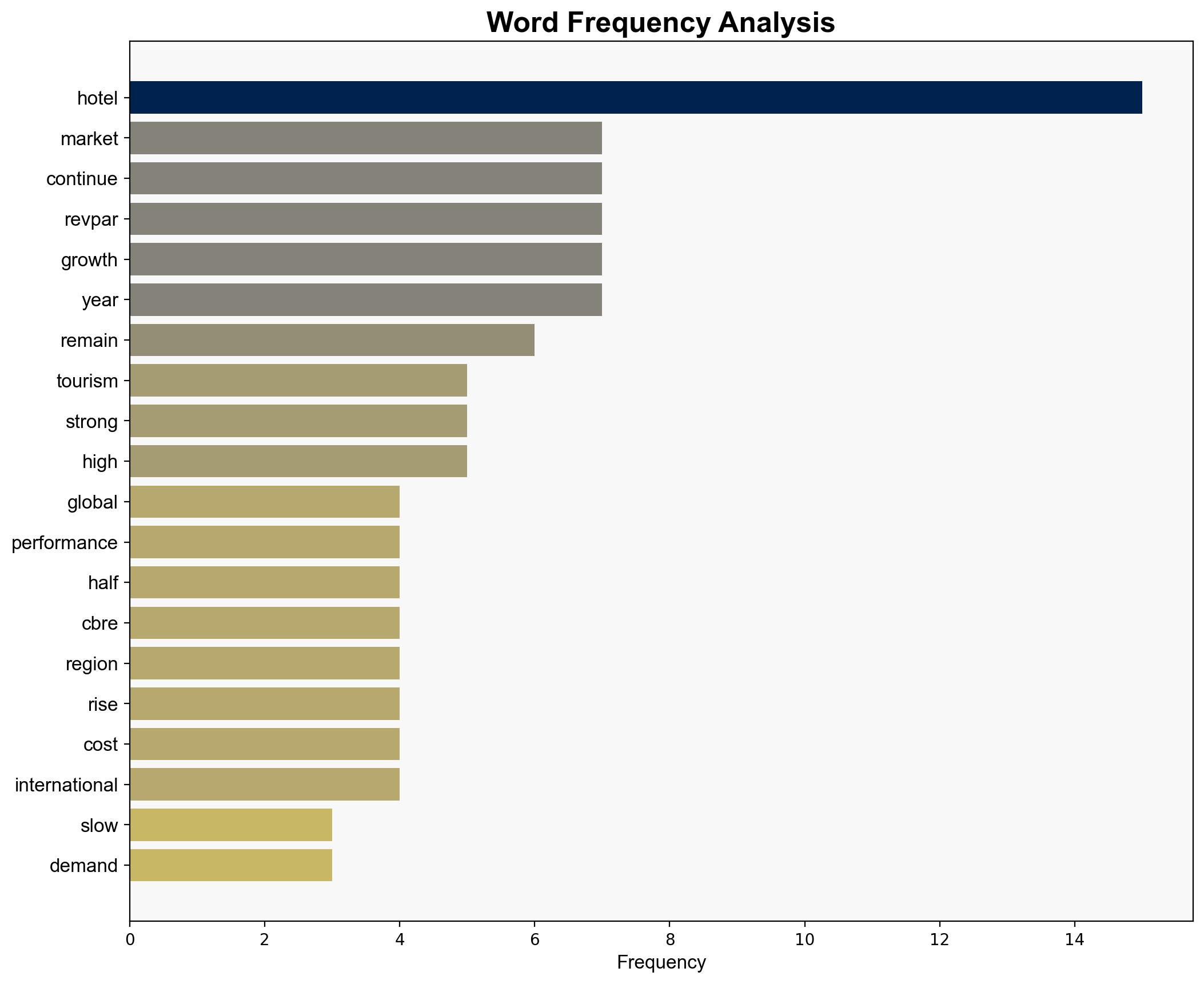

The global hotel industry is experiencing uneven recovery in the second half of 2025, with varying performance across regions. The most supported hypothesis is that regional economic resilience and tourism demand are driving growth in certain areas, while others face challenges due to economic pressures and increased competition. Confidence level: Moderate. Recommended action: Focus on enhancing competitive strategies in struggling markets and leveraging strengths in high-performing regions.

2. Competing Hypotheses

Hypothesis 1: The mixed performance of the hotel industry is primarily due to regional economic resilience and tourism demand, which drive growth in certain areas despite global economic challenges. This hypothesis is supported by strong tourism rebounds in Latin America and the Middle East, as well as stable pricing in Europe.

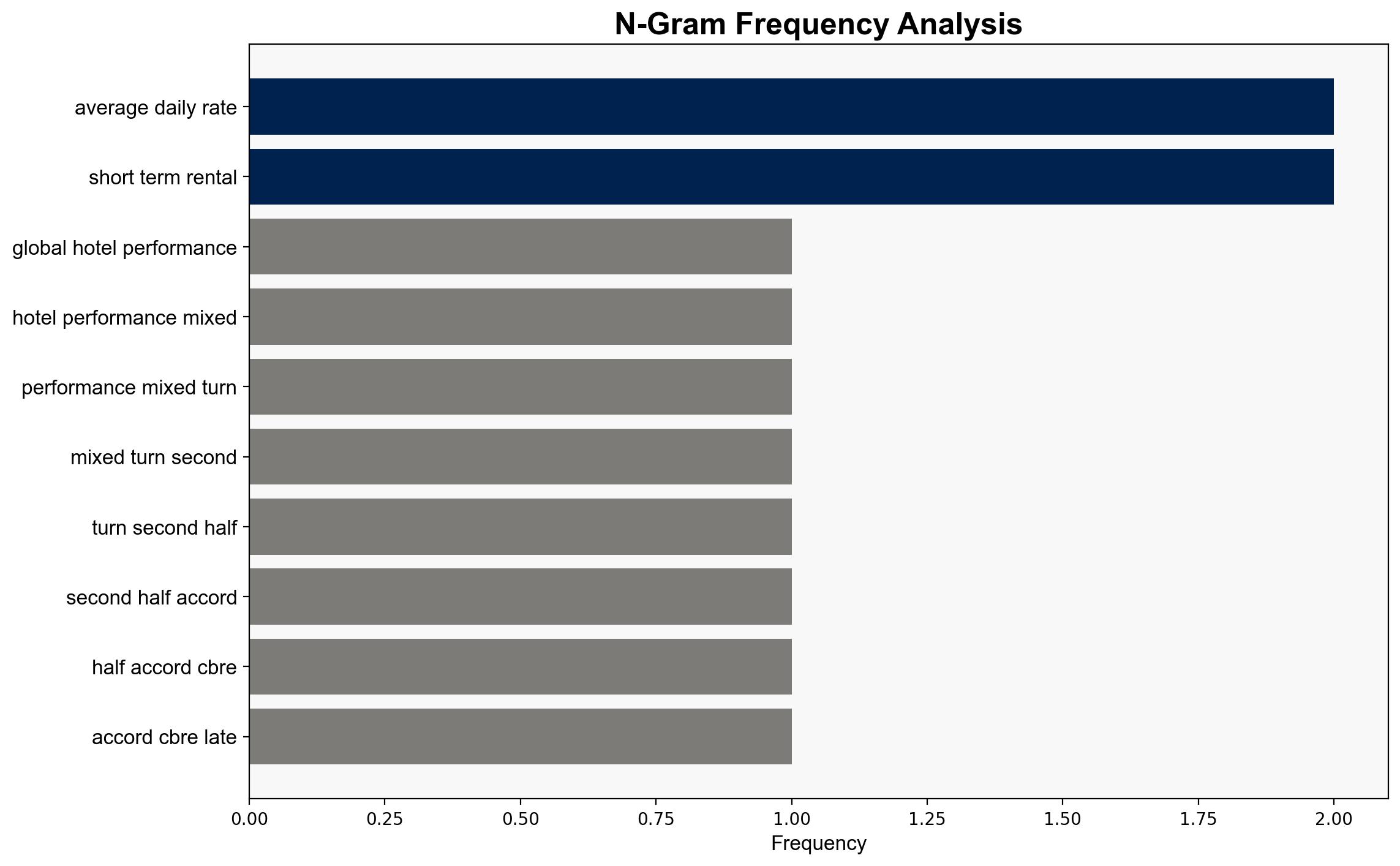

Hypothesis 2: The uneven performance is largely a result of external economic pressures, such as high inflation, trade tensions, and increased competition from short-term rentals, which are impacting hotel margins and growth prospects. This is evidenced by the slowdown in the U.S. market and challenges in Asia Pacific, particularly in China.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that regional economic resilience will continue to drive tourism demand.

– Hypothesis 2 assumes that external economic pressures will persist and negatively impact hotel performance.

Red Flags:

– Potential over-reliance on historical data without considering rapid changes in consumer behavior.

– Inconsistent data on short-term rental impacts and regional economic forecasts.

4. Implications and Strategic Risks

The mixed performance of the hotel industry could lead to increased competition and consolidation in struggling markets. Economic pressures may force hotels to innovate or diversify their offerings. Geopolitical tensions and trade policies could further exacerbate regional disparities. There is a risk of reduced investor confidence in markets with declining performance, potentially affecting future development and expansion plans.

5. Recommendations and Outlook

- Enhance competitive strategies in underperforming markets by focusing on unique value propositions and customer experience.

- Leverage strengths in high-performing regions through targeted marketing and loyalty programs.

- Scenario-based projections:

- Best Case: Global economic stabilization leads to uniform growth across regions.

- Worst Case: Prolonged economic pressures and geopolitical tensions result in further decline in key markets.

- Most Likely: Continued mixed performance with pockets of growth and areas of stagnation.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Key entities include CBRE, GlobalData, and various regional hotel markets.

7. Thematic Tags

economic resilience, tourism demand, regional performance, inflation impact, hotel industry trends