How did Tether profit 13B in 2024 from USDT – Substack.com

Published on: 2025-09-07

Intelligence Report: How did Tether profit 13B in 2024 from USDT – Substack.com

1. BLUF (Bottom Line Up Front)

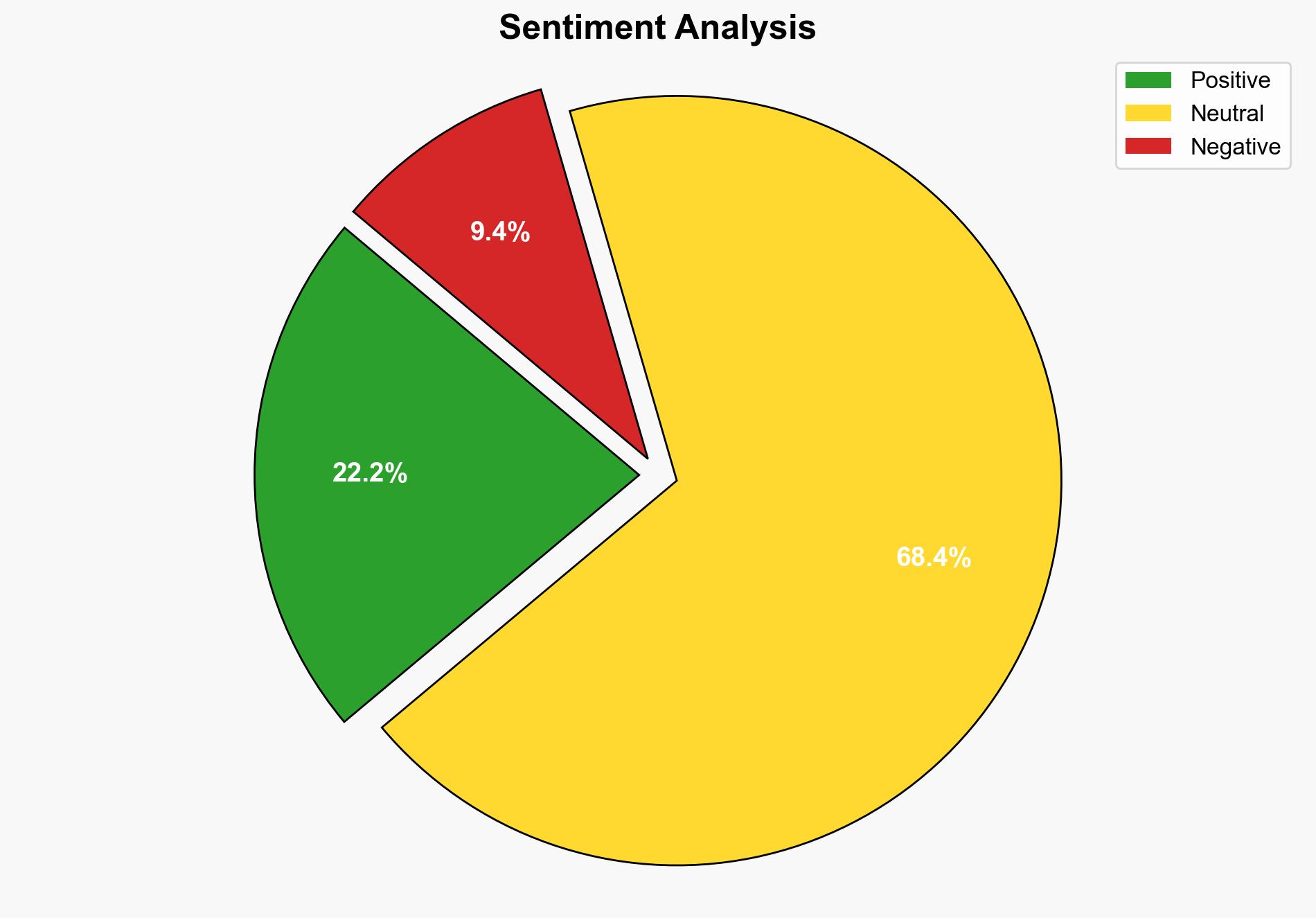

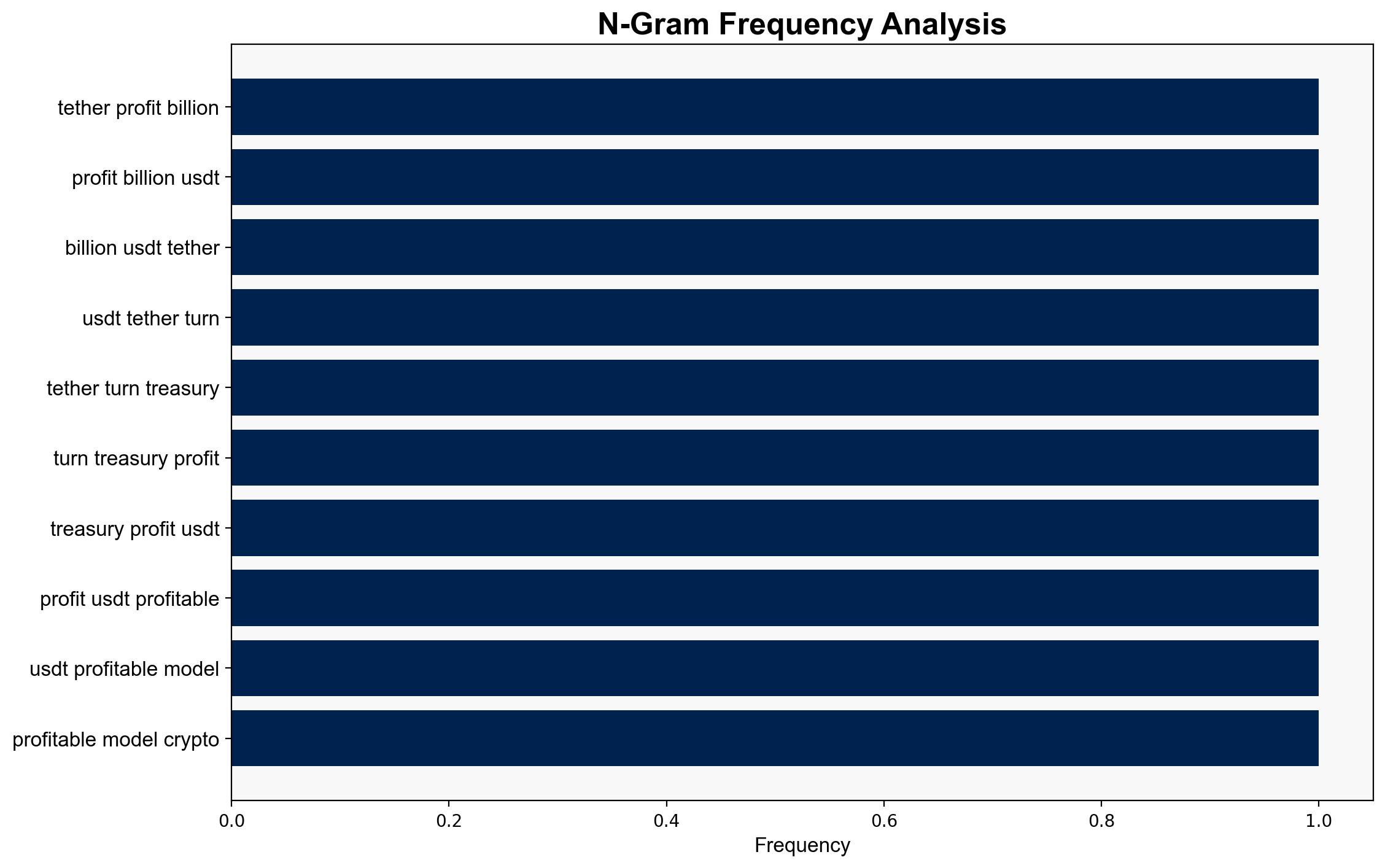

Tether’s reported $13 billion profit in 2024 is primarily attributed to strategic investments in government debt and high-yield assets, alongside efficient operational practices. The most supported hypothesis suggests Tether’s profit model is sustainable but faces regulatory and market risks. Confidence Level: Moderate. Recommended action is to monitor regulatory developments and market dynamics closely.

2. Competing Hypotheses

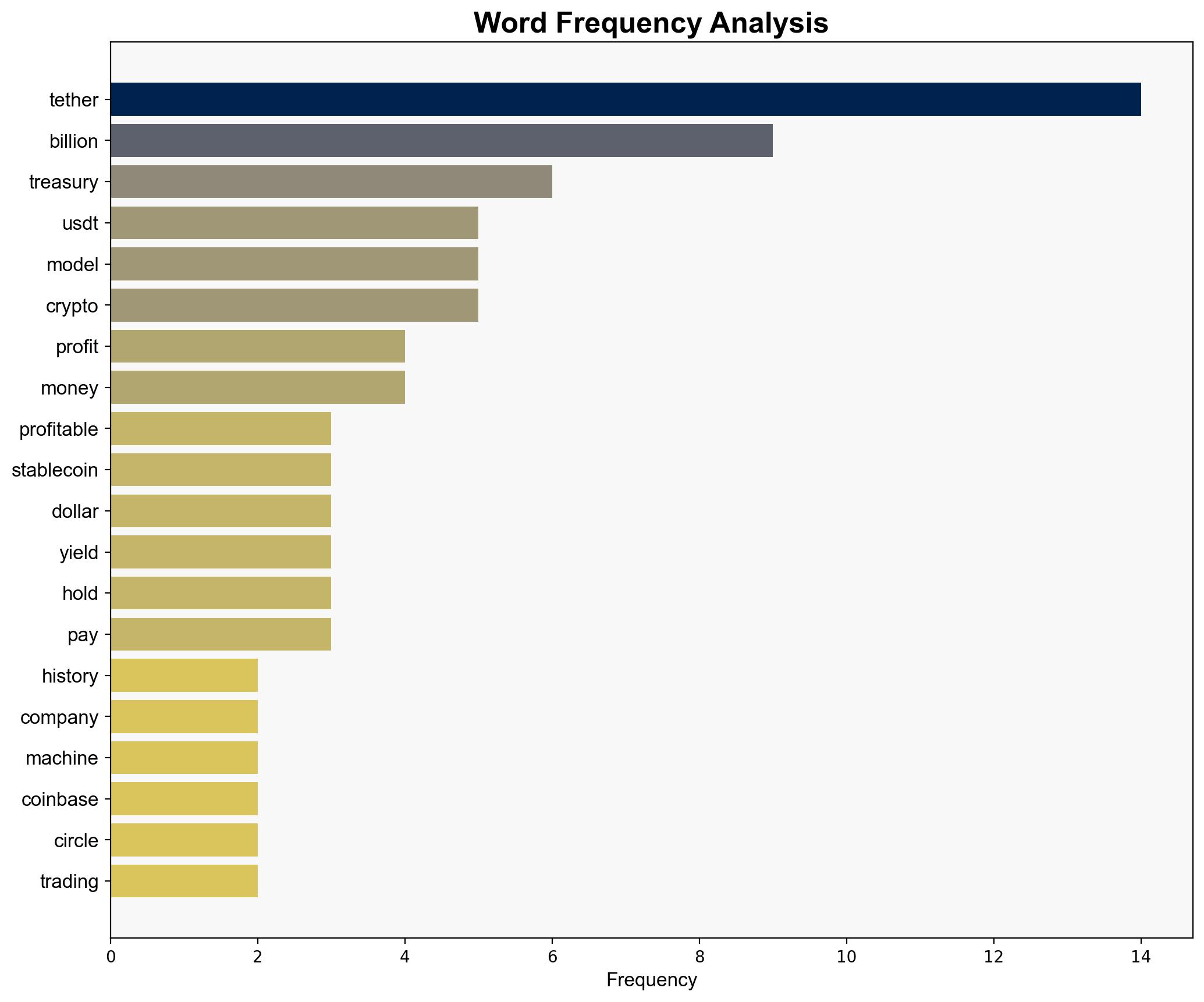

Hypothesis 1: Tether’s profit is primarily driven by its investment in government treasuries and high-yield assets, leveraging its reserves effectively to generate substantial returns. This hypothesis is supported by the mention of Tether holding significant treasury assets and earning yields from them.

Hypothesis 2: Tether’s profit stems from a combination of trading fees, token issuance, and strategic fintech partnerships, which enhance its revenue streams beyond mere asset investments. This hypothesis considers the broader operational model, including transaction fees and fintech collaborations.

3. Key Assumptions and Red Flags

Assumptions:

– Tether’s treasury holdings are accurately reported and yield the claimed returns.

– The operational model, including fees and partnerships, is sustainable and scalable.

Red Flags:

– Lack of transparent audits and regulatory scrutiny could mask financial instability.

– Potential over-reliance on high-yield investments that may not be sustainable long-term.

4. Implications and Strategic Risks

Tether’s financial model, while profitable, operates within a volatile crypto market and under increasing regulatory scrutiny. The potential for regulatory changes, particularly in Europe and the US, poses a risk to its operations. Additionally, shifts in interest rates could impact the profitability of its treasury investments. The geopolitical landscape and its impact on global financial systems could further influence Tether’s strategic positioning.

5. Recommendations and Outlook

- Monitor regulatory developments, particularly in major markets like the US and EU, to anticipate potential compliance challenges.

- Evaluate the sustainability of Tether’s investment strategies in the context of changing interest rates and market conditions.

- Scenario Projections:

- Best Case: Tether adapts to regulatory changes, maintains high yields, and continues to expand its market presence.

- Worst Case: Regulatory crackdowns lead to significant operational disruptions and loss of market confidence.

- Most Likely: Tether navigates regulatory challenges with moderate adjustments, sustaining profitability but with reduced growth.

6. Key Individuals and Entities

– Tether

– Coinbase

– Circle

– Paxos

7. Thematic Tags

financial stability, regulatory compliance, cryptocurrency market, investment strategy