‘If They Can Do it to Sun Who’s Next’ Say Insiders as WLFI Claims Freeze Was to ‘Protect Users’ – CoinDesk

Published on: 2025-09-06

Intelligence Report: ‘If They Can Do it to Sun Who’s Next’ Say Insiders as WLFI Claims Freeze Was to ‘Protect Users’ – CoinDesk

1. BLUF (Bottom Line Up Front)

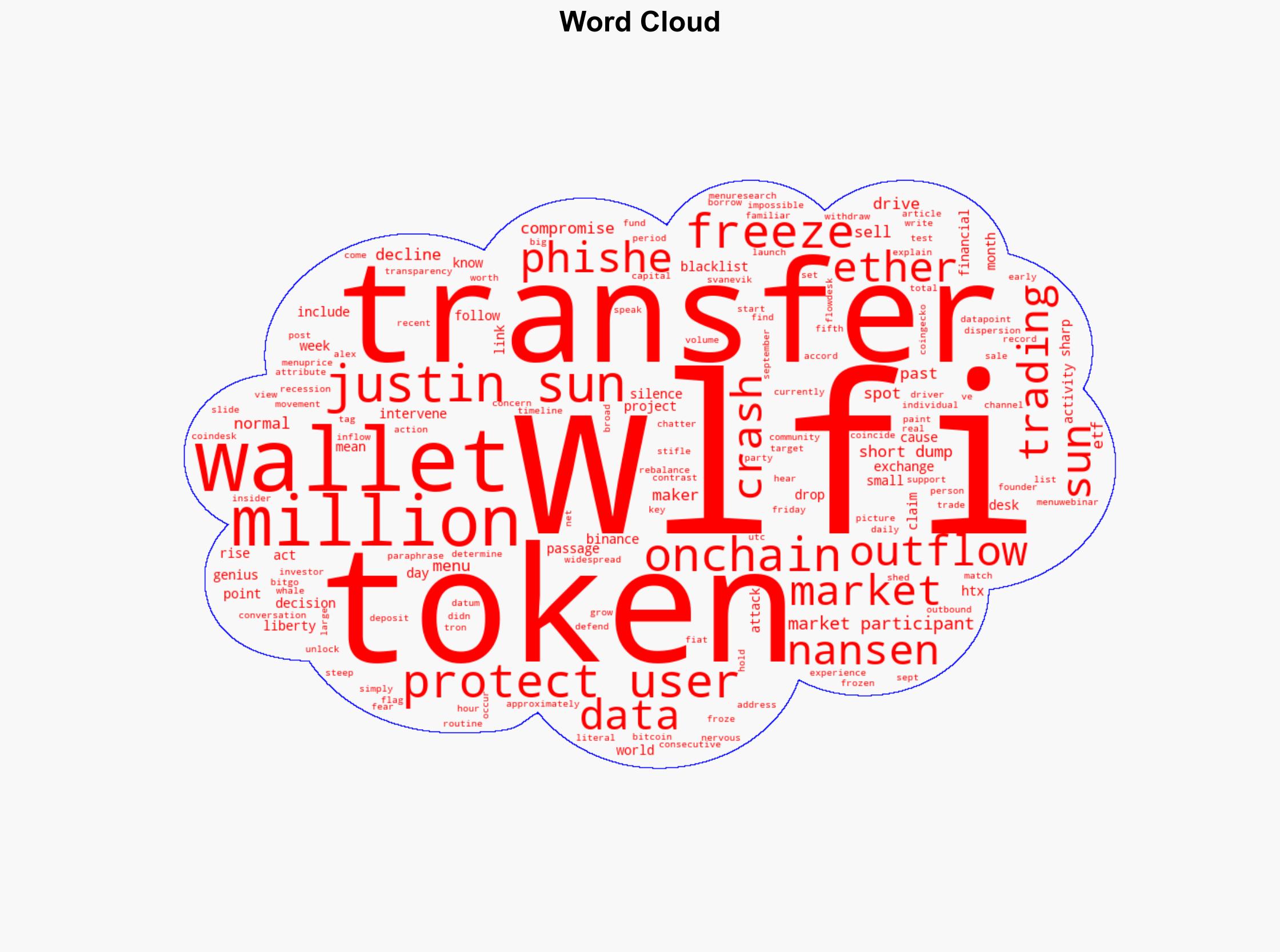

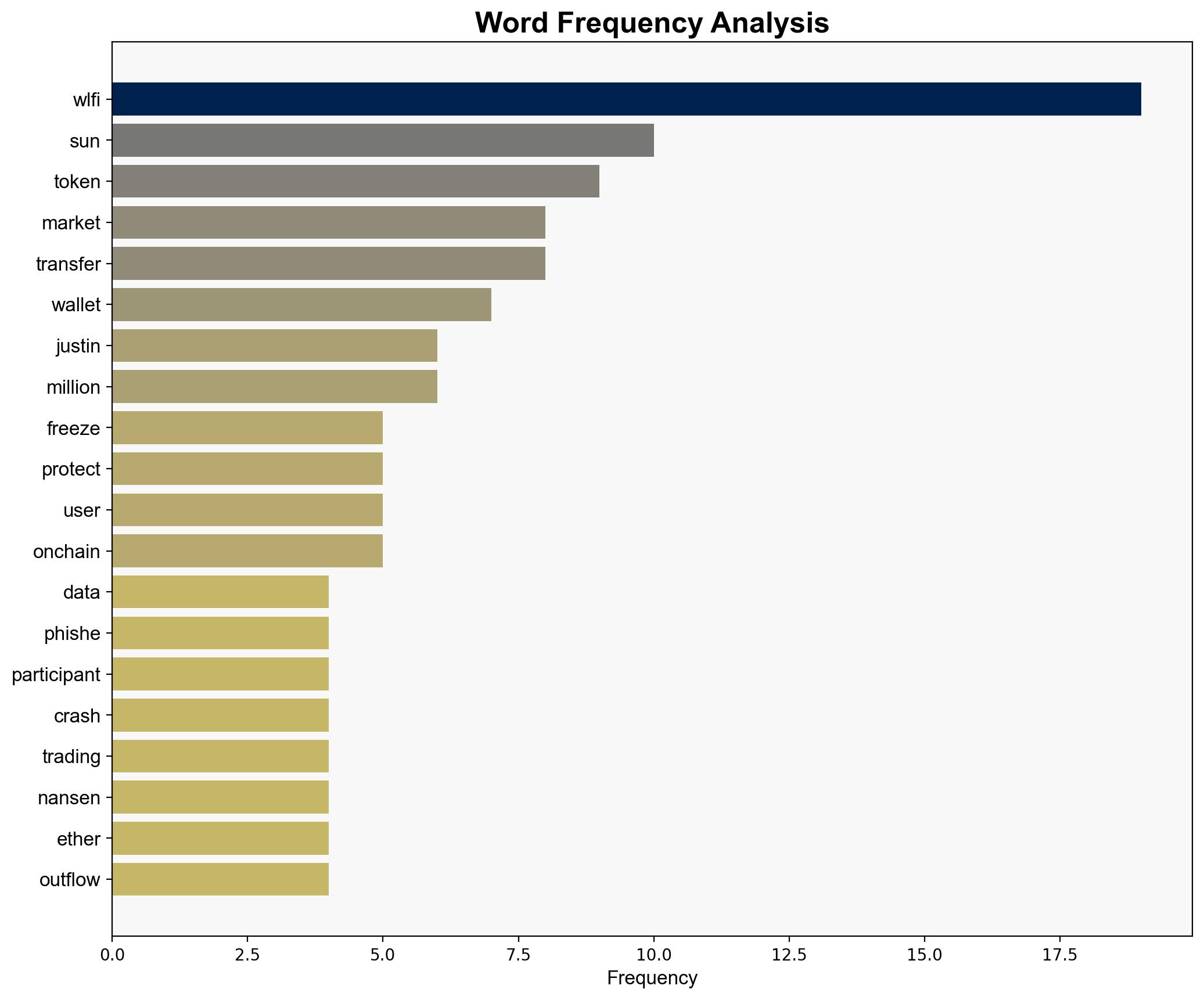

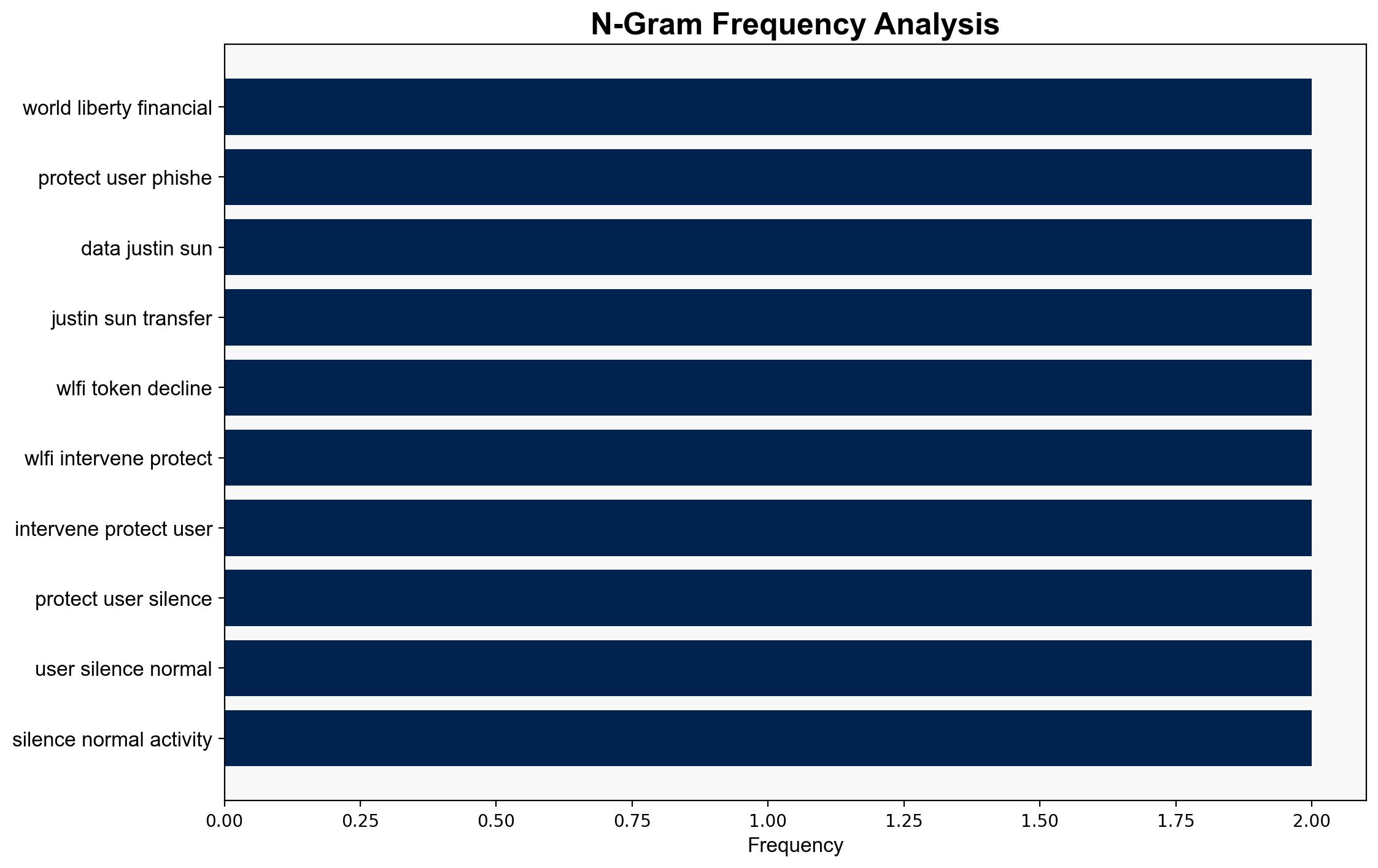

The most supported hypothesis is that WLFI’s decision to freeze wallets, including Justin Sun’s, was primarily a protective measure against phishing attacks, rather than a market manipulation tactic. This conclusion is drawn with moderate confidence, given the available on-chain data and statements from WLFI. It is recommended to monitor WLFI’s future actions for consistency with their stated protective intent and to assess the broader implications for market stability.

2. Competing Hypotheses

1. **Hypothesis A**: WLFI froze wallets, including Justin Sun’s, to protect users from a phishing attack, as claimed. This action was a defensive measure to prevent further compromise and protect market integrity.

2. **Hypothesis B**: The wallet freeze was a strategic move by WLFI to manipulate the market, potentially targeting high-profile investors like Justin Sun to create market panic and drive down the token’s value for ulterior motives.

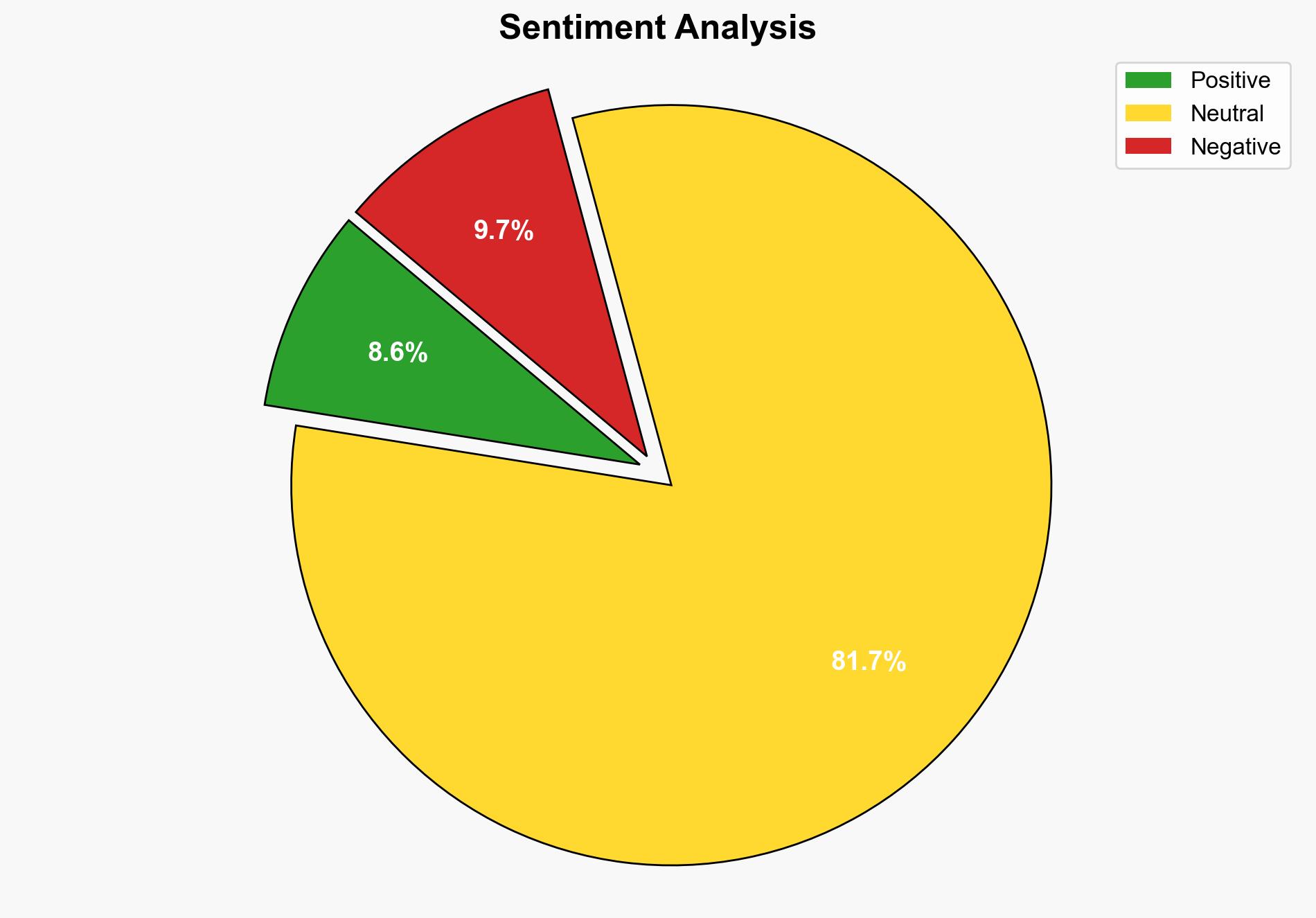

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported by the available data. The on-chain data shows a correlation between the wallet freeze and phishing attack claims, while Hypothesis B lacks direct evidence of intentional market manipulation.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes WLFI’s transparency and integrity in their protective claims. Hypothesis B assumes ulterior motives without direct evidence.

– **Red Flags**: The timing of the wallet freeze and subsequent market crash could indicate potential manipulation. The lack of detailed information on the phishing attack raises questions about its severity and scope.

– **Blind Spots**: Limited visibility into WLFI’s internal decision-making processes and the full extent of the phishing threat.

4. Implications and Strategic Risks

The wallet freeze sets a precedent for intervention in digital asset markets, potentially impacting investor confidence and market stability. If perceived as manipulative, it could lead to increased regulatory scrutiny and market volatility. The psychological impact on investors, particularly large stakeholders, may result in cautious trading behavior, affecting liquidity and market dynamics.

5. Recommendations and Outlook

- Monitor WLFI’s future actions and communications for consistency with their protective claims.

- Engage with cybersecurity experts to assess the phishing threat and develop robust preventive measures.

- Scenario Projections:

- **Best Case**: WLFI’s actions are validated as protective, restoring market confidence and stability.

- **Worst Case**: Perceived manipulation leads to regulatory crackdowns and investor withdrawal.

- **Most Likely**: Continued scrutiny and cautious trading behavior as stakeholders await further clarity.

6. Key Individuals and Entities

– Justin Sun

– WLFI

– Nansen (data analytics firm)

7. Thematic Tags

national security threats, cybersecurity, market manipulation, digital asset regulation