India now reverse AI trade after being relative-return disaster Chris Wood of Jefferies – The Times of India

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: India now reverse AI trade after being relative-return disaster Chris Wood of Jefferies – The Times of India

1. BLUF (Bottom Line Up Front)

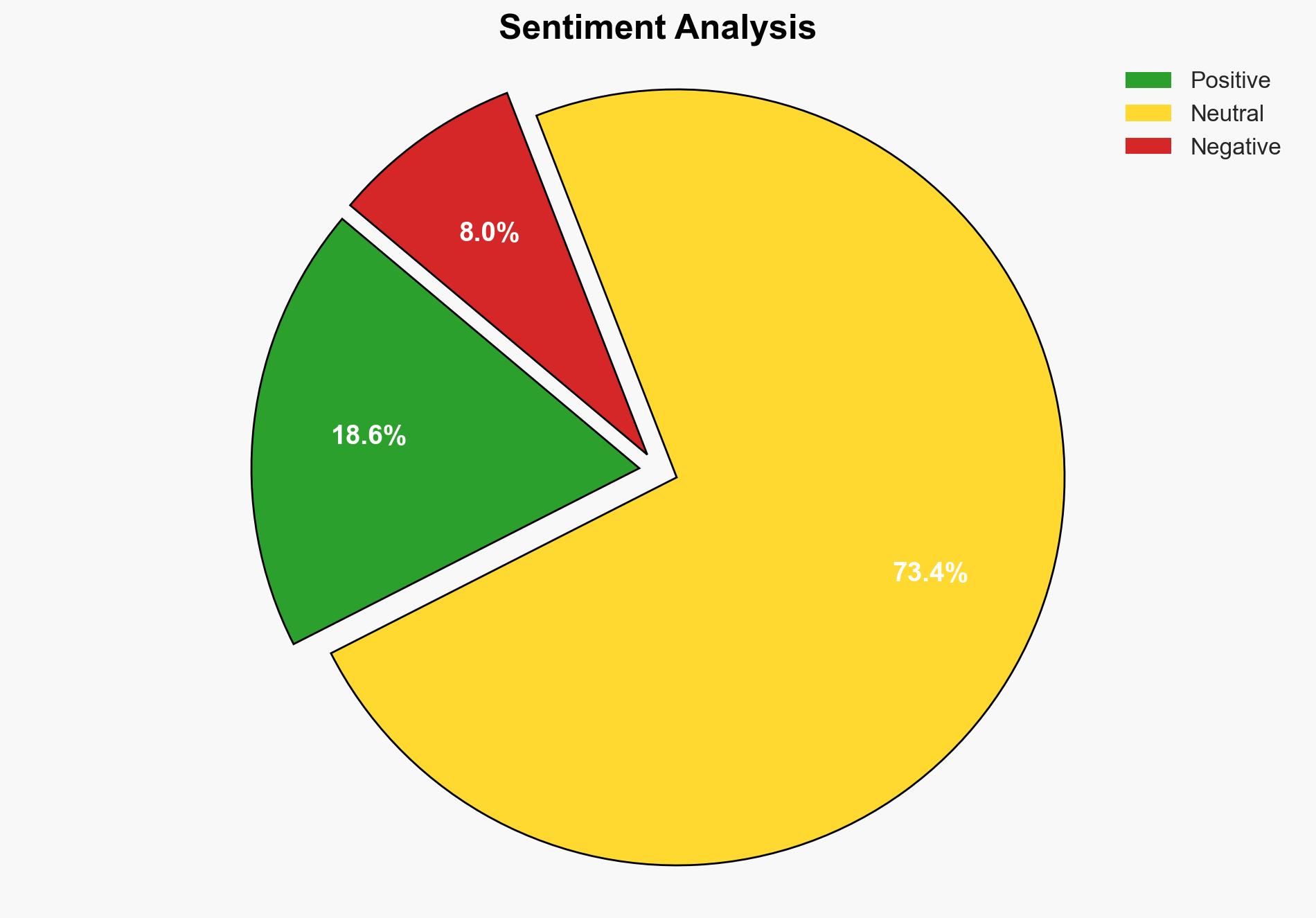

India’s recent underperformance in the AI trade, as highlighted by Chris Wood of Jefferies, may be a temporary setback. The strategic judgment is that India could potentially reverse this trend and outperform in the AI sector due to its improving macroeconomic indicators and strong domestic investor demand. The confidence level in this assessment is moderate, given the uncertainties in global AI market dynamics and domestic economic policies.

2. Competing Hypotheses

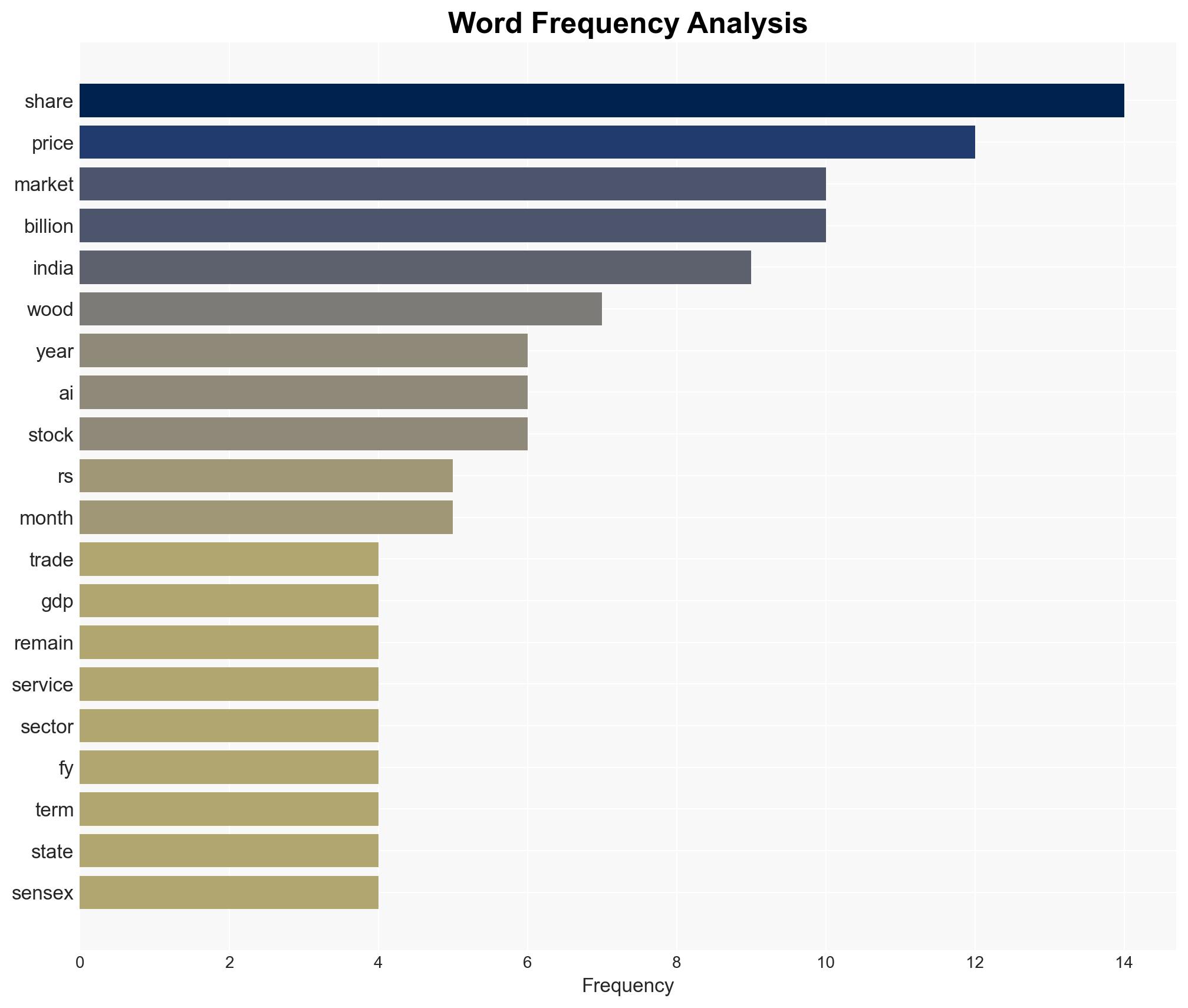

Hypothesis 1: India’s underperformance in the AI trade is a temporary phenomenon, and the country will reverse this trend due to strong domestic investor demand and improving macroeconomic indicators.

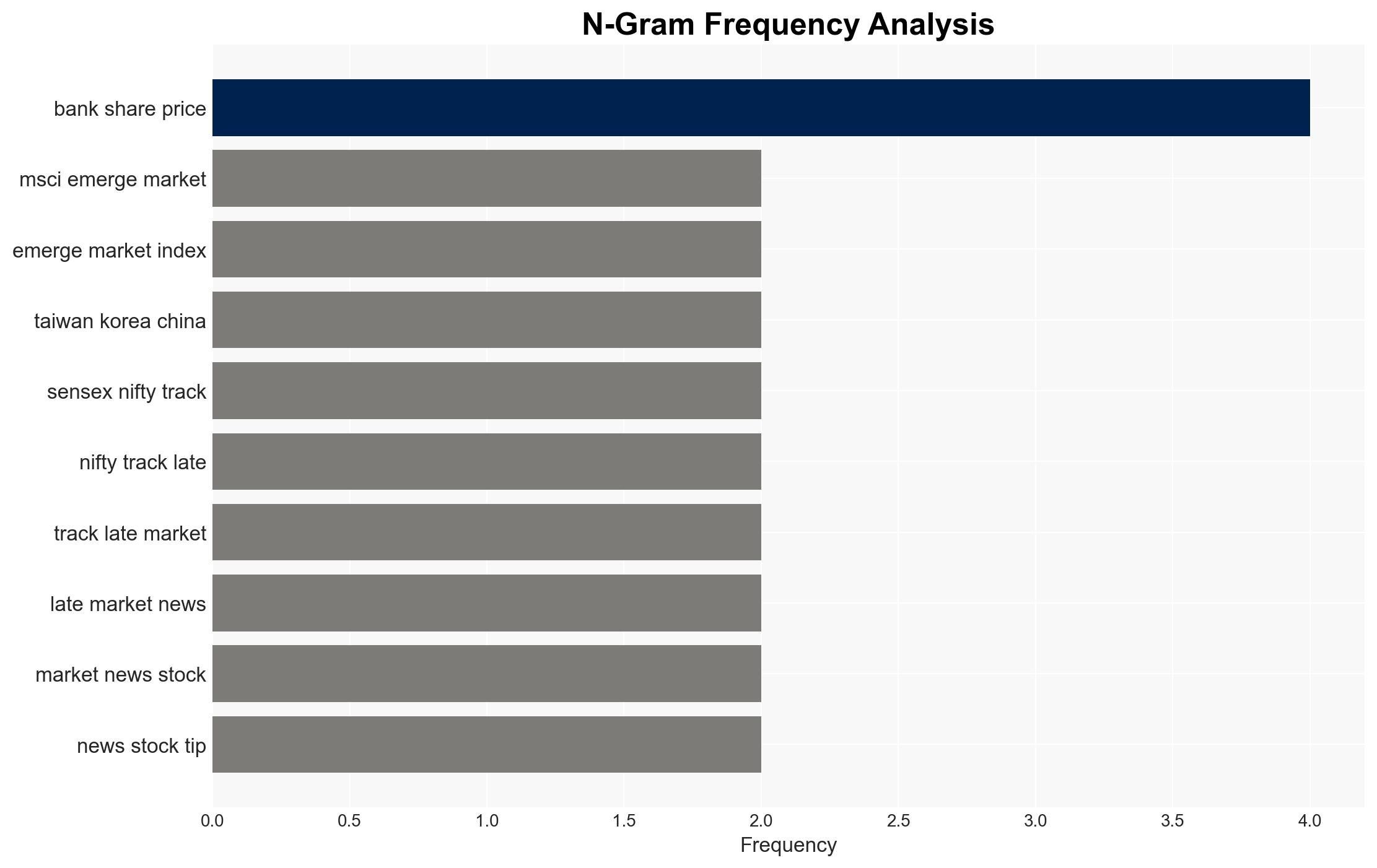

Hypothesis 2: India’s underperformance is indicative of deeper structural issues in its economy and AI sector, which will continue to hinder its ability to capitalize on the AI boom compared to other emerging markets like Taiwan, Korea, and China.

The first hypothesis is more likely due to evidence of strong domestic investor demand and improving macroeconomic indicators, such as the stabilization of the rupee and potential monetary easing. However, the second hypothesis cannot be dismissed given the challenges in AI infrastructure deployment and potential political risks.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that domestic investor demand will continue to offset foreign institutional outflows and that macroeconomic indicators will improve as projected.

Red Flags: Potential political instability, especially related to state elections and fiscal deficits, could undermine economic stability. Additionally, global AI market dynamics, such as power constraints and infrastructure deployment challenges, pose risks.

4. Implications and Strategic Risks

The primary risk is that continued underperformance in the AI sector could lead to a loss of investor confidence and further capital outflows. Politically, fiscal deficits and election-related spending could strain government resources. Economically, failure to capitalize on AI advancements could result in missed growth opportunities and reduced competitiveness.

5. Recommendations and Outlook

- Actionable Steps: Encourage policy measures to stabilize the rupee and support AI infrastructure development. Promote investor confidence through transparent economic policies.

- Best Scenario: India successfully reverses its AI trade underperformance, leveraging domestic demand and improved macroeconomic conditions.

- Worst Scenario: Structural issues persist, leading to continued underperformance and economic stagnation.

- Most-likely Scenario: India experiences moderate improvement in AI trade performance, contingent on domestic and global economic conditions.

6. Key Individuals and Entities

Chris Wood, Jefferies; Satya Nadella, Microsoft; Andrew Jassy, Amazon; Jensen Huang, Nvidia; Mahesh Nandurkar, Jefferies.

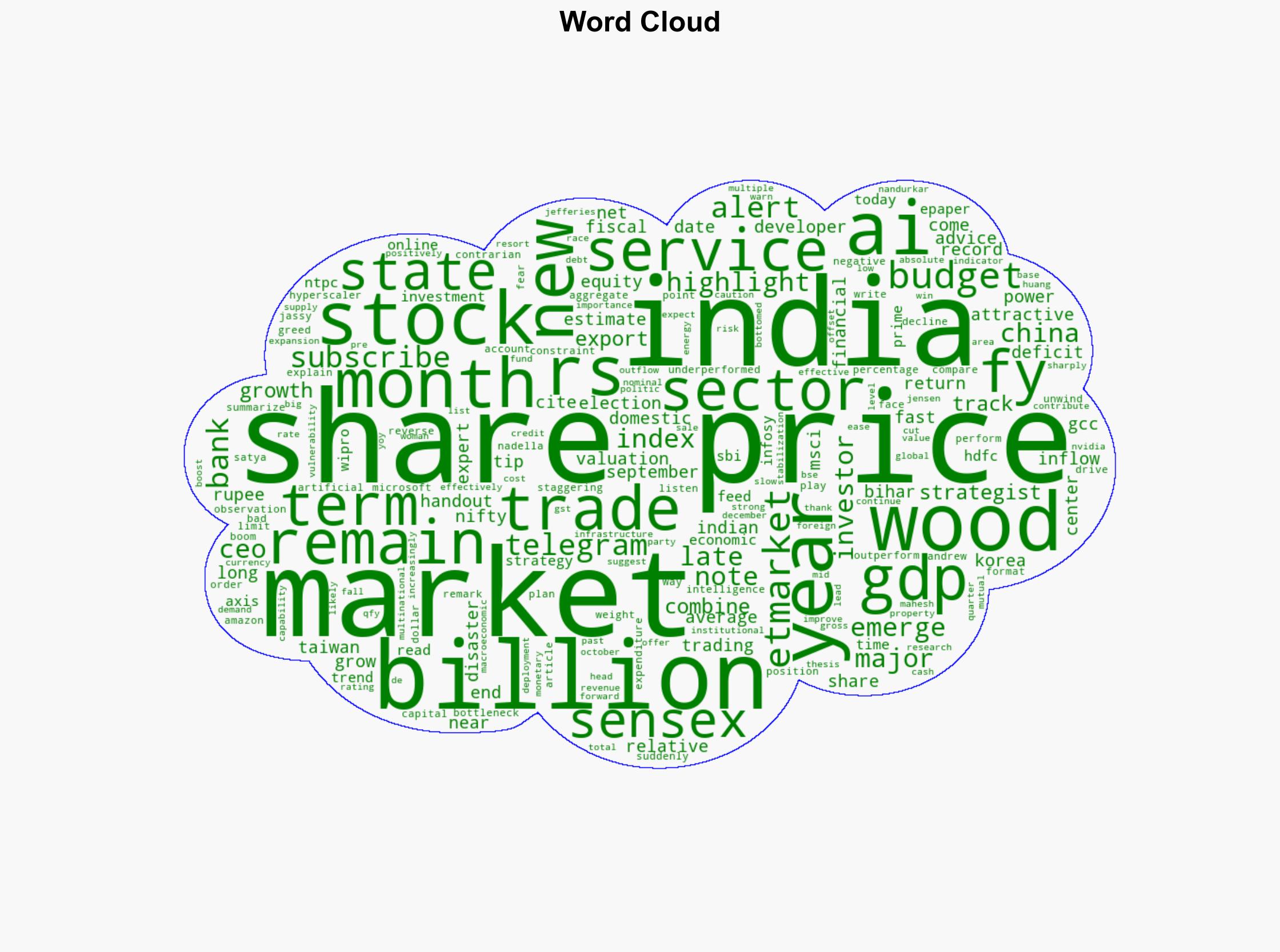

7. Thematic Tags

Cybersecurity, AI Trade, Emerging Markets, Economic Policy, Investor Confidence

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology