Indian investments in gold ETFs third highest in October – BusinessLine

Published on: 2025-11-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Indian Investments in Gold ETFs

1. BLUF (Bottom Line Up Front)

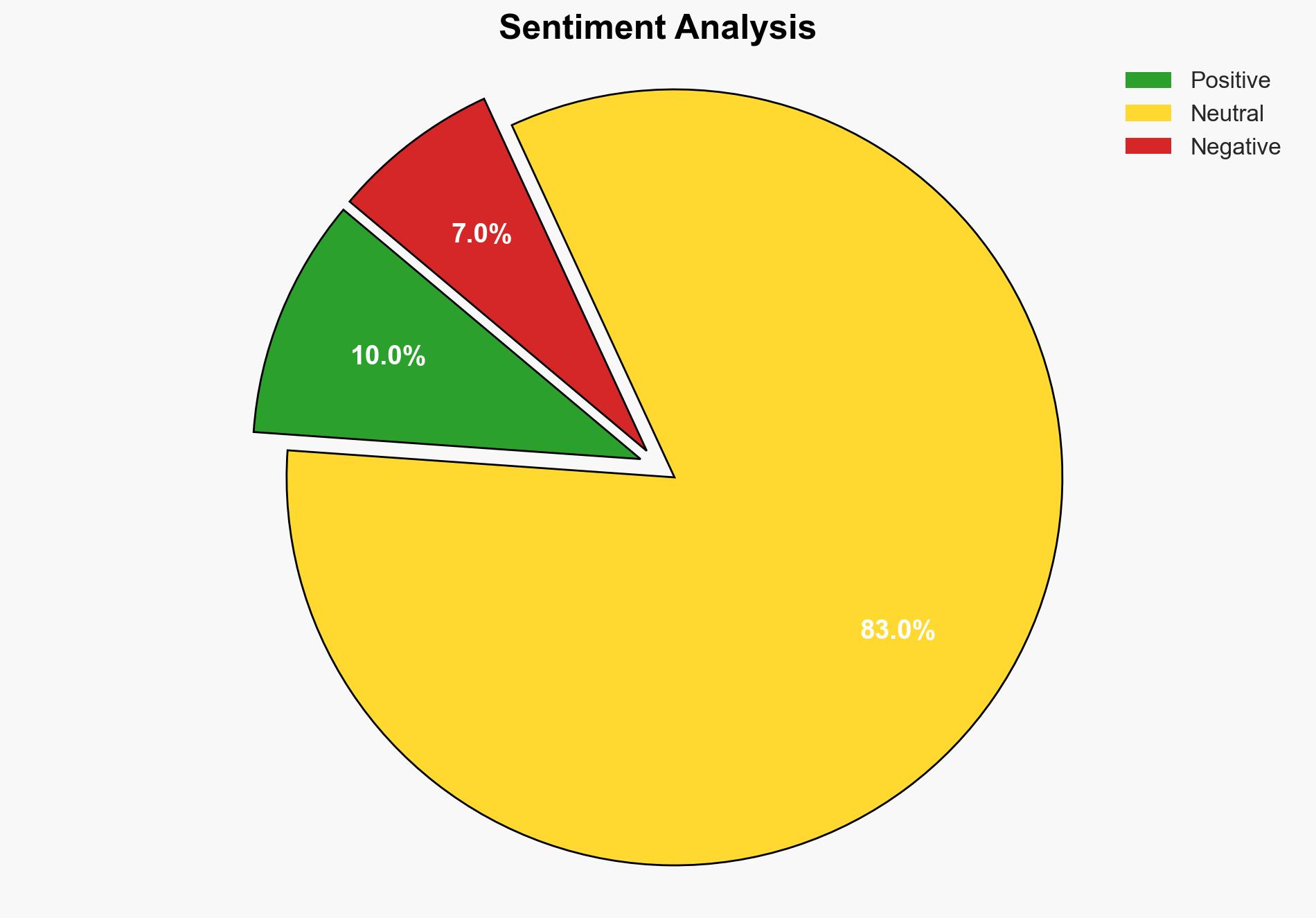

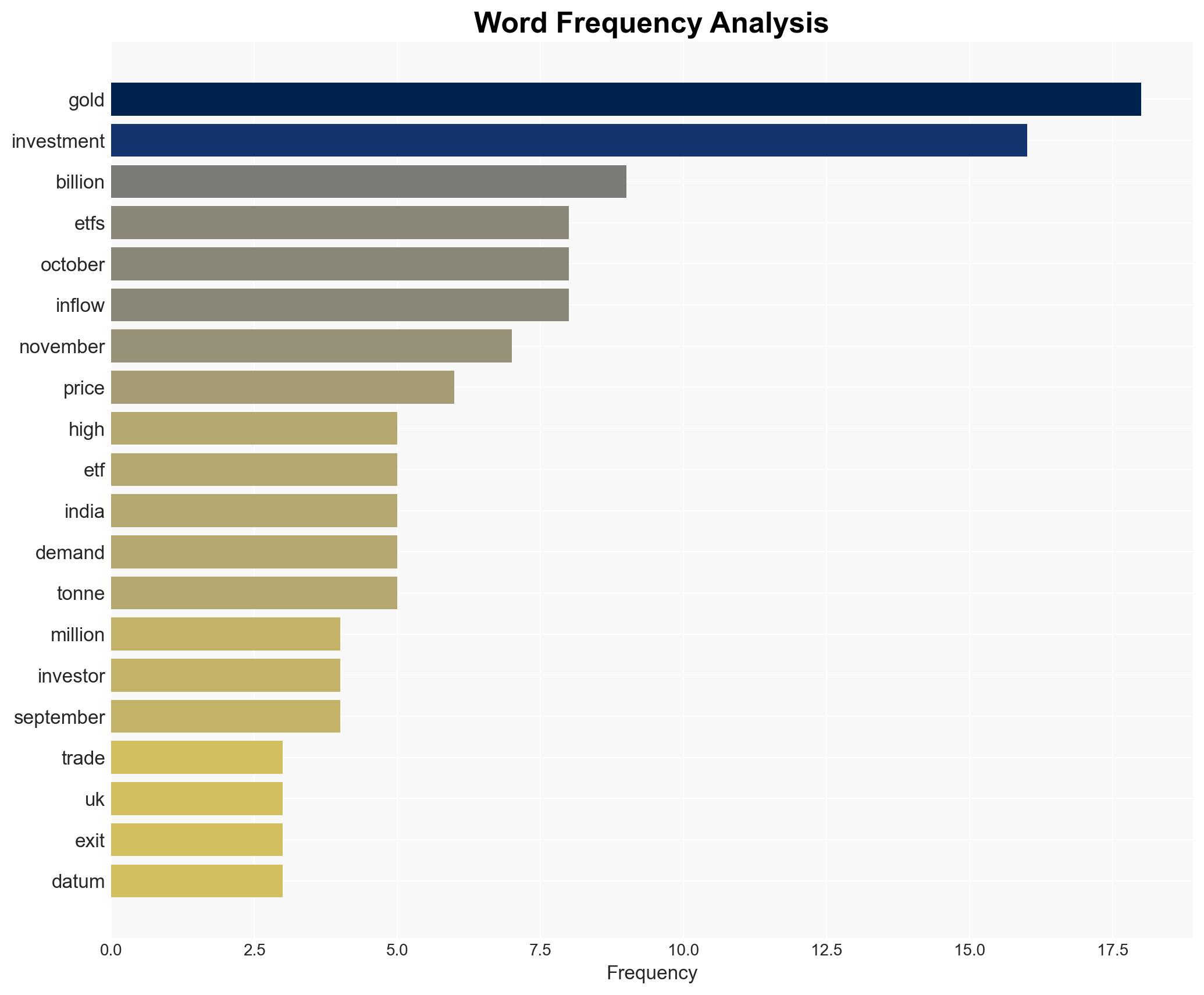

With a moderate confidence level, the most supported hypothesis is that Indian investments in gold ETFs are primarily driven by geopolitical uncertainties and economic volatility, leading investors to seek safe-haven assets. It is recommended to monitor geopolitical developments closely and assess their impact on investment behaviors.

2. Competing Hypotheses

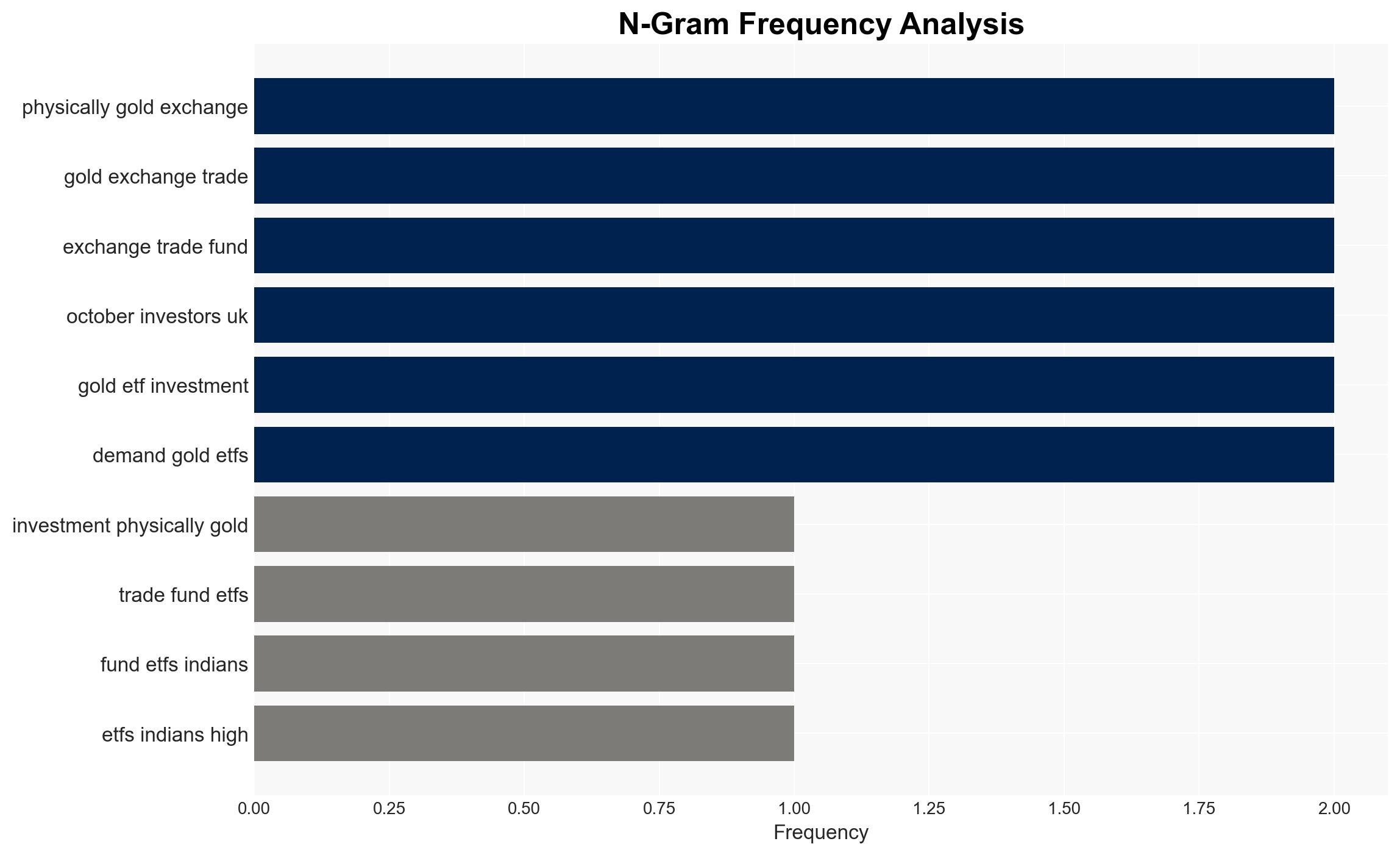

Hypothesis 1: Indian investments in gold ETFs are driven by geopolitical uncertainties and economic volatility, prompting investors to seek safe-haven assets.

Hypothesis 2: The increase in Indian investments in gold ETFs is primarily due to domestic factors such as festive season demand and cultural affinity towards gold.

Hypothesis 1 is more likely due to the global trend of increased gold ETF investments in response to geopolitical tensions and economic instability, as indicated by similar patterns in other countries.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that geopolitical tensions and economic volatility have a direct impact on investment behaviors. Additionally, it is assumed that data from the World Gold Council is accurate and comprehensive.

Red Flags: Potential bias in data interpretation due to cultural factors influencing investment decisions. Lack of detailed breakdown of individual vs. institutional investments could skew analysis.

4. Implications and Strategic Risks

Increased investments in gold ETFs could lead to a shift in asset allocation strategies, impacting financial markets. Geopolitical tensions could exacerbate economic instability, leading to further volatility in gold prices. A significant downturn in gold prices could result in substantial financial losses for investors heavily invested in gold ETFs.

5. Recommendations and Outlook

- Monitor geopolitical developments and economic indicators closely to anticipate shifts in investment behaviors.

- Encourage diversification of investment portfolios to mitigate risks associated with heavy reliance on gold ETFs.

- Best-case scenario: Stabilization of geopolitical tensions leads to a balanced investment environment.

- Worst-case scenario: Escalation of geopolitical conflicts results in extreme market volatility and financial instability.

- Most-likely scenario: Continued moderate investment in gold ETFs as a hedge against ongoing uncertainties.

6. Key Individuals and Entities

The World Gold Council is a key entity providing data and insights on gold investment trends.

7. Thematic Tags

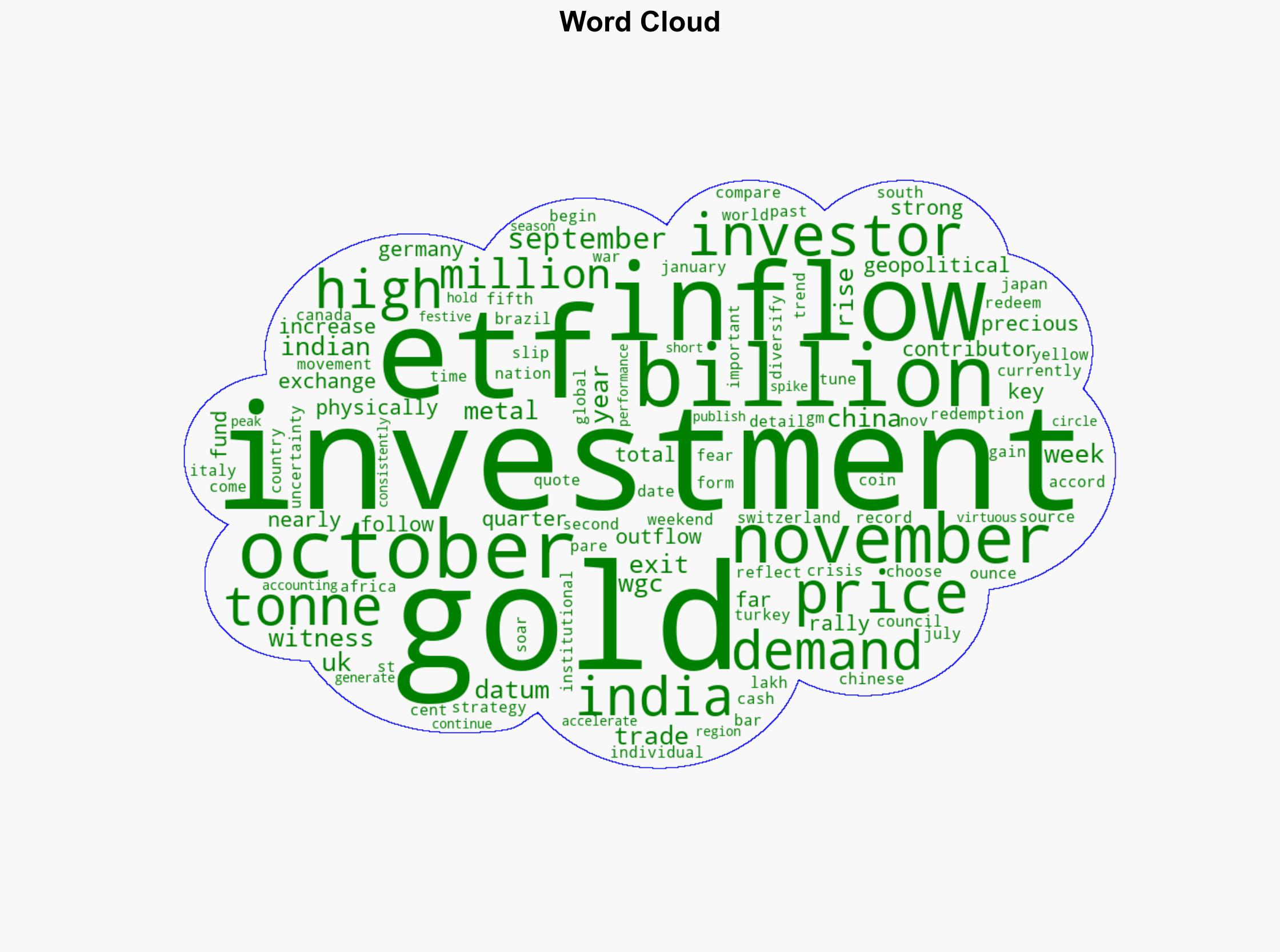

Regional Focus, Regional Focus: India, Global Economic Trends, Geopolitical Uncertainty

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·