Indian markets decline amid US-China tensions precious metals hit all-time high – The Times of India

Published on: 2025-10-15

Intelligence Report: Indian markets decline amid US-China tensions precious metals hit all-time high – The Times of India

1. BLUF (Bottom Line Up Front)

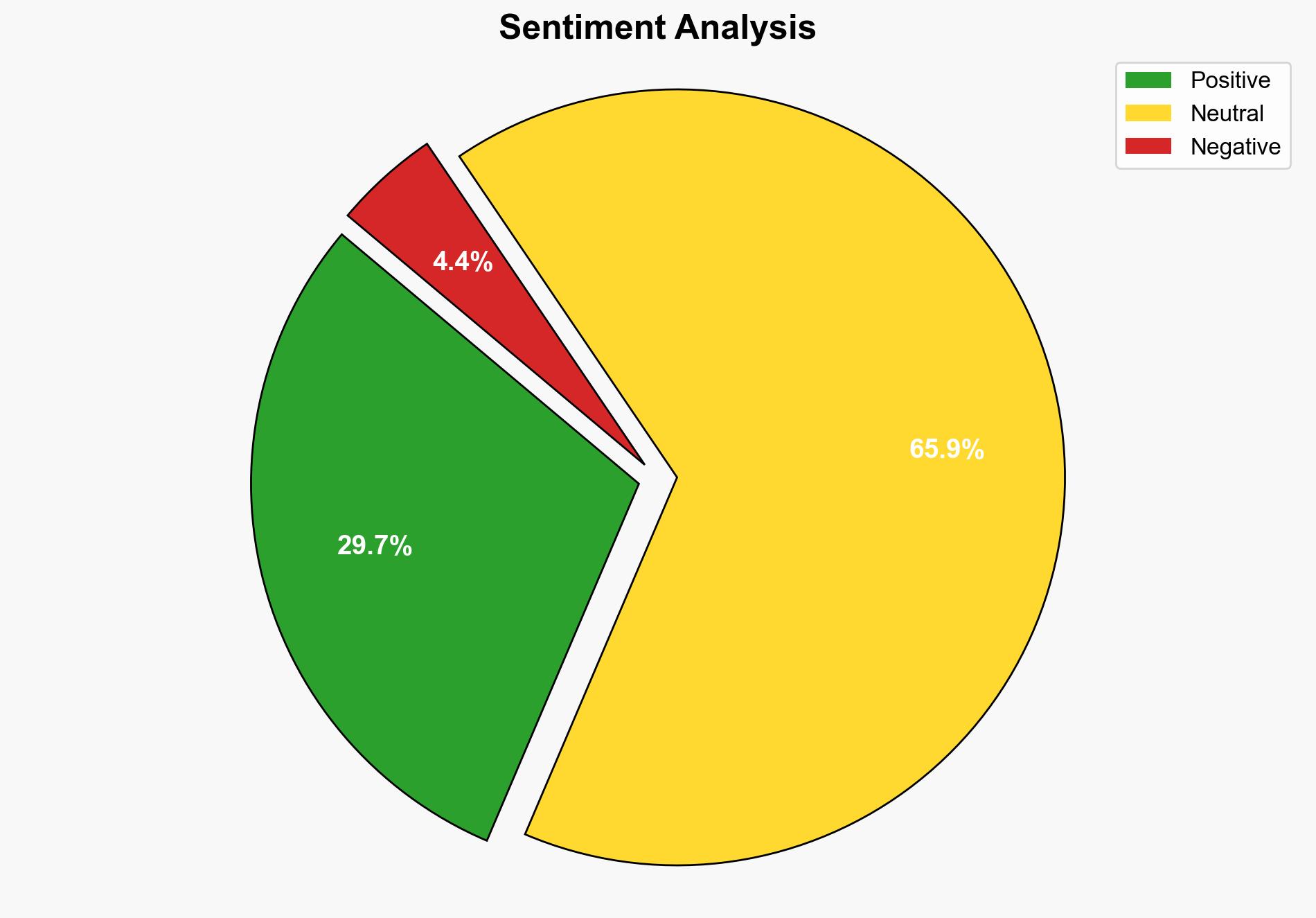

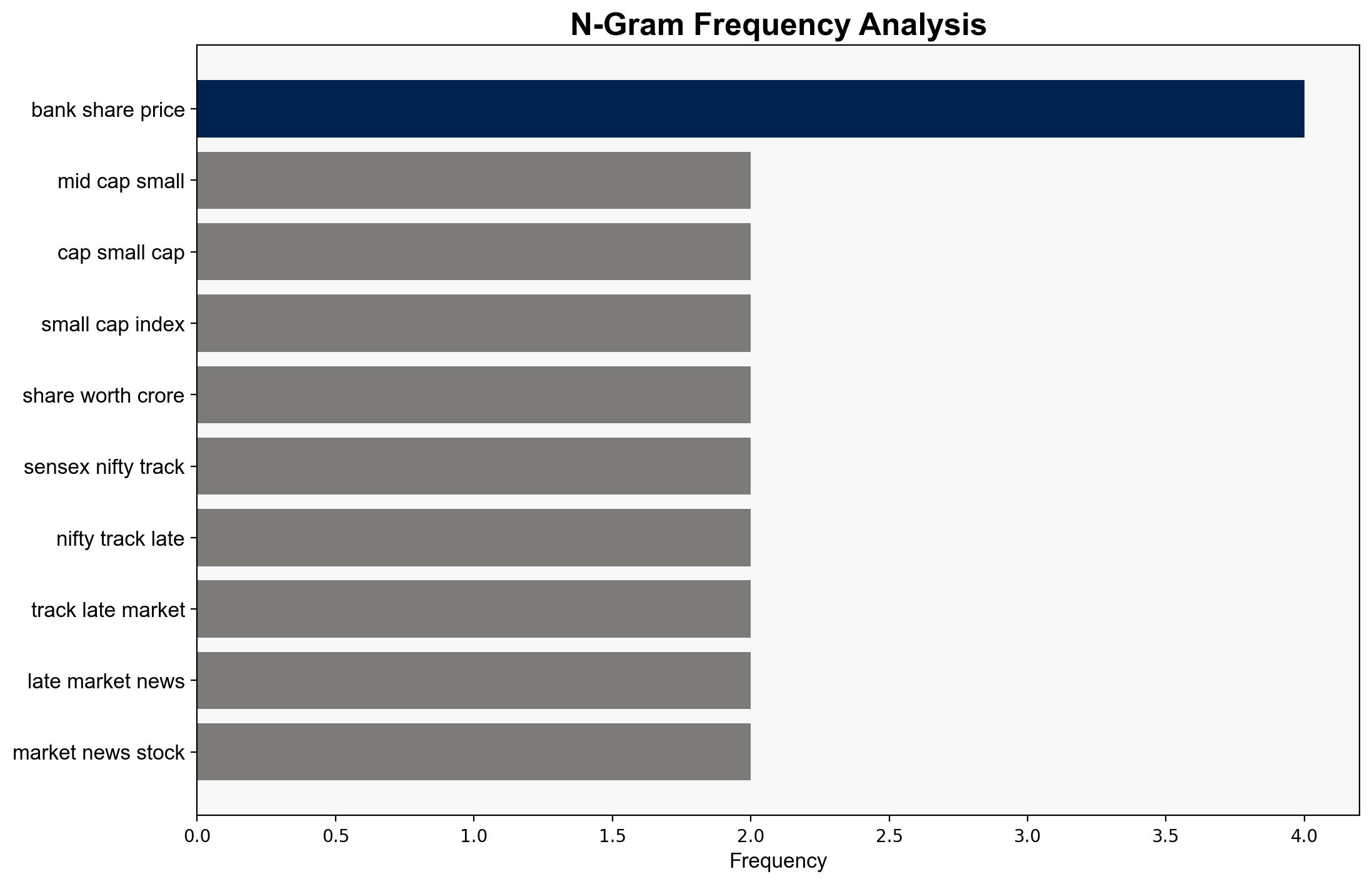

The Indian stock market’s decline, juxtaposed with the rise in precious metals, suggests a shift in investor sentiment driven by global geopolitical tensions. The most supported hypothesis is that investor fear, fueled by US-China tensions, is causing a flight to safety in precious metals. Confidence level: Moderate. Recommended action: Monitor geopolitical developments closely and advise stakeholders to diversify portfolios to hedge against volatility.

2. Competing Hypotheses

1. **Hypothesis A**: The decline in Indian markets is primarily due to US-China tensions, leading investors to seek safety in precious metals, thus driving their prices to all-time highs.

2. **Hypothesis B**: The decline is driven by domestic factors such as profit-taking and sectoral underperformance, with the rise in precious metals being coincidental and driven by separate global market dynamics.

Using ACH 2.0, Hypothesis A is better supported as the correlation between geopolitical tensions and market behavior is historically strong, and the simultaneous rise in precious metals suggests a classic flight-to-safety response.

3. Key Assumptions and Red Flags

– Assumption: Geopolitical tensions directly impact investor behavior in the Indian market.

– Red Flag: Lack of specific data linking US-China tensions to Indian market movements.

– Blind Spot: Potential domestic economic factors influencing market trends are not fully explored.

4. Implications and Strategic Risks

– Economic: Prolonged tensions could lead to sustained market volatility, affecting investment inflows.

– Geopolitical: Escalation in US-China tensions may further destabilize regional markets.

– Psychological: Increased investor anxiety could exacerbate market swings and lead to irrational decision-making.

5. Recommendations and Outlook

- Advise stakeholders to diversify investments, including precious metals, to mitigate risks.

- Monitor geopolitical developments and adjust strategies accordingly.

- Scenario Projections:

- Best: Diplomatic resolutions ease tensions, stabilizing markets.

- Worst: Escalation leads to broader economic impacts and market downturns.

- Most Likely: Continued volatility with periodic market corrections.

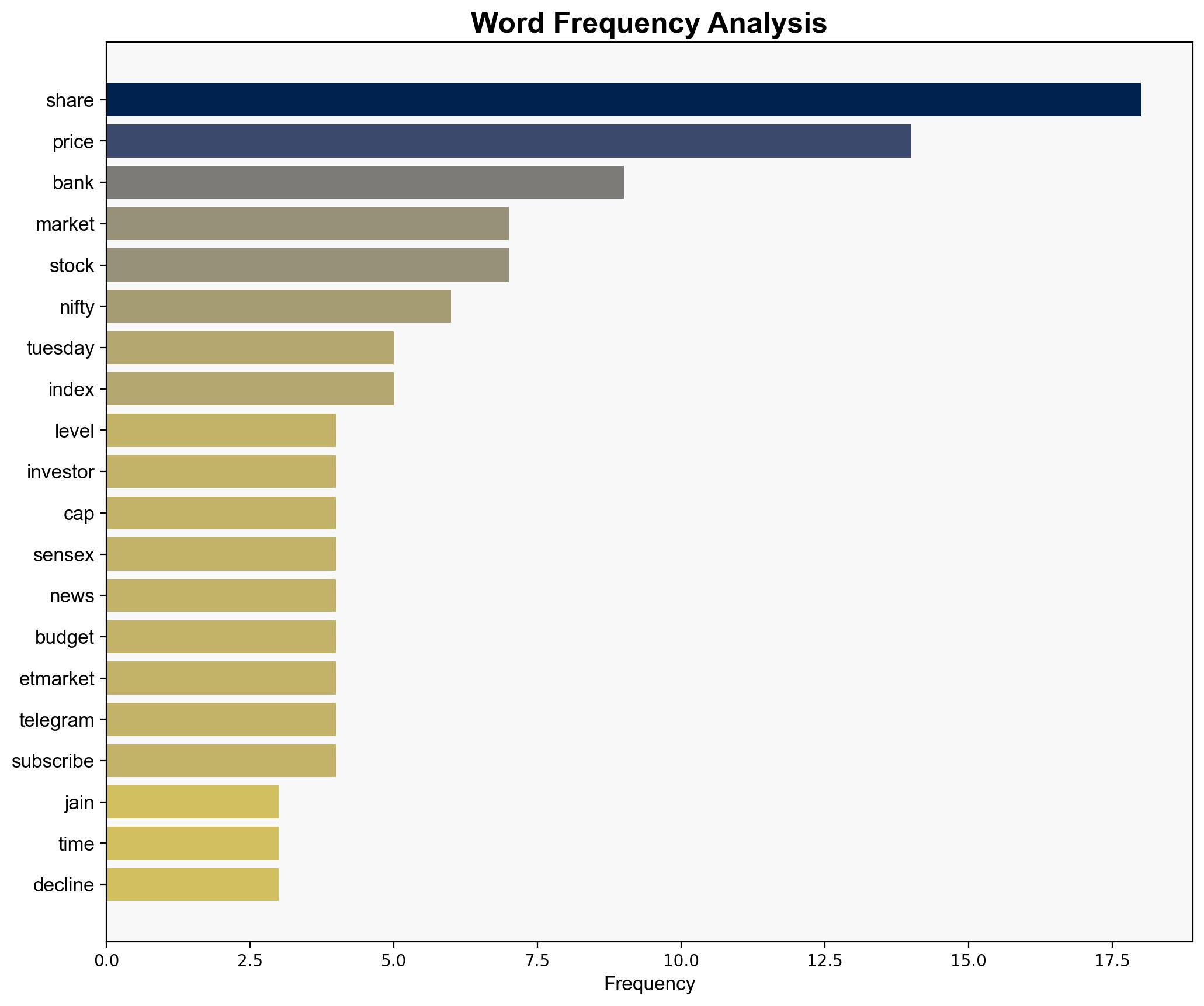

6. Key Individuals and Entities

– Nilesh Jain

– Gaurav Sharma

7. Thematic Tags

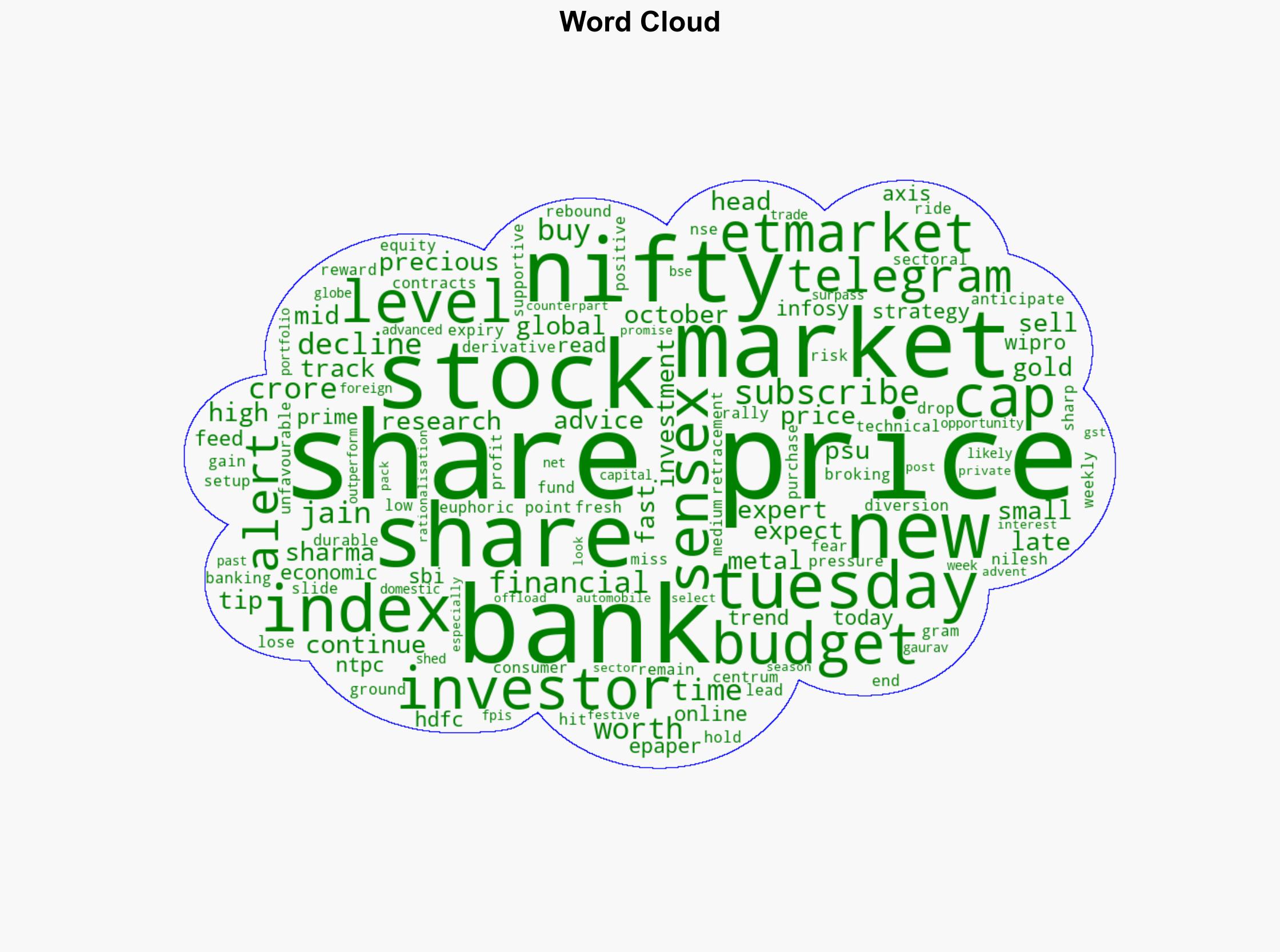

national security threats, economic volatility, geopolitical tensions, market analysis