India’s renewables space has more scope for platform assets Brookfield’s Nawal Saini – Livemint

Published on: 2025-09-10

Intelligence Report: India’s renewables space has more scope for platform assets Brookfield’s Nawal Saini – Livemint

1. BLUF (Bottom Line Up Front)

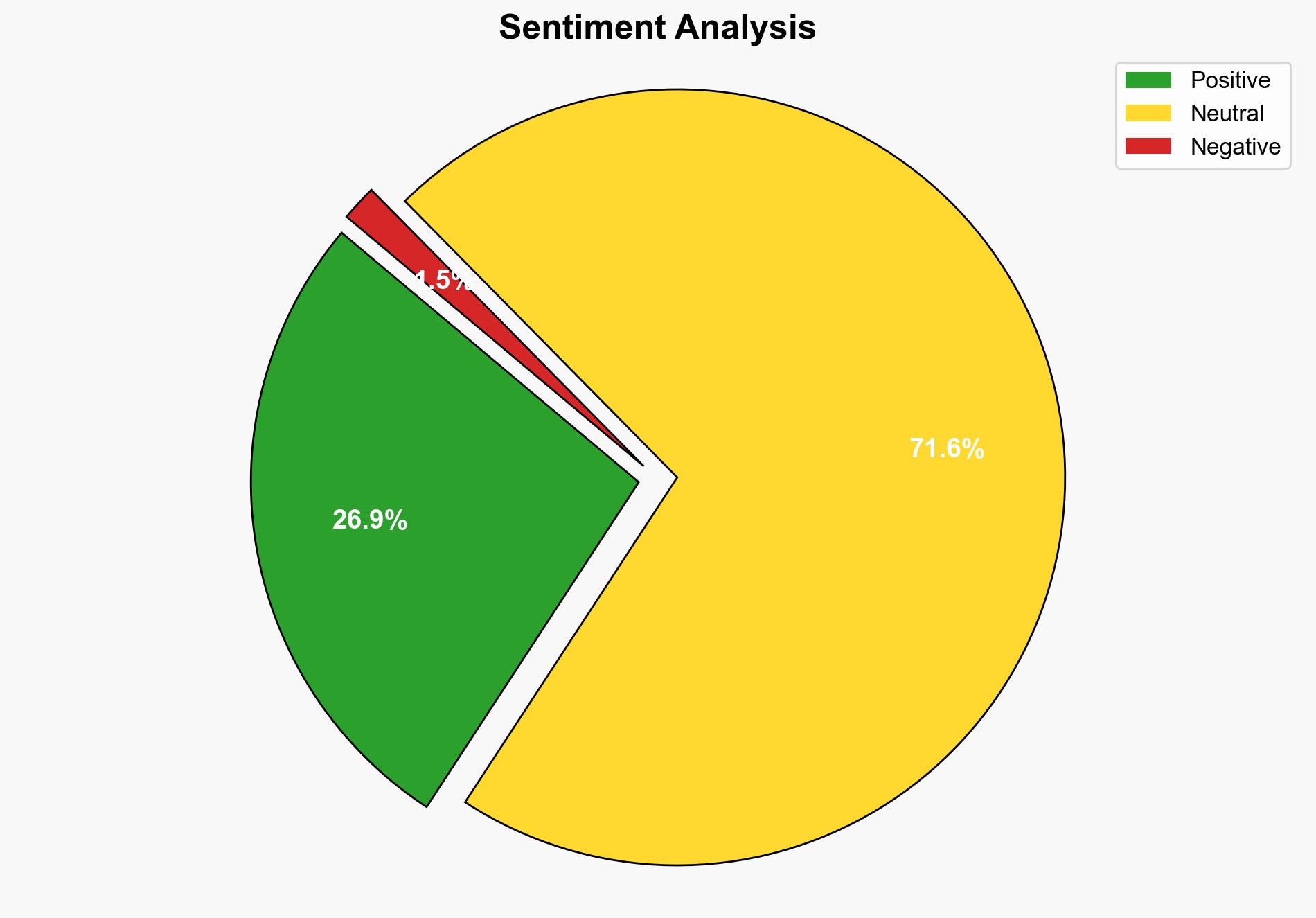

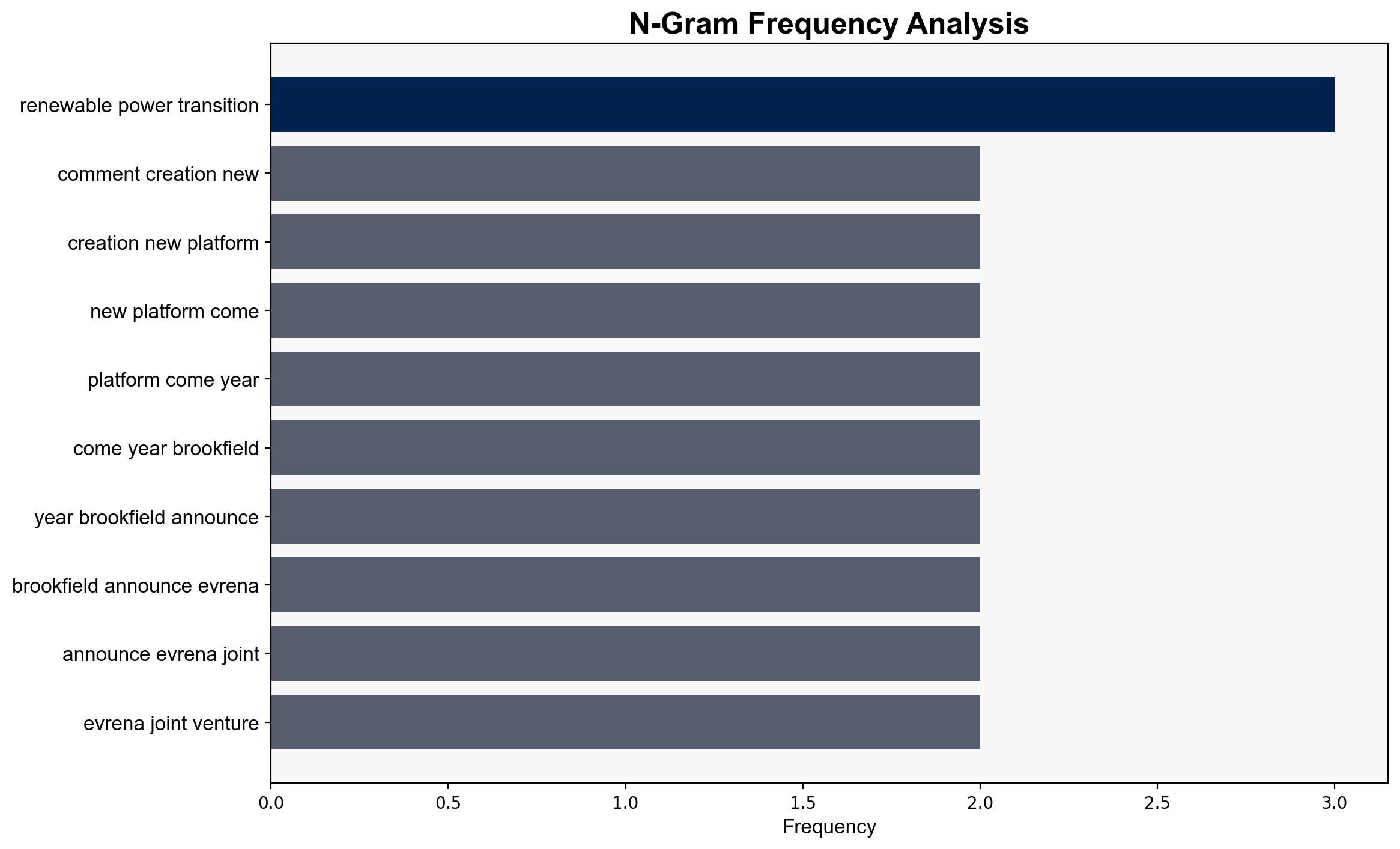

India’s renewable energy sector presents significant growth opportunities, particularly for platform assets. Brookfield’s strategic moves, including joint ventures and investments, suggest a robust expansion plan. The most supported hypothesis is that Brookfield will successfully leverage India’s renewable energy market to enhance its portfolio, driven by government support and market demand. Confidence level: High. Recommended action: Monitor Brookfield’s partnerships and policy developments to anticipate market shifts and investment opportunities.

2. Competing Hypotheses

Hypothesis 1: Brookfield will successfully establish a strong platform in India’s renewable energy sector, driven by strategic partnerships, government support, and increasing market demand.

Hypothesis 2: Brookfield’s efforts may face significant challenges due to regulatory hurdles, competition, and potential policy shifts, limiting their ability to capitalize on the market.

Using ACH 2.0, Hypothesis 1 is better supported due to Brookfield’s existing investments, government incentives, and the strategic importance of renewable energy in India’s economic plans.

3. Key Assumptions and Red Flags

Assumptions include the continued support of the Indian government for renewable energy and the stability of regulatory frameworks. A red flag is the potential for policy changes that could impact foreign investments. Another assumption is Brookfield’s ability to manage and integrate new assets effectively, which could be challenged by operational complexities.

4. Implications and Strategic Risks

The expansion of renewable energy platforms in India could enhance energy security and reduce carbon emissions, aligning with global sustainability goals. However, risks include potential geopolitical tensions affecting energy policies and market volatility impacting investment returns. The shift towards renewable energy could also disrupt traditional energy sectors, leading to economic and social adjustments.

5. Recommendations and Outlook

- Monitor regulatory developments and potential policy shifts that could affect renewable energy investments in India.

- Engage with local stakeholders to mitigate risks associated with market entry and operational integration.

- Scenario-based projections:

- Best: Brookfield successfully expands its platform, achieving high returns and setting a precedent for further investments.

- Worst: Regulatory changes and market competition hinder Brookfield’s expansion, resulting in financial losses.

- Most likely: Brookfield navigates challenges effectively, achieving moderate growth and establishing a foothold in the market.

6. Key Individuals and Entities

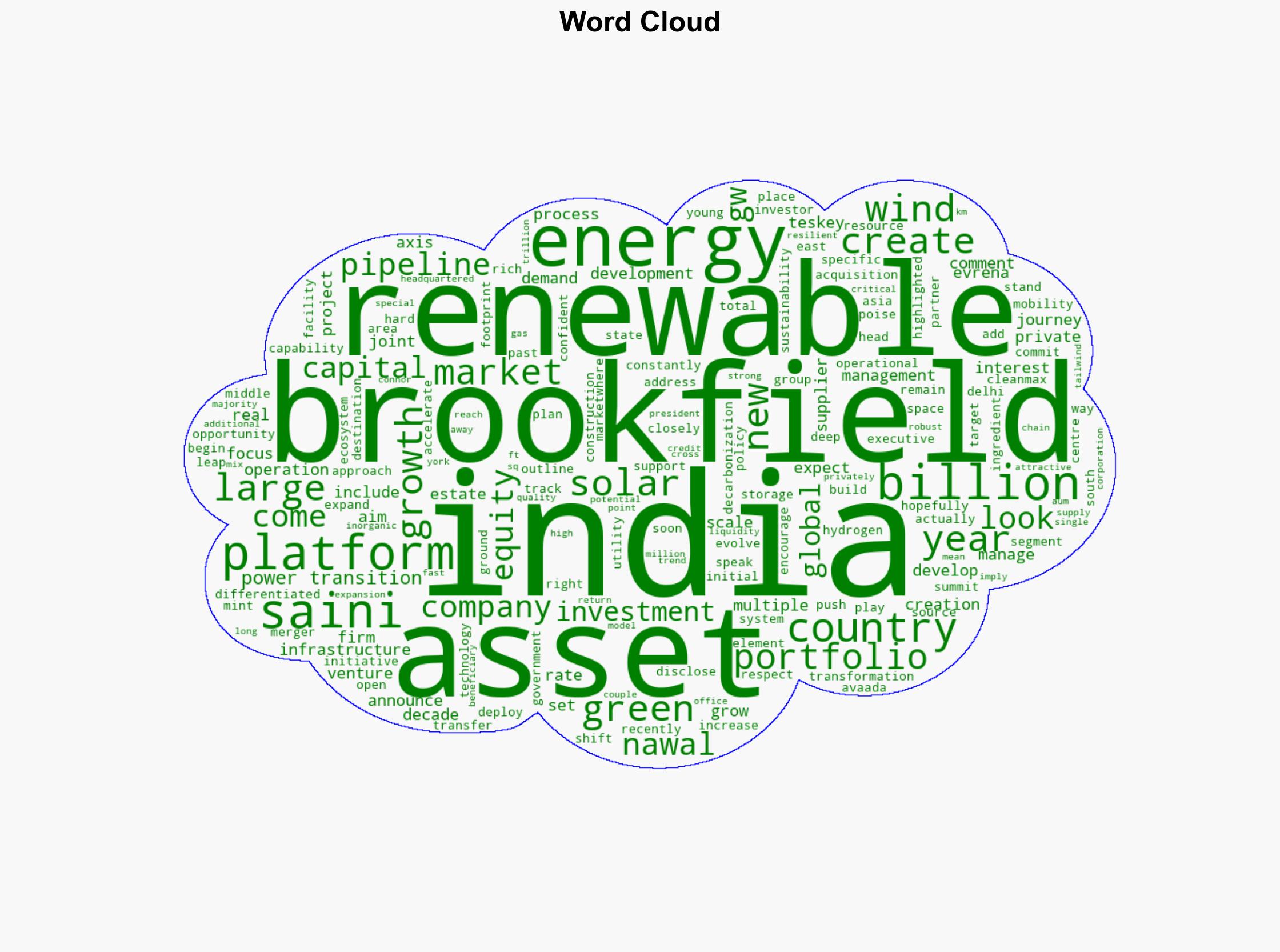

Nawal Saini, Brookfield, Evrena, Axis Energy, Leap Green Energy, CleanMax, Avaada Group.

7. Thematic Tags

renewable energy, investment strategy, India market, regulatory environment, strategic partnerships