Intel’s Tick-Tock Isn’t Coming Back – Slashdot.org

Published on: 2025-10-24

Intelligence Report: Intel’s Tick-Tock Isn’t Coming Back – Slashdot.org

1. BLUF (Bottom Line Up Front)

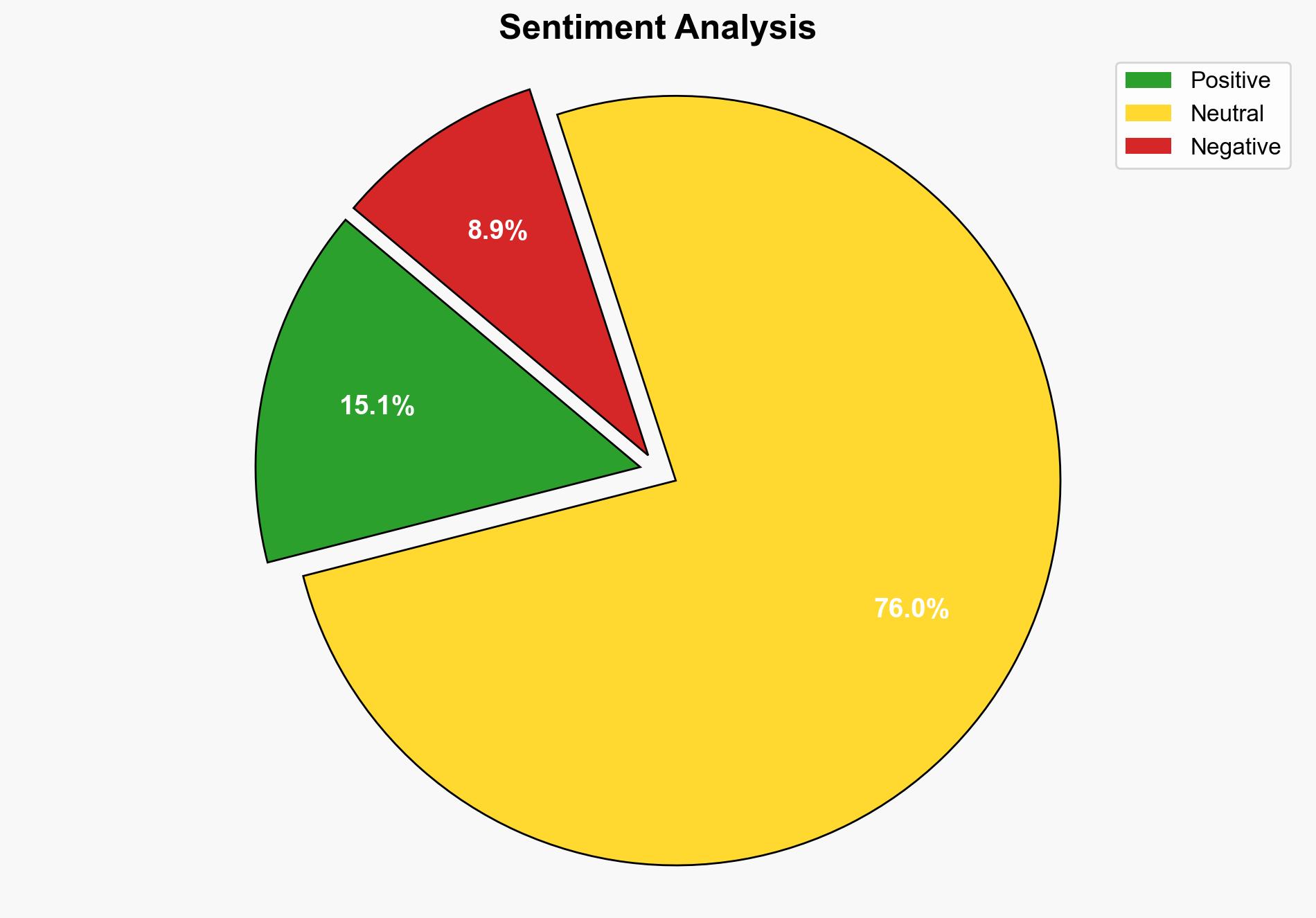

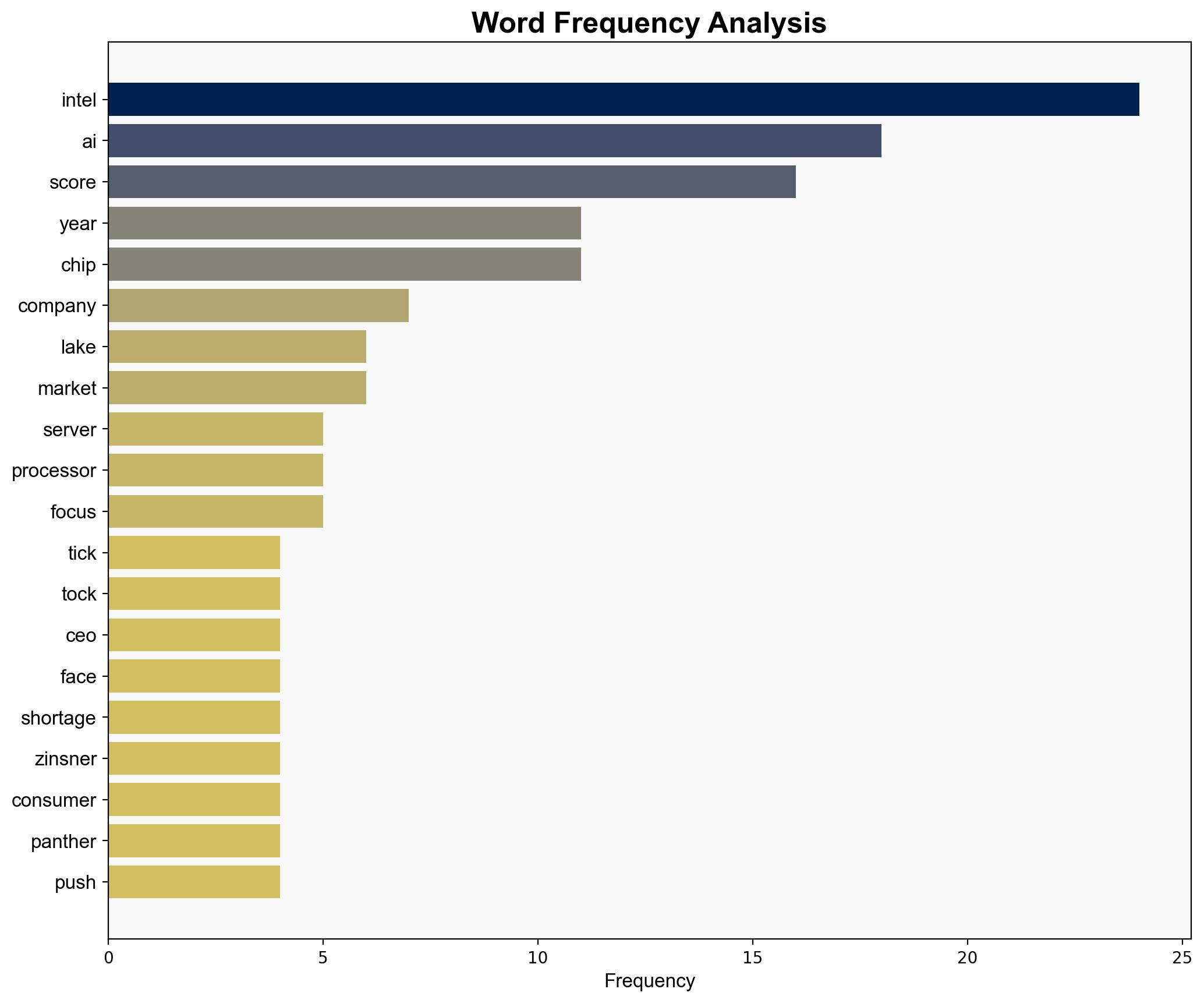

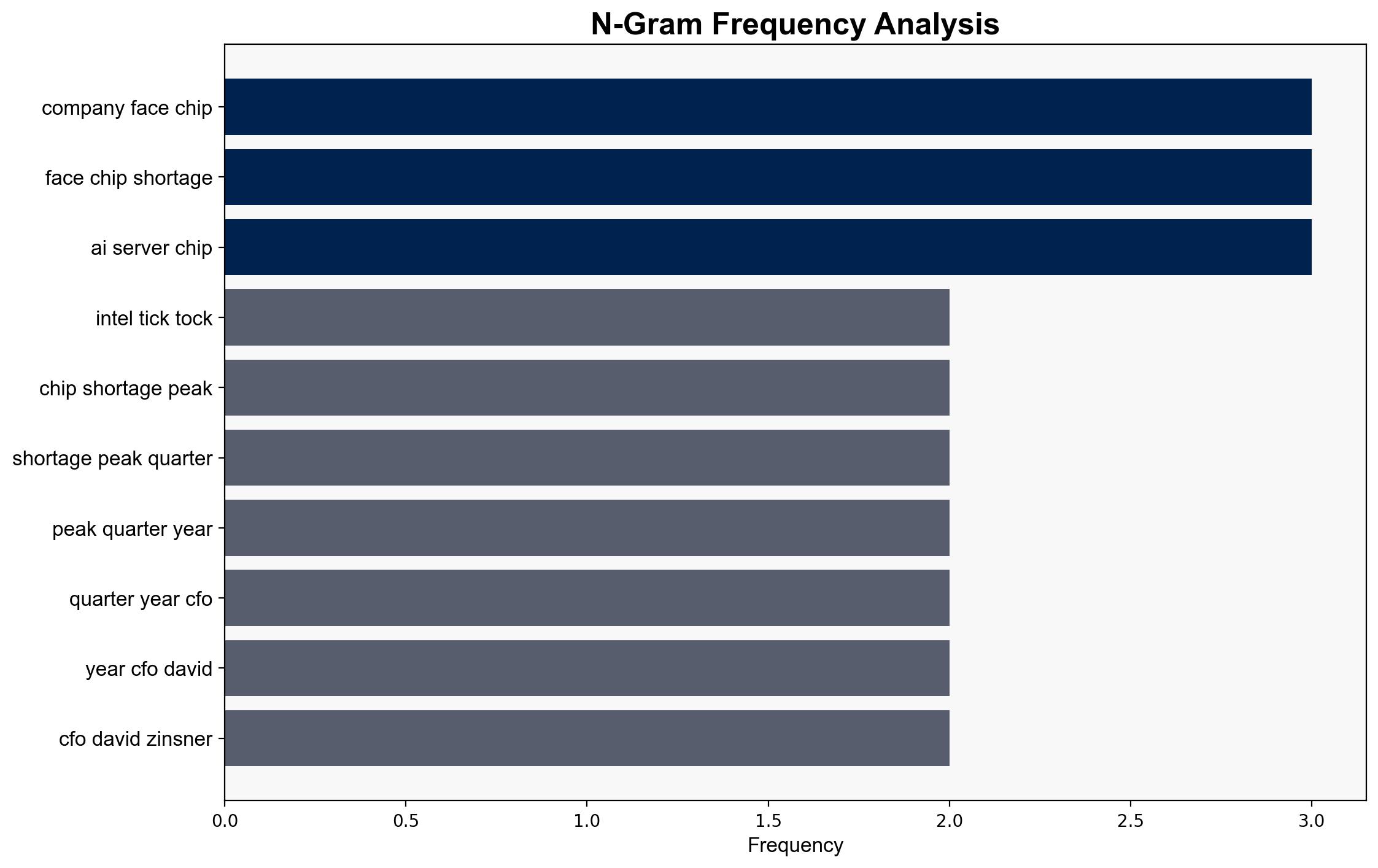

Intel is unlikely to return to its previous “Tick-Tock” development cadence due to strategic shifts towards AI and server chip prioritization amid ongoing chip shortages. The most supported hypothesis is that Intel’s focus on AI and server markets is a strategic adaptation to current market conditions, rather than a temporary deviation. Confidence level: Moderate. Recommended action: Monitor Intel’s strategic shifts and market responses, particularly in AI and server sectors, to assess long-term viability and potential impacts on competitors.

2. Competing Hypotheses

1. **Hypothesis A**: Intel’s shift away from the “Tick-Tock” model is a permanent strategic pivot towards AI and server markets, driven by long-term market trends and competitive pressures.

2. **Hypothesis B**: Intel’s current focus on AI and server chips is a temporary response to immediate challenges such as chip shortages and investor pressures, with plans to revert to traditional models once conditions stabilize.

Using ACH 2.0, Hypothesis A is better supported due to Intel’s significant investments in AI and server technologies, as well as external pressures from competitors like AMD and ARM. Hypothesis B lacks strong evidence of a planned return to the “Tick-Tock” model.

3. Key Assumptions and Red Flags

– **Assumptions**: Intel’s strategic focus on AI and server chips will yield long-term profitability. The chip shortage is a temporary issue that will not fundamentally alter market dynamics.

– **Red Flags**: Overreliance on AI market growth projections, potential underestimation of competitors’ advancements, and lack of clear communication on long-term strategy.

– **Blind Spots**: Possible underestimation of consumer processor market resilience and the impact of geopolitical factors on supply chains.

4. Implications and Strategic Risks

– **Economic**: Intel’s shift could lead to increased market share in AI and server sectors but risks losing ground in consumer processors.

– **Cyber**: Increased focus on AI may expose Intel to cybersecurity risks associated with AI technologies.

– **Geopolitical**: Chip shortages could be exacerbated by geopolitical tensions, affecting Intel’s supply chain and market position.

– **Psychological**: Investor confidence may waver if Intel’s strategic shifts do not yield expected results, impacting stock performance.

5. Recommendations and Outlook

- Monitor Intel’s AI and server chip developments and market reception closely.

- Engage in scenario planning to prepare for potential supply chain disruptions.

- Consider strategic partnerships or acquisitions to bolster AI capabilities.

- Scenario Projections:

- Best Case: Intel successfully captures significant AI market share, offsetting consumer processor losses.

- Worst Case: AI market growth stalls, leaving Intel vulnerable to competitors.

- Most Likely: Intel maintains a balanced portfolio with moderate success in AI and server markets.

6. Key Individuals and Entities

– Lip-Bu Tan

– David Zinsner

– Competitors: AMD, ARM

– Partners: Nvidia, SoftBank

7. Thematic Tags

national security threats, cybersecurity, economic strategy, technology market dynamics