Investors facing tariff turmoil ‘It’s fastest finger first’ – BBC News

Published on: 2025-04-10

Intelligence Report: Investors facing tariff turmoil ‘It’s fastest finger first’ – BBC News

1. BLUF (Bottom Line Up Front)

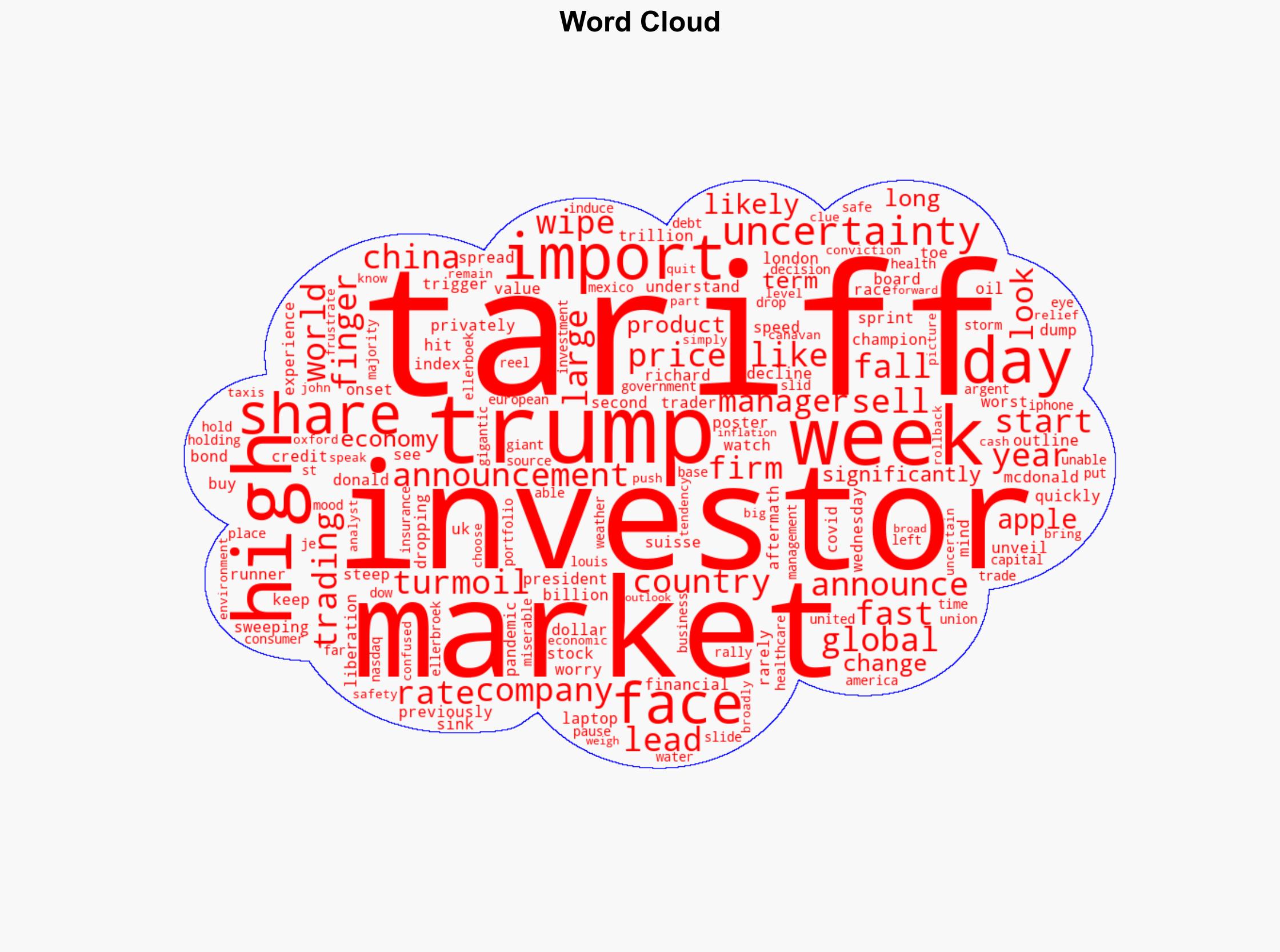

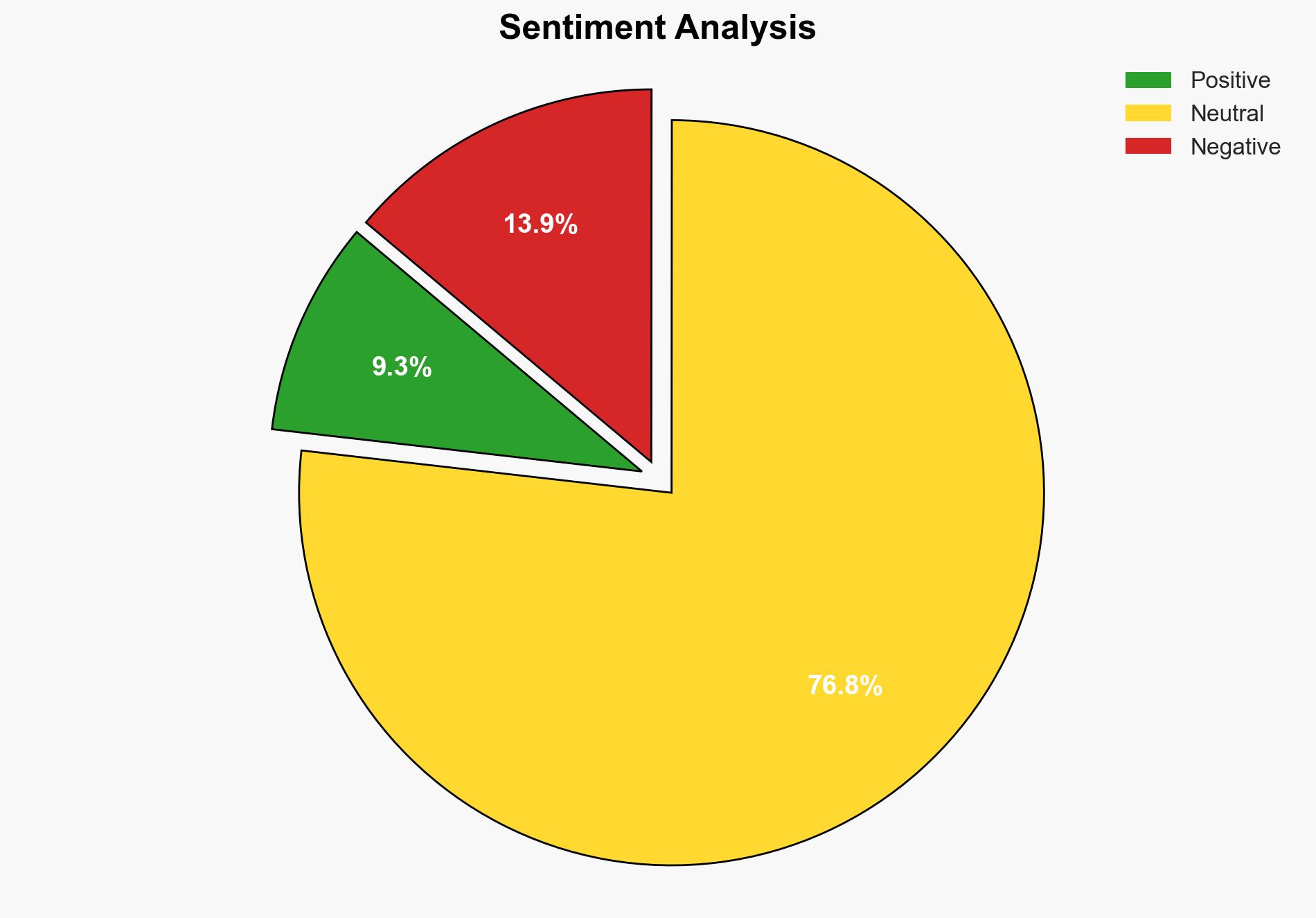

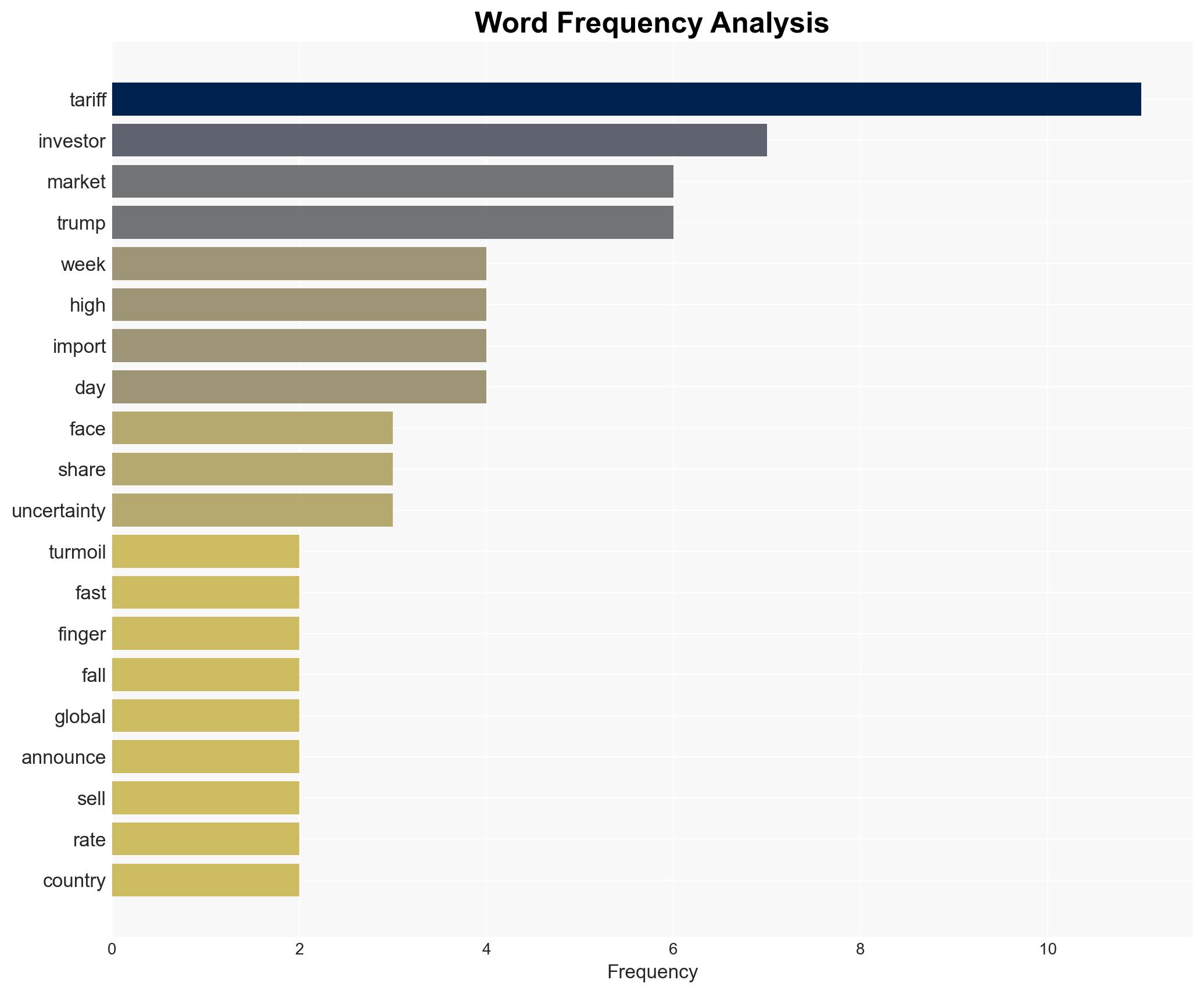

The recent announcement of global tariffs by Donald Trump has triggered significant volatility in financial markets, leading to rapid declines in major stock indexes and increased uncertainty among investors. Key findings indicate that the tariffs, particularly those targeting China, have caused widespread market disruption, with trillions in value lost. Immediate action is required to address the economic instability and provide clarity to market participants.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

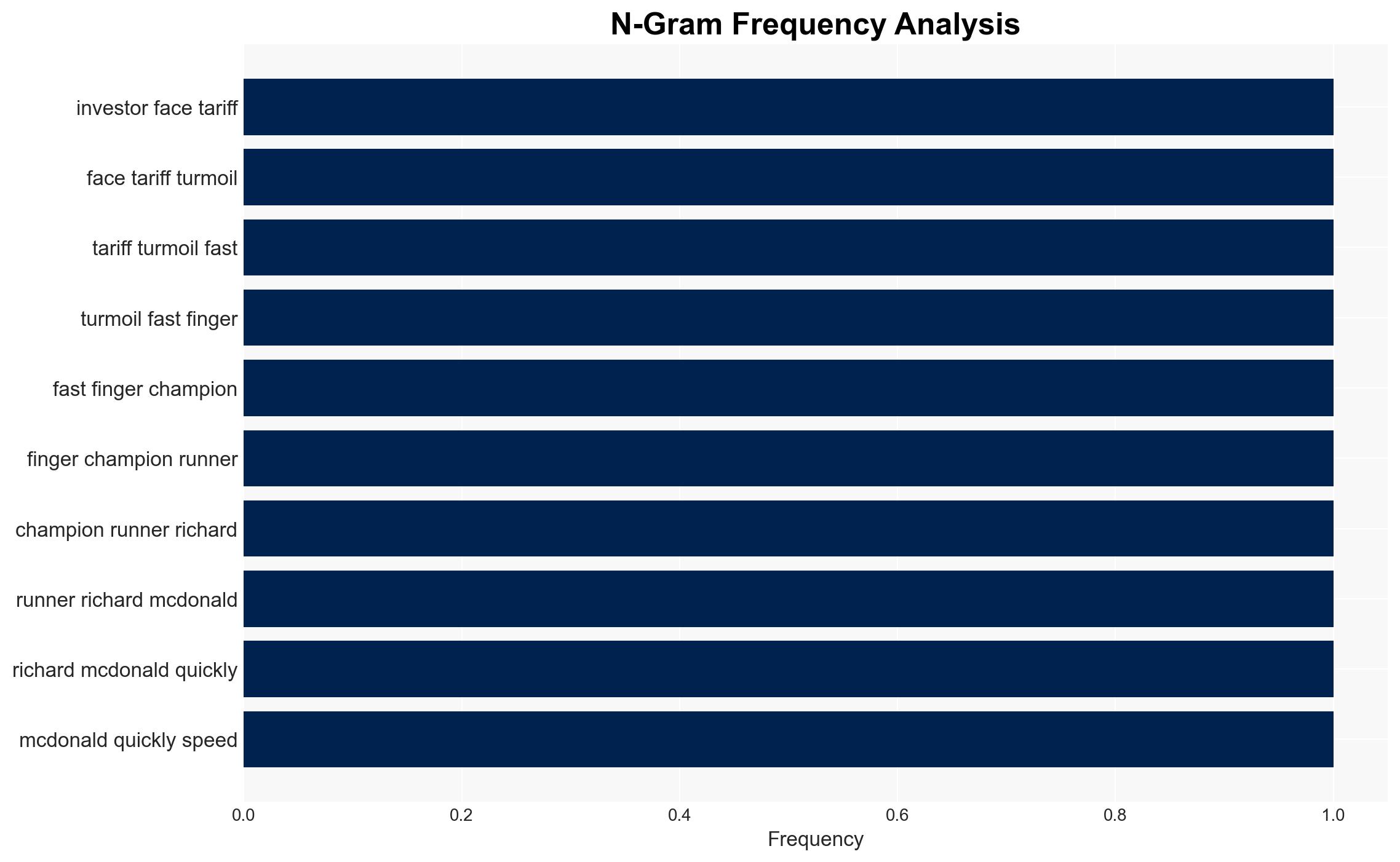

The imposition of tariffs as high as 145% on imports from China has led to a sharp decline in global stock markets, with the S&P 500, Dow, and Nasdaq experiencing significant losses. The uncertainty surrounding future tariff rates has left investors hesitant to make long-term decisions, as evidenced by Richard McDonald’s rapid trading actions and Jed Ellerbroek’s cautious stance on investments like Apple. The market’s reaction underscores the sensitivity of global trade dynamics to policy changes.

3. Implications and Strategic Risks

The tariffs pose substantial risks to economic stability, with potential repercussions for national security and regional stability. The uncertainty has led to a sell-off in US government debt, traditionally a safe haven, indicating a loss of confidence in economic policy. The disruption in trade relations, particularly with China, could exacerbate tensions and impact global supply chains, affecting sectors reliant on international imports and exports.

4. Recommendations and Outlook

Recommendations:

- Engage in diplomatic negotiations to clarify tariff policies and reduce market uncertainty.

- Implement regulatory measures to stabilize financial markets and protect investor interests.

- Encourage diversification of supply chains to mitigate risks associated with trade disruptions.

Outlook:

In a best-case scenario, diplomatic efforts lead to a rollback of tariffs, stabilizing markets and restoring investor confidence. In a worst-case scenario, prolonged trade tensions result in sustained market volatility and economic downturn. The most likely outcome involves gradual adjustments in trade policies, with intermittent market fluctuations as stakeholders adapt to new economic realities.

5. Key Individuals and Entities

The report mentions significant individuals such as Richard McDonald, Donald Trump, Jed Ellerbroek, and John Canavan. Key entities include Credit Suisse, Argent Capital Management, and Oxford Economics. These individuals and organizations play crucial roles in the unfolding economic scenario, influencing market dynamics and investor sentiment.