Iranian Banks Left No Funds in Foreign Accounts Foreseeing Freezes – Sputnikglobe.com

Published on: 2025-09-30

Intelligence Report: Iranian Banks Left No Funds in Foreign Accounts Foreseeing Freezes – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

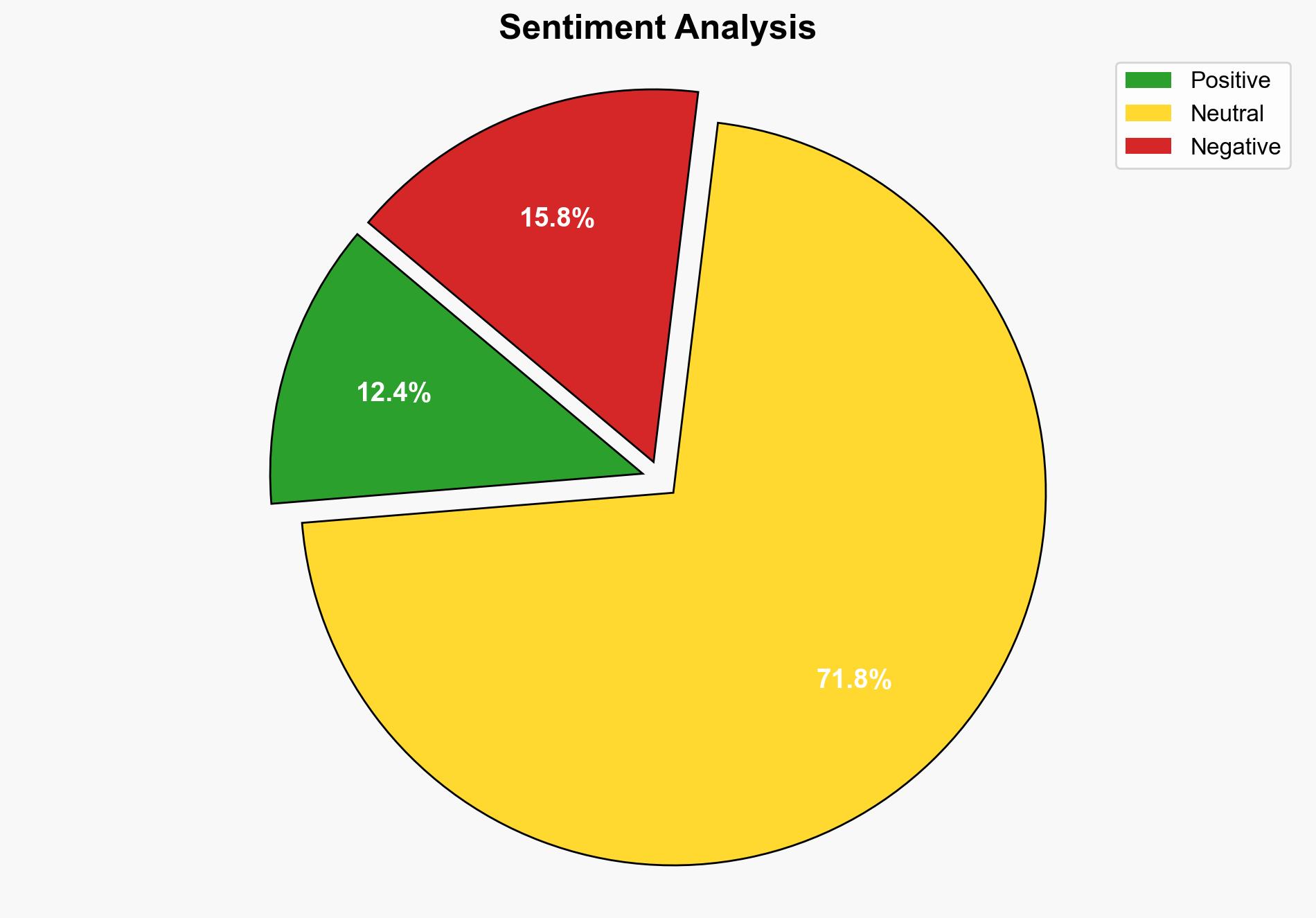

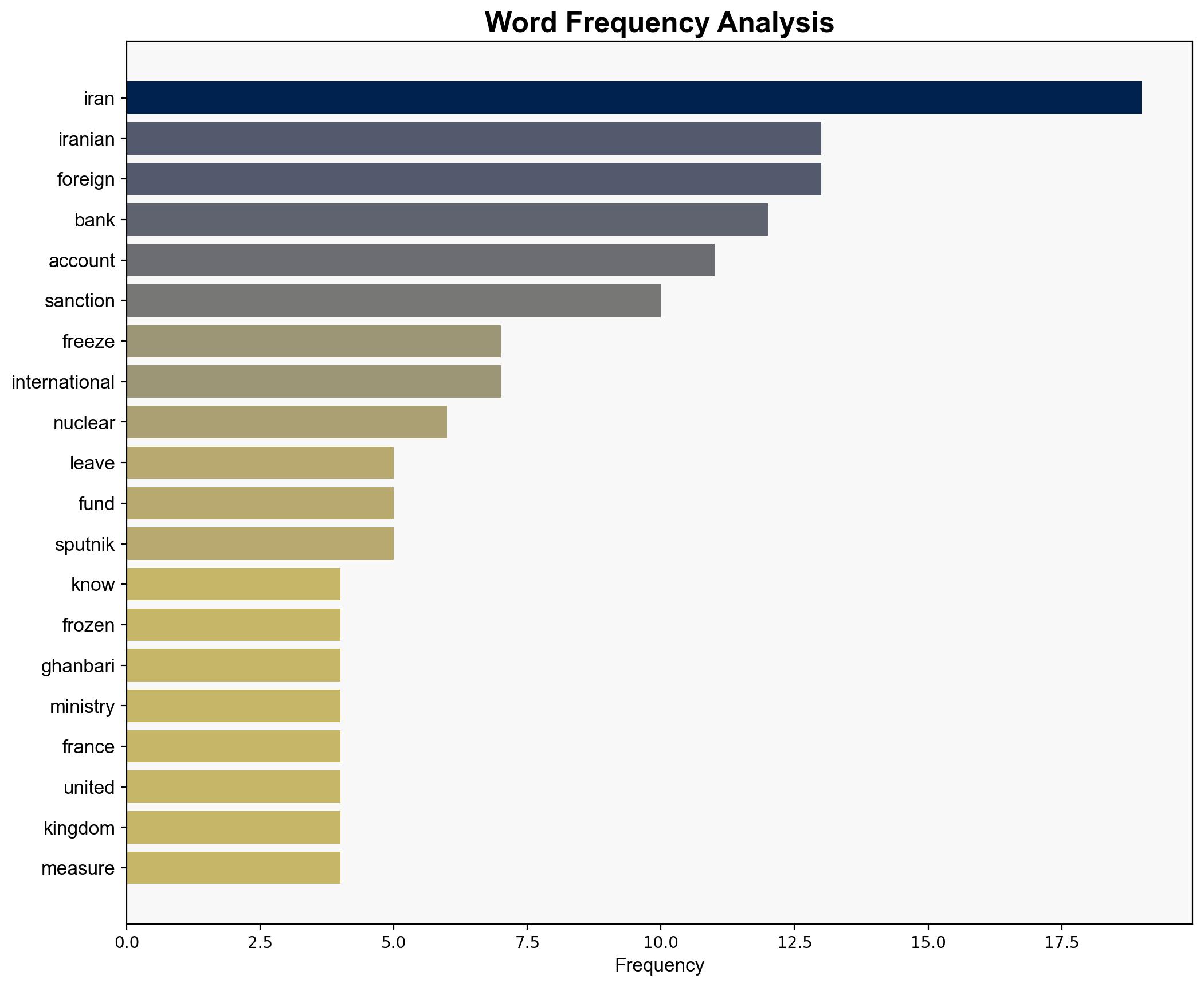

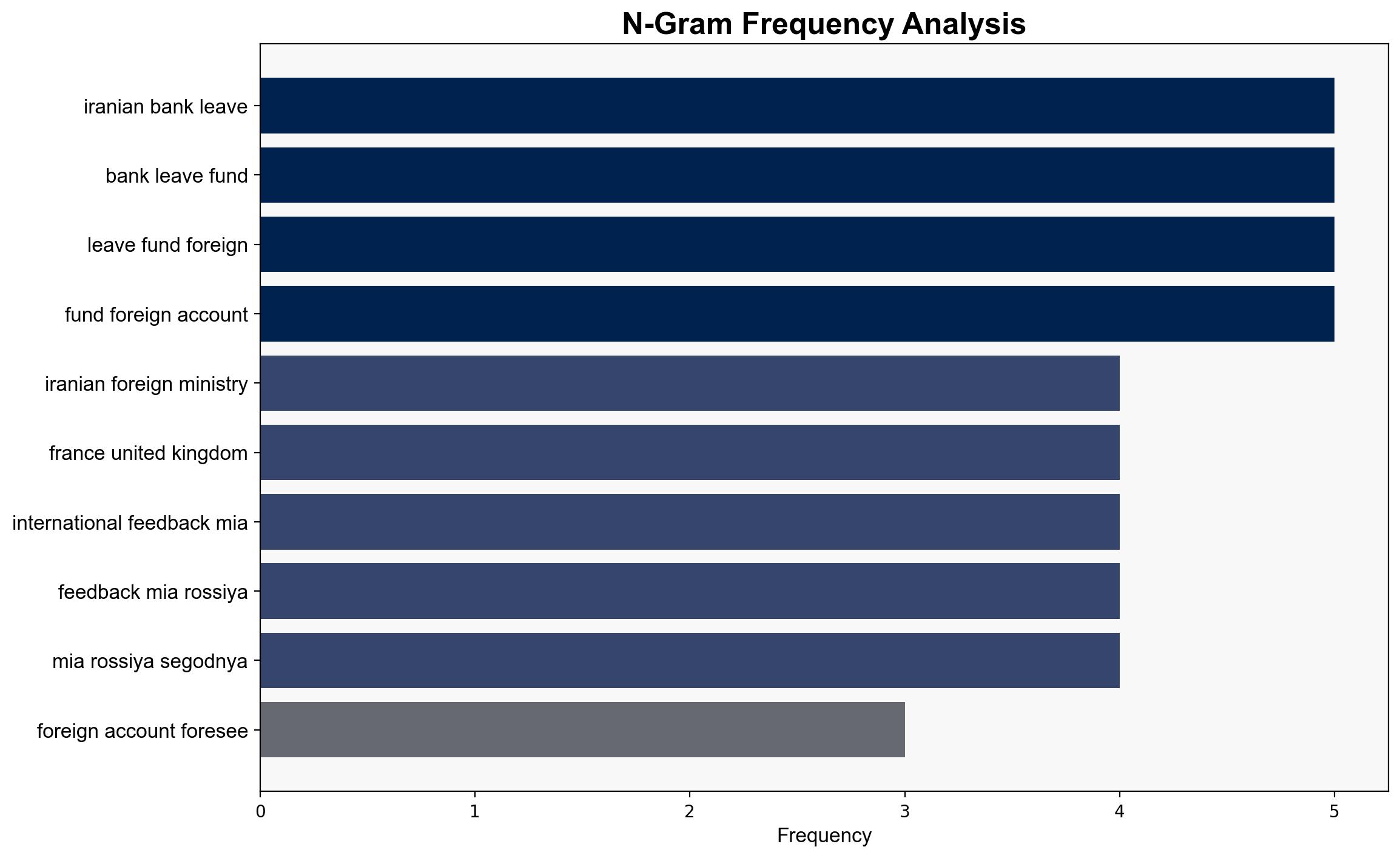

Iranian banks have reportedly minimized funds in foreign accounts to preempt potential asset freezes due to renewed sanctions. The most supported hypothesis is that this move is a strategic response to anticipated international financial restrictions. Confidence level: Moderate. Recommended action: Monitor financial transactions and diplomatic communications for further indications of Iran’s strategic adjustments.

2. Competing Hypotheses

1. **Strategic Withdrawal Hypothesis**: Iranian banks intentionally reduced foreign account balances to avoid asset freezes, anticipating sanctions reinstatement.

2. **Operational Necessity Hypothesis**: The reduction in foreign account balances is due to operational challenges or internal financial needs, rather than a strategic anticipation of sanctions.

Using the Analysis of Competing Hypotheses (ACH) 2.0, the Strategic Withdrawal Hypothesis is better supported by the timing of the EU’s announcement and Iran’s historical responses to sanctions. The Operational Necessity Hypothesis lacks direct evidence linking operational needs to the timing of fund withdrawals.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Iranian banks have the capability to predict and respond to international sanctions effectively. Another assumption is that the information provided by Hamid Ghanbari is accurate and not intended to mislead.

– **Red Flags**: The source is Sputnik, which may have biases or motivations to present information in a certain light. The lack of corroborating evidence from independent financial audits or third-party confirmations is a significant gap.

4. Implications and Strategic Risks

– **Economic Risks**: Potential destabilization of Iran’s international trade and financial transactions.

– **Geopolitical Risks**: Increased tensions between Iran and Western nations, particularly the EU, UK, and US, potentially leading to further diplomatic isolation.

– **Cyber Risks**: Possible increase in cyber activities as Iran seeks alternative methods to circumvent financial restrictions.

– **Psychological Risks**: Domestic unrest or dissatisfaction if economic conditions worsen due to sanctions.

5. Recommendations and Outlook

- Enhance monitoring of financial transactions involving Iranian entities to detect shifts in strategy.

- Engage in diplomatic dialogues to clarify intentions and reduce tensions.

- Scenario Projections:

- Best: Iran complies with international norms, leading to eased sanctions.

- Worst: Escalation of sanctions leading to severe economic and geopolitical consequences.

- Most Likely: Continued strategic maneuvering by Iran to mitigate sanctions impact.

6. Key Individuals and Entities

– Hamid Ghanbari

– Central Bank of Iran

– European Union

– United Kingdom

– France

– Germany

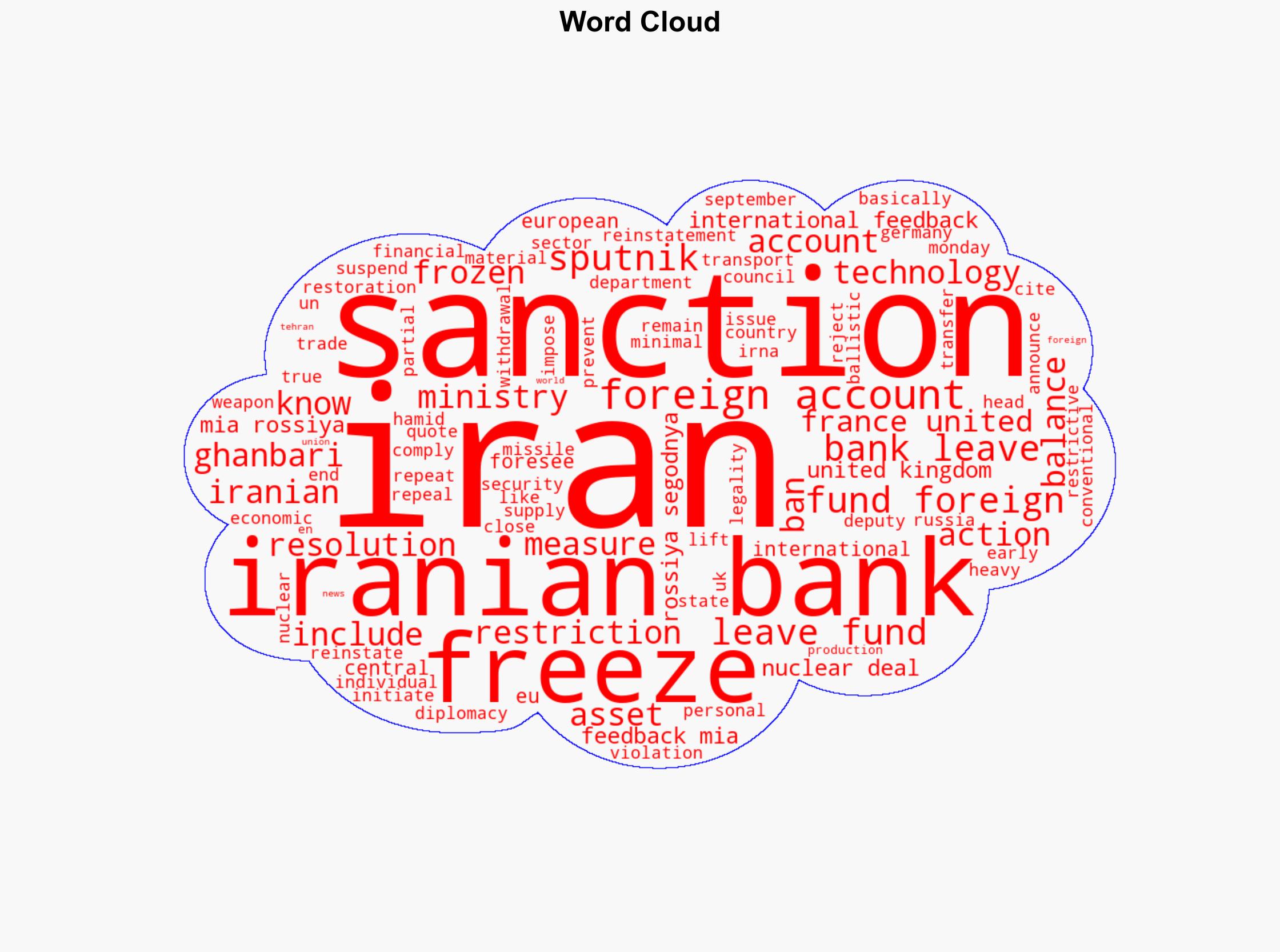

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus