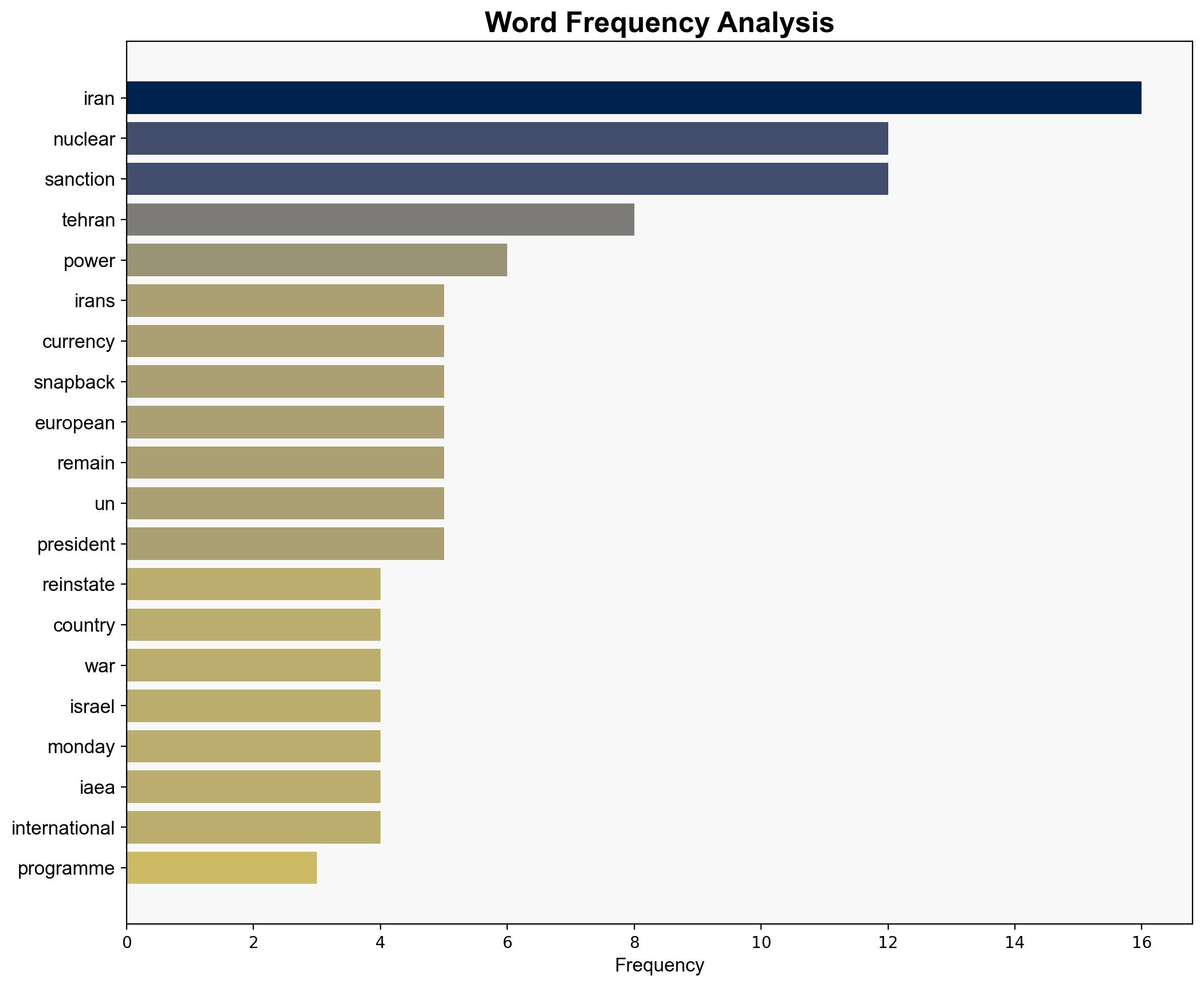

Irans currency hits new low as snapback looms over nuclear programme – Al Jazeera English

Published on: 2025-09-01

Intelligence Report: Iran’s Currency Hits New Low as Snapback Looms Over Nuclear Programme – Al Jazeera English

1. BLUF (Bottom Line Up Front)

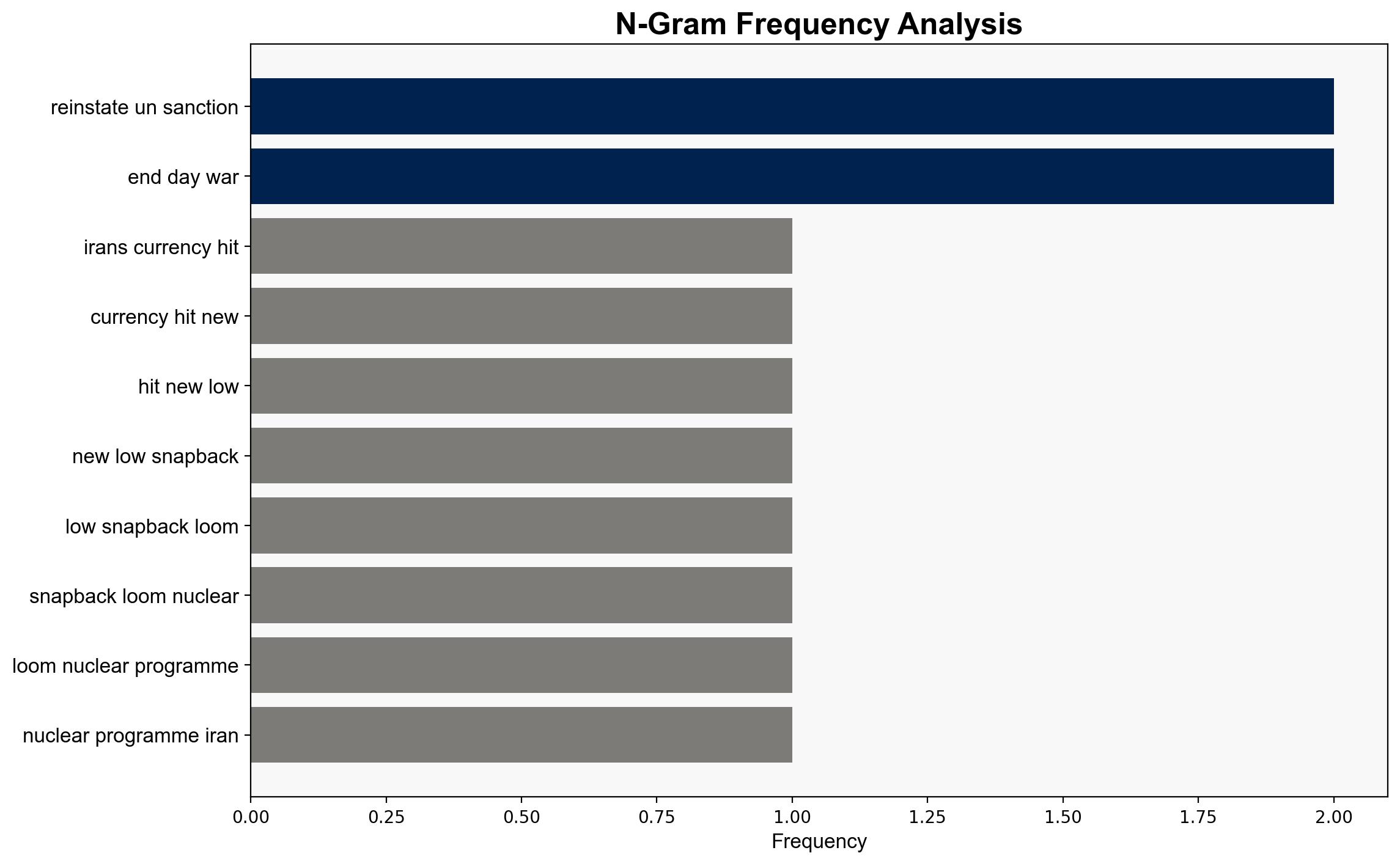

The most supported hypothesis is that the depreciation of Iran’s currency is primarily driven by geopolitical tensions and the looming threat of reinstated sanctions, rather than solely domestic economic mismanagement. Confidence level: Moderate. Recommended action: Engage in diplomatic efforts to de-escalate tensions and encourage dialogue between Iran and Western powers to prevent further economic destabilization.

2. Competing Hypotheses

1. **Hypothesis A**: The depreciation of Iran’s currency is primarily due to external geopolitical pressures, including the threat of sanctions reinstatement and regional tensions, which have led to a loss of investor confidence.

2. **Hypothesis B**: The currency depreciation is mainly a result of internal economic mismanagement and structural weaknesses within Iran’s economy, exacerbated by political instability.

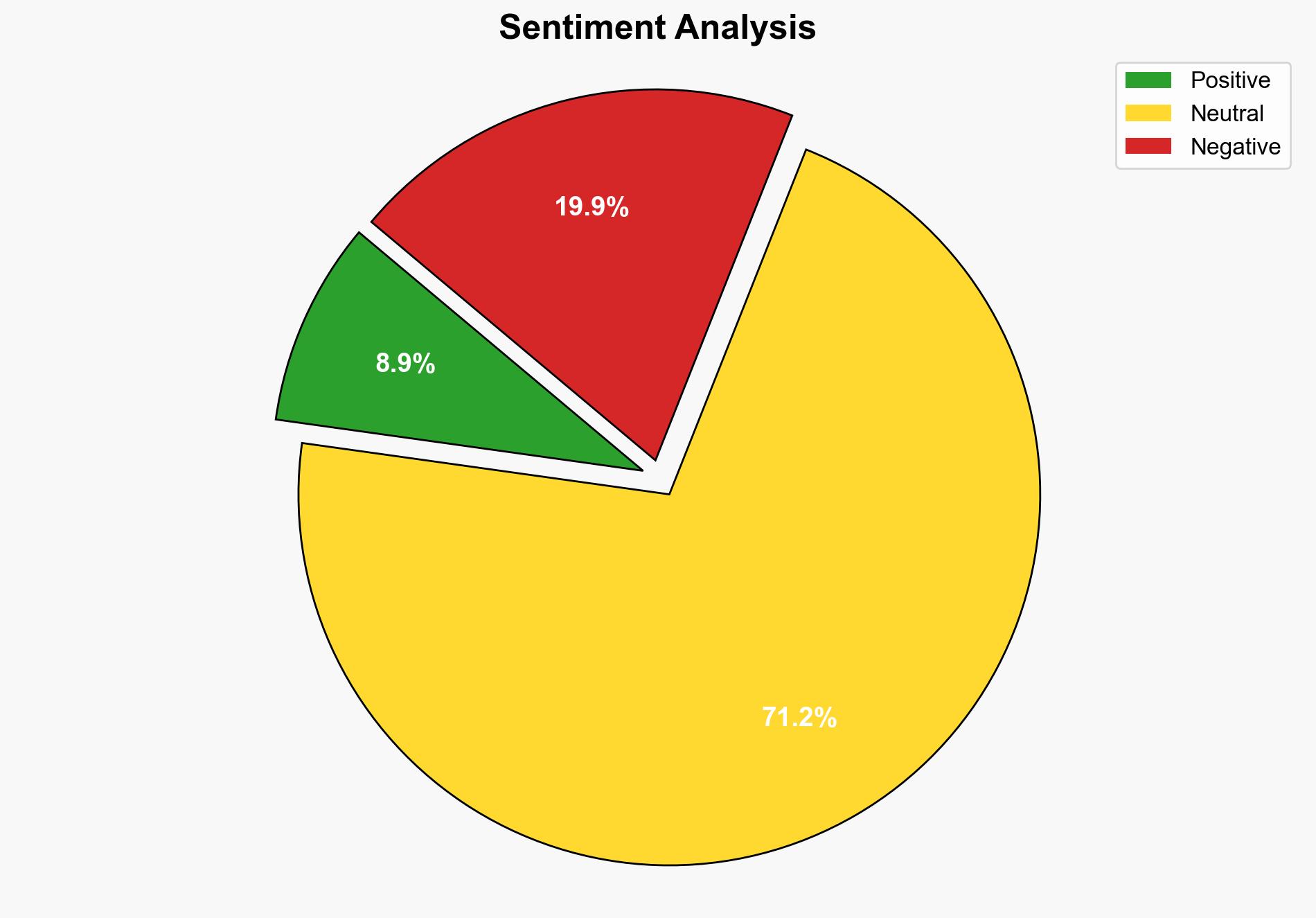

Using ACH 2.0, Hypothesis A is better supported as the timing of the currency drop correlates with increased geopolitical tensions and threats of sanctions, which are external factors beyond Iran’s immediate control. Hypothesis B, while plausible, lacks sufficient evidence of recent internal economic policy changes that would account for the sharp currency decline.

3. Key Assumptions and Red Flags

– Assumption for Hypothesis A: External geopolitical factors have a more immediate impact on currency valuation than internal economic policies.

– Assumption for Hypothesis B: Iran’s economic policies are ineffective in stabilizing the currency without external pressure.

– Red Flags: Potential bias in attributing currency depreciation solely to external factors without considering internal economic data; lack of detailed economic indicators in the source.

4. Implications and Strategic Risks

– Economic: Continued depreciation could lead to hyperinflation, increasing domestic unrest.

– Geopolitical: Escalating tensions may lead to military confrontations, particularly with Israel.

– Psychological: Public perception of economic instability could undermine government authority.

– Cyber: Potential increase in cyber operations targeting financial institutions to exploit economic vulnerabilities.

5. Recommendations and Outlook

- Encourage multilateral talks to address nuclear program concerns and reduce sanction threats.

- Monitor economic indicators for signs of further destabilization.

- Best Case: Successful diplomatic negotiations lead to eased tensions and currency stabilization.

- Worst Case: Failure to negotiate results in full sanctions reinstatement and economic collapse.

- Most Likely: Continued diplomatic stalemate with periodic economic fluctuations.

6. Key Individuals and Entities

– Abbas Araghchi

– Masoud Pezeshkian

– International Atomic Energy Agency (IAEA)

– United Nations Security Council (UNSC)

7. Thematic Tags

national security threats, geopolitical tensions, economic instability, nuclear diplomacy