IRS Issues Advice to Taxpayers on Identity Theft – Newsweek

Published on: 2025-08-13

Intelligence Report: IRS Issues Advice to Taxpayers on Identity Theft – Newsweek

1. BLUF (Bottom Line Up Front)

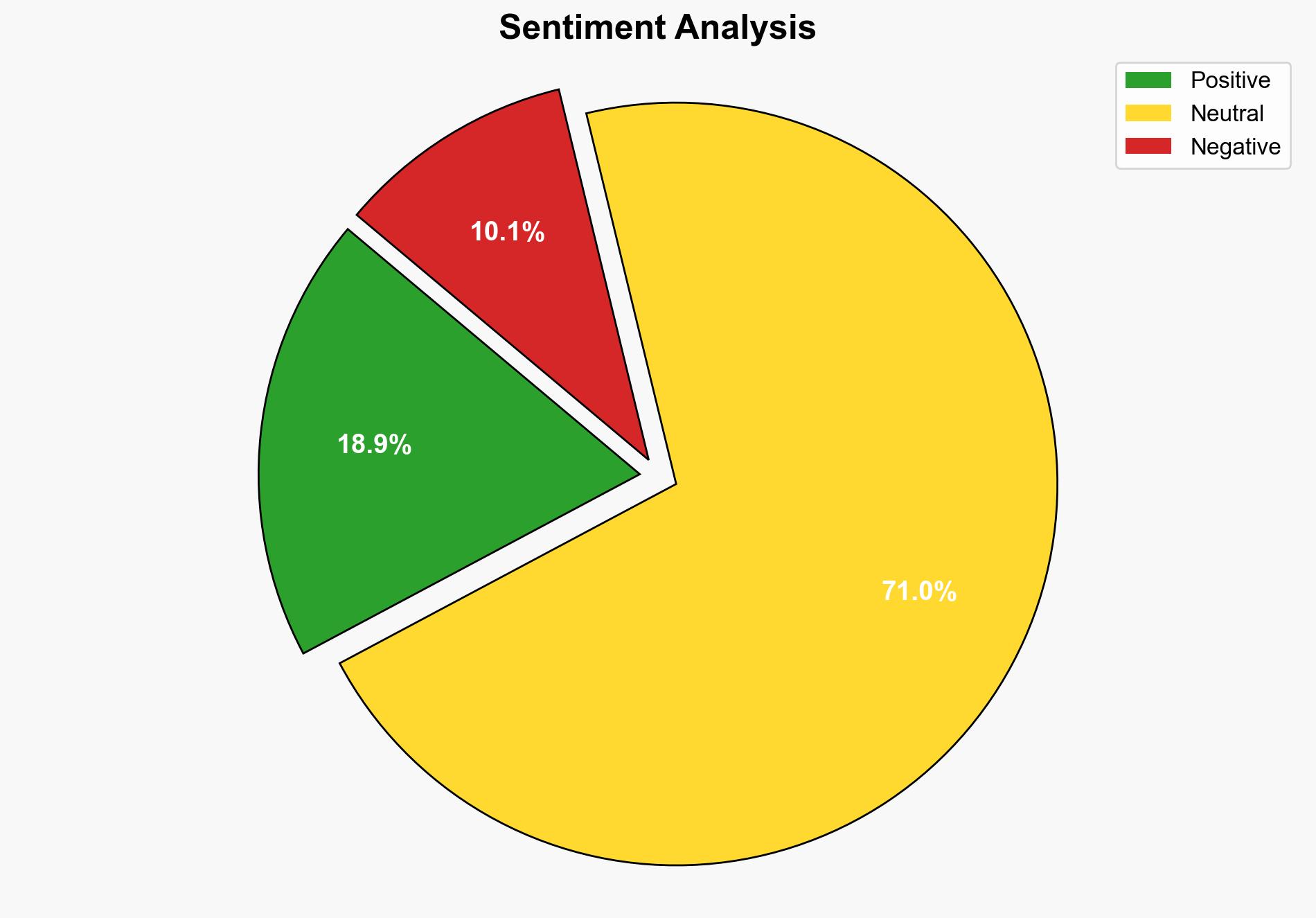

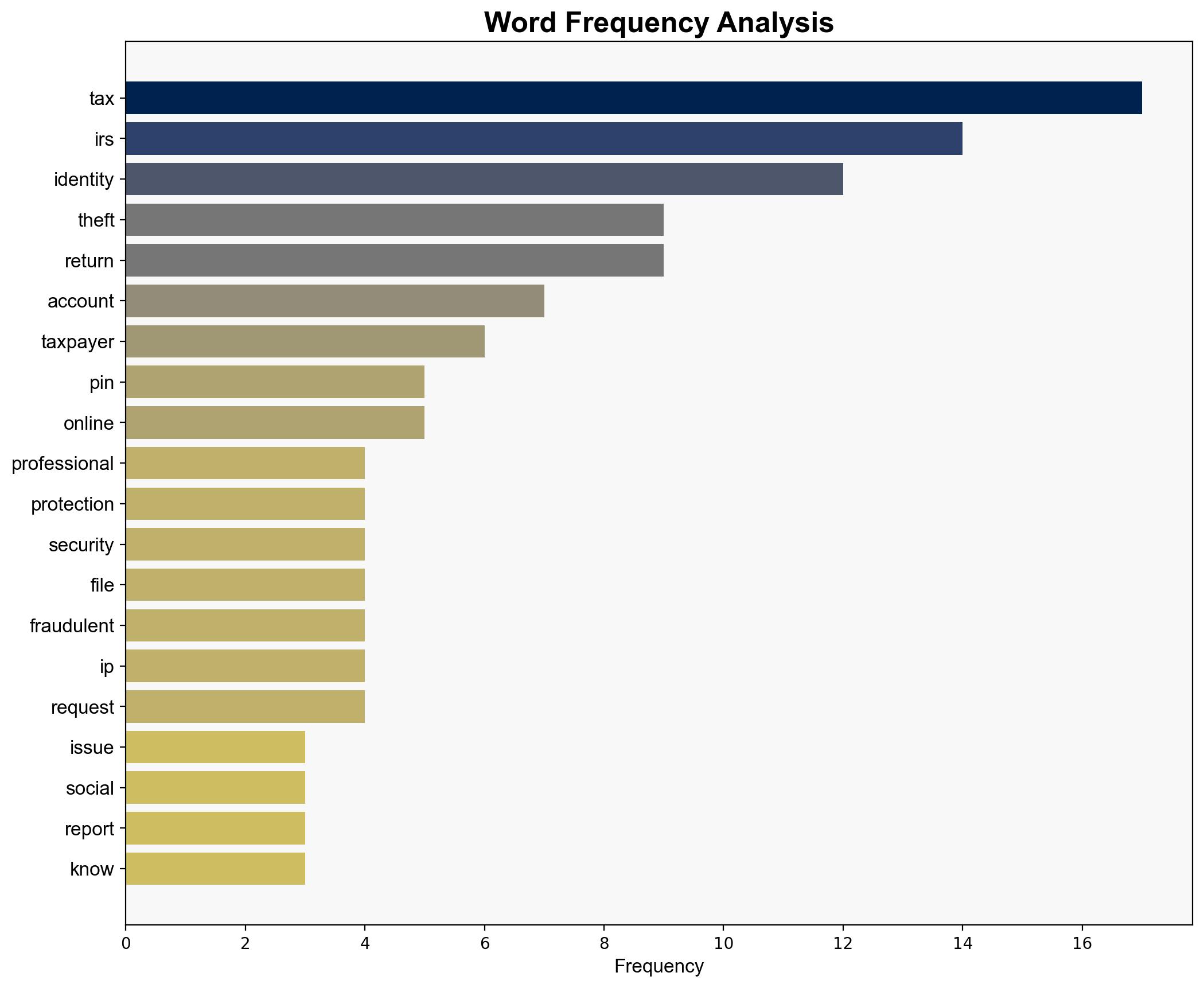

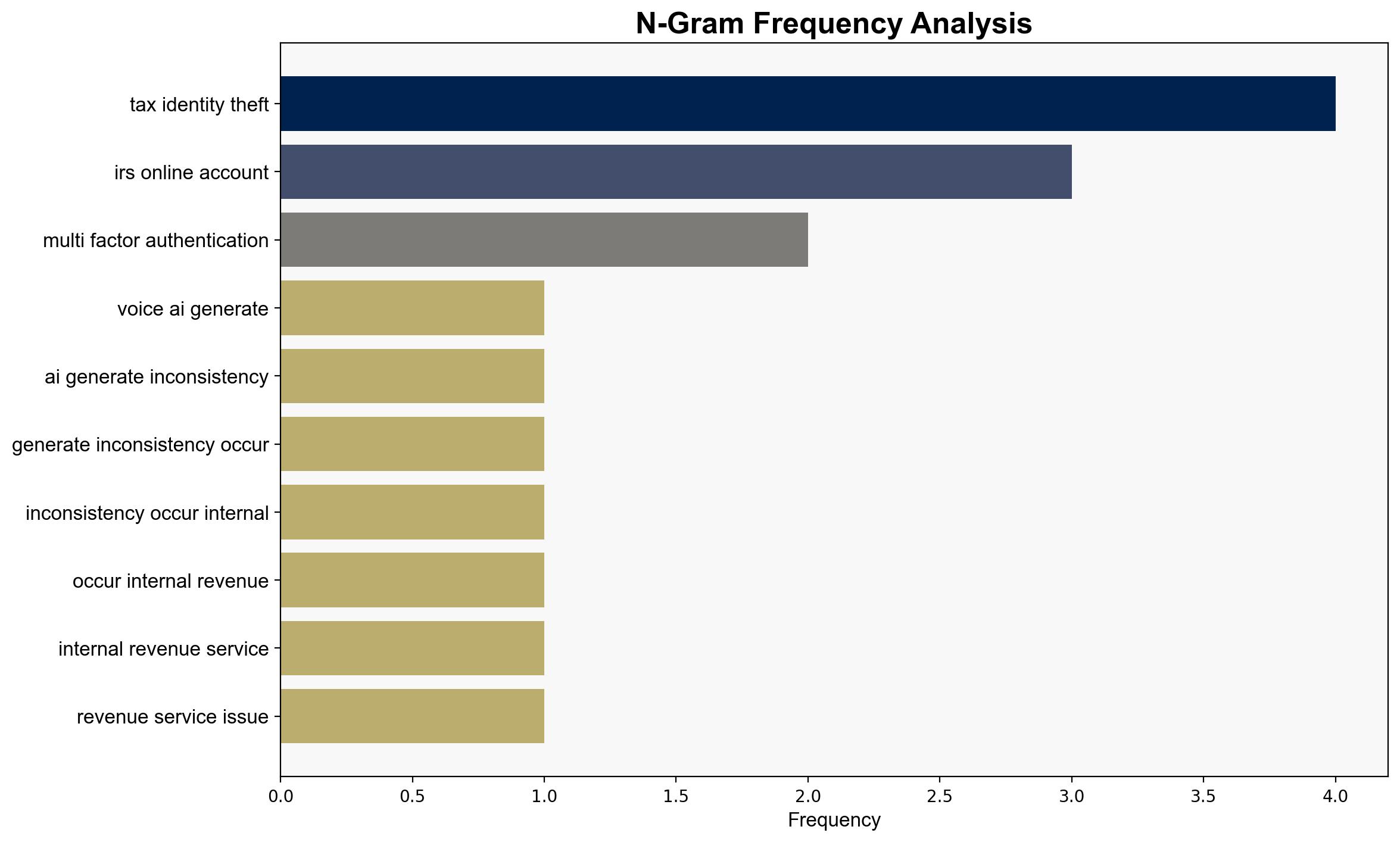

The IRS’s guidance on identity theft aims to enhance taxpayer security through measures like the Identity Protection PIN and multi-factor authentication. The most supported hypothesis is that these measures are primarily intended to protect taxpayers from increasing identity theft threats. Confidence in this hypothesis is moderate, given the potential for alternative motives such as increasing IRS control over taxpayer data. Recommended action includes promoting awareness and adoption of these security measures among taxpayers.

2. Competing Hypotheses

1. **Hypothesis A**: The IRS’s guidance is primarily a response to a genuine increase in identity theft incidents, aiming to protect taxpayers and secure tax processes.

2. **Hypothesis B**: The IRS’s guidance is a strategic move to increase control and oversight over taxpayer data under the guise of security measures.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported by the available data, as the IRS has documented increases in identity theft cases and has implemented specific measures like the IP PIN and MFA to address these threats.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the IRS’s measures are sufficient to significantly reduce identity theft incidents. Another assumption is that taxpayers will adopt these measures willingly.

– **Red Flags**: The voluntary nature of the IP PIN program may limit its effectiveness. There is also a lack of detailed data on the success rate of these measures in preventing identity theft.

– **Blind Spots**: Potential for taxpayer resistance due to privacy concerns or mistrust in government handling of personal data.

4. Implications and Strategic Risks

– **Economic**: Failure to effectively combat identity theft could lead to significant financial losses for both taxpayers and the government.

– **Cyber**: Increased cyber threats targeting IRS systems could arise as a result of heightened security measures.

– **Geopolitical**: International actors might exploit vulnerabilities in the IRS system to undermine U.S. financial stability.

– **Psychological**: Public perception of IRS effectiveness and trust in government institutions could be impacted by the success or failure of these measures.

5. Recommendations and Outlook

- Increase taxpayer education and outreach to promote the adoption of security measures.

- Enhance IRS cybersecurity infrastructure to protect against potential attacks.

- Scenario Projections:

- Best Case: High adoption of security measures leads to a significant reduction in identity theft cases.

- Worst Case: Low adoption and increased cyber threats result in widespread identity theft and financial loss.

- Most Likely: Moderate adoption with gradual improvement in identity theft prevention.

6. Key Individuals and Entities

Aliss Higham, Newsweek reporter based in Glasgow, Scotland.

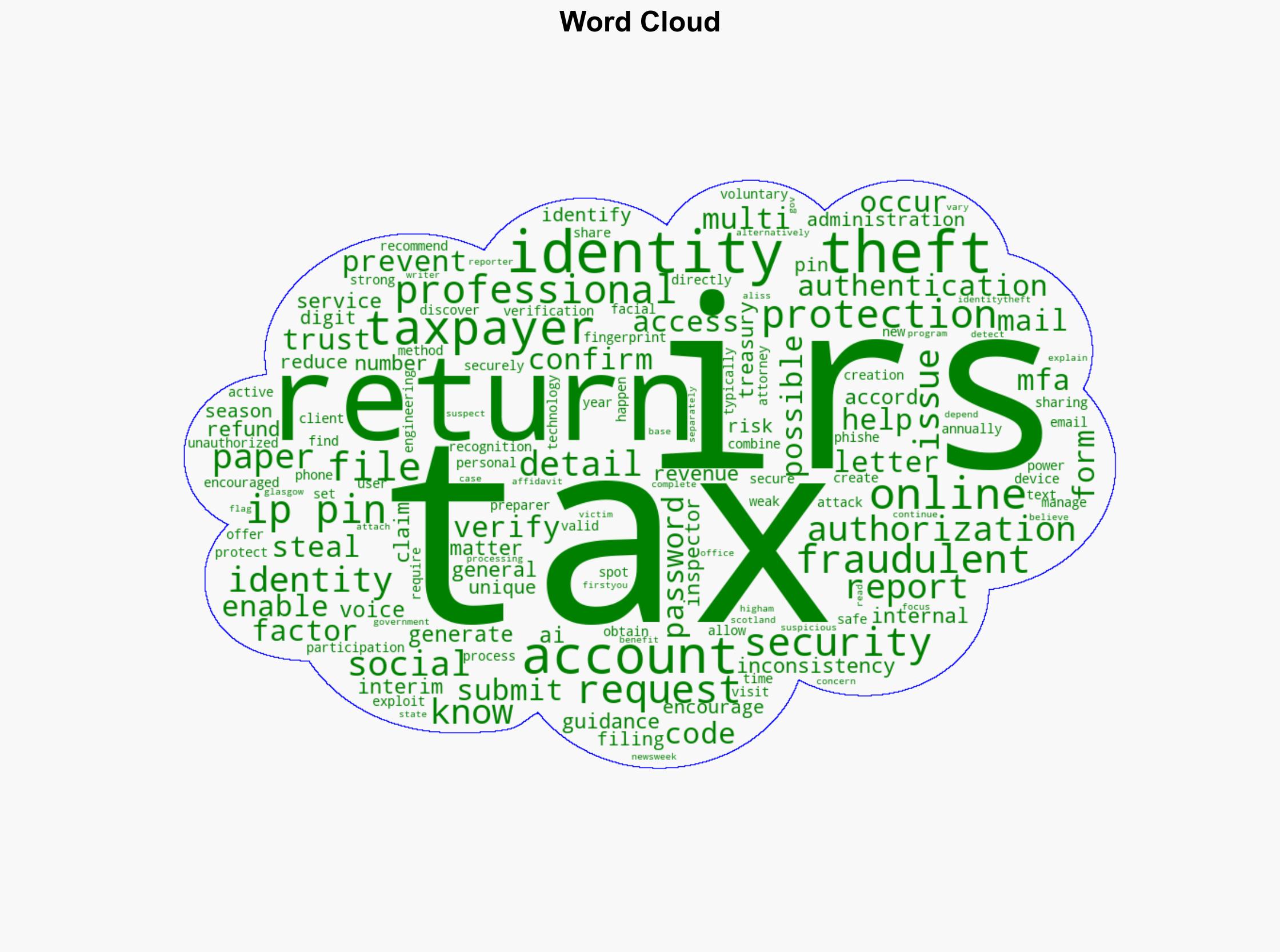

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus