Is Commscope Holding COMM the Most Undervalued Penny Stock to Buy According to Hedge Funds – Yahoo Entertainment

Published on: 2025-04-21

Intelligence Report: Is Commscope Holding COMM the Most Undervalued Penny Stock to Buy According to Hedge Funds – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

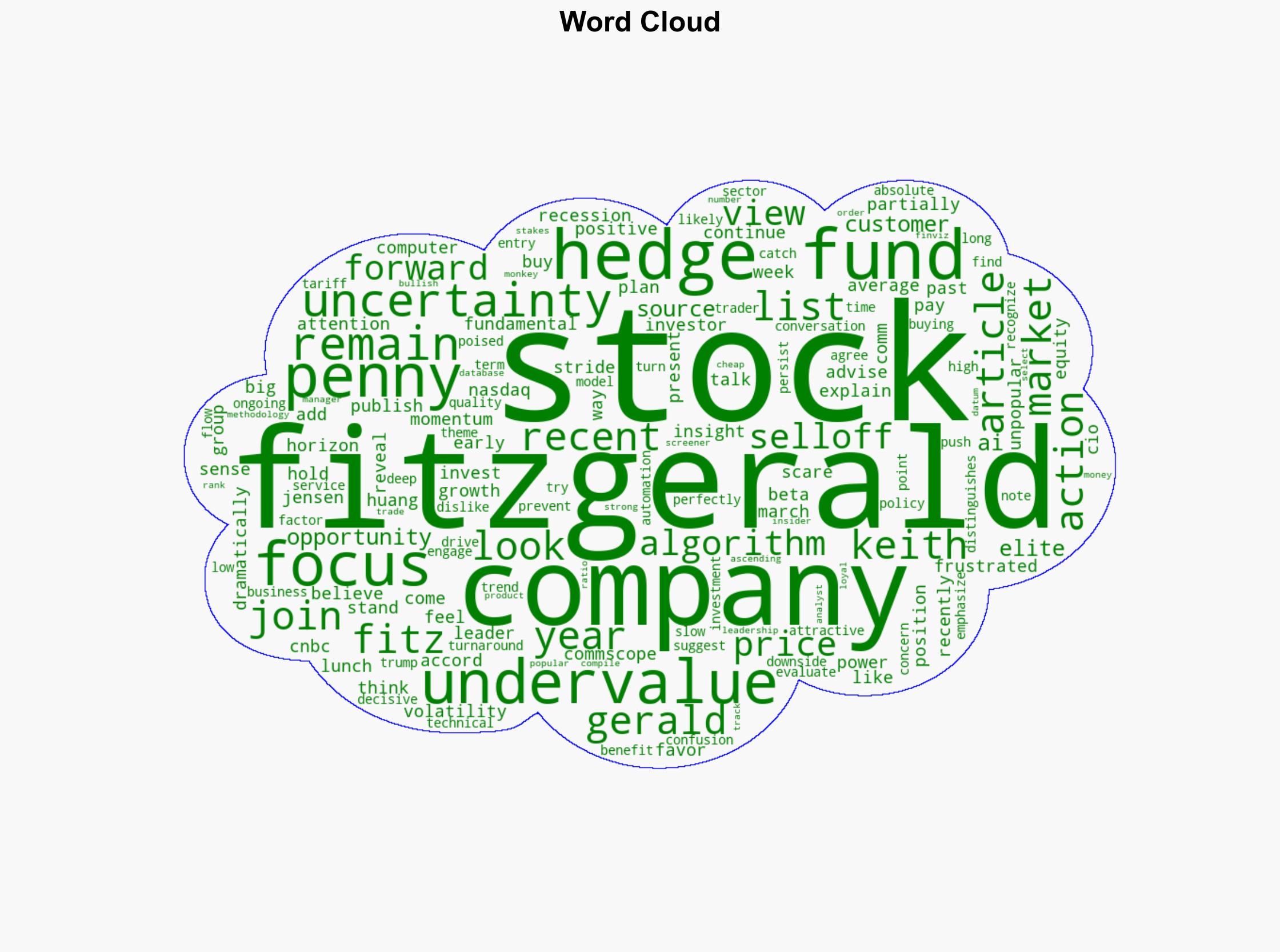

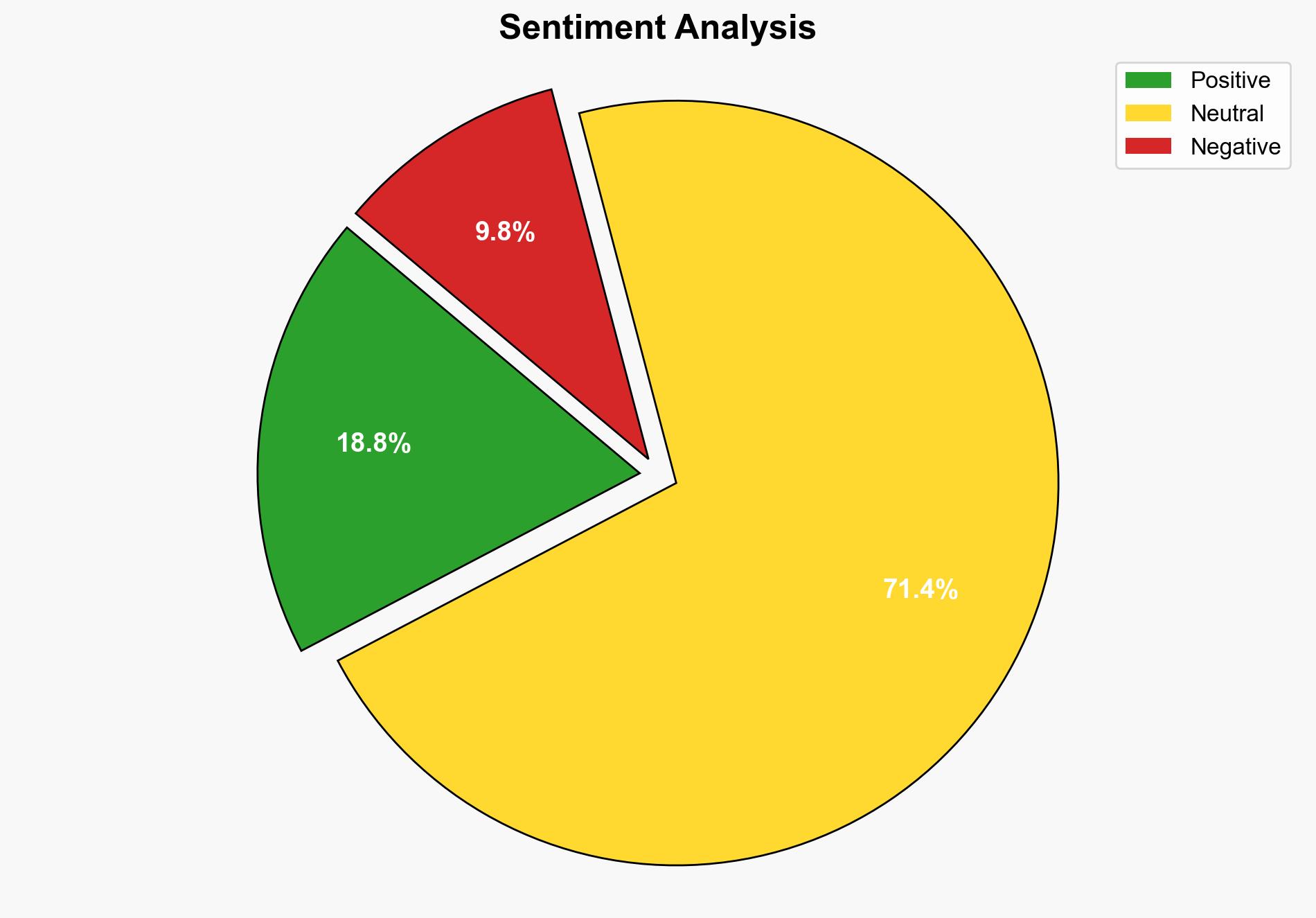

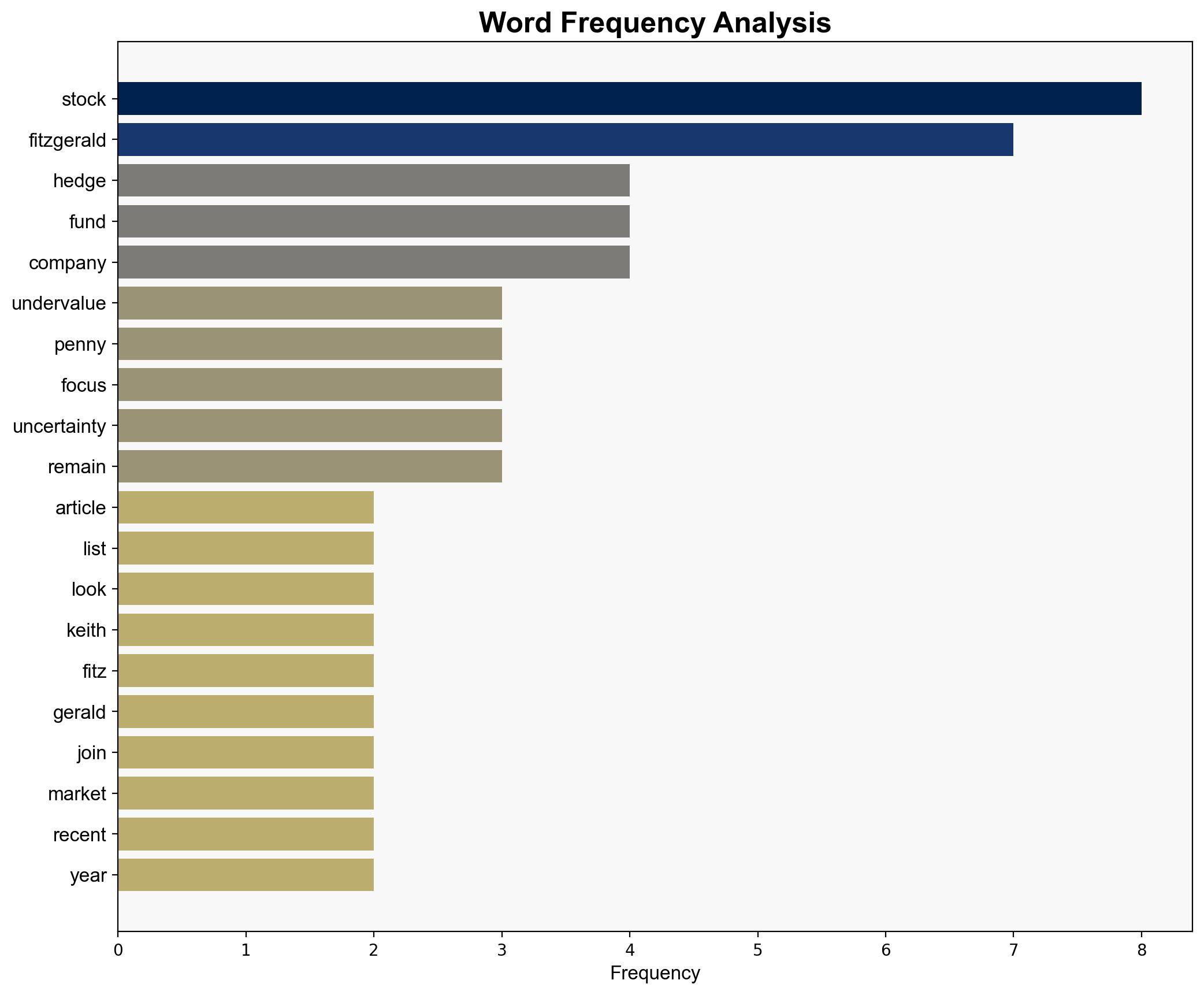

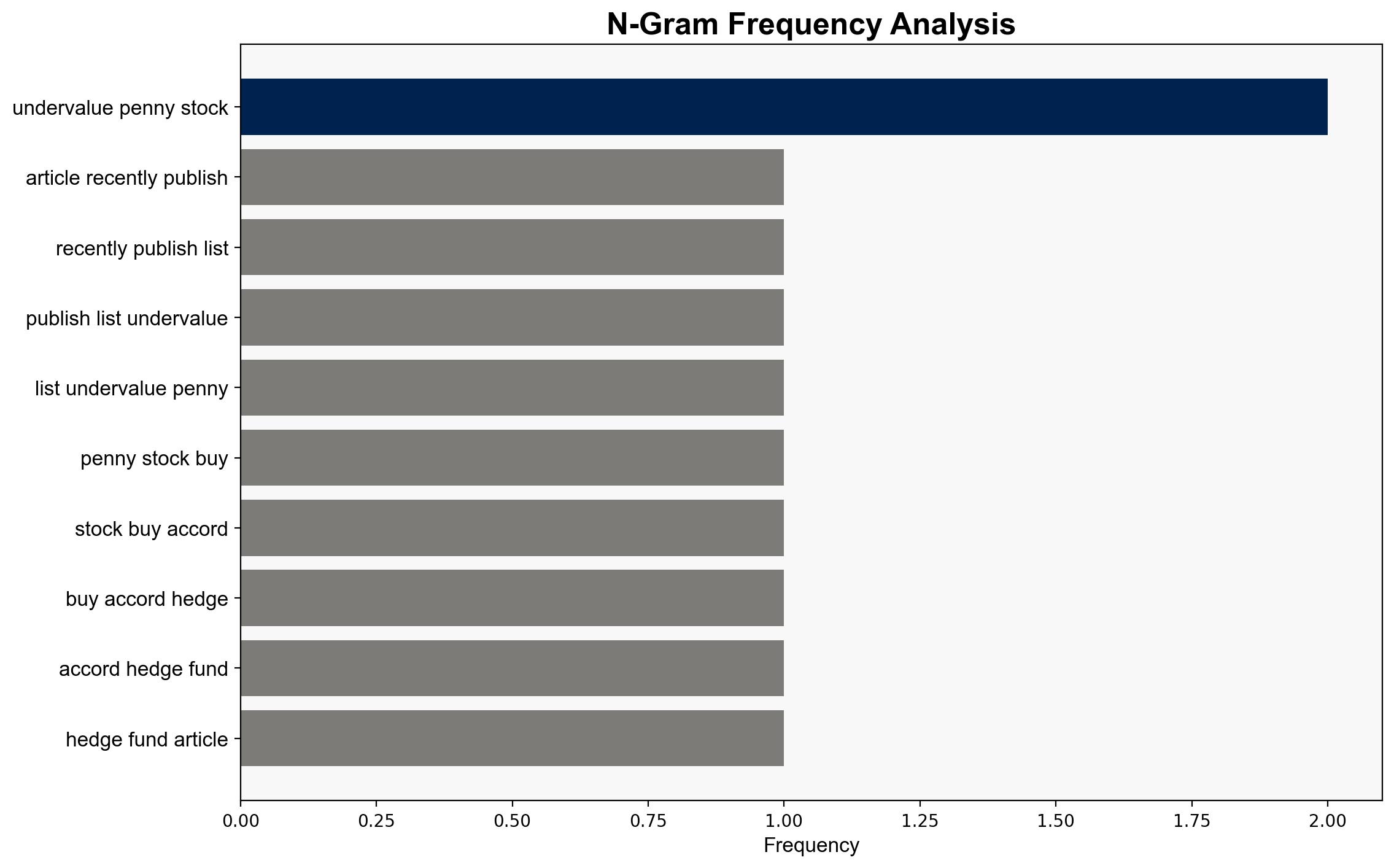

Commscope Holding (COMM) is identified as a potentially undervalued penny stock, attracting interest from hedge funds. The analysis suggests that despite market volatility and external uncertainties, the stock may present a strategic investment opportunity due to its perceived undervaluation and potential for turnaround. Investors are advised to consider long-term trends and leadership quality when evaluating this stock.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Analysis of Competing Hypotheses (ACH)

Commscope’s undervaluation is assessed against market volatility, algorithm-driven price fluctuations, and external economic factors. The hypothesis that it is undervalued is least refuted by evidence of hedge fund interest and expert analysis.

SWOT Analysis

Strengths: Strong leadership, loyal customer base, and strategic positioning in AI and automation sectors.

Weaknesses: Current market volatility and potential over-reliance on algorithmic trading impacts.

Opportunities: Long-term growth potential in AI and automation, potential market correction.

Threats: Ongoing tariff policy uncertainty and broader economic instability.

Indicators Development

Monitor hedge fund activity, leadership communications, and market reactions to AI and automation trends as indicators of stock performance.

3. Implications and Strategic Risks

The undervaluation of Commscope may signal broader market inefficiencies or emerging opportunities in the tech sector. Continued volatility and policy uncertainty pose risks, potentially affecting investor confidence and market stability.

4. Recommendations and Outlook

- Consider gradual investment in Commscope, focusing on long-term growth potential and leadership quality.

- Monitor geopolitical and economic developments affecting market conditions.

- Scenario-based projections:

- Best Case: Market correction leads to significant stock appreciation.

- Worst Case: Continued volatility and policy uncertainty depress stock value.

- Most Likely: Moderate growth as market stabilizes and AI sector expands.

5. Key Individuals and Entities

Keith Fitz-Gerald, Jensen Huang

6. Thematic Tags

(‘investment strategy, market volatility, hedge funds, AI sector, economic uncertainty’)