Is your home really safe Why insurance is a must for financial protection against natural disasters – The Times of India

Published on: 2025-09-15

Intelligence Report: Is your home really safe Why insurance is a must for financial protection against natural disasters – The Times of India

1. BLUF (Bottom Line Up Front)

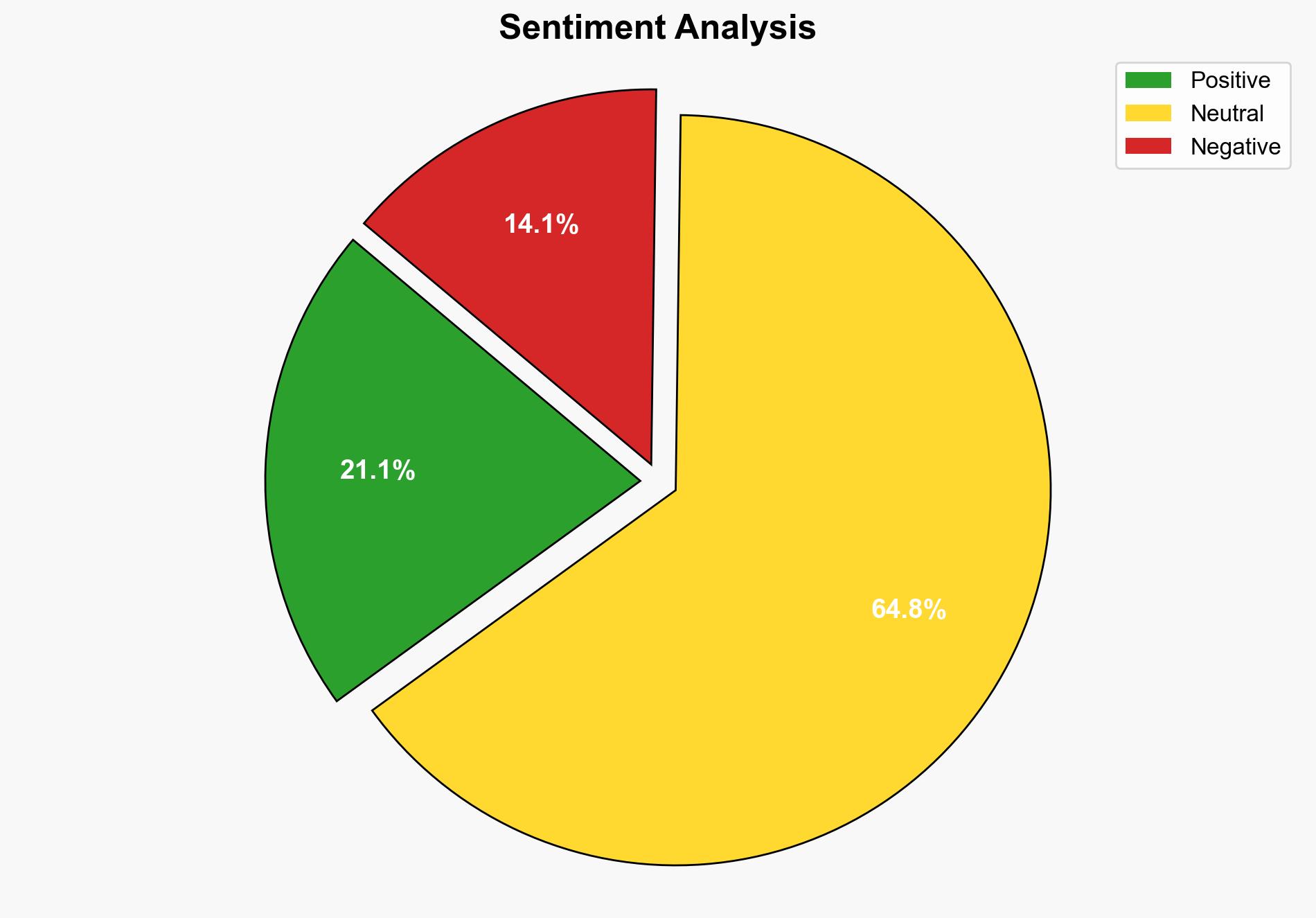

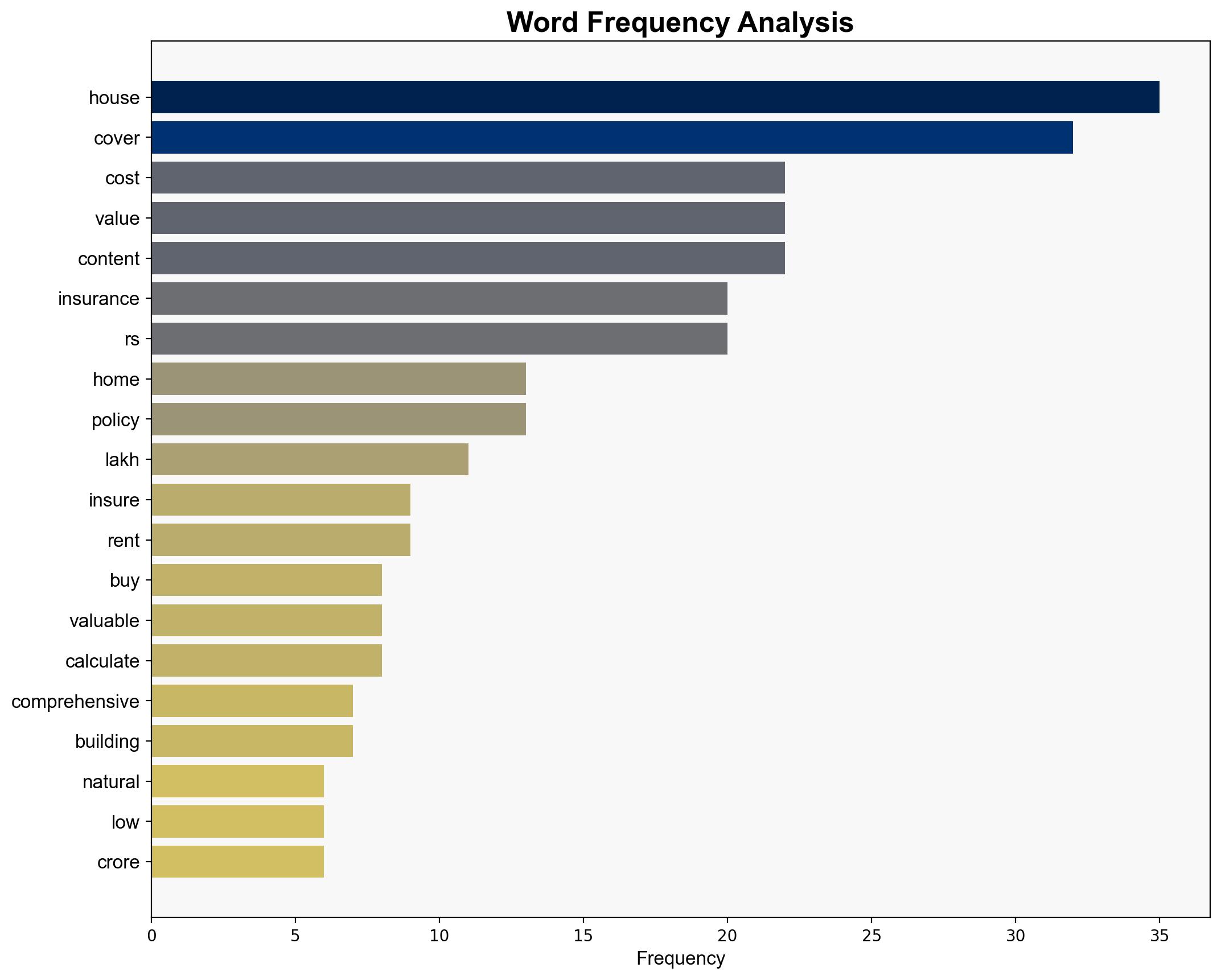

The analysis suggests that the increasing frequency of natural disasters is a critical driver for promoting home insurance in India. The hypothesis that the low penetration of home insurance is due to a lack of awareness and perceived necessity is better supported. Confidence level: Moderate. Recommended action: Enhance public awareness campaigns to educate homeowners on the benefits and affordability of comprehensive home insurance policies.

2. Competing Hypotheses

1. **Hypothesis A**: The low penetration of home insurance in India is primarily due to a lack of awareness and perceived necessity among homeowners.

2. **Hypothesis B**: The low penetration of home insurance is due to economic constraints and the high cost of premiums relative to perceived risk.

Using ACH 2.0, Hypothesis A is better supported by evidence such as statements from industry leaders highlighting the affordability and necessity of insurance, alongside the increasing frequency of natural disasters. Hypothesis B is less supported given the evidence of low premium costs relative to the potential financial loss from disasters.

3. Key Assumptions and Red Flags

– Assumptions: Homeowners are rational actors who will purchase insurance if they perceive it as necessary and affordable.

– Red Flags: Potential bias in industry statements promoting insurance as a necessity. Lack of data on actual economic constraints faced by homeowners.

– Blind Spots: Limited exploration of cultural factors influencing insurance adoption.

4. Implications and Strategic Risks

The increasing frequency of natural disasters poses a significant economic risk to uninsured homeowners, potentially leading to large-scale financial instability. The lack of insurance could exacerbate recovery times and economic burdens on both individuals and the state. There is also a risk of misinformation or underestimation of the benefits of insurance, leading to continued low uptake.

5. Recommendations and Outlook

- Implement targeted awareness campaigns highlighting the affordability and necessity of home insurance.

- Encourage partnerships between insurance companies and government bodies to subsidize premiums for low-income households.

- Scenario Projections:

- Best Case: Increased insurance uptake leads to greater financial resilience against natural disasters.

- Worst Case: Continued low uptake results in significant economic losses and prolonged recovery periods post-disaster.

- Most Likely: Gradual increase in insurance adoption as awareness efforts take effect.

6. Key Individuals and Entities

– Dilip Baba

– Ashwini Dubey

– Gaurav Arora

7. Thematic Tags

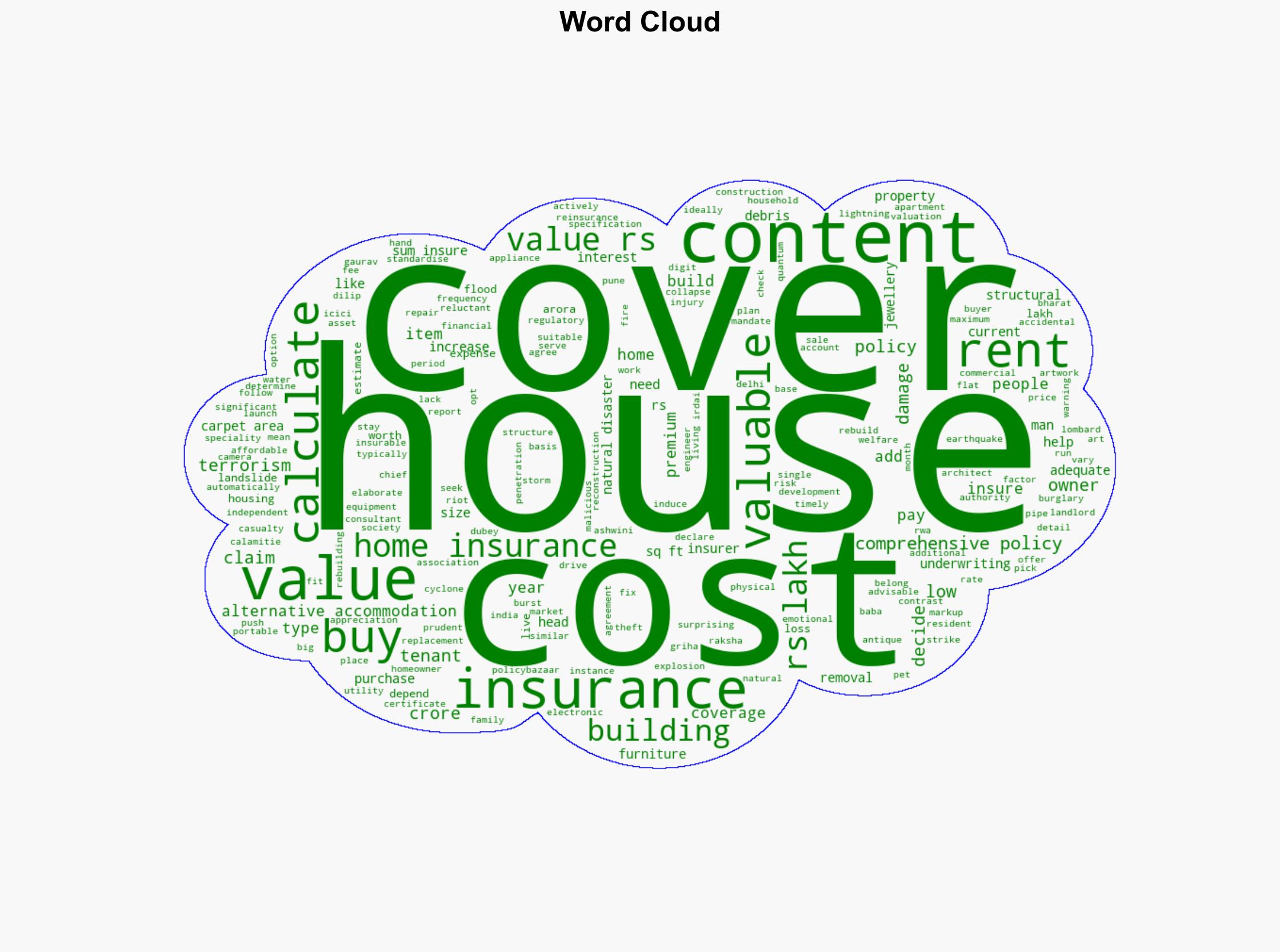

national security threats, economic resilience, disaster preparedness, insurance awareness