Israels Ever-Expanding War Machine Is Financed Through International Bond Sales – Truthout

Published on: 2025-07-26

Intelligence Report: Israels Ever-Expanding War Machine Is Financed Through International Bond Sales – Truthout

1. BLUF (Bottom Line Up Front)

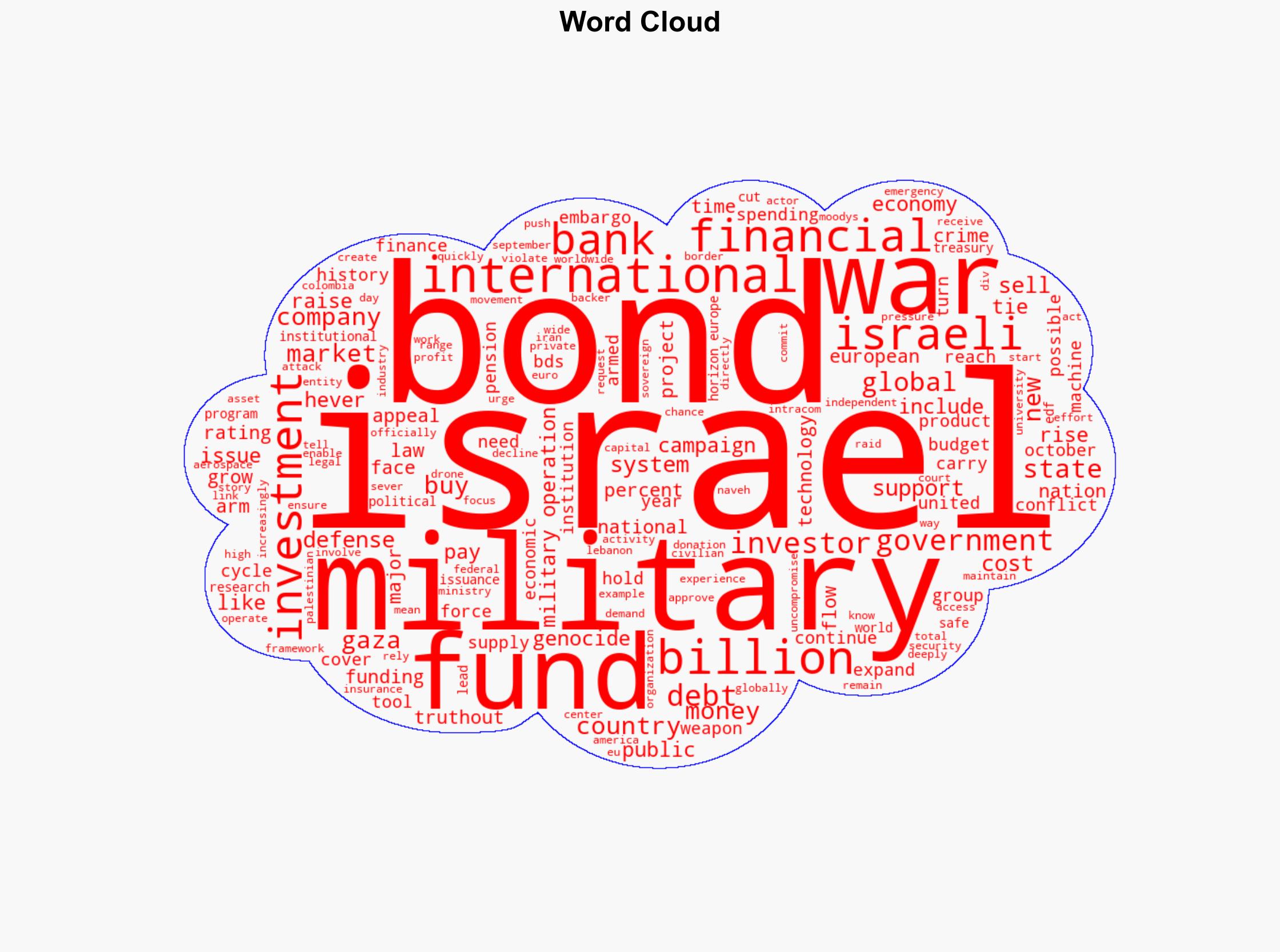

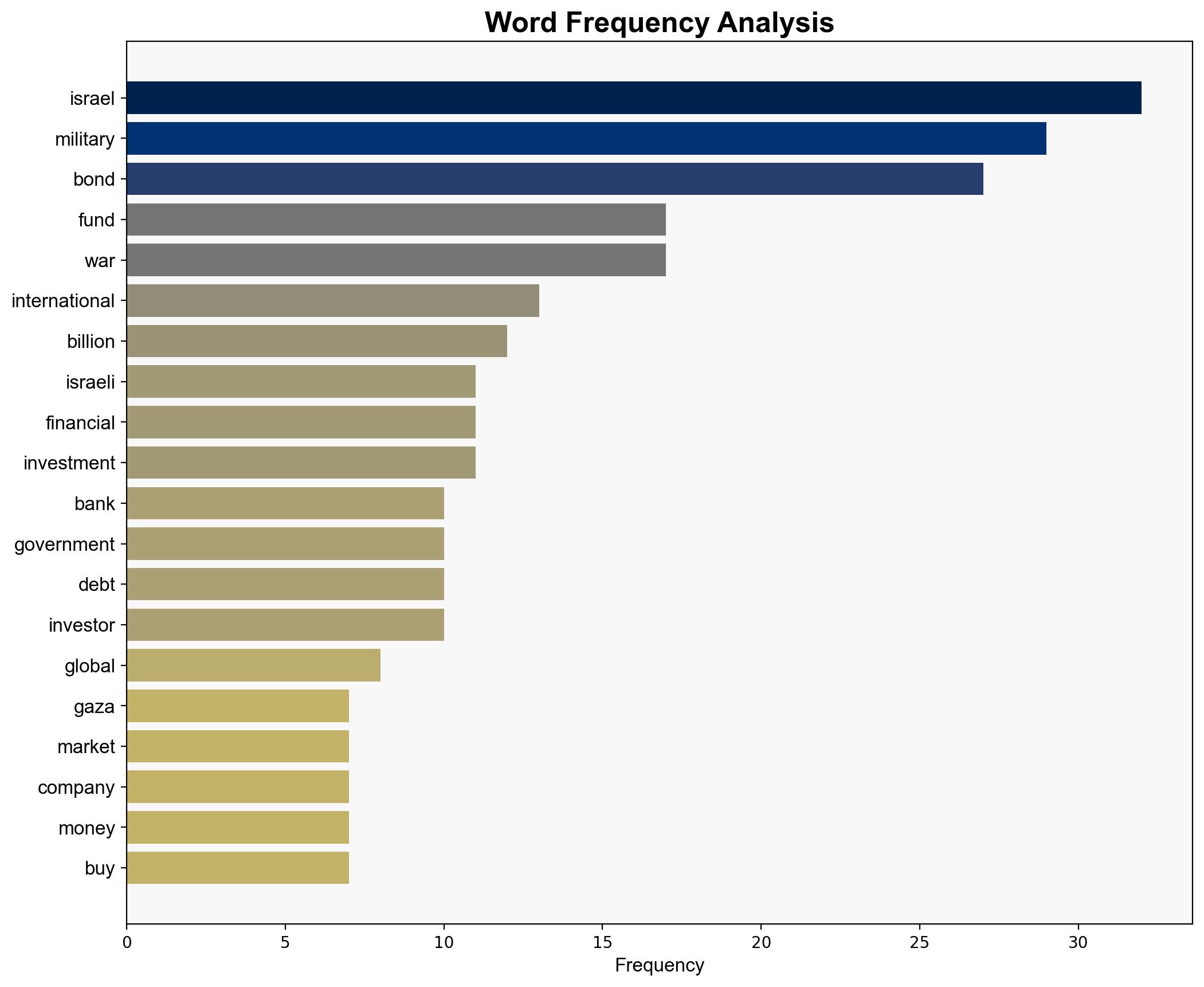

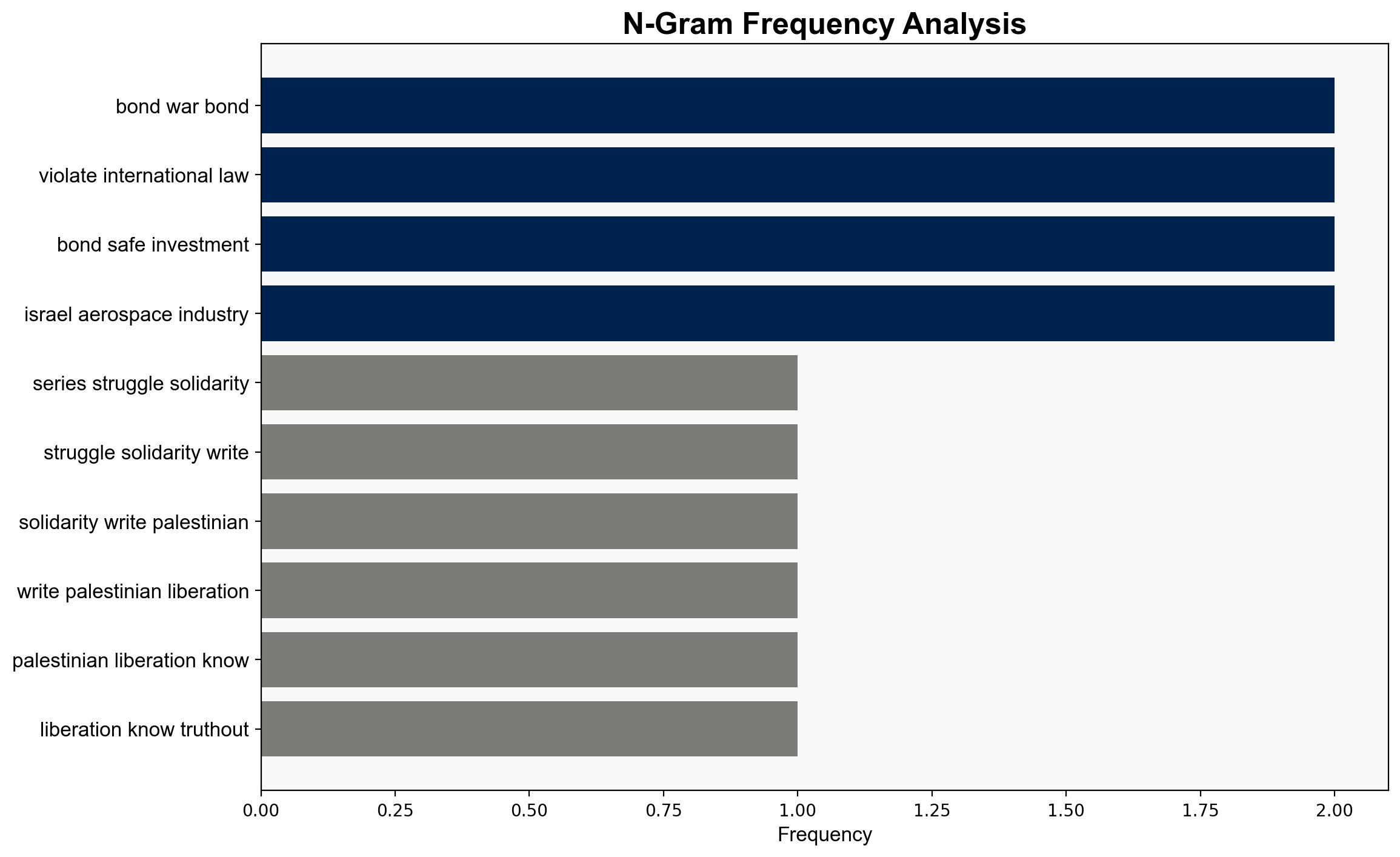

The most supported hypothesis is that Israel’s military expansion is strategically financed through international bond sales, leveraging global financial markets to sustain its military operations despite increasing international scrutiny and embargoes. Confidence in this assessment is moderate due to the complexity of financial networks and geopolitical dynamics. Recommended action includes monitoring international financial flows and diplomatic engagements to anticipate shifts in Israel’s military funding strategies.

2. Competing Hypotheses

1. **Hypothesis A**: Israel is strategically using international bond sales to finance its military operations, effectively bypassing international embargoes and maintaining military readiness.

2. **Hypothesis B**: Israel’s military financing through bond sales is primarily a response to domestic economic pressures and not a deliberate strategy to circumvent international embargoes.

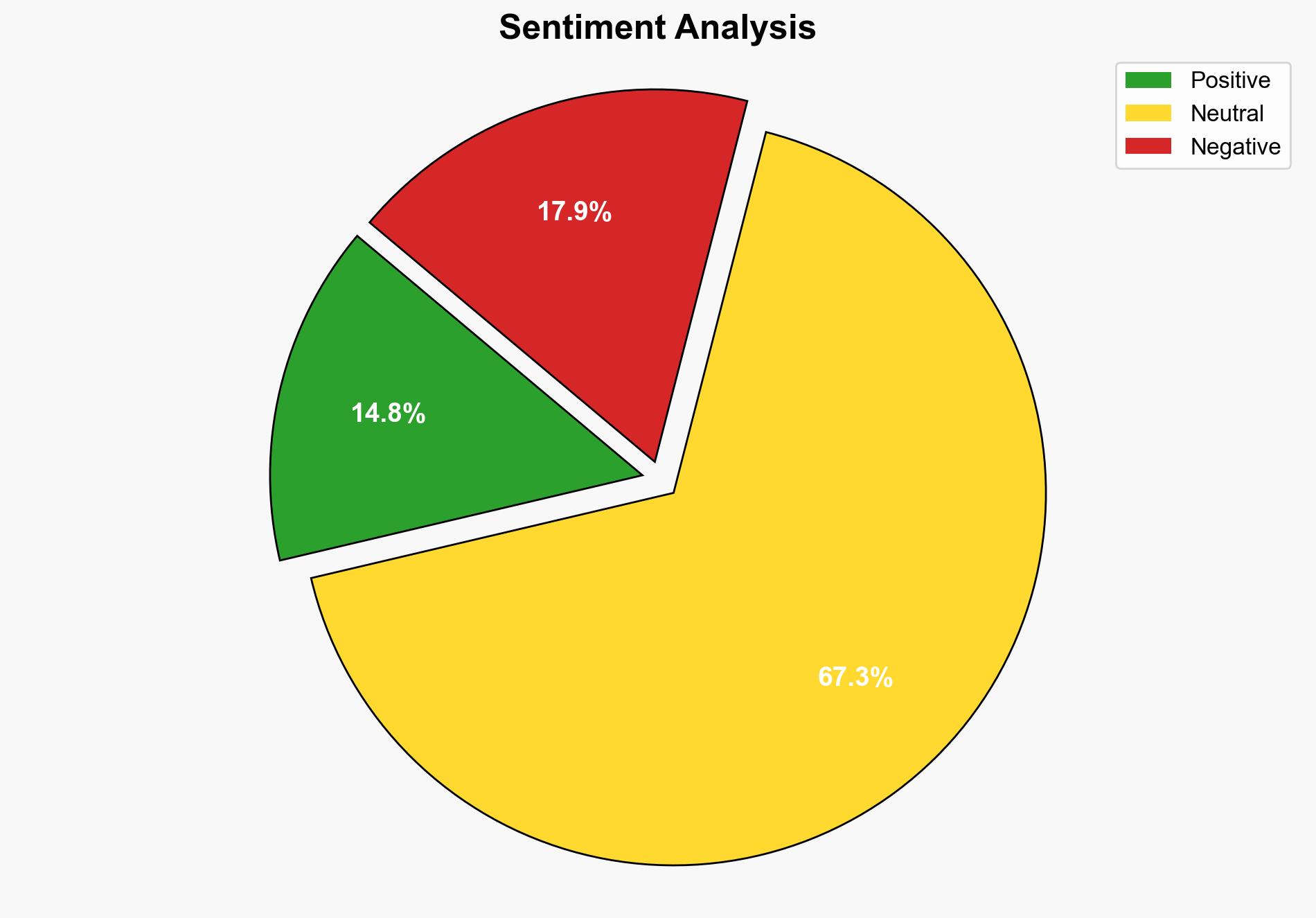

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to evidence of sophisticated international financial systems being utilized and the strategic framing of military operations as investment opportunities. Hypothesis B lacks support as the narrative and actions suggest a proactive rather than reactive financial strategy.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that international investors are willing to overlook potential ethical concerns for financial returns. Hypothesis B assumes domestic economic pressures are the primary driver of bond sales.

– **Red Flags**: The lack of transparency in bond sale details and potential underreporting of international investor motivations. The narrative may be biased towards portraying Israel as aggressively circumventing embargoes without considering legitimate security concerns.

4. Implications and Strategic Risks

– **Economic**: Continued bond sales could stabilize Israel’s military funding but risk increasing public debt and economic vulnerability if investor sentiment shifts.

– **Geopolitical**: Escalating military operations may provoke stronger international responses, including expanded embargoes or diplomatic isolation.

– **Psychological**: The framing of military operations as investment opportunities may desensitize global perceptions of conflict impacts.

5. Recommendations and Outlook

- Monitor shifts in international investor behavior and sentiment towards Israeli bonds.

- Engage in diplomatic efforts to address potential escalations and promote transparency in military financing.

- Scenario Projections:

- **Best Case**: Israel diversifies its funding sources, reducing reliance on controversial bond sales.

- **Worst Case**: Increased international isolation and economic instability due to reliance on bond sales amid growing embargoes.

- **Most Likely**: Continued bond sales with moderate international pushback, maintaining current military funding levels.

6. Key Individuals and Entities

– Bezalel Smotrich: Mentioned in the context of the national budget approval.

– Shir Hever: Coordinator of the Boycott, Divestment, Sanctions (BDS) Movement’s military embargo campaign.

7. Thematic Tags

national security threats, international finance, military strategy, geopolitical dynamics