Japan invests 20 million in African startups through Uncovered Fund – Techpinions.com

Published on: 2025-08-30

Intelligence Report: Japan invests 20 million in African startups through Uncovered Fund – Techpinions.com

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that Japan’s investment through the Uncovered Fund aims to strategically position Japanese firms within the rapidly growing African tech ecosystem, leveraging financial strength and technological expertise for mutual benefit. Confidence Level: Moderate. Recommended action includes monitoring the development of these investments and assessing their impact on regional economic dynamics and Japan’s geopolitical influence.

2. Competing Hypotheses

Hypothesis 1: Japan’s investment is primarily driven by economic interests, seeking to capitalize on the burgeoning African tech sector and establish a foothold in emerging markets.

Hypothesis 2: The investment is a strategic geopolitical maneuver to counterbalance China’s influence in Africa by fostering economic ties and partnerships with African startups.

3. Key Assumptions and Red Flags

Assumptions:

– Japan’s financial strength and technological expertise will translate into successful partnerships with African startups.

– African markets are stable and conducive to long-term investment.

– There is a genuine interest from African startups to collaborate with Japanese firms.

Red Flags:

– Potential overestimation of the readiness of African markets to absorb and integrate Japanese technology.

– Lack of detailed information on specific sectors and startups targeted by the investment.

– Possible underestimation of China’s entrenched influence in the region.

4. Implications and Strategic Risks

The investment could lead to increased competition in the African tech sector, potentially escalating into a broader economic rivalry with China. There is a risk of over-dependence on Japanese technology, which could stifle local innovation. Geopolitically, this move might alter alliances and economic dependencies in the region, impacting regional stability and economic growth patterns.

5. Recommendations and Outlook

- Monitor the progress of the Uncovered Fund’s investments and their impact on local economies and regional stability.

- Engage with African governments and startups to ensure investments align with local development goals.

- Scenario Projections:

- Best Case: Successful integration of Japanese technology leads to robust growth in African startups, fostering innovation and economic development.

- Worst Case: Investments fail to yield expected returns, leading to financial losses and strained Japan-Africa relations.

- Most Likely: Moderate success with some startups thriving, leading to incremental growth and strengthened economic ties.

6. Key Individuals and Entities

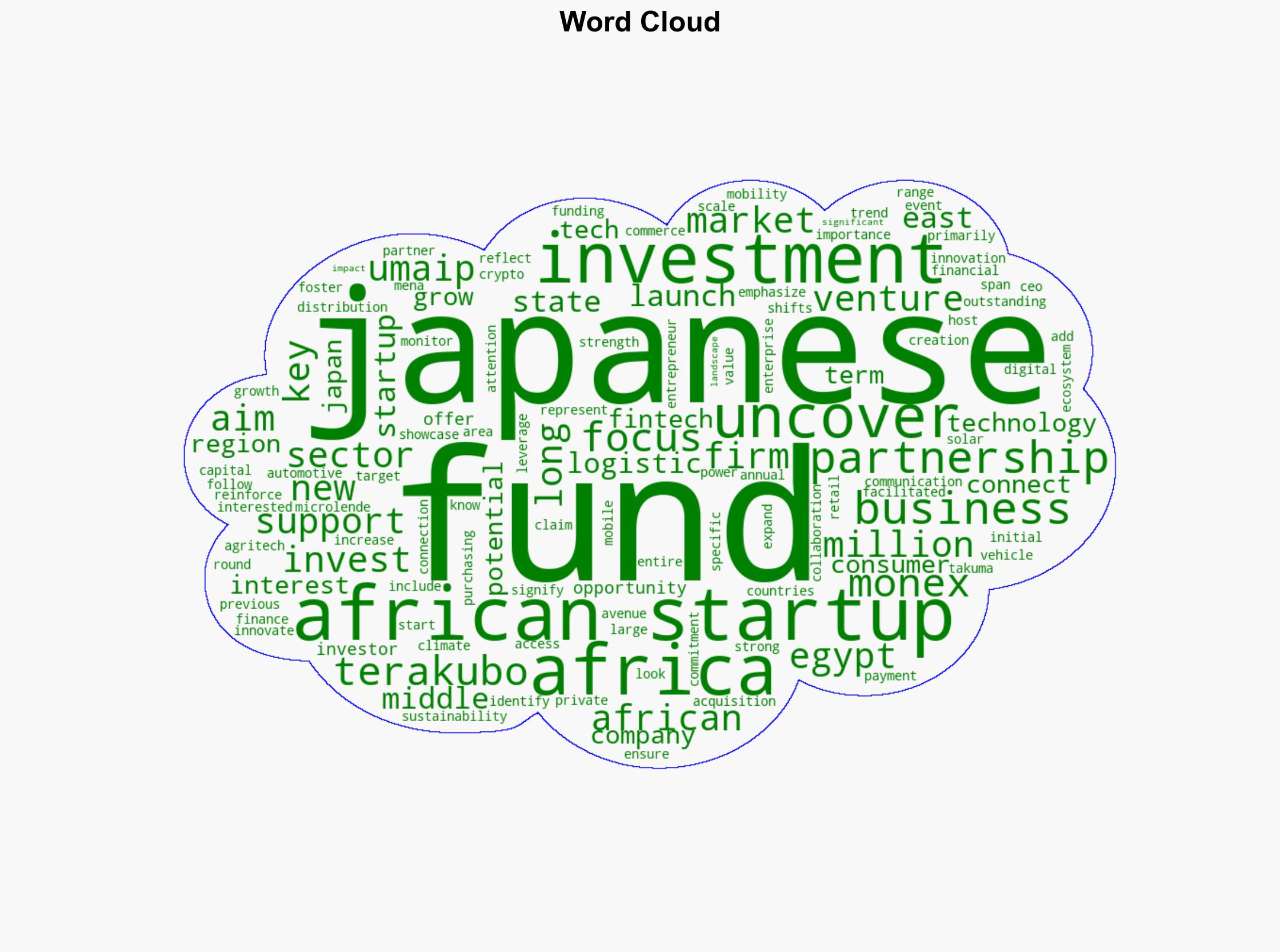

Takuma Terakubo, Uncovered Fund, Monex Venture Fund, Uncovered Monex Africa Investment Partnership (UMAIP).

7. Thematic Tags

economic strategy, geopolitical influence, Africa-Japan relations, technology investment