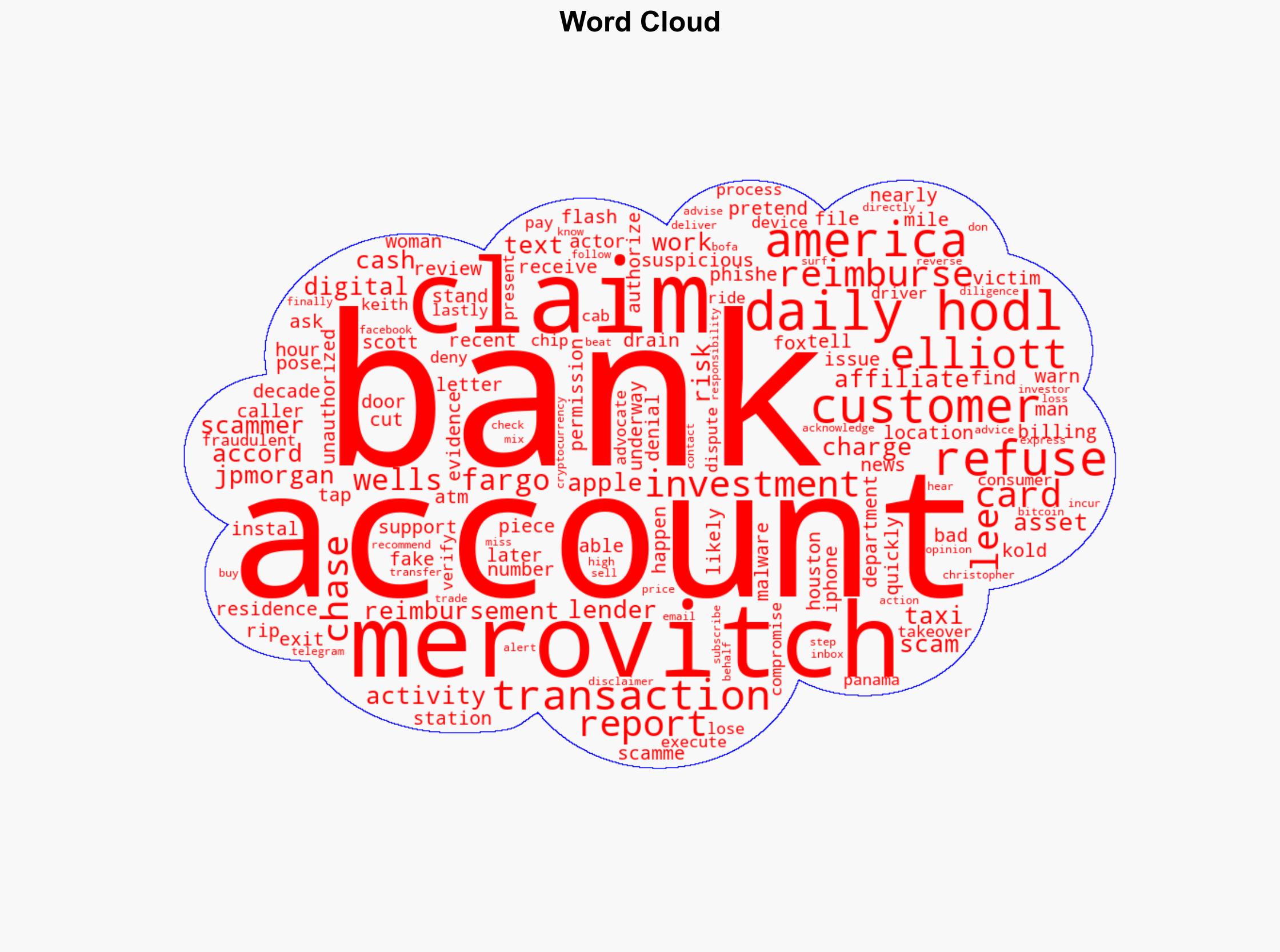

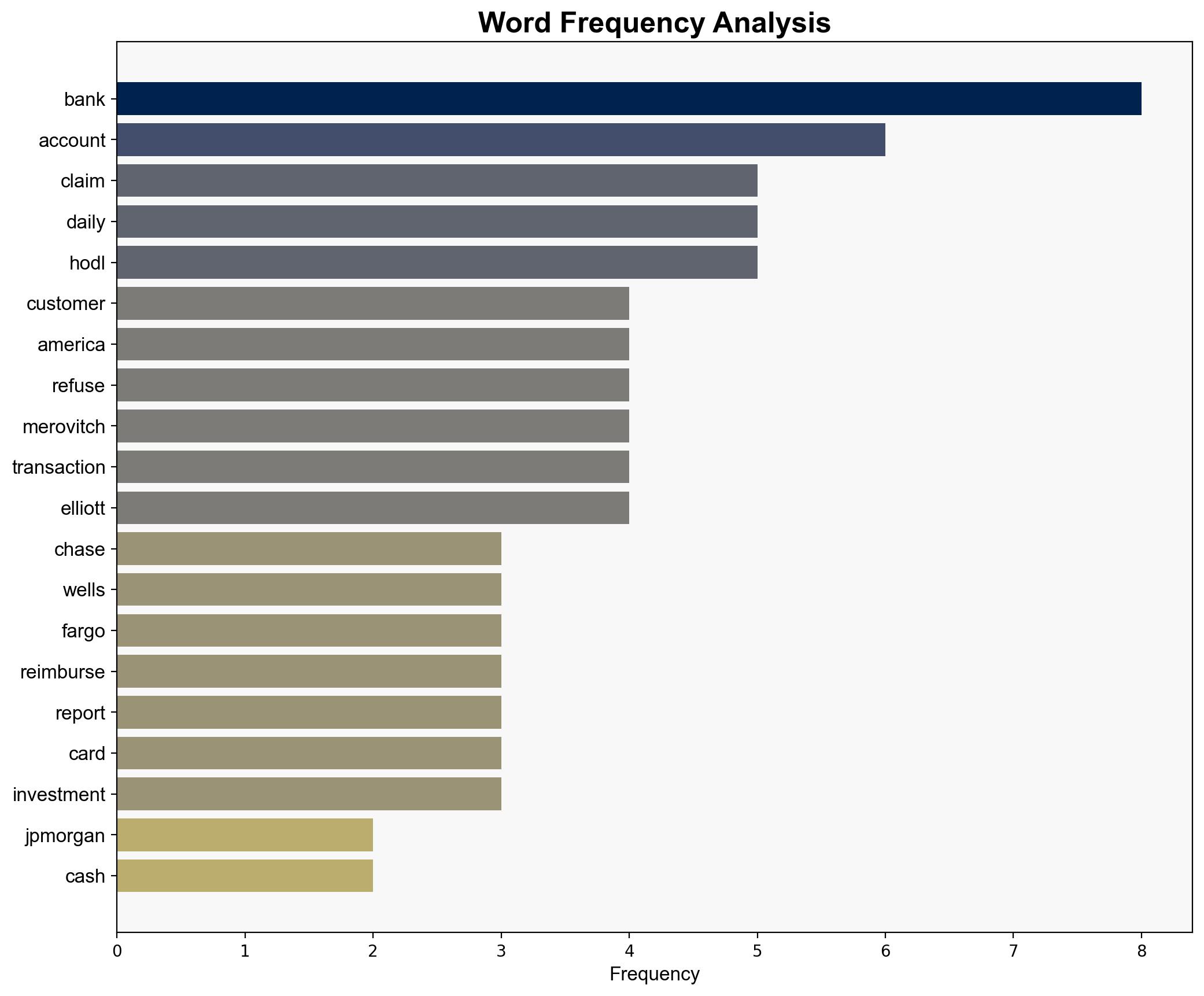

JPMorgan Chase Bank of America and Wells Fargo Refuse To Reimburse Customers After 22450 Drained From Bank Accounts – The Daily Hodl

Published on: 2025-07-12

Intelligence Report: JPMorgan Chase Bank of America and Wells Fargo Refuse To Reimburse Customers After $22,450 Drained From Bank Accounts – The Daily Hodl

1. BLUF (Bottom Line Up Front)

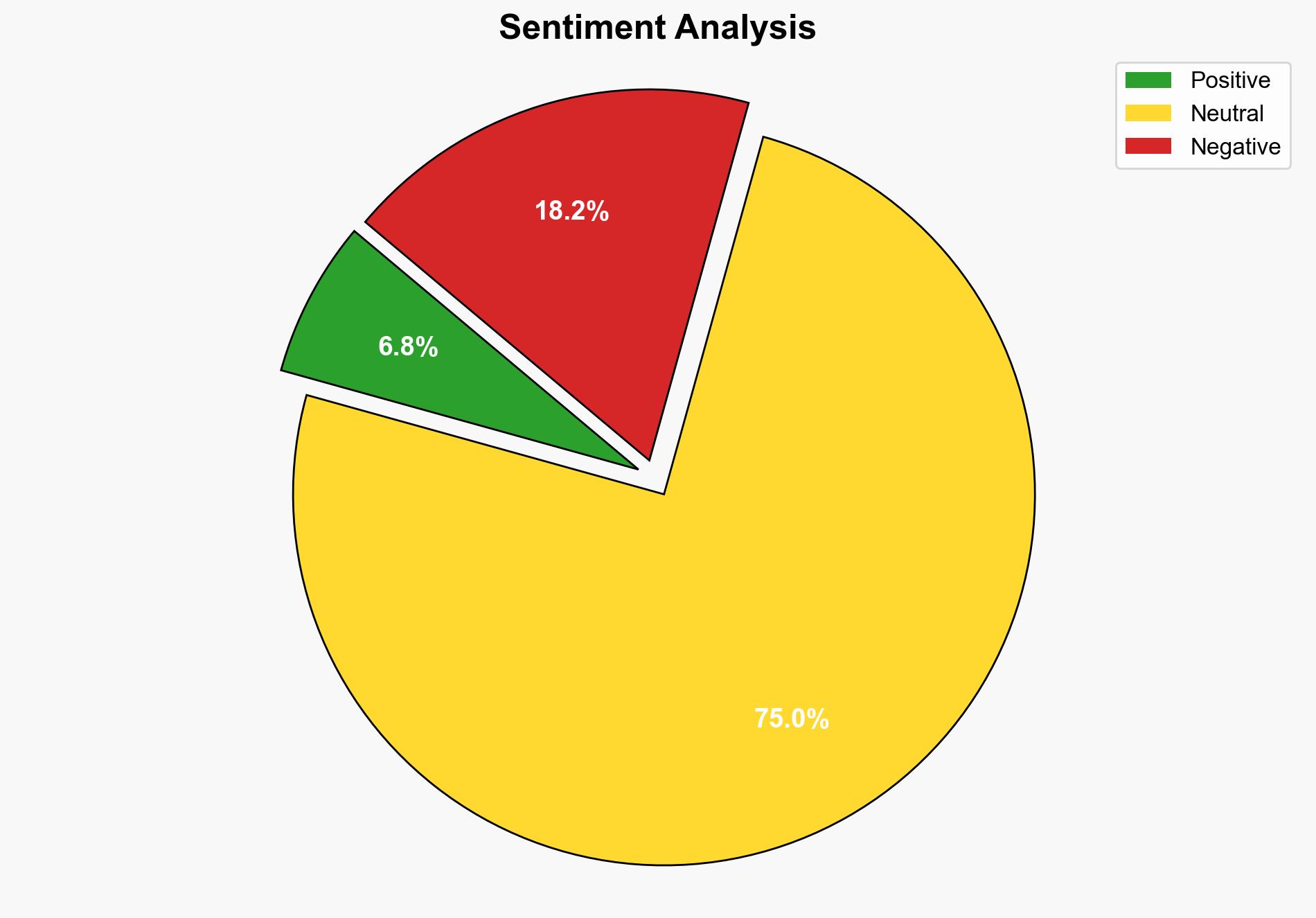

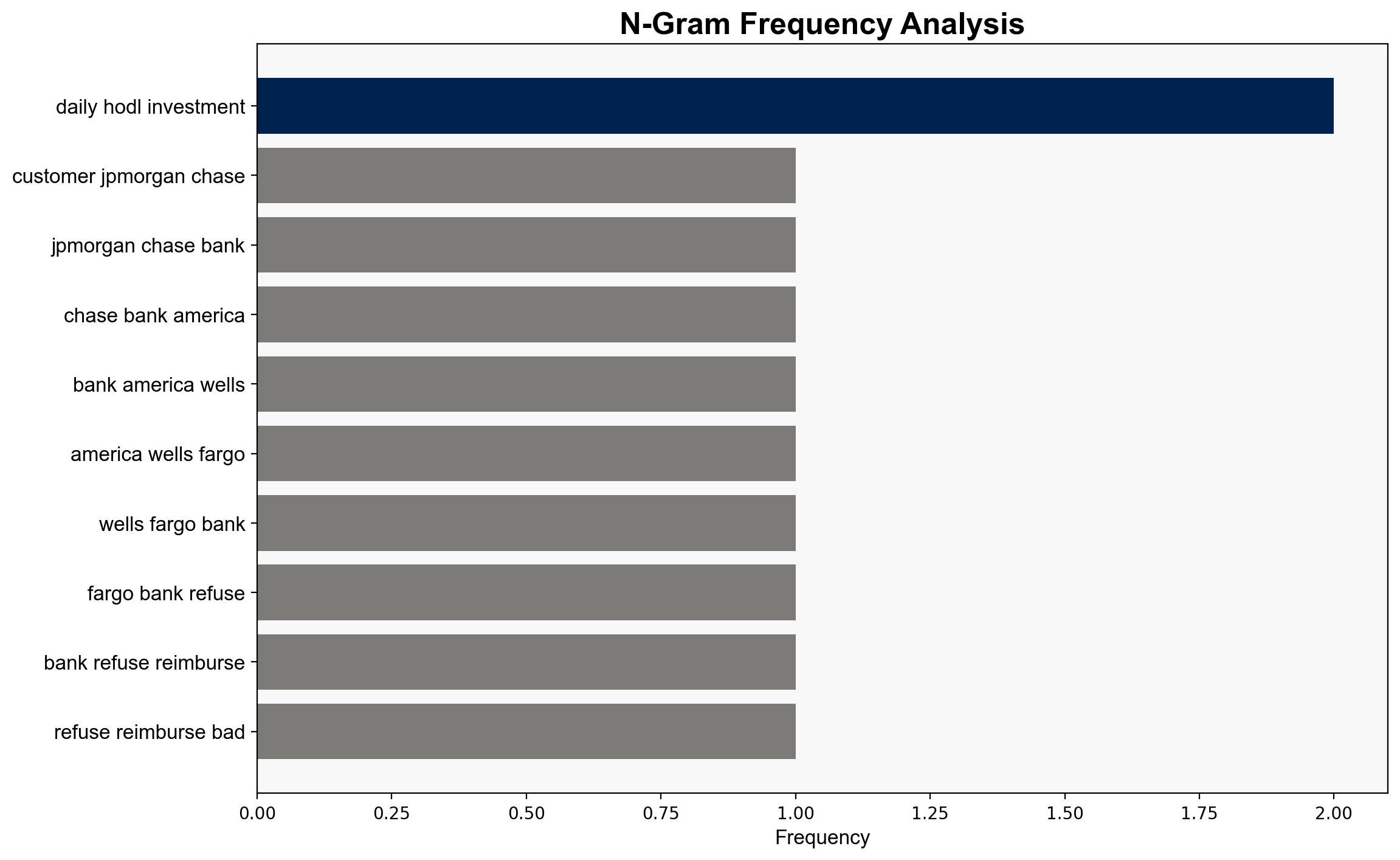

Recent incidents involving JPMorgan Chase, Bank of America, and Wells Fargo highlight significant vulnerabilities in customer account security and the banks’ reluctance to reimburse victims of fraud. These cases underscore the need for enhanced fraud detection and customer protection measures. Immediate strategic actions are recommended to address these gaps and restore consumer trust.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Adversarial Threat Simulation

Simulations indicate that cyber adversaries exploit social engineering tactics to gain access to customer accounts, as demonstrated by the impersonation of bank officials and tech support.

Indicators Development

Key indicators include unusual transaction patterns and unauthorized access attempts, which should trigger immediate alerts and account freezes.

Bayesian Scenario Modeling

Probabilistic models suggest a high likelihood of similar fraud attempts recurring unless banks enhance their verification processes and customer education efforts.

3. Implications and Strategic Risks

The refusal to reimburse affected customers may lead to reputational damage and a loss of consumer confidence in major banking institutions. This could result in broader economic implications if not addressed. Additionally, the persistence of such fraud schemes poses a systemic risk to the financial sector’s stability.

4. Recommendations and Outlook

- Implement advanced fraud detection systems that utilize machine learning to identify and respond to suspicious activities in real-time.

- Enhance customer verification processes to prevent unauthorized account access, including multi-factor authentication.

- Conduct regular customer education campaigns to raise awareness about common fraud tactics and prevention strategies.

- Scenario projections: Best case – Enhanced security measures lead to a reduction in fraud incidents; Worst case – Continued fraud leads to regulatory scrutiny and financial penalties; Most likely – Gradual improvement in security with ongoing challenges.

5. Key Individuals and Entities

Scott Merovitch, Keith Lee, Christopher Elliott

6. Thematic Tags

financial security, fraud prevention, consumer protection, banking sector vulnerabilities