JPMorgan Chase Refuses to Reimburse Customer After Scammers Drain 32000 by Posing As Bank Employees Report – The Daily Hodl

Published on: 2025-06-21

Intelligence Report: JPMorgan Chase Refuses to Reimburse Customer After Scammers Drain $32,000 by Posing As Bank Employees

1. BLUF (Bottom Line Up Front)

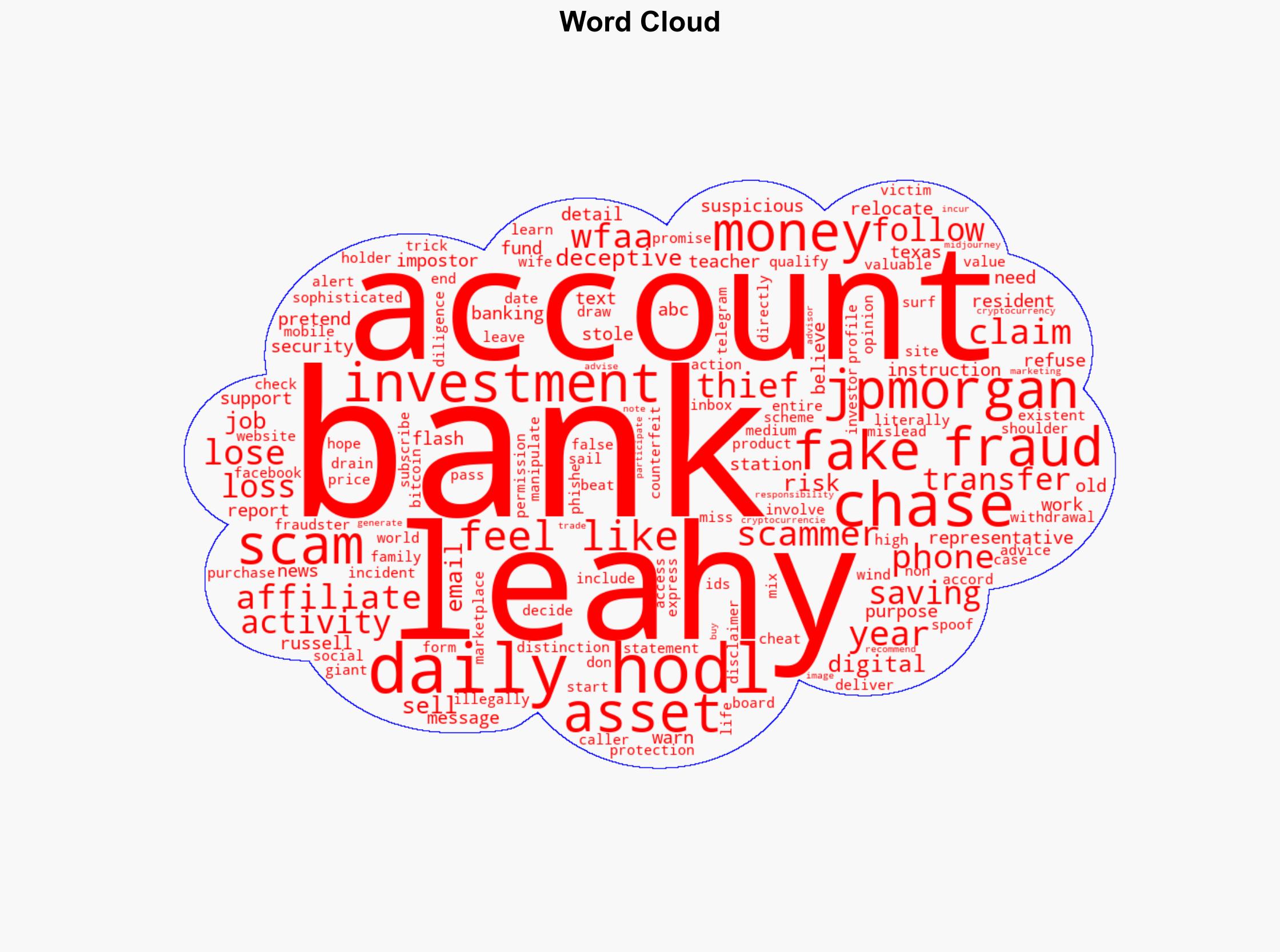

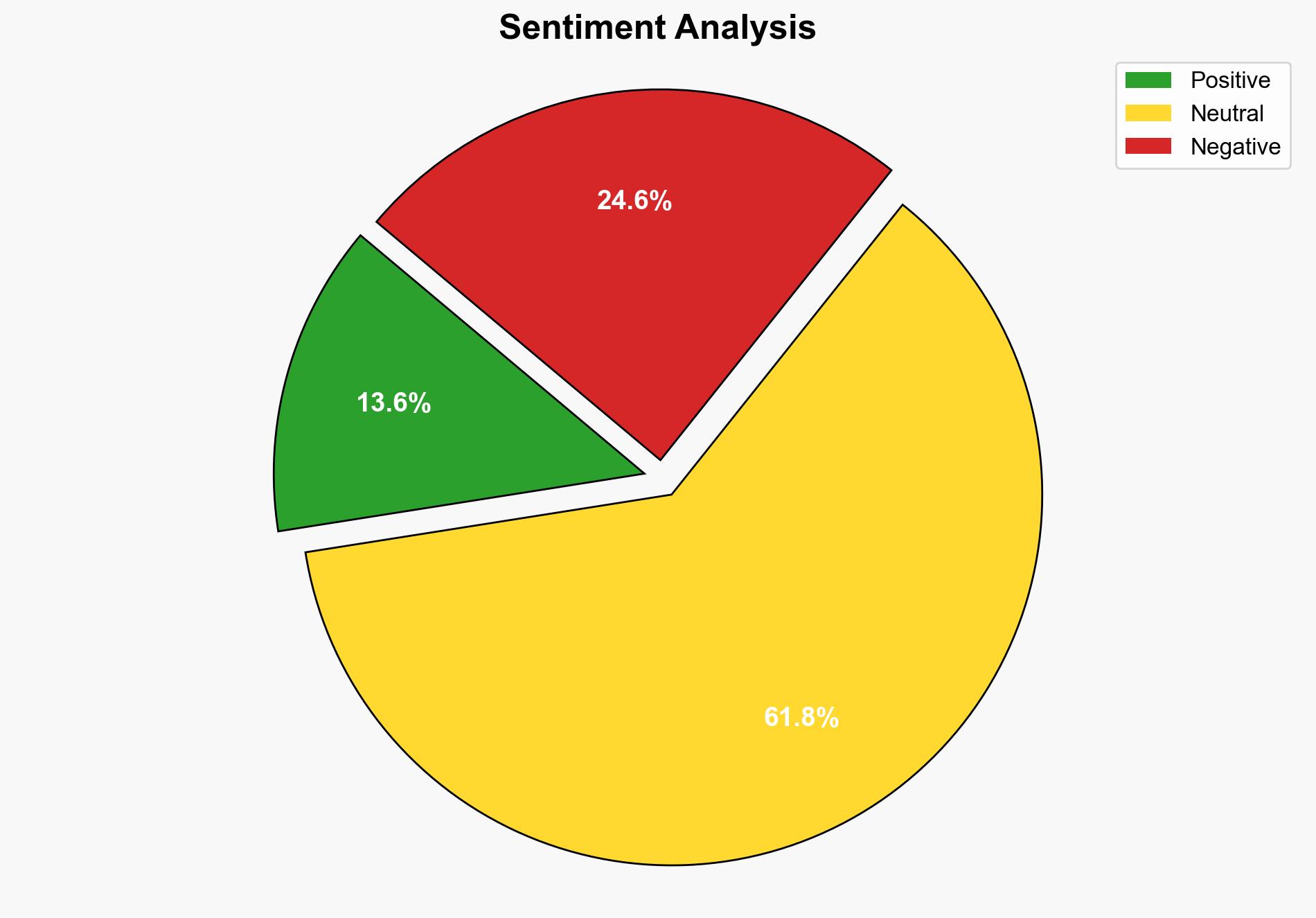

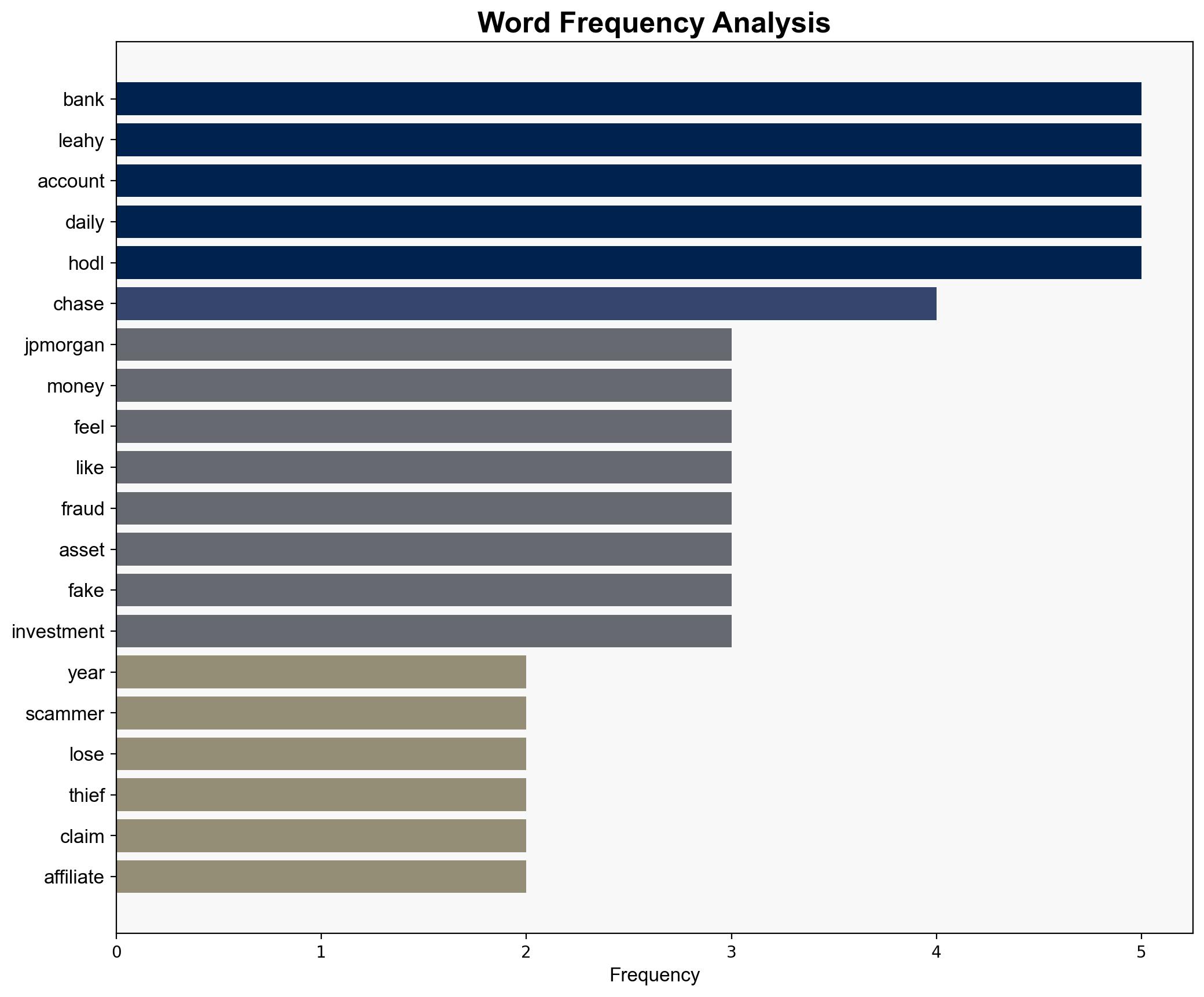

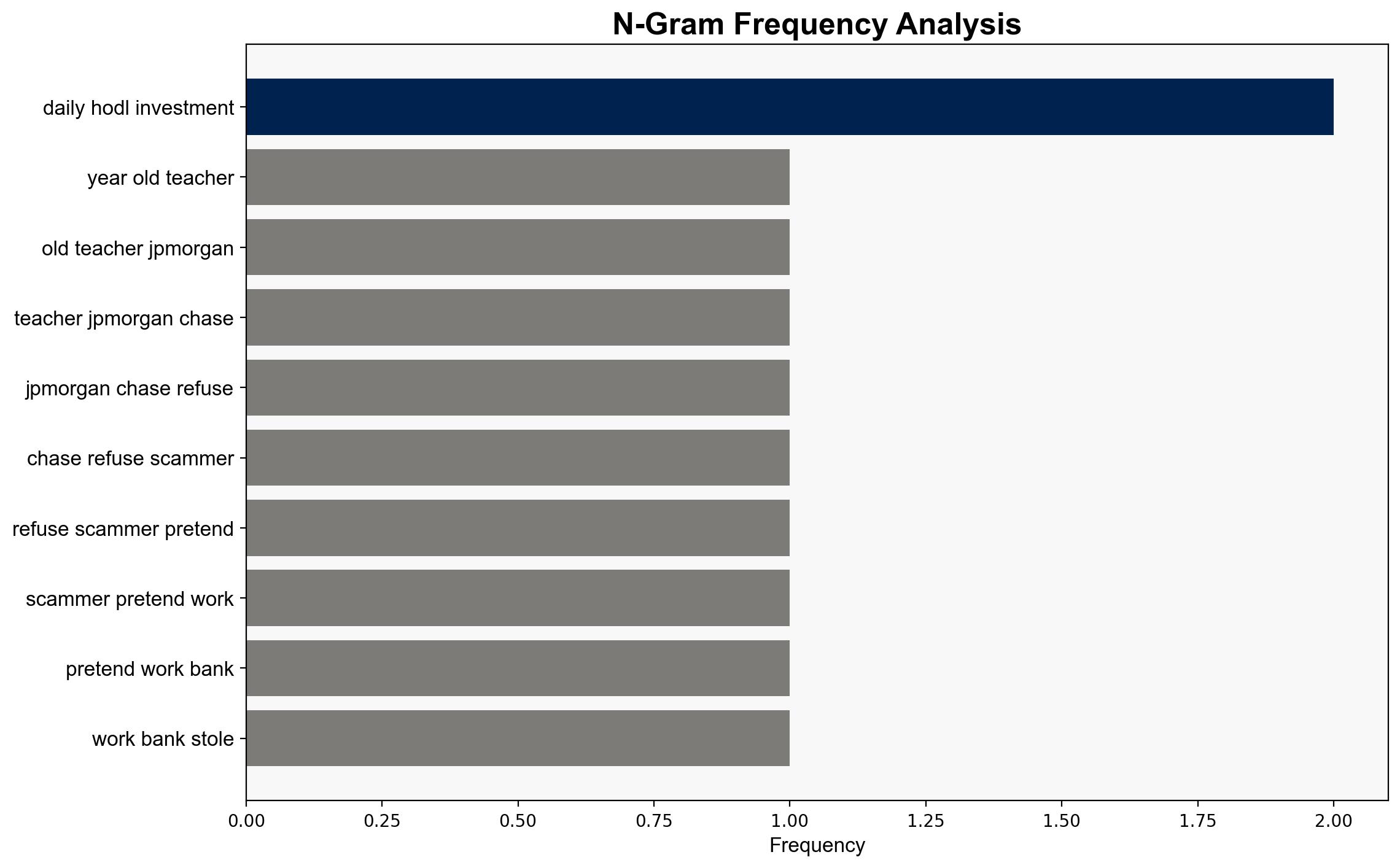

A Texas resident, Russell Leahy, lost $32,000 after scammers impersonated JPMorgan Chase employees. The bank has refused reimbursement, citing the incident as a scam rather than fraud. This case underscores the need for enhanced cybersecurity measures and consumer awareness to prevent similar occurrences. Recommendations include strengthening customer verification processes and increasing public awareness campaigns.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Adversarial Threat Simulation

Scammers employed social engineering tactics, posing as bank representatives to gain trust and access funds. This highlights vulnerabilities in customer verification processes.

Indicators Development

Key indicators include unusual transaction requests and unsolicited communication from purported bank representatives. Monitoring these can aid in early detection.

Bayesian Scenario Modeling

Probabilistic models suggest a high likelihood of similar scams recurring unless preventive measures are implemented. The pathway involves initial contact, trust-building, and fund transfer under false pretenses.

3. Implications and Strategic Risks

The incident reflects broader systemic vulnerabilities in financial institutions’ security protocols. It poses risks to consumer trust and highlights the potential for increased financial crime. The distinction between scams and fraud in banking policies may leave customers unprotected, necessitating policy reviews.

4. Recommendations and Outlook

- Enhance customer verification and authentication processes to prevent impersonation.

- Conduct public awareness campaigns on identifying and avoiding scams.

- Review and potentially revise bank policies to offer better protection against scams.

- Scenario Projections:

- Best Case: Implementation of robust security measures reduces scam incidents significantly.

- Worst Case: Continued rise in scam cases erodes consumer trust in financial institutions.

- Most Likely: Incremental improvements in security and awareness lead to a moderate decrease in scam occurrences.

5. Key Individuals and Entities

Russell Leahy

6. Thematic Tags

cybersecurity, financial security, consumer protection, scam prevention